Top 5 Investment Calculators and Why You Need Them

No time to read? Let AI give you a quick summary of this article.

Investing in crowdfunding campaigns is a risky venture, so to make informed decisions, investors need to assess potential returns, taxes and investment limits.

Calculating these factors manually can be complex and may not accurately reflect the true ROI, especially when considering fees and dividends in the long run.

That’s where investment calculators come in handy — they simplify the process by providing, “hopefully”, accurate projections based on various factors.

The are all sorts of investment calculators including:

- Investment return & growth calculators

- Lending calculators

- Crowdfunding fee calculators

- Investor limits calculators

- Crowdfunding success calculators

Investment calculators can be a powerful tool not only for investors, but also fundraisers and even the platforms themselves that want to offer their clients an engaging and informative way to learn about the financial aspects of the platform or campaign.

What you will learn in this post:

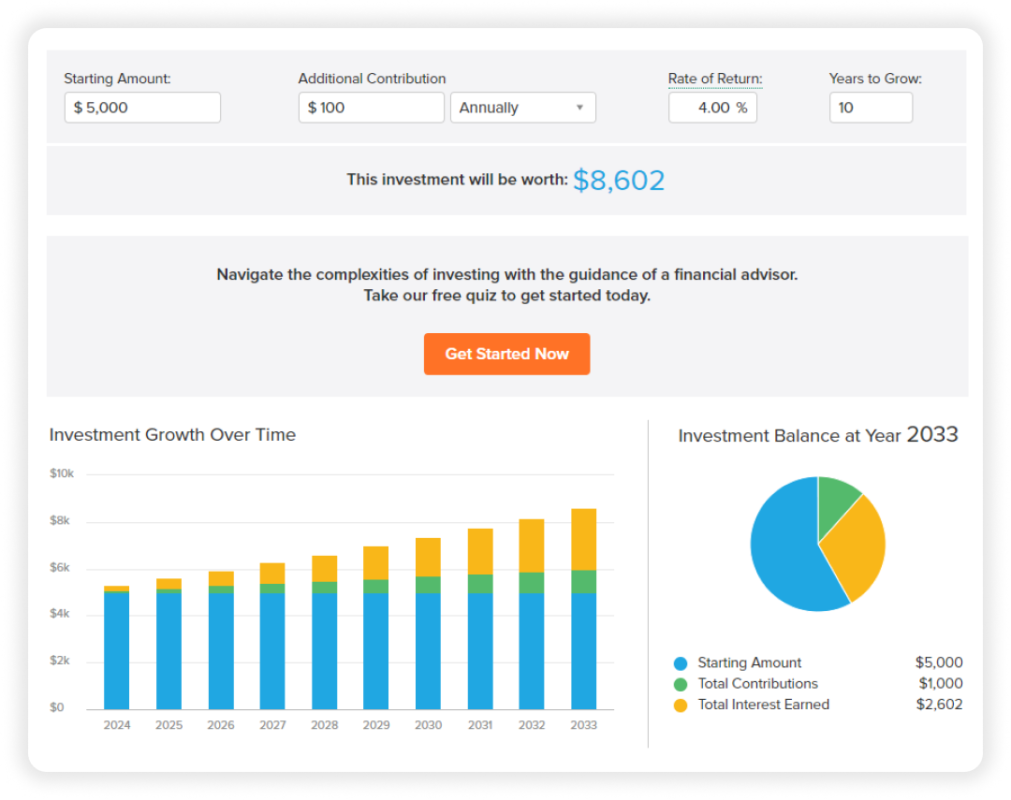

Investment return & growth calculator

The investment return and growth calculator is one of the most common calculator types. You provide the initial investment sum, and additional contribution, indicate the frequency of the additional contribution, and the duration time of the investment. The annual rate of return is indicated by the resource where you want to invest.

Here’s an investment calculator offered by smartasset1:

Investment calculators can not only come with some graphics to show what to expect after the investment maturity in a more interactive and interesting manner, but also provide a detailed breakdown of all contributions and returns.

