Why eIDAS Is a Game-Changer for Cross-Border Fintech Operations

No time to read? Let AI give you a quick summary of this article.

There’s a quiet revolution across Europe — one that could finally remove the friction that has long slowed down cross-border financial innovation.

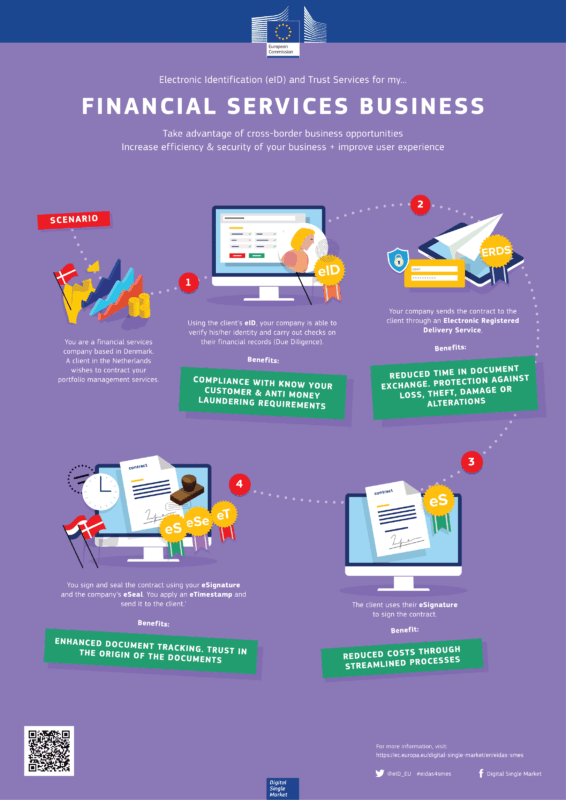

eIDAS1, short for Electronic Identification, Authentication and Trust Services, can redefine how fintech companies onboard users, verify identities and execute contracts anywhere in the EU.

What sounds like a bureaucratic update to EU regulation may in fact be one of the most consequential shifts for fintech since the PSD2 directive2 opened up banking APIs.

What you will learn in this post:

A single digital identity for Europe

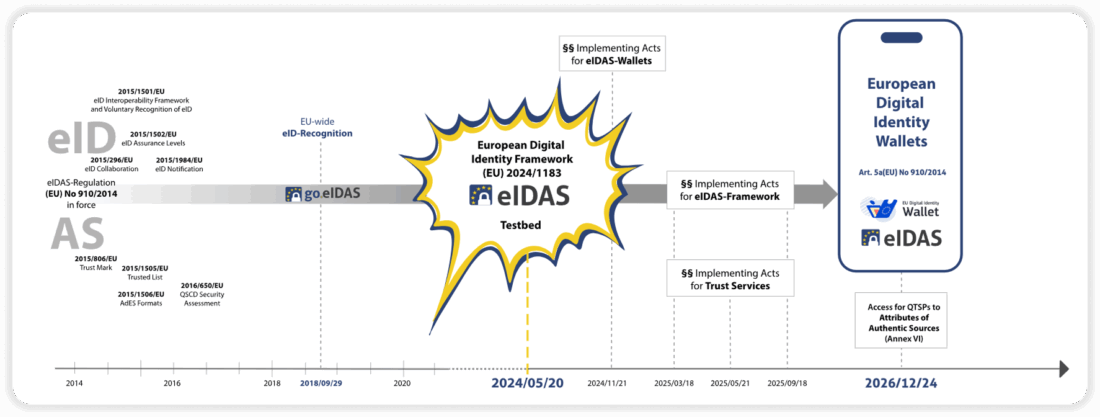

The original eIDAS Regulation (EU 910/2014)3 created the first legal framework for digital identity and electronic trust services across Member States. Its goal was simple: if one EU country recognizes a digital identity scheme, every other Member State should too.

In practice, adoption was limited4. Each country built its own eID scheme, and very few were opened for private-sector use. The vision of a seamless, EU-wide digital identity remained largely theoretical.

That changes with eIDAS 2.05 (the European Digital Identity Framework under Regulation (EU) 2024/1183). The new regulation requires every Member State to issue an EU Digital Identity Wallet (EUDI Wallet). Citizens, residents and businesses will be able to use this wallet to store verified digital credentials, such as ID cards, diplomas, business registration details, payment information and others.

These credentials will be cryptographically signed and interoperable across the EU. Most importantly, individuals will control what data to share, allowing for selective disclosure, such as proving age or citizenship without revealing the full ID.

The rollout is scheduled to begin in late 20266 after technical standards are finalized.

The missing link in fintech integration

For fintech companies, particularly those operating across borders, eIDAS solves two long-standing problems: identity verification and trust.

Easy KYC and onboarding

At the moment, fintech platforms face costly, fragmented onboarding. Verifying users in multiple jurisdictions requires separate integrations with local KYC providers, document checks, and AML procedures.

Under eIDAS 2.0, a fintech in Denmark could accept a customer from the Netherlands using their verified eID wallet credentials, without new identity verification steps. These credentials are issued by trusted national authorities and cryptographically verified under a common EU standard.

This change could reduce onboarding costs, reduce fraud, and improve conversion rates for cross-border platforms.

