5 Reasons Why Crowdfunding May Never Get Big

No time to read? Let AI give you a quick summary of this article.

Every second crowdfunding report reads “the industry is booming”. Before the COVID-19 broke in, the global crowdfunding market size was around $30 billion.

In the next 5 years, it’s going to raise up to $196.36 billion1. Just to compare, as of Q3 21, the global venture capital market was peaking at $160 billion2, seed and angel deals were valued at $6.3 billion3. Does it mean that the crowdfunding future is so bright that it may outshine VCs and angels? In fact, there are a few obstacles preventing crowdfunding from getting big.

Market challenges for global crowdfunding

Crowd investing and p2p lending would have already outperformed traditional banks and venture capitalists if only crowdfunding investors were more disciplined, regulation – friendlier, and donations – larger.

If wishes were horses, beggars would ride, but the reality is the following.

What you will learn in this post:

Retail investors lack financial discipline

Mark Roderick from “The Crowdfunding Attorney” says4: “Everyday backers come to the market certainly because their friends are getting a 9% yield or a 12% and that sounds really terrific”.

So, in general, crowdfunding investors follow “the pack” behaviour.

Some investors are driven by money-making decisions, some will see the whole game as gambling, others focus on ideas and high matters, but the main question “Do they invest regularly and consistently enough to be able to fund multi-million projects?” is still open.

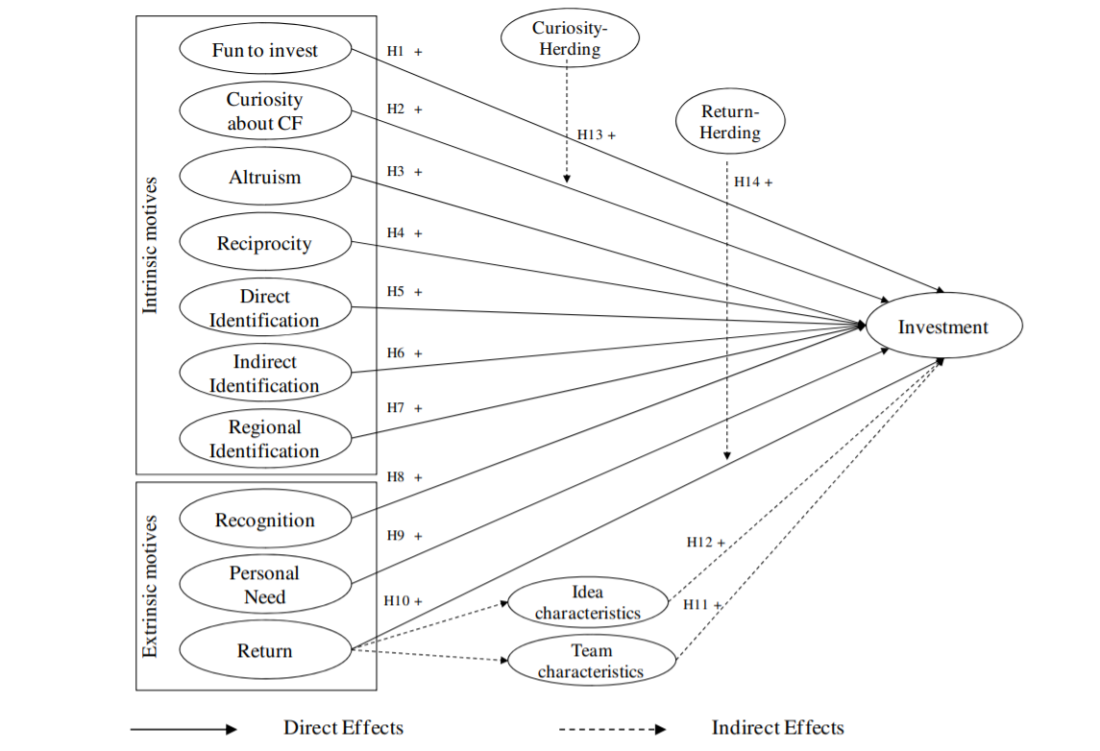

There are many speculations about investor motives in crowdfunding. Scientists believe there are 8 forces driving individuals to donate5, in particular, fun to invest, curiosity about crowdfunding, altruism, reciprocity. These stimuli create different investors’ personas and hurdles they may experience along the way.