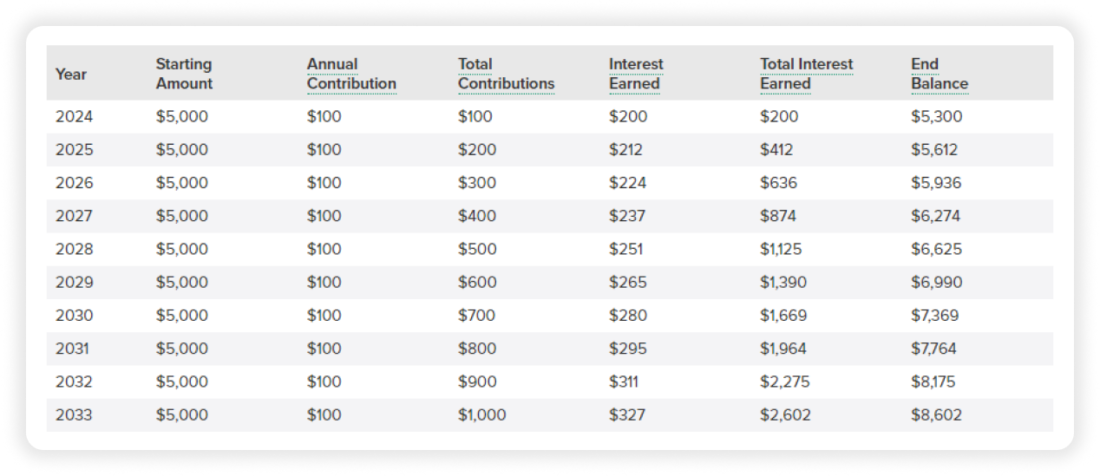

ArborCrowd investment calculator

An investment calculator may have a unique design, but serve the same purpose if it is integrated into a crowdinvesting platform. For example, here is the investment calculator by ArborCrowd2, one of the leading crowd investment platforms that works with real estate.

When it comes to real estate, investors may earn not only on the property appreciation but also get their share from rent, leasing, and other operations. If this opportunity exists, it is possible to indicate that there is cash flow from operations, and additional fields appear. After indicating when the operating cash flow begins and adjusting the annual return, one gets the adjusted results.

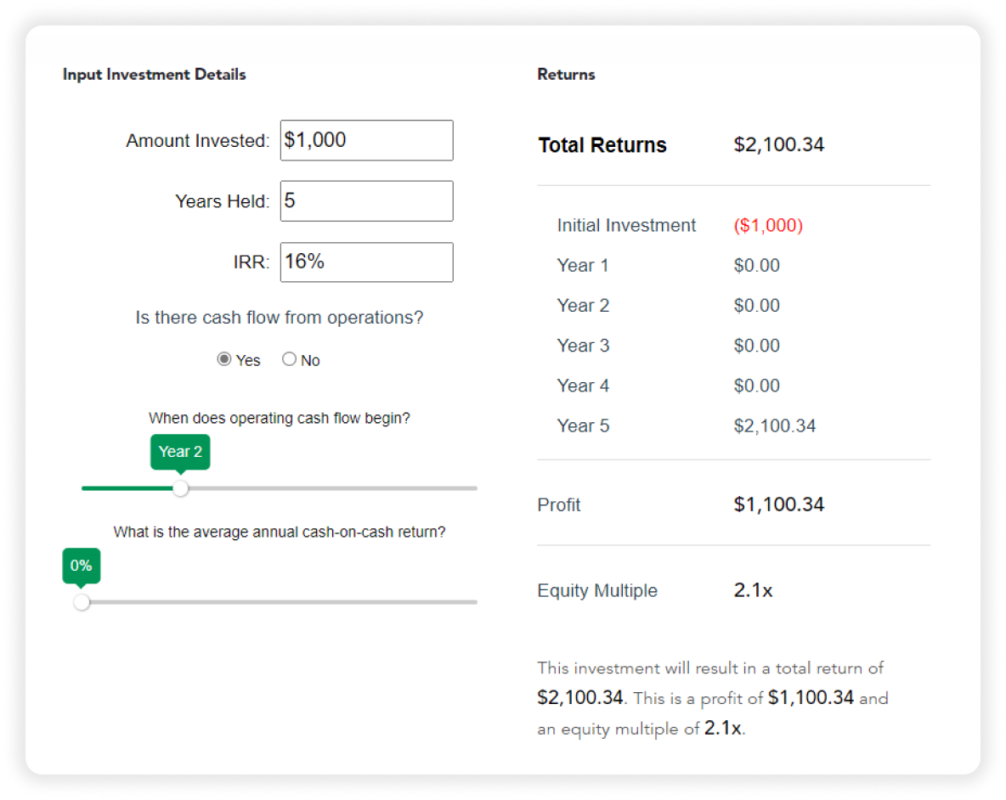

EstateGuru investment calculator

EstateGuru3, a platform that offers investment in property-backed loans, offers a very straightforward calculator that focuses completely on the needs of a potential investor.

