Can You Tokenize Equity Crowdfunding Projects?

Tokenization of debt and equity assets has been a hot topic for a while now. It inspired many entrepreneurs to launch new investment platforms focusing on startup equity and real estate asset tokenization.

But how does it work exactly, how can you tokenize assets and what tools will you need to succeed in launching your tokenized investment platform?

What you will learn in this post:

What is asset tokenization and how it works

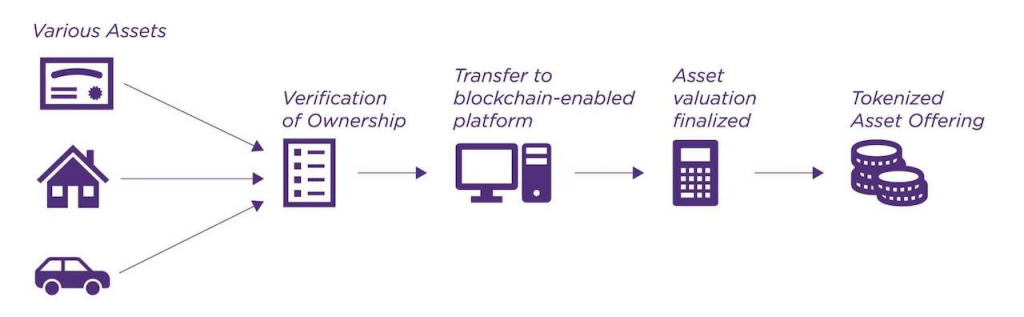

Asset tokenization is the process of creating a token, fungible or non-fungible, on a blockchain. This token can represent anything: a piece of art, a plot of land, ownership rights or copyright, equity shares. It’s expected that the process of asset tokenization for investing is easy and accessible to anybody.

For example, you have a company, and create a token that represents a stake in this company. This stake or equity is recorded on a blockchain.

Selling the token equals selling the company’s equity, but the process of transferring the token is much easier.

Everything is implemented on a blockchain by a smart contract: the buyer sends funds to the seller’s wallet, and the token that represents the company equity is sent to the buyer by the smart contract. There is no need to meet personally or sign physical agreements because everything is done in a couple of clicks without intermediaries and also absolutely transparently.

Benefits of equity tokenization

Tokenization offers several advantages in making investments more accessible to a broader audience.

- Instant Settlements: token transfers are finalized immediately upon processing on a blockchain, providing rapid settlement compared to the typically illiquid nature of traditional equity investments.

- Liquidity Transformation: tokenization allows for easy selling of tokens on specialized marketplaces, transforming traditionally illiquid investments into liquid ones.

- Geographical Accessibility: tokenization eliminates geographical barriers, making equity offerings accessible to a wider audience.

- Fractionalization: equity can be tokenized as a single token, allowing a single investor to own it. This token can further be fractionalized, enabling different investors to purchase small parts of the equity.

- Financial Inclusivity: fractionalization eliminates financial barriers by enabling investors to buy smaller portions of an equity, making investments more accessible.

- Equity Crowdfunding Enhancement: tokenization and fractionalization can significantly benefit equity crowdfunding, maintaining familiar processes while allowing investors to buy tokens representing fractions of equities. This enhances inclusivity and liquidity in the investment landscape.

But if the benefits are so evident, why is tokenization still not widely applied in the equity crowdfunding sector? To understand it, let’s delve deeper into the basics of tokenomics, and check how tokenized equity is regulated in different countries.

Regulation of equity tokenization

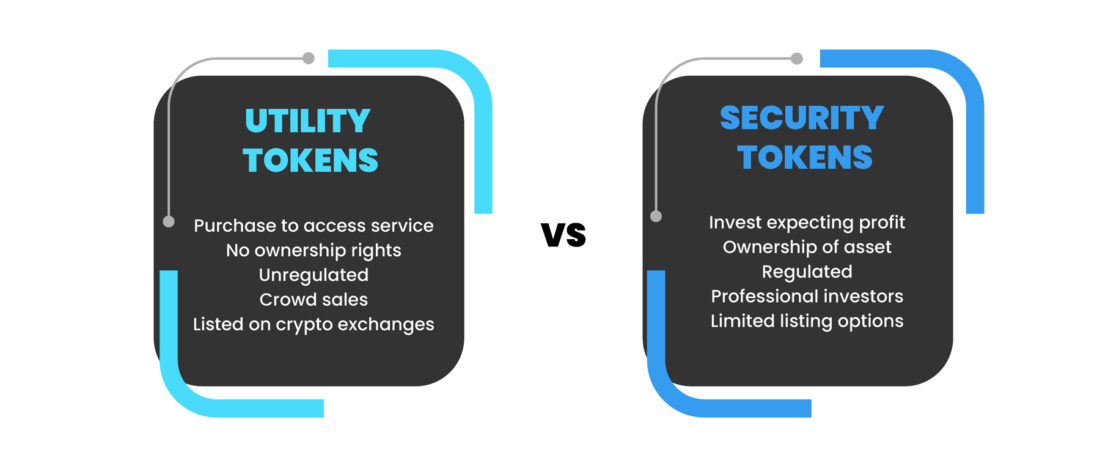

Tokens are divided into utility and security ones.