Since receiving a financial reward is considered to be the main motivation for supporters, not receiving the reward can act as a deterrent for future funding activity.

Small financial appetites

If there are not enough investors, then there’s not enough money. But a crowdfunding offering may attract hundreds of investors and every one will donate a few bucks.

In this case, there’s still not enough money.

The situation gets worse since there are no investment advisors for the crowd – as Mark Roderick believes4.

Although the niche is more than a decade old, there is still no one who will guide uneducated backers around a bunch of crowdfunding deals.

Yes, some portals have built-in robo-advisors6 helping backers choose the most suitable investment strategy and optimise investment portfolios based on a set of parameters.

But again, backers have to be savvy enough to fine-tune product portfolios to get returns.

Mark Roderick7 suggests that a licensed investment advisor could provide investment consulting services concerning investments in crowdfunding projects and make the investments on behalf of their retail customers for an annual fee based on the amount invested.

Every backer will be able to create their own “mutual fund” of projects based on individual preferences.

Moreover, investment advisors can manage the investors’ money and make decisions based on their own experience, rather than giving it all to uneducated retail investors.

Regulators are too strict to retail backers

Crowdfunding platforms always blame the government and regulators for being “innovation-killers”.

Although the SEC, FCA and others oblige platforms to conduct appropriateness tests, rank backers by their status, and carefully track the amounts raised, they do a great job.

Restrictions on how much money you can raise and how much you can invest are the major “innovation-killer”, but it protects people from fake platforms and crowdfunding scams.

Investor protection in adjustable regulation is one of the hot crowdfunding trends.

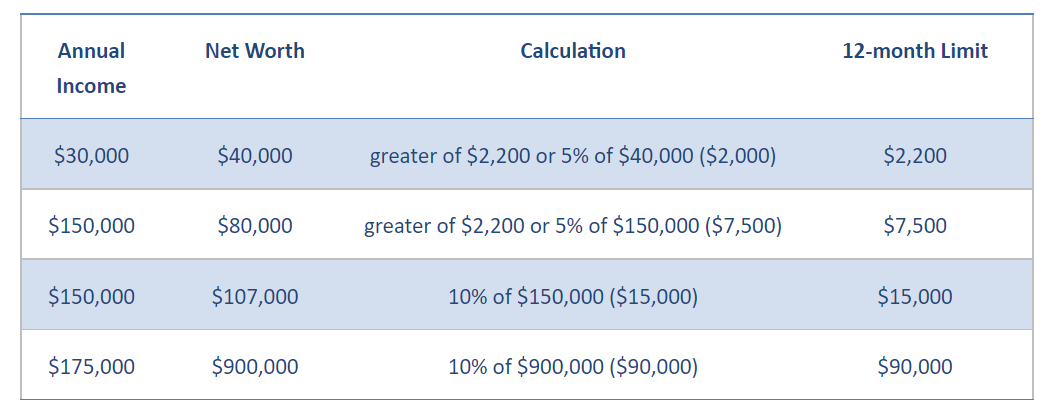

The SEC limits fundraising amounts for non-accredited investors8. The limitation on how much you can invest depends on your net worth and annual income.

For accredited backers, there are no restrictions in the US.

Also read: Crowdfunding for retail vs accredited investorsThe FCA obliges retail backers to fill in an investment statement and invest less than 10% of their net assets in non-readily realisable securities.

Banks are reluctant to work with platforms

Given that banks and crowdfunding platforms collabs are trendy, this statement may sound weird.

In fact, incumbents don’t rush to enter crowdfunding investor pools or set up their own platforms.

Alternative financing is full of risks for all parties, and banks aren’t willing to take them.

Among the most innovative and proactive banks partnering with platforms, there are BNP Paribas, P. Morgan Chase, HSBC Bank, and Barclays.

Also read: Banks and CrowdfundingP2P lending is a competitive market where platforms are luring away startups and small businesses

In general, marketplace lending affects small commercial banks through these banks’ losses in loan volume and acceptance of riskier borrowers.

