How to Start a Real Estate Crowdfunding Platform

Real estate crowdfunding is a way of financing property development projects through debt or equity instruments. Crowdfunding is most commonly used to finance buy-to-rent and buy-to-sell projects including:

- Property development

- Unit renovation

- Land acquisition

- Facilities provision for real estate projects, etc.

The capital for various projects can be raised from everyday investors and sophisticated or high-net-worth individual and corporate investors who will expect to get the returns on their investment in terms of dividends or in full after successful deal closure.

What you will learn in this post:

How much is the average deal size in real estate crowdfunding?

An average deal size of the real estate crowdfunding projects is a good indicator of the market capacity which you can analyse and measure before looking to start a real estate crowdfunding business.

The average amount raised for real estate projects, usually, is somewhere between $500,000 – $4M or higher.

Often, crowdfunding for real estate is necessary for a particular purpose. In other words, crowdfunding is used as an instrument to finance a certain part of the whole project while the overall deal size may vary from $1M to $10M, $15M to $50M or higher. However, crowdfunding represents only some part of that deal; often, a seed investment.

What real estate crowdfunding niches you can enter as a platform owner

To brainstorm real estate crowdfunding platform niche ideas effectively, you can look into commercial and residential real estate and industries.

Commercial real estate:

- Office buildings

- Shopping centres

- Hotels

- Medical buildings

- Multi-family commercial

Residential real estate:

- Apartments

- Luxury houses

- Terraced houses

- Multi-family residential

- Condo

If you’d like to position your business in a particular niche you may look into more specific industries like:

- Agriculture (warehouses, farms, lands)

- Industrial real estate (building units, equipment)

- Education and fitness (schools, gyms)

- Travelling (vacation homes, cottages, hotels)

You can combine the offerings, invest only in the income-producing properties and not risk investing in ground-up construction or land, and do whatever else you have experience working with.

Overall, your choice of the niche of a real estate crowdfunding website will depend on your expected deal size, liquidity, risk tolerance, and other factors.

Does a property crowdfunding niche impact the platform on the technology level?

The choice of an industry does not affect the core functionality of a real estate crowdfunding platform. However, other things such as debt or equity investing will affect your platform’s core workflows at the development stage.

These investment flows are fundamentally different and are calculated in a different way. As a business owner, you may want to entitle different investors to different dividends and schedule repayments. In other words, the functionality of your platform will depend on the preferred money flows including:

- Payment processing

- Escrow, pledge

- Lock-up period

- Capital structure

- Fees structure, etc.

Peculiar to your niche, the design of your marketing website and a web portal has to be developed while the additional features in the admin panel may be added as per your request.

As a real estate crowdfunding software developers, our LenderKit team provides a feature-rich admin back office, web portal for investors and borrowers, and marketing site tailored for real estate crowdfunding.

Examples of real estate crowdfunding platforms

The best way to get started with a real estate crowdfunding platform is by learning from your competitors. In 2020, you’ll probably be a pioneer with your property crowdfunding software in some markets, so you have higher chances of hitting your business objectives.

Here are 3 examples of real estate crowdfunding websites that are steadily growing.

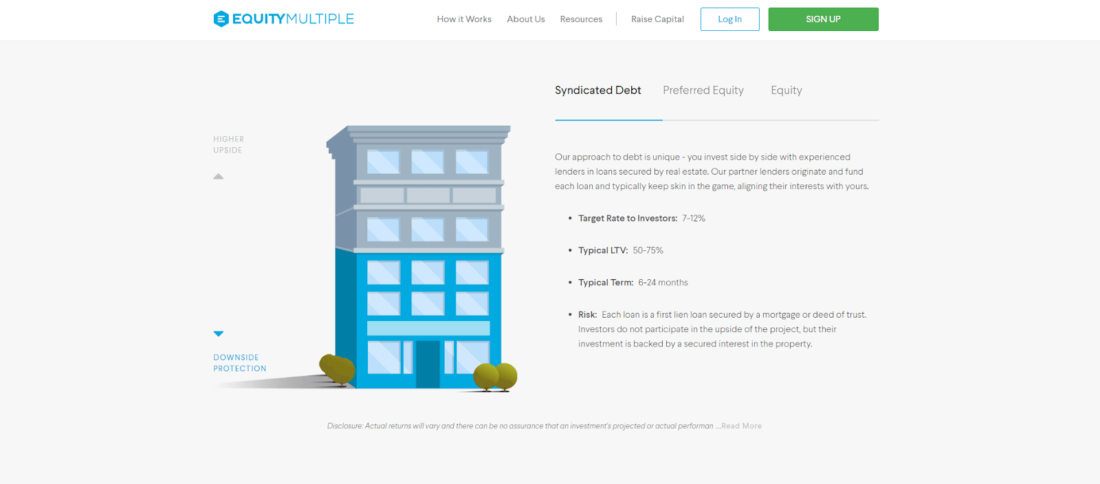

EquityMultiple

EquityMultiple is a commercial real estate crowdfunding platform with $131 million assets under management and over $1 billion total deal value, according to the InvestorJunkie.

EquityMultiple is focused on individual, accredited, investors since the very beginning. With a minimum deal target of $500,000 and a minimum investment of $10,000, the platform has experienced rapid growth at a steady pace of 100% year-over-year.

The crowdfunding platform allows accredited individuals to invest in syndicated debt, preferred equity or common equity with terms ranging from 6 months to 5 years and 6 to 12% annual returns.

Each deal is protected through an LLC in case the parent company goes out of business. This approach ensures higher security and protection to investors on the platform and is a pretty solid selling point on its own.