With only three fields available, it is easy to use and provides all the needed information in a very minimalistic way.

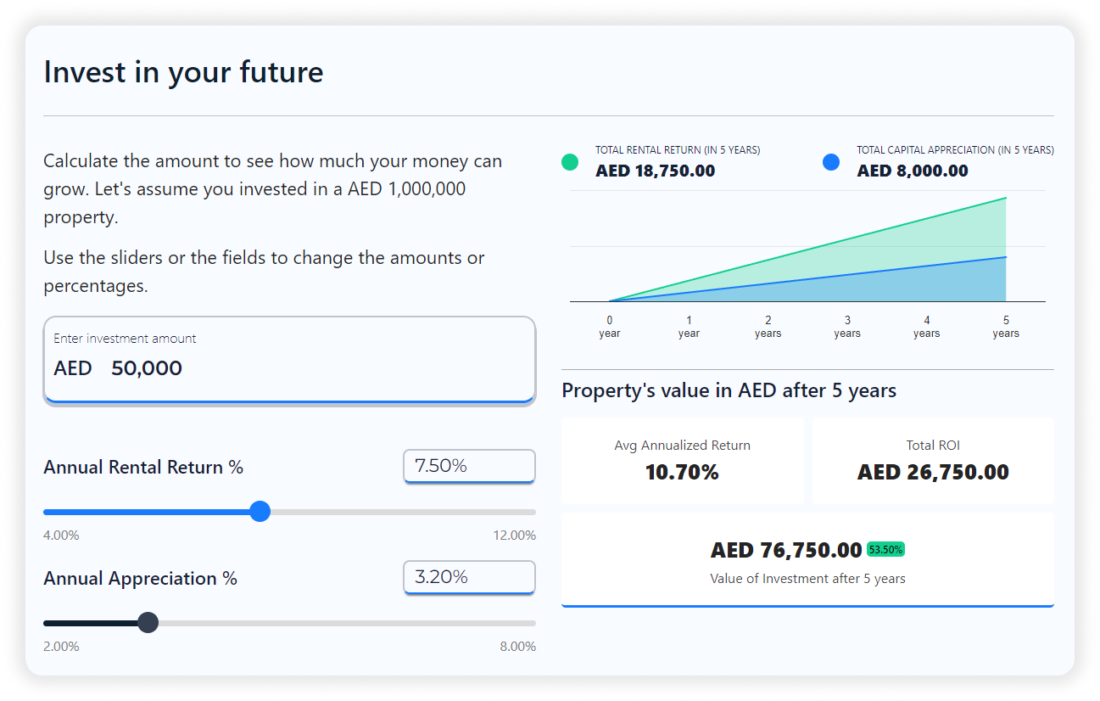

SmartCrowd investment calculator

Real estate in Dubai has been a trending investment option recently, and SmartCrowd4 decided to create a special calculator for this investment sector. By adjusting fields such as Ïnvestment amount”, “Annual rental return”, and “Annual appreciation”, one can check how his investment will grow over time.

All you have to do is pick a real estate project, check the parameters that you need to provide in the calculator, and you’ll see how much your investment is going to increase.

