The Evolution of Crowdfunding: From Mail-Order Subscriptions to Online Platforms

No time to read? Let AI give you a quick summary of this article.

Did you know that crowdfunding has existed for several centuries? Now, when we use the Internet and specialized platforms to raise funds for promising projects, it is difficult to imagine how funds were collected when technology was at a much lower level or how rewards were paid out. While it is clear how the donation-based crowdfunding model works, questions arise regarding equity-based or reward-based crowdfunding.

However, all the main crowdfunding models have existed for a long time.

In Ancient Rome1, a system called “subscription” was used to perform large-scale works for the benefit of citizens, such as the construction of aqueducts or public baths. Rich aristocrats could donate funds to gain public favor, and citizens who considered participating in such projects a civic duty could donate smaller amounts.

For example, in reward-based crowdfunding2, rich people could contribute to a cathedral’s construction to get the right to be buried under the cathedral when they die, or poorer people would offer construction materials and labor in exchange for the same right. Professional guilds could provide financing in exchange for being illustrated on stained glass windows and similar.

Alexander Pope3 used a reward-based crowdfunding model to collect funds for his translation of the ancient Greek poem, The Iliad. In return, he committed to publish one volume per year, and have the names of subscribers published in the first editions of the book.

Wolfgang Amadeus Mozart3 followed this example in 1780-ies when the icon in the classical music field couldn’t have a planned tour due to financial problems. Mozart reached out to his fans and could raise enough funds for his tour. Later, 176 of his backers received a concert manuscript with their names along with Mozart’s personal thanks.

Equity-based crowdfunding existed, too, when merchants jointly sent expeditions that were highly risky but, in case of success, used to be extremely profitable.

However, those efforts were limited and inconsistent.

What you will learn in this post:

Irish Loan Fund – the first example of organized lending-based crowdfunding

The Irish Loan Fund4 was launched in the 1700s and is the first organization that officially was into crowdfunding. The Irish Loan Fund was founded by Jonathan Swift5, a famous writer, who set aside £500 to give zero-interest loans to honest, hardworking individuals who wanted to start their own businesses but didn’t have funds.

The borrowers had to present a guarantee from two neighbors to prove that they were creditworthy.

Some local organizations, such as the Dublin Musical Society and the Irish Relief Committee, supported the case. Since then, local families who didn’t have money but were willing to work could ensure their future.

The Statue of Liberty – the first use of modern communication ways to crowdfund

In 1885, France was going to send the Statue of Liberty6 to New York but initially failed because, in New York, the governor refused to use the city money to build a pedestal for the statue, and the US Congress couldn’t agree on a funding package. Baltimore, Boston, San Francisco, and Philadelphia offered to pay in return for the relocation of the statue.

Joseph Pulitzer, a famous publisher, intervened by starting a crowdfunding campaign in his newspaper.

https://colossal.org/news/how-crowdfunding-saved-lady-liberty6

The publisher kept the campaign going by constantly listing the names of donors and their contributions on the first page of his newspaper.

Those who contributed more than $1 and $5 received a 6” or a 12” version of the statue as a reward, respectively. Those who donated large sums received gold coins.

In less than five months, they collected funds sufficient to assemble the statue.

The crowdfunding campaign for the Statue of Liberty was the first tier-based subscription model, as we call it now. The supporters received a reward depending on their donation size.

1976 – the birth of modern microfinancing

In 1976, professor Muhammad Yunus7 visited Jobra, a village in Bangladesh where he discovered that women making bamboo furniture didn’t qualify for bank loans and instead had to take loans from local lenders on which they had to pay huge interest rates. As a part of a research project, he gave a $27 loan to 45 women in the village, and each loan made a small profit.

Grameen Bank – the first microfinancing institution

The lending project of professor Yunus was so successful that it led to the creation of the first microfinance institution – Grameen Bank8. In Bengali, it means “rural bank” or “village bank.” Over time, the project expanded all over India, and in 2006, when Yunus won the Nobel Peace Prize, Grameen Bank helped over 7 million borrowers.