Shojin

Shojin is a UK-based real estate crowdfunding platform where managers invest alongside their clients while charging 0% management fees. In 2019, the platform was acquired by SmartLands, a security token issuance company.

Crowdfunding platforms like Shojin are often acquired by bigger companies or partnered with to explore new markets, improve services and drive innovation. If you’re thinking about a realistic exit strategy for your real estate crowdfunding business, a potential partnership or acquisition might be an attractive growth trajectory for your business.

Also read: “Can Crowdfunding Make You Rich?”

Shojin Case Study

Shojin focuses on individual investors from the UK as well as international investors. The minimum investment amount is $5,000 which is 50% less than EquityMultiple’s one.

The relatively high minimum investment threshold helps to sort out the unsophisticated investors with little knowledge about the real estate market and investing in general.

This is something you may keep in mind when building your own real estate crowdfunding platform.

Fundrise

Fundrise is a commercial real estate crowdfunding platform which offers direct investing opportunities through eREITs, real estate investment trusts. Focusing on senior secured debt, mezzanine debt, and preferred equity. Fundrise invests in short-term projects with terms ranging from 1 to 3 years. However, the money lock-up period for investors is 5 years.

Regardless of accreditation, anyone with $500 and above 18 years old can invest at Fundrise. However, the only requirement is being a US resident as international investments aren’t allowed at this point.

Fundrise has built its strategy around the passive investing concept which occurs, from an investor standpoint, through a highly-vetted portfolio offerings which the company proposes based on the potential customer profiles.

Each portfolio has different investment plans such as supplemental investing, balanced investing, and long-term growth with a major focus on maximizing dividends or total returns. The following plans are structured in the most compelling way to a target customer (investor) with a preferred risk-return-ratio and investment amounts.

How to make your real estate crowdfunding platform competitive and attractive

The above-mentioned examples of real estate crowdfunding platforms can help you decide how you can structure and build a real estate crowdfunding portal.

Technology-wise, your crowdfunding platform for real estate should become your right hand. Unless your platform is a tool which you can use to conduct everyday operations, it’s not worthy of your time, effort, and money.

On the admin side, it must allow you to perform all sorts of the required operations including:

- User management and filtering

- Offering management

- Wallet management and fees management

- Payment processing either offline or online through a third-party payment gateway

- Portfolio management

- Secondary market trading

- Reporting, etc.

On the business side of your crowdfunding platform, you should focus on creating the most attractive options for investors in terms of fees, tax reduction, and returns. Having analysed your competitors, you may determine a few interesting opportunities which you can think of incorporating in your offering strategy such as:

- Opportunity Funds

- ISA/IFISA or IRA/Roth IRA

- Fees reduction through eliminating the man-in-the-middle, etc.

Apart from that, you should focus on providing diverse offerings for your investors in terms of capital structure including debt, senior debt, mezzanine debt, equity, or preferred equity depending on your business model, experience, and choice. At the start, many real estate crowdfunding platforms focus on debt or equity only, usually, because launching multiple offerings is costly due to obtaining a license from the regulator.

Where can you find real estate crowdfunding platform developers?

Once you decide on your crowdfunding platform strategy and business plan, you may start looking for crowdfunding platform development agencies.

A few trusted resources on the market include:

There might be other listings, but these 3 are among the few you can rely on. The following listing and reviews websites follow strict rules and apply algorithms or human-verification procedures to make sure employees don’t score their own companies. These websites also do a good job eliminating spam reviews and fraudulent reviews.

Is there any real estate crowdfunding software that can help you?

To build a real estate crowdfunding platform, you may choose between the white-label crowdfunding software and custom solutions.

Each of these types have their own advantages and disadvantages. Obviously, custom solutions will cost you more because of the from-scratch development, and may not always be a good fit for you, especially, if you’re just starting out.

In contrast, white-label crowdfunding software may be much more affordable but limited to functionality, security, and updates which might restrict you from scaling and growing your business in the future.

You should probably look for alternative crowdfunding solutions which offer combined types of software. In other words, there are crowdfunding platform providers like LenderKit which offer both product and services:

- Admin back office

- Web portal for investors and fundraisers

- Marketing site

- Custom development either based on the software or from scratch

Out-of-the-box, we provide an MVP-ready white-label real estate crowdfunding software with additional back end and front end customisation to better fit your business model, design preferences, flows, and regulations.

Apart from that, we also offer full-cycle crowdfunding platform development based on LenderKit or from scratch as per your request.

This flexibility should allow you to enter the real estate crowdfunding business with the required solution depending on your financial status. Our approach helps you solve 3 major business problems:

- Pitching to investors with a demo prototype to raise funds for further development

- Testing your hypothesis on real users with a functional MVP

- Developing a custom product to go full scale

Final thoughts on building a real estate crowdfunding website

Real estate crowdfunding business is a lucrative opportunity which is growing worldwide. Some of the emerging and developing markets in Europe include Austria, Germany, Italy, France and the UK. Also, the USA is generally a well-developed real estate crowdfunding market with potential opportunities dynamically changing from state to state.

Launching a real estate crowdfunding platform based on the real estate crowdfunding software may become a part of the business strategy and help you reach your customers globally.

A crowdfunding platform is basically an automation tool which allows you to conduct your operations online and on a large scale or privately. It should allow you to manipulate the data smoothly, perform the required calculations, if necessary, and market your business effectively.

If you’re looking to start a real estate crowdfunding business reach out to us at lenderkit@justcoded.com.