Top 10 SaaS Lending Software

No time to read? Let AI give you a quick summary of this article.

The process of launching a lending platform may be costly, time-consuming and complex , this is why many business founders opt for SaaS lending software to automate processes and speed up the platform launch. To choose the right SaaS lending software provider, it is important to understand software features, compare the costs and see how the solutions match with the needs of your business.To facilitate your research, we have made a list of the top 10 SaaS lending software providers worldwide.

What you will learn in this post:

Finastra

Finastra1 was launched in 2017 and since then, it has offered the most comprehensive portfolio of end-to-end lending solutions in the market. They cover syndicated, consumer, commercial, and mortgage lending. Finastra’s solutions are suitable for a range of businesses, corporations, and consumers.

The SaaS lending platform works with over 9,000 customers all around the world, including 90 of the 100 banks globally.

With cloud lending software by Finastra, you get solutions for all lending needs:

- Cash and liquidity management

- Commercial lending

- Mortgage lending

- Corporate lending

- Loan origination

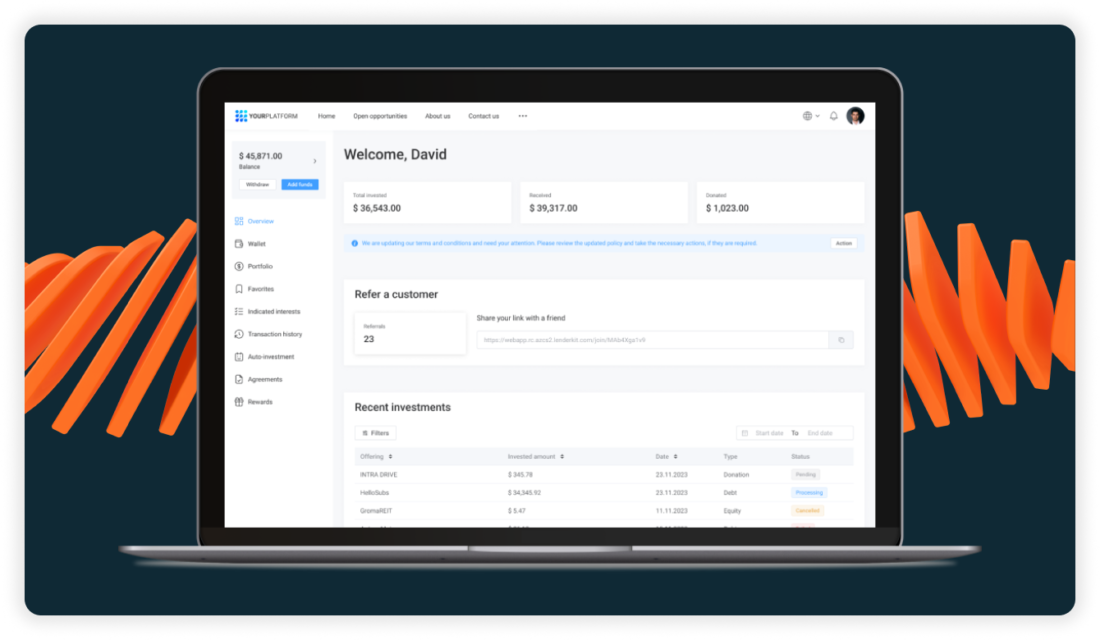

LenderKit

If you want to start a P2P lending platform, but don’t want to rely on a standard SaaS provider, you can check out white-label lending software by LenderKit. The major difference is that LenderKit has a team of developers and can build unique platforms for every client, but also offer ready-made packages which can be upgraded further.

LenderKit offers a customizable white-label P2P lending software with ability to onboard users, create deals, manage transactions, export data for reporting and leverage third-party integrations to make your platform run smoothly.

HESFintech

HESfintech2 was launched in 2012 in Lithuania, and since then, the platform has provided all-around loan management software development that meets the client’s needs and market requirements. With 3-4 months time-to-market, lifelong user support, and no additional charges per customer, the software allows for up to 50% faster loan processing.

For those who want to expedite their workflow and ensure the fastest ROI, HES LoanBox3, a ready-made SaaS lending platform is available. It includes a white-label lending platform, a branded mobile app, a KYC plugin, biometric authentication to identify borrowers, and a dedicated online portal for borrowers, among other options.

The SaaS lending platform is suitable for any type of lending business and allows business owners to streamline the entire loan workflow, front to back.

TurnkeyLender

TurnkeyLender4 provides P2P lending platform software that allows to automate all steps of a lending process from loan application to origination, underwriting, servicing, collection, reporting, and others. AI-powered decisioning algorithms and machine learning help to automate credit processing and make faster loan decisions.

In-depth risk scoring, borrower evaluation, loan agreement generation, loan offer management, and other tools help to streamline loan underwriting processes.

All TurnkeyLender solutions can be integrated with more than 75 accounting systems, payment and notification providers, KYC/AML providers, and whatever is needed for a lending platform’s seamless operations.

The solutions come with the possibility to automate configurable or pre-defined dynamic reports and optimize debt-collection operations with AI-driven collection priority, configurable collection strategies, and conversation scripts.

A collateral module includes assets valuation and re-evaluation to make every type of secured lending fast and easy.

TurnkeyLending offers software for all lending sectors:

- Consumer lending

- Commercial lending

- Bank lending, and others.

Loandisk

Loandisk5 offers SaaS lending software that is secure and easy to use. It allows managing all loans and repayments in a single place.