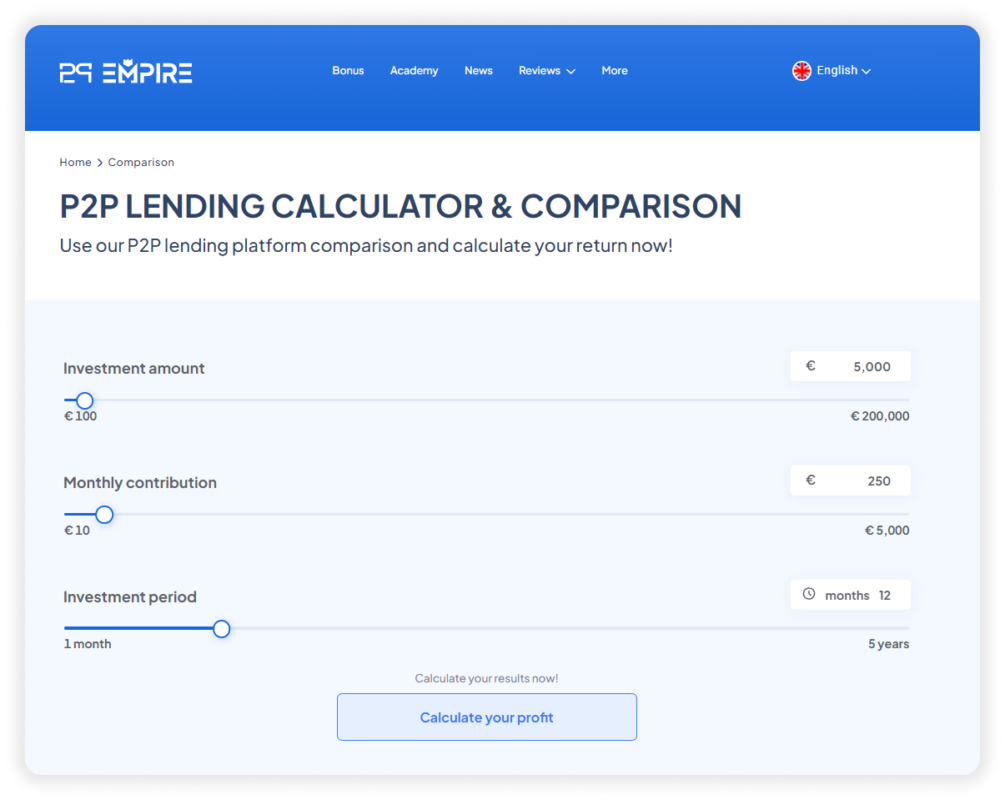

Lending calculator by P2P Empire

This calculator type works based on the same principle as an investment calculator. It calculates your potential profit from investing in a loan.