1997 – the inception of modern crowdfunding

Marillion9, a British rock band that had been very popular a decade before, went out of fashion in 1996 – 1997 and was dropped by their label, EMI Records10. While their fans in the USA were demanding a tour, the group was not at all optimistic about it. The tour would cost at least $60,000, and with the financial problems Marillion was facing, collecting such funds was not feasible.

Their US fans launched a US tour fund. One thousand fans contributed, the fund got media attention, and within half a year, the tour was fully funded11.

Inspired by this success, Marillion again turned to their fans for help three years later to record their new album, Anoraknophobia11. This time, the question was whether their fans would pre-order the album several months in advance. Soon, the supportive community started placing pre-orders. In return, the backers received special edition CDs with bonus tracks and small booklets with all the backers’ names.

Since then, raising funds from fans through pre-orders has become a common practice for artists.

2003 – ArtistShare, the first crowdfunding platform

ArtistShare12, the first commercial crowdfunding website for artists, was launched by the American producer Brian Camelio in 2003. This platform allowed artists to interact with their fans, share creative processes with them, and receive funds.

In 2005, the jazz artist Maria Schneider won a Grammy Award for her album Concert in the Garden. This became the first album that won a Grammy and was sponsored solely by the public without relying on a professional record label and even without being sold in physical stores.

From records funded through ArtistShare, 29 were nominated for Grammy2, and 10 received a Grammy Award.

2005 – Zopa: the first lending-based crowdfunding platform

Zopa13 was launched in 2005 as the first peer-to-peer lending platform. Its aim was to give people access to better-value loans and investment opportunities. The platform offered four investment products, among which investors could choose based on their return appetite.

In 2020, the platform launched Zopa Bank with the aim of creating simple, fair, and honest financial products. In 2021, the P2P lending side would focus solely on Zopa Bank.

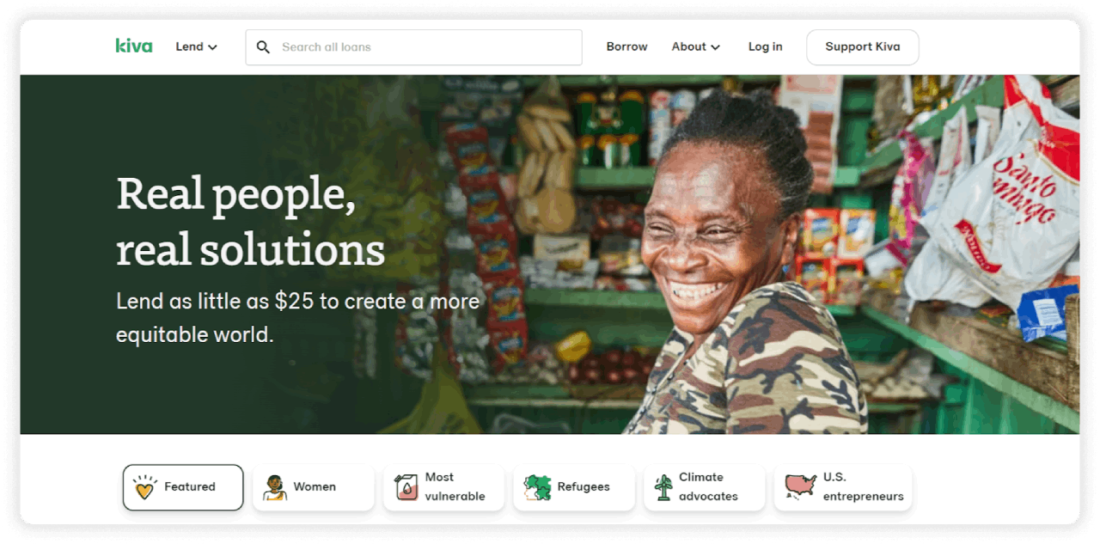

2005 – Kiva, a microlending platform

The launch of Kiva14, a microlending platform, is another important milestone in the development of modern crowdfunding. The platform was launched by Matt Flannery and Jessica Jackley. Both of them were attending a lecture given by Muhammad Yunus at Stanford Business School in 2003. Inspired by the lecturer, they interviewed village entrepreneurs in East Africa. They noticed that the common problem for these entrepreneurs was the lack of capital and access to financial services.