Charts and reports allow business owners to see how the loan is released and collections are made, loan terms, schedule, collateral, files, and comments, generate cash flow reports and profit/loss statements, and track the business performance through graphic charts.

The solution allows to send automated SMS and emails, create savings and investor accounts, and manage all the staff.

All plans offered by Loandisk include all the needed functionalities and are limited just by several parameters:

- Startup, $49/month, for 1 user, allows to manage up to 2,000 loans and have 1,000 savings accounts.

- Business, $109/month, for 3 users, allows to manage up to 4,000 loans, and have 2,000 savings accounts.

- Company, $198.month, for 8 users, allows to manage up to 8,000 loans and have 4,000 savings accounts.

- Enterprise, $298/month, for an unlimited number of users, allows to manage an unlimited number of loans and have as many savings accounts as needed.

Each plan comes with a 30-day trial period.

LendingPad

LendingPad6 is a cloud-based loan origination software that includes all that a lending business needs:

- Inbuilt customer relationship management (CRM) tool

- Compliance check

- Documentation archiving

- Real-time updates

- Custom workflows

- Lead and campaign management

- Service level agreements.

The cloud lending software comes with multiple third-party applications to facilitate loan processing, manage compliance matters, insurance, payment processing, and other processes.

The starting solution price is $50/month per user for brokers; lenders, banks, and credit unions are billed per closed loan.

LendFusion

LendFusion7 is a loan management system developed for established lending businesses. The loan applications can be directly configured and managed within the system by users. All solutions can be customized to enhance functionality and support the end-to-end lending process. Such features as automated loan application processing, communication templates, customer origination, disbursement, contract generation, and loan collections, among others, are available to meet all the needs of lenders.

The solutions are subscription-based and start at EUR 1,659 per month. The price increases when the business grows.

Nortridge

Nortridge8 has been in the lending business for more than 42 years and since its launch in the early 1990s, it has been delivering flexible loan accounting and servicing solutions to multiple clients all around the US.

The P2P lending solutions by Nortridge cover such fields as commercial & business, retail & consumer, non-profit loans, student lending, auto finance, and medical loans, among others. All solutions offered by the provider come with third-party integrations that automate mailing and documentation signing, facilitate bankruptcy processing, and include hosting solutions.

The pricing starts at $1,050 per month and increases depending on the requirements. High loan volume lenders can get a customized quote that fits their lending model or lending scenario.

LendFoundry

LendFoundry9 is a cloud-based platform that offers tools and accelerators to lenders to manage the entire digital lending cycle. It offers comprehensive Loan Origination and Loan Servicing systems, along with a range of additional features that facilitate customer management, compliance reporting, authentication, security checks, and AI-powered credit scoring and marketing.

The LendFoundry SaaS model minimizes the costs needed for launching a lending business, and the AI-enabled platform helps to identify priority accounts, create risk profiles, and recommends interest rates.

Over 50 integrations with major FinTech providers and platforms enable LendFoundry to digitize the entire loan lifecycle and state-of-the-art microservice design allows for high performance and seamless scaling.

The starting price is $1,500.

Fyndoo

Fyndoo10 is an end-to-end cloud-based lending software. The software is made from modules that can be used individually or in combination.

- Fyndoo Connect allows connecting to specified data sets and integrating the data within the customer’s ecosystem.

- Financial Spreading allows performing fully automated report spreading and integrating reports with other systems such as origination and monitoring.

- Originate assists in assessing and underwriting financial applications thus helping to onboard more customers and reduce costs.

- Pay & Collect matches the incoming payments with the outstanding payment obligations, and includes them in the administration via an accounting link.

- Manage helps to organize the management processes, from revision, monitoring, and restructuring to all kinds of change requests.

Fyndoo offers custom pricing on their software solutions.

Abrigo

Abrigo11 is a leading provider of compliance, credit risk, and lending solutions for financial institutions. The software provider works with all types of organizations:

- Mid-size businesses

- Small businesses

- Non-profit

- Startups

- Governmental Organizations

Abrigo offers a powerful suite of tools that help companies navigate a complex landscape of regulatory requirements and risk management. Along with ensuring regulatory compliance of its solutions, the provider offers a comprehensive set of tools for analysis, reporting, and decision-making.

Final thoughts

Each SaaS lending solution or P2P lending software comes with a unique set of features, collaboration models, packages and pricing options. If you are strict on budget, consider the most affordable option and see if there’s an opportunity to opt out with your data if you decide to change the provider in the future.

In constrast, if you have some money to spend on the P2P lending software, then explore solutions with the highest flexibility and customizability opportunities. As your business grows, you may want to add more features to your platform to stay competitive and potentially avoid vendor lock-in.

With LenderKit, you can have the best of the two worlds – ready-made packages to get started quickly and also a development team behind the solution to help you add custom features and run a competitive P2P lending platform.

If you’d like to learn more about LenderKit and how it works, reach out to us and we’ll answer your questions.

Article sources:

- Finastra | Financial Software Solutions & Systems

- Loan Management & Lending Automation Software

- Modular Lending Software | Digital Platform | HES LoanBox

- TurnKey Lender - global leader in digital lending automation

- Loandisk - Online Loan Management System for Microfinance Cos

- Home

- Loan Management Software for Specialist Lenders

- Nortridge | Enterprise Loan Servicing & Management Software

- Cloud-Based Best Alternative Lending Software | Digital Lending Platform

- Akkuro | Composable Banking Platform | Lending

- Abrigo: Software for Lending, Financial Crime, Risk & Analytics