While marketplace lending directly competes with bank lending, equity crowdfunding doesn’t, since entrepreneurs traditionally choose debt financing over equity financing.

One of the primary advantages of banks’ partnering with equity crowdfunding sites is information asymmetries elimination and collateral provision.

Crowdfunding isn’t the only egg in the basket

Despite the breathtaking crowdfunding growth, savings accounts, cryptocurrency, and REITs remain popular investment paths.

To win the “crowd” as an investor, platforms are competing9 with public stock market traders and crypto-investors, index funds, savings accounts, etc.

And crowdfunding isn’t always a winner.

While veteran backers from Bloomberg suggest10 investing in Europe’s best industrial automation companies and Chilean equities, the Times focuses on ethical investment11 as one of the best options in 2021.

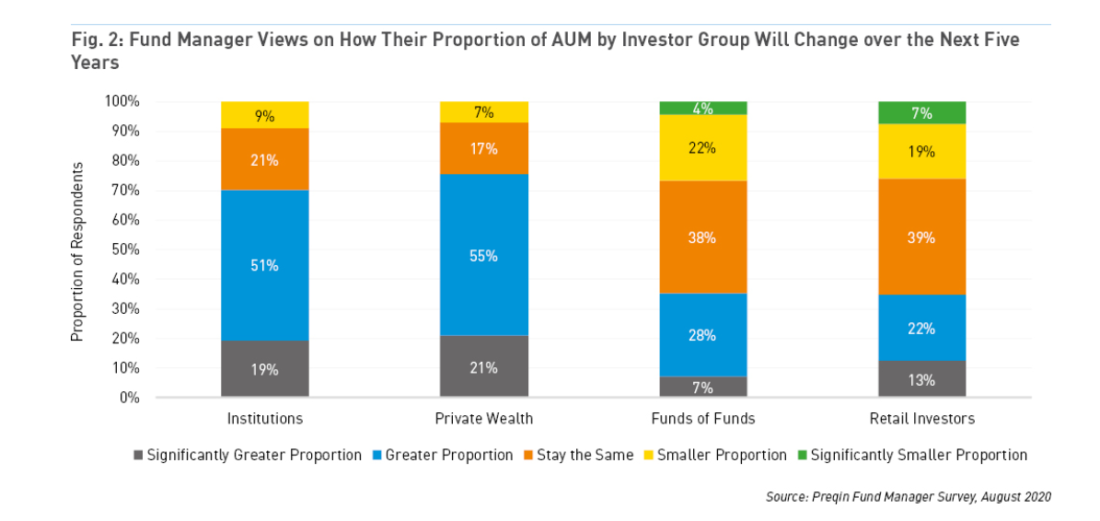

Interestingly, according to stats12, some crowdfunding managers and real estate fund managers admit that they are going to stop offering services to retail investors.

To be a highly effective investor, you should diversify. Compare available options by an investment term, potential yield, and risks to make an informed decision.

On a side note

The crowdfunding market continues scaling despite the temporary downturn due to COVID-19. Can it grow big and win the competition between other fundraising methods? A moot point.

There are several obstacles hindering the further evolution of alternative financing. The main ones are unclear investment stimuli from backers, big financial appetites, strict regulations, alternative investment options, etc.

We suppose that crowdfunding will continue developing in its own path and get a stable market niche. If you’d like to launch your investment platform early and be the among the first platforms to get big when crowdfunding reaches its heights, reach out to us at LenderKit.

Article sources:

- 80 Crowdfunding Statistics You Must See: 2024 Platforms, Impact & Campaign Data - Financesonline.com

- The Q3 2021 Global Venture Capital Report: Record Funding Trend Held Strong

- Global seed and angel venture capital deal size 2022| Statista

- - YouTube

- PDF (http://pubs.wi-kassel.de/wp-content/uploads/2015/04/JML_5321.pdf)

- - YouTube

- Will Someone Please Offer Investment Advice For Crowdfunding? - Crowdfunding & FinTech Law Blog

- Updated Investor Bulletin: Regulation Crowdfunding for Investors | Investor.gov

- 10 Best Investments For 2025 | Bankrate

- Bloomberg suggest

- Ethical investment

- Preqin | Alternative Assets Data, Solutions and Insights