A Modern Investor Portal Built for Scale

Provide individual and corporate investors with a dedicated space to invest, monitor portfolios and manage transactions. Built for regulatory flexibility, investor segmentation and seamless investment flows, the Investor Portal supports both startup and established crowdfunding platforms.

Investor Infrastructure at a Glance

Investor-Ready Out of the Box

Launch a fully functional investor portal with proven flows for onboarding, verification, investing, and portfolio management.

Flexible Investor Segmentation

Support individual and corporate investors with pre-built investor categories and custom roles or groups configured by platform operations.

Built for Regulated Investment Flows

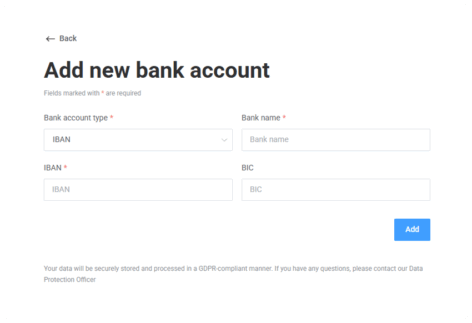

Designed to handle KYC, permissions, transactions and investment visibility in line with crowdfunding and private investment requirements.

What is an Investor Portal?

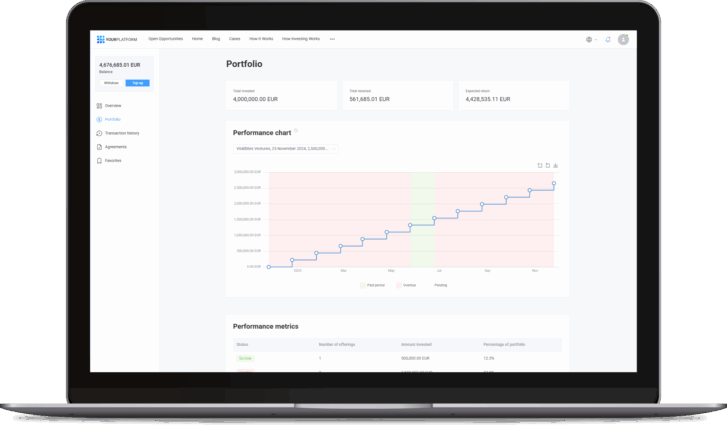

The Investor Portal is a dedicated area designed for individuals and companies to manage their investments, track performance, and interact with offerings available on the platform.

LenderKit supports both individual investors and corporate investors, providing each user with a secure personal environment tailored to their investment activity and regulatory status.

Investment management and monitoring

Through the Investor Portal, verified investors can:

- Browse and review offering details

- Make investments in available offerings

- Monitor portfolio performance in real time

- Track investment status and history

- Top up and manage e-wallet balances

- Participate in secondary market transactions (if enabled)

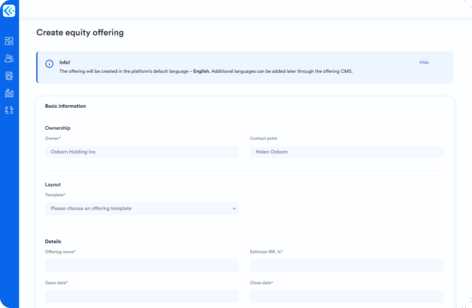

Issuer or Fundraiser Portal

The Issuer Portal is a separate environment designed specifically for fundraisers and issuers managing offerings and campaigns on the platform. It provides a consolidated view of:

- Offering creation flow

- Active and past offerings

- Campaign status and performance

- Transaction monitoring

- Repayments and payout schedules

FAQs

Who is the Investor Portal designed for?

The Investor Portal is designed to support both individual and corporate investors on your platform. Each investor type is provided with a secure personal environment that adapts to their investment activity, permissions and regulatory classification.

Can I manage different investor types and permissions within the same platform?

Yes. The Investor Portal includes pre-built investor categories such as retail, sophisticated, and accredited investors. In addition, your operations team can define custom investor roles and groups to control access rights, investment limits and offering visibility.

Does the Investor Portal support regulated crowdfunding and private investments?

The Investor Portal is built to support regulated investment flows, including KYC onboarding, permission-based access, transaction tracking, and controlled investment visibility. This allows your platform to align the investor experience with local crowdfunding and private investment regulations.

What functionality will my investors have access to?

Your investors can browse and evaluate offerings, make investments, monitor portfolio performance, track investment history, manage e-wallet balances and participate in secondary market transactions — subject to the features you enable on your platform.

How is the Investor Portal different from the Issuer (Fundraiser) Portal?

The Investor Portal is designed for investors interacting with offerings and managing their portfolios. The Issuer Portal is a separate environment for fundraisers to create offerings, manage campaigns, monitor transactions, and handle repayments and payout schedules — allowing clear separation of roles on your platform.