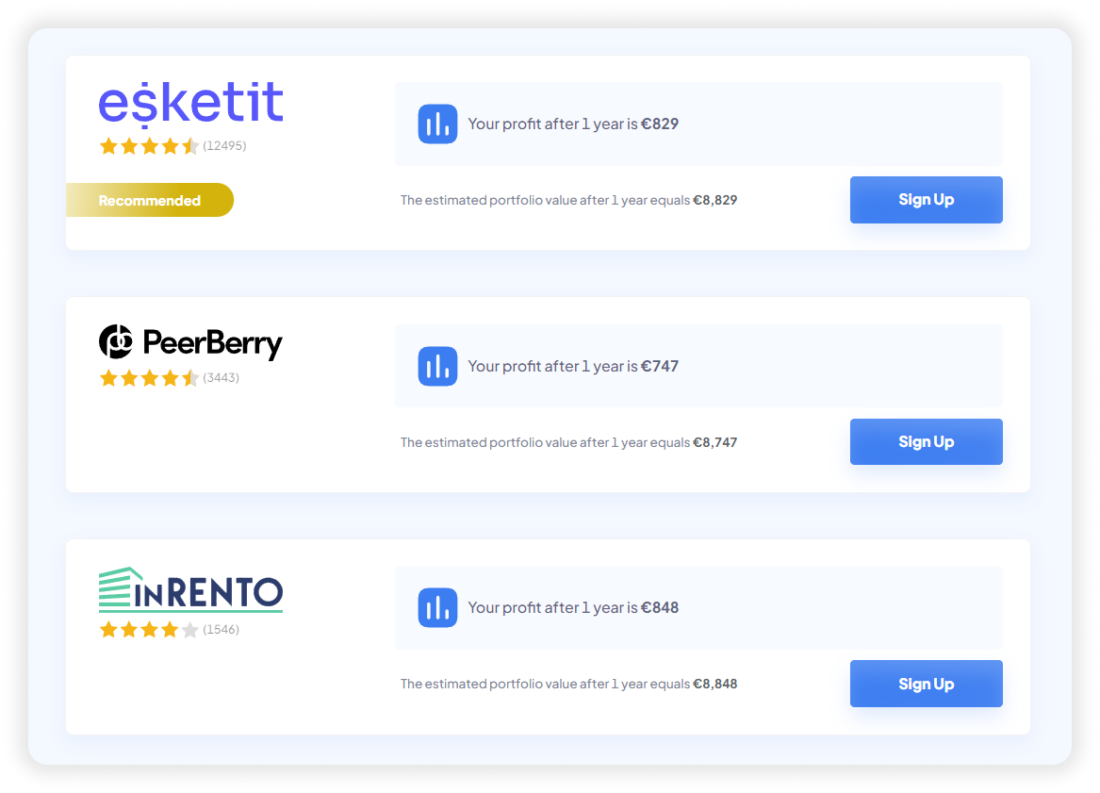

P2P Empire5, a leading platform that helps investors to compare P2P lending platforms, offers a lending calculator that allows you to calculate a potential return from investing in one of them.

Then, you scroll down to see your potential profit for each listed platform.