The Kiva story15 began in March 2005 when the first loan was funded. Elisabeth, a Ugandan lady, used her loan of $500 to expand her fish-selling business. She used to go buy fish by the basket and sell it at local markets. That loan changed her life.

By now, over 5 million people used Kiva to get their life-changing loans.

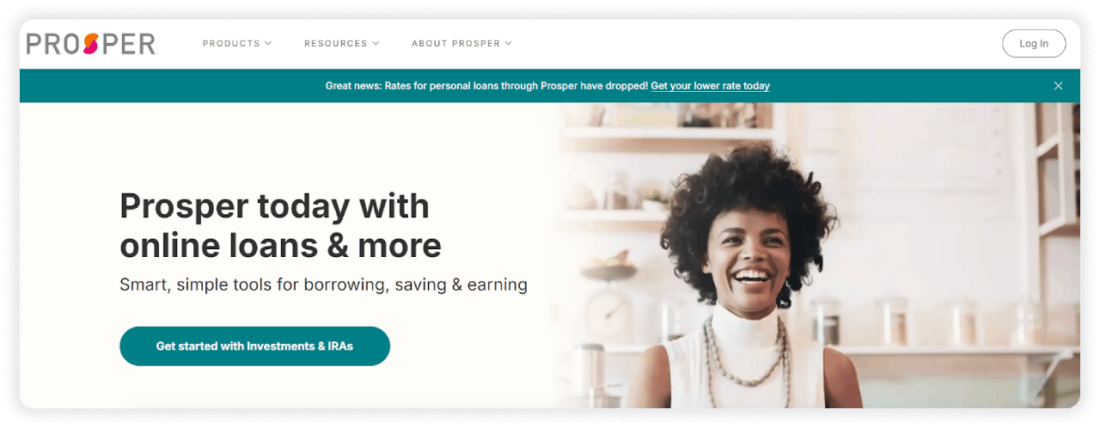

2005 – Prosper: the first peer-to-peer lending marketplace in the USA

Prosper Marketplace16 became the first peer-to-peer lending marketplace in the USA. From 2005 to 2010, borrowers and lenders could determine their loan rates on their own through a reverse auction system. A borrower would set a maximum interest rate that he was willing to pay, and lenders were bidding lower and lower rates.

In 2010, the platform moved to pre-set rates that are calculated by a loan pricing algorithm.