Utility tokens are used to reward users, they give access to certain functions of a project or some perks, and are not regulated.

Security tokens represent ownership and transfer value from a whole asset or its part to a token. In other words, tokens that represent equity are security tokens. In different countries, regulation for security tokens varies or is not available altogether.

SEC asset tokenization regulations

In the USA, security tokens are regulated by the Security and Exchange Commission (the SEC).

According to the SEC, when the offering involves security tokens, this offering must be registered with the SEC, or the company raising funds through the token offering must apply for one of the exemptions:

- Rule 506(b), Regulation D: a company may raise funds from an unlimited number of accredited investors and not more than 35 sophisticated non-accredited investors within 90 days, no advertising is permitted.

- Rule 506 (c), Regulation D: a company may raise money from an unlimited number of accredited investors, advertising is permitted.

- Regulation A, Tier 1: a company may raise up to $20M from any type of investors, and advertising is permitted.

- Regulation A, Tier 2: a company may raise up to $75M from any type of investors, but non-accredited investors are subject to limitations, advertising is permitted.

Also, Regulation Crowdfunding provides an exemption from registration requirements for crowdfunding platforms that host security offerings. According to the regulation, companies can offer and sell up to $5M of their securities through a crowdfunding platform.

Thus, in the USA, security tokens equal securities and are in the jurisdiction of the SEC. Equity crowdfunding platforms can fully benefit from tokenization if they receive all the permissions from the SEC.

Equity crowdfunding tokenization in the UK

Equity crowdfunding regulation in the UK is very clear and transparent. All equity crowdinvesting platforms have to be registered with the FCA (Financial Conduct Authority), and for all deals above €5M Prospectus Rules apply.

However, cryptocurrency is not yet properly regulated in the United Kingdom. The only crypto asset that is regulated is security tokens. They equal any other type of securities, and platforms willing to operate with them shall get permission from the FCA (Financial Conduct Authority). Equity crowdfunding platforms can operate with security tokens in the same way as they operate with any other asset.

Security tokens regulation in Europe vs crowdfunding

In Europe, the Regulation on European Crowdfunding Service Providers (ECSP) lays down rules for equity- and debt-based crowdfunding operators across the region. However, the tokenization application in equity crowdfunding is not covered in the new regulation.

Tokens are cryptocurrency thus, they shall be regulated by the Markets in Crypto Assets (MiCA), however, MiCA explicitly excludes security tokens from the existing regulation by claiming that they are financial instruments and are subject to MiFID regulations, and the crowdfunding sector is not regulated by MiFID.

Even if crowdfunding platforms found a way to allow projects to raise funds via sales of tokenized equity, this would not solve the problem completely. Another issue is that being traded on secondary markets is an inherent feature of all tokens, and security tokens are no exception. But to enable trading security tokens on secondary markets, it is required to be registered with MiFID as a regulated multilateral trading facility which is a completely different business than the one of a crowdfunding platform.

Finally, operations with financial instruments are regulated differently in EU countries. For example, in Germany, BaFin permits blockchain-based debt instruments rather than equity instruments, and in Luxembourg and France, blockchain-based securities are out of the securities regulation.

It seems like a lot of adjustments shall be made to the existing asset tokenization regulations to enable equity crowdfunding to benefit from tokenization to a full extent. At the moment, platforms can experiment with utility tokens.

How tokenization impacts equity crowdfunding

As we can see, in different countries, equity crowdfunding platforms cannot benefit from tokenization differently. In the USA, the platforms are regulated by the SEC and shall comply with all the rules applied for dealing with securities.

In Europe, due to imperfections in the existing regulation or the absence of such, all the tokenization benefits are not available to equity crowdinvesting platforms at the moment. While equity crowdfunding is one of the most regulated crowdinvesting sectors, cryptocurrency regulation is full of gaps and doesn’t cover most blockchain-based assets. More revisions of the existing regulations are needed to enable platforms to benefit from the new technology.

In most countries, crypto regulation, as well as crowdfunding regulation, is in a nascent stage or doesn’t exist at all. There, steps shall be made to establish clear sets of rules in both