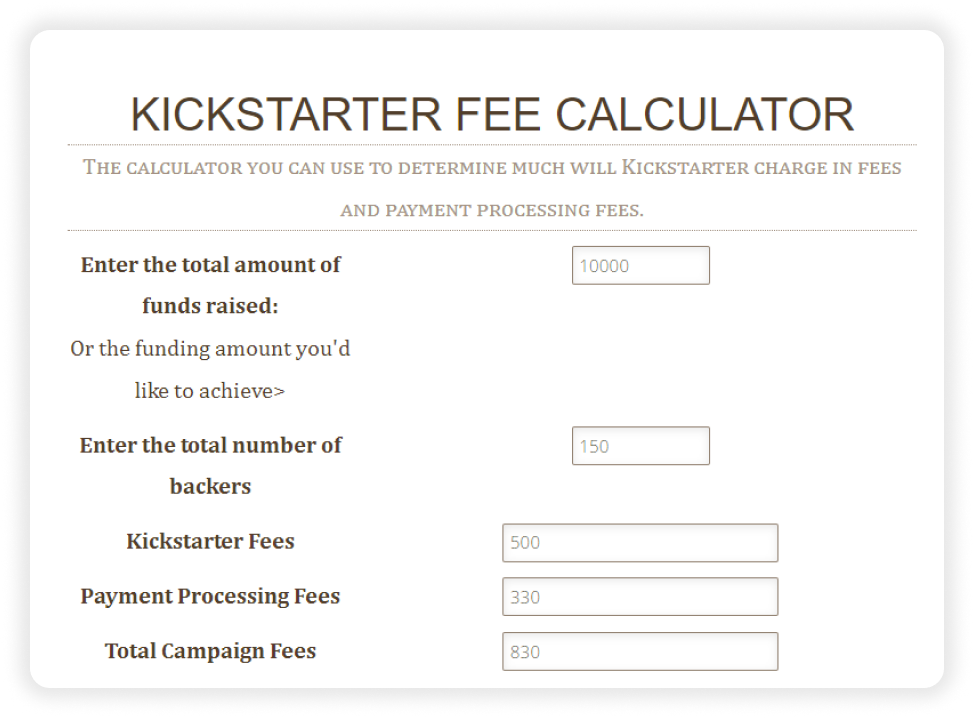

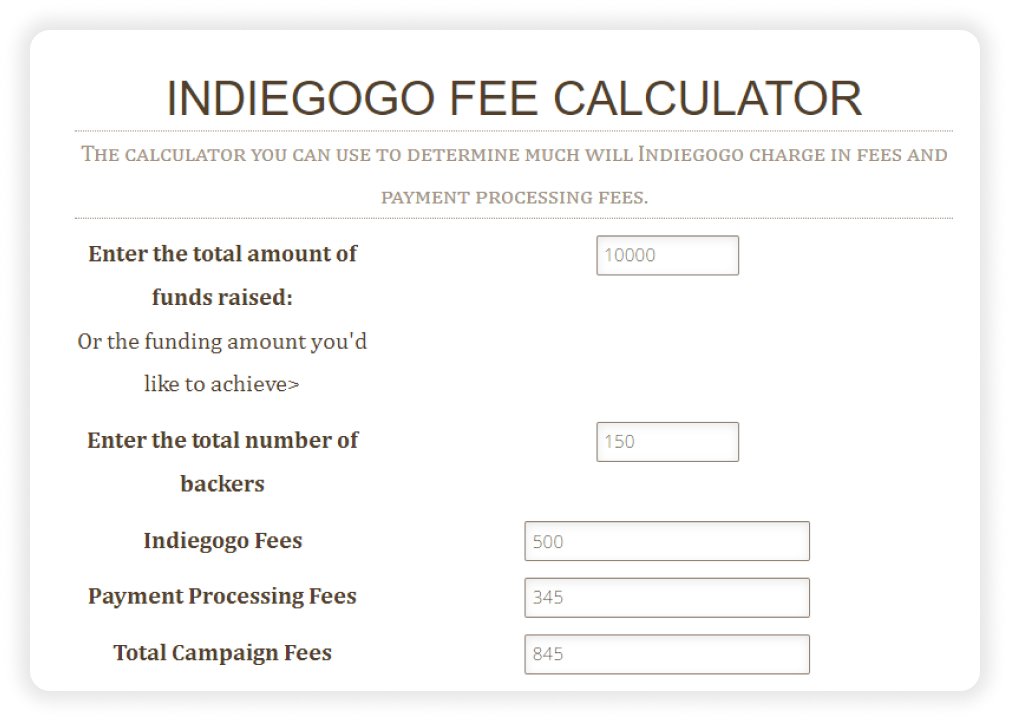

Fee calculator for Indiegogo and Kickstarter

Many investments come with fees, this is why it is crucial to understand how much you are going to pay from the money that you will get. When it comes to crowdfunding, the same principle applies: even in donation-based crowdfunding, somebody has to cover payment processing fees, platform fees, and whatever else fees. Knowing fees in advance helps to set funding goals more accurately.

Indiegogo6, a leading reward-based crowdfunding platform, charges a 5% fee on the funds raised, and a payment processing fee. Kickstarter7 has the same fee system with some changes in the values when it comes to a payment processing fee.

Including these fees in calculations is crucial for fundraisers to understand what target funding sum they shall indicate. Fundraisers can calculate them manually or use a calculator to get values within seconds.

While the platforms themselves don’t provide a calculator for fees, other resources do. Here is how such calculators from Crushcrowdfunding for Indiegogo and Kickstarter look.

These values differ depending on the project, investment type, and the country from which the investment is made, however, they help to get an idea of how much the target funding goal shall be increased.

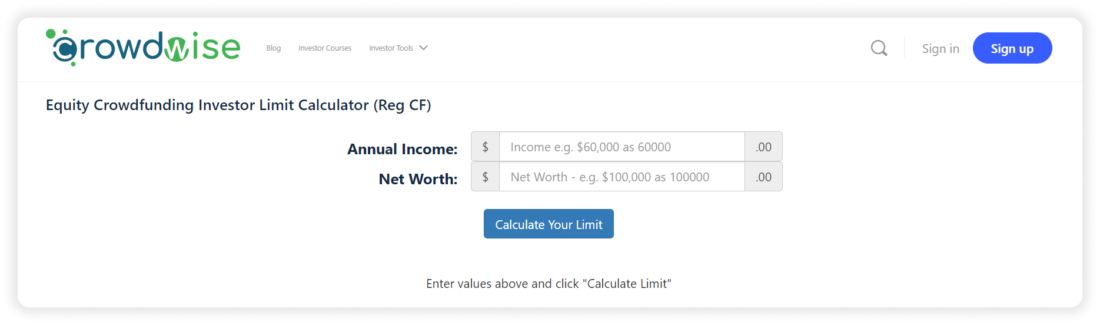

Investor limit calculator from CrowdWise

Some investment types are open to financial institutions and accredited investors who can invest any sums. However, in crowdfunding, investments can also be accessible to non-accredited investors, with some limitations on the maximum investment sum. If you are a non-accredited investor and want to calculate how much you are permitted to invest in a promising real estate offering, you will find out that it can be tricky. Here is when an investor limit calculator can be of great help.

CrowdWise8 offers a simple calculator to check investing limits for non-accredited investors based on Reg CF.

All you need to know is your annual income and net worth, and the calculator will calculate your investment limit for 12 months.