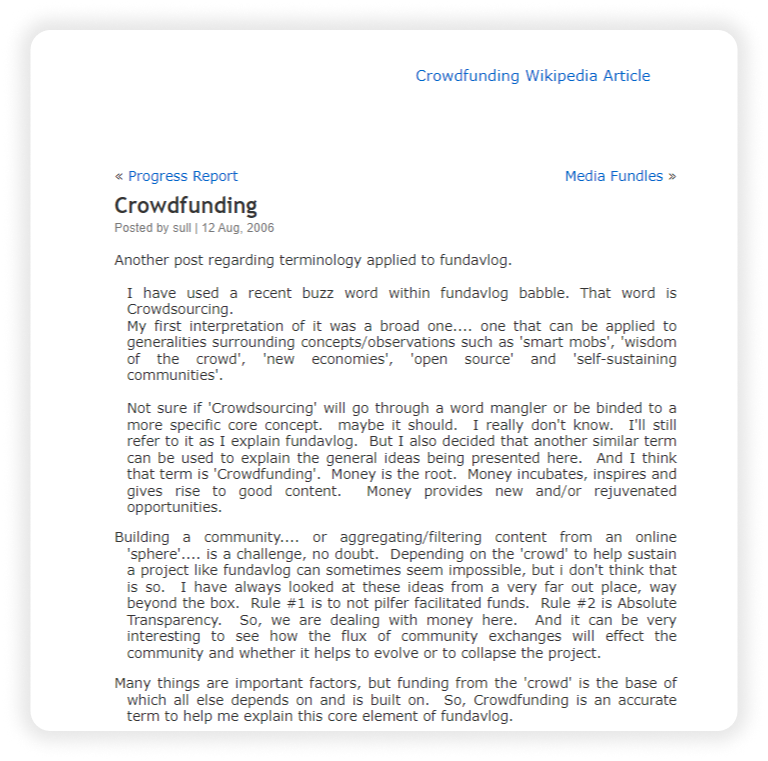

2006 – the term “crowdfunding” appears

Even though the phenomenon of crowdfunding has existed for ages, there was no word to define it. The term “crowdfunding” was invented in 2006 by Michael Sullivan18. He was researching video blogging and podcasting communities with the aim of improving the way video creators engage with their fans. As a result, he created a platform called “Fundavlog” where video creators could post their videos, and their followers could “like” them by clicking a button that would also instantly send a donation. Later, he launched his blog called “Crowdfunding,” where he wrote about Fundavlog and a new era of fundraising.

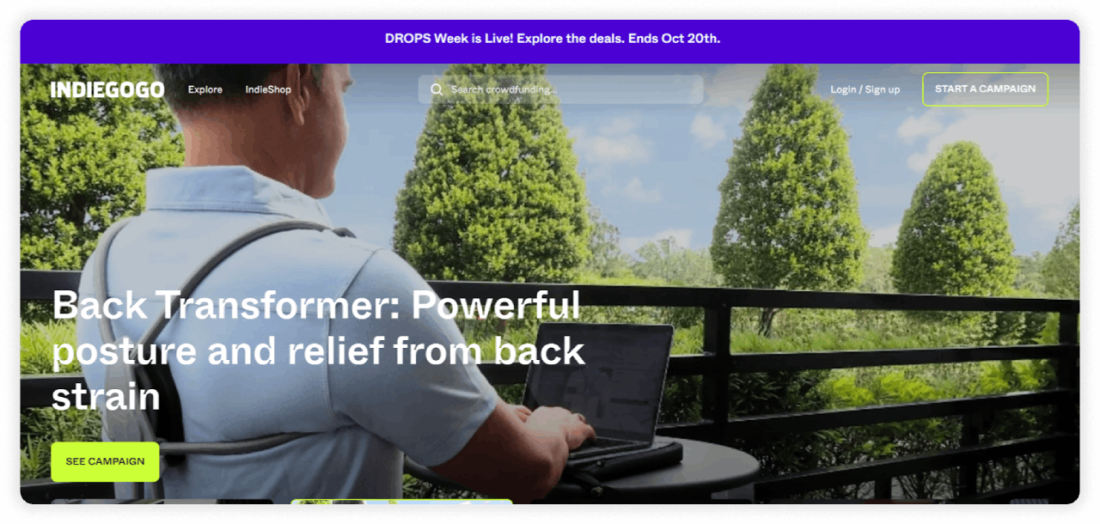

2008 – Indiegogo: a reward-based crowdfunding platform that goes mainstream

Indiegogo19 was launched in 2008 at the Sundance Film Festival to help producers of independent films.

After a while, new project categories were added, such as Hotels, eBikes, Tech, and many others. Now, it is one of the most famous reward-based crowdfunding platforms, with millions of daily visitors from over 200 countries.