Legally binding digital agreements

eIDAS7 also gives legal force to electronic signatures. A Qualified Electronic Signature (QES) has the same legal status as a handwritten one across all Member States.

That means fintechs can execute contracts, investor agreements, or loan documents digitally with full legal certainty, without a need to navigate 27 different national e-signature rules.

The updated regulation goes further by adding new trust services such as electronic archiving and ledger-based recordkeeping.

Streamlined regulatory compliance

Compliance with AML and KYC laws is a major operational expense for fintechs. eIDAS 2.0 enables interoperability between identity and regulatory systems, simplifying checks and reporting.

A single, verified source of digital identity reduces duplication of compliance processes across countries and makes cross-border supervision more effective.

Enhanced security and fraud prevention

Identity theft remains one of fintech’s biggest risks. The EUDI wallet introduces multi-factor authentication, cryptographic verification, and selective disclosure, which raises the bar for fraudsters.

According to an analysis performed by Edgar, Dunn & Company9, the combination of cryptographic proofs and real-time authentication will make impersonation attacks much more complicated.

What eIDAS mean for crowdfunding platforms

There are not many sectors that illustrate the potential of eIDAS better than crowdfunding, where trust and identity verification underpin every transaction.

Crowdfunding platforms often operate across borders: A Spanish investor backing a Dutch startup or a German platform hosting a French campaign. But still, each transaction triggers its own set of KYC, investor classification, and regulatory hurdles.

Investor verification made simple

With eIDAS 2.0, an investor can onboard with their digital wallet credentials, which may already include verified age, residency, and tax ID information. The platform can instantly validate these details under EU standards, eliminating document uploads and manual review.

For equity crowdfunding, where investor classification matters, wallets could carry verified attestations like “retail investor” or “professional investor,” helping platforms enforce investment limits automatically.

Streamlined issuer due diligence

On the other side of the equation, project issuers or startups raising funds must undergo background checks and corporate verification. eIDAS wallets could store verifiable credentials such as company registration numbers, VAT certificates, or ownership data to allow for quick cross-border validation.

That means a crowdfunding platform in Finland could onboard a startup from Portugal as easily as a local one.

Transparency for building trust

Trust is very important in crowdfunding. Backers are more likely to invest when they know that the project owner’s identity has been verified through a trusted EU framework.

Wallets should support a graphical Trust Mark (a logo or icon) indicating authenticity and certification. This will help to see that project owners and investors are fully identified and verified under EU standards.

What could slow down eIDAS implementation across Europe

Even though eIDAS is promising, there are some challenges to overcome.

Uneven rollout across Member States

Some countries, such as Estonia11 and Finland12, already have mature digital ID ecosystems, while others are far behind. The regulation gives states up to 24 months to implement wallets, but not all will move quickly. Until adoption becomes widespread, interoperability will remain partial.

Technical and privacy challenges

Interoperability sounds simple on paper but is technically complex13. Different biometric standards, authentication protocols, and privacy laws still need to be reconciled.

There is also a delicate balance between privacy and compliance14: financial services often require full disclosure, whereas eIDAS emphasizes user-controlled data minimization.

Security and governance

Centralizing identity introduces systemic risk. A compromised wallet, vulnerable trust service provider, or weak national implementation could have far-reaching effects. Governance, auditing, and revocation procedures must be regulated and transparent15.

How to launch a compliant crowdfunding platform with LenderKit

Launching an EU-ready crowdfunding platform involves aligning with evolving regulations such as eIDAS 2.0, GDPR, KYC/AML and the European Crowdfunding Service Providers (ECSP) framework. LenderKit provides a solid foundation for operators aiming to meet these standards through secure architecture, transparent data handling and flexible onboarding flows.

While LenderKit does not directly integrate with eIDAS nodes or EUDI Wallets, the platform’s infrastructure allows you to connect with third-party identity verification and electronic signature providers to meet your specific compliance needs. This gives you the flexibility to design investor and fundraiser journeys that align with both national and cross-border requirements.

LenderKit’s modular setup supports features such as selective data collection, configurable KYC/AML checks, and integration with trusted partners for electronic signing — ensuring a compliant and user-friendly experience.

With LenderKit, you can build a secure, adaptable crowdfunding or investment platform that’s ready to evolve with Europe’s digital identity and compliance landscape.

Ready to launch your crowdfunding platform? Get in touch with us.

Article sources:

- EIDAS Regulation | Shaping Europe’s digital future

- Directive - 2015/2366 - EN - Payment Services Directive - EUR-Lex

- Regulation - 910/2014 - EN - e-IDAS - EUR-Lex

- Regulation (EU) 2024/1183 – The New Framework for a European Digital Identity | EY - Greece

- EIDAS 2.0 | Updates, Compliance, Training

- European Digital Identity (EUid) - Bird & Bird

- PDF (https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gr/technical/tax/tax...)

- The impact of eIDAS 2.0 on privacy, anti-money laundering

- The Impact of eIDAS 2.0 on Digital Identity & Payments

- EIDAS - The Ecosystem

- How Estonia outpaced the rest of Europe at digitalization – DW – 07/18/2025

- Finnish BankID and Mobile-ID (FTN) - Scrive

- EIDAS Interoperability and Cross-Border Compliance Issues

- PDF (https://www.ebf.eu/wp-content/uploads/2018/09/EBF-Position-and-recommendation...)

- EIDAS - Wikipedia