The Ultimate Guide to P2P Lending

Peer-to-peer lending is an alternative to traditional loan services offered by banks, credit bureaus and other financial institutions. It enables individuals and businesses to obtain loans from other individuals, rather than from a bank, by using a specialized online p2p lending platform. Both lenders and borrowers benefit from this arrangement, as it eliminates the need for a third-party financial institution.

What you will learn in this post:

How do P2P lending platforms work?

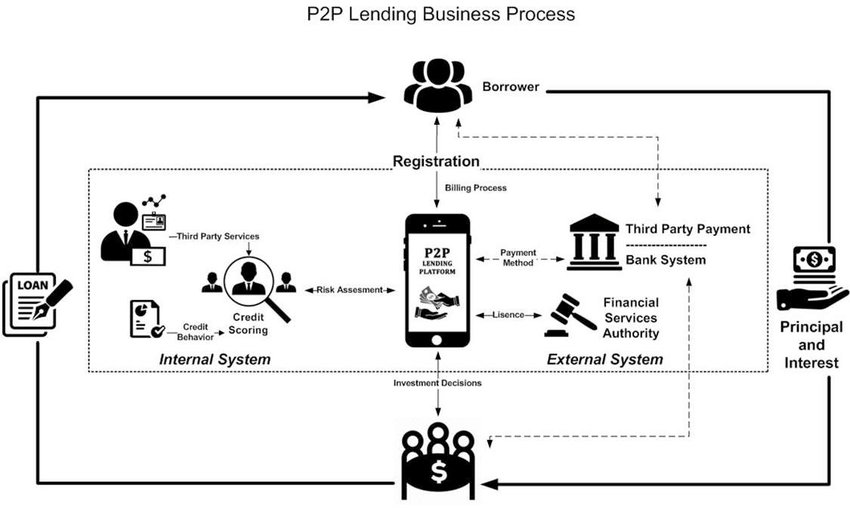

A peer-to-peer crowdinvesting platform is an app or a website that manages the relationships between two parties: lenders and borrowers.

The platform collects data of both users and creates the investor and borrower profiles to find the best fit and match potential borrowers with lenders.

- Investors pledge money through a platform that offers loans for businesses.

- Companies that want to take out a loan complete financial profiles on the platform.

- The platform then assesses the risk level of the potential borrower based on the available information about the company and its owners.

- This risk level is used to calculate the interest rate that the borrower will have to pay.

- Lenders have the ability to select one or more applications with a risk-reward ratio that meets their investment criteria to diversify their portfolio and invest in companies they believe in.

- Once a loan is funded, and the borrower starts repaying the debt according to a predetermined schedule, lenders begin receiving their interest.

- The debt-based crowdinvesting platform handles the collection of loan payments and the disbursement of funds to lenders.

P2P websites earn on the fees that are imposed on the borrowers, lenders, or both. These fees may differ significantly depending on the P2P lending platform. And that’s why this business model is so popular and helps more P2P lending firms compete on the market.

P2P lending market overview

The P2P lending market has been growing rapidly for the last few years, and it is expected that in the future, the growth at a high CAGR (compound annual growth rate) will continue.

In 2021, the global market size was valued at USD 82,300 million, and in 2030, it is expected to reach USD 804,200 million, with growth at a 29.1% CAGR.

P2P lending in the USA

The USA has the largest P2P lending market share in terms of revenue. Within the last few years, this sector has been developing steadily with such platforms as Prosper and Lending Club being among the first ones in their niches and the most successful ones.

P2P lending in the USA enables the public to invest in American businesses in such fields as agriculture, farming, crypto lending, personal debt, and loan originator debt.

According to P2P Market Data, the minimum investment varies from $1 to $32,000 with an expected profit of 1% to 9% depending on the platform and offering.

P2P lending in Europe

In Europe, P2P lending is becoming increasingly available for retail investors. There are almost 200 registered platforms operating in the region, the majority of which offer automated investing and allow trading on secondary markets to enable an early exit.

France is the largest player in the alternative finance market with a market share of around 20% and Germany takes the second place with a more than 17% market share, according to Crowdspace.

P2P lending platforms allow retail investors to invest directly in small business invoices and debt, receivable from companies, personal debt to individuals, loan originator debt, crypto lending, green energy, and agriculture & farming.

P2P lending in the UK

There are over 53 P2P lending crowdinvesting platforms in the UK. Their focus is personal loans, green energy, education, and mortgages. The investment range varies depending on the platform from a minimum of 1€ to a maximum of 100,000€.

All P2P lending platforms are regulated by the Financial Conduct Authority which ensures some protection for lenders and borrowers. However, it doesn’t protect investors from borrowers’ insolvency.

The most active players in the UK P2P lending market are Zopa, Funding Circle, and Ratesetter.

P2P lending regulations

In the USA, P2P lending platforms are highly regulated at the federal and state level. The Securities and Exchange Commission (SEC) oversees the investing side of the P2P platforms’ activities, and the Consumer Protection Financial Bureau with the Federal State Trade Commission takes care of the borrower side.

American P2P lending platforms are not permitted to issue loans directly with money provided by lenders. That’s why platforms collaborate with banks that originate loans from a platform to borrowers, and issue debt securities to lenders. This way, lenders become creditors to the platform.

Europe adopted unified rules for P2P lending and crowdfunding in 2022. These rules look to harmonize requirements to platforms to enable them to operate with fewer complications on all EU territory. According to these rules, all P2P lending platforms have to apply for an “EU passport”. Once a company gets it, it can operate in all of the EU.

In the UK, all P2P lending platforms are regulated by the Financial Conduct Authority (FCA). Platforms must comply with the minimum capital requirements to make sure they can resist if there are some financial difficulties.

Platforms are obliged to provide both borrowers and lenders with extensive information about P2P lending risks, products, and communicate information in a clear, fair, and not misleading way.

How to start a P2P lending platform

Even though there are a lot of P2P lending platforms, the market is still immature. That’s why launching a P2P debt-based crowdinvesting platform with carefully thought-through functionality can be highly beneficial in the long term.

Developing a P2P lending platform from scratch requires a lot of time and money, so many businesses focus on white-label P2P lending software instead. But selecting a proper P2P lending platform solution is not easy, and picking one randomly may in the end lead to additional expenses or even not work as expected.

When choosing a loan crowdfunding software provider, consider the scale of business, automation level of operations, need to access and use advanced data and analytics, such as investing and fundraising patterns, minimum and maximum invested amounts, etc. These details will help you determine if the peer-to-peer investing software is the right fit for you.

At LenderKit, we provide white-label P2P lending software for established and early-stage businesses. Our solutions are suitable for both prototyping and obtaining regulatory licenses or running a fully-functional P2P crowdfunding platform.

LenderKit investment solutions come with a comprehensive set of features such as:

- Credit scoring functionality that allows you to assign a credit score to borrowers

- Secondary market trading for more liquidity

- 3rd party integrations that connect your platform with payment gateways and KYC/AML providers

- Auto-investing which allows investors to set up their investment preferences

- A possibility to assign roles to your team members: administrators, lawyers, advisors and provide them access to the platform sectors depending on their roles

If you want to see in more detail how LenderKit P2P lending software works, feel free to contact us to request a live demo.