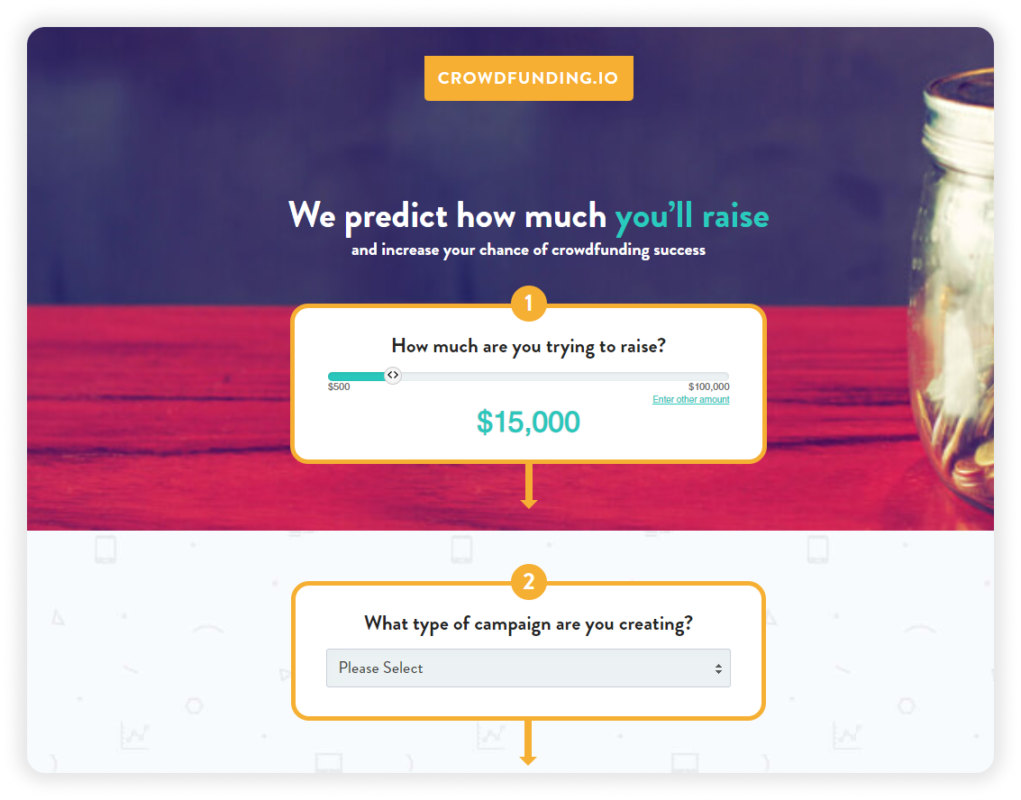

Crowdfunding success calculator

Before launching a crowdfunding campaign, most fundraisers would want to see a forecast of how much their project can launch and whether their campaign is going to achieve success. There are AI-based calculators that can give such estimations based on past campaigns and current market trends such as the one offered by crowdfunding.io9.

You are requested to fill in the replies to several questions, and a tool gives you the estimates. It is important to understand that this type of calculator is not accurate and its estimations are based on the data of past similar campaigns.

LenderKit white-label investment software

An investment calculator is great, but it’s usually a part of a larger platform. If you’re looking to start your own investment platform, check out white-label investment software offered by LenderKit.

At LenderKit, we can help you launch a crowdfunding platform prototype or a full scale investment platform with a focus on real estate or startups, fiat or crypto, retail or accredited investors.

If you’d like to learn more about how our investment software works, don’t hesitate to fill out the contact form and our fintech strategist will get back to you shortly.

Article sources:

- Investment Return Calculator: Growth on Stocks, Bonds & More

- Real Estate Calculator: Use IRR to Find Profits - ArborCrowd

- Start Investing in Property-Backed Business Loans - Estateguru

- Dubai Real Estate Investments Calculator | SmartCrowd

- P2P Lending Calculator & Comparison 🎖️ November 2025

- Indiegogo Fees Free Calculator - Crush Crowdfunding

- How to know your fees FAST? Use the Kickstarter Fees Calculator FREE

- Equity Crowdfunding Investor Limit Calculator (Reg CF) - Crowdwise

- Crowdfunding Website Success Calculator