2009 – Kickstarter: another giant in reward-based crowdfunding

One year after Indiegogo’s launch, Kickstarter21 was founded. Soon after that, the platform became one of Indiegogo’s major competitors.

In 2010, Time magazine named Kickstarter among the best inventions of 201020, and in 2011, the platform was named the best website of 201122 on the same resource.

2011 – Obama launches the Startup America initiative

In 2011, Barack Obama launched the Startup America23 initiative with the goal of accelerating high-growth entrepreneurship throughout the nation. Alongside this, the Startup America Partnership24 was launched, which is an independent alliance formed by entrepreneurs – for entrepreneurs. Within slightly more than two years of its existence, the alliance built a network of more than 13,000 startups all around the country.

2012 – the JOBS Act

The next year after launching the Startup America initiative, Barack Obama signed the Jumpstart Our Business Startups (JOBS) Act25. It was meant to make it easier for startups to raise capital and it allowed retail investors to invest in businesses.

The JOBS Act also facilitates reporting and lessens oversight requirements for emerging growth companies.

2023 – ECSPR

In 2023, the European Crowdfunding Service Provider Regulation26 came into force. According to this regulation, crowdfunding service providers willing to operate in the EU must obtain a license, and it also provides for uncomplicated passporting for a licensed platform to operate in any EU member state.

Modern-day crowdfunding

Crowdfunding has gone a long way, from raising funds for the construction of cathedrals to using the most advanced tools and platforms. In 2024, the crowdfunding market is estimated at $1.5 billion27, with around 1,500 crowdfunding organizations28 located in the USA.

With the development of crowdfunding regulation in the US29 and Europe30, the crowdfunding market is expected to grow even faster, and by 2029, it is expected to reach $3.11 billion27. It means that if you have been thinking of launching a crowdfunding platform, it may be the right time to do so.

How to launch a crowdfunding platform with LenderKit

If you are looking to build a crowdfunding platform and facilitate the development of the crowdfunding market, democratize access to capital or gain market share in the alternative investing niche, check out white-label crowdfunding software offered by LenderKit.

Our investment software comes with a set of ready-made features, integrations and infrastructure that will help you launch an equity or debt crowdfunding platform prototype, MVP or even a custom platform.

If you are interested to learn more about how LenderKit works and discuss your project requirements, fill out the contact form and we’ll get back to you.

Article sources:

- The History and Evolution of Crowdfunding: Revolutionizing Investment and Capital Access

- Page not found - Crowdfunding & Kickstarter Marketing Agency | LaunchBoom

- History of crowdfunding - Smallbrooks

- Irish loan funds - Wikipedia

- Jonathan Swift - Wikipedia, la enciclopedia libre

- How Crowdfunding Saved Lady Liberty — Colossal Impact

- Muhammad Yunus - Wikipedia

- Grameen Bank - Wikipedia

- Marillion.com | The Official Website

- Marillion - Wikipedia

- Pledge Pioneers: How Marillion invented crowdfunding | Louder

- Home Page

- Zopa | Easy banking - current accounts, loans & savings

- Make a loan, change a life | Kiva

- About Us | Kiva

- About Us

- Crowdfunding.com | Crowdfunding

- Crowdfunding-Wortschöpfer Michael Sullivan im Interview | crowdfunding.de

- Indiegogo

- Kickstarter - The 50 Best Inventions of 2010 - TIME

- Kickstarter

- Kickstarter - The 50 Best Websites of 2011 - TIME

- FACT SHEET: WHITE HOUSE LAUNCHES “STARTUP AMERICA” INITIATIVE | The White House

- Startup America Partnership

- Jumpstart Our Business Startups (JOBS) Act

- ESMA publishes technical standards on crowdfunding

- Crowdfunding Market Report | Growth Analysis, Size & Industry Forecast 2030

- 80 Crowdfunding Statistics You Must See: 2024 Platforms, Impact & Campaign Data - Financesonline.com

- Federal Register :: Request Access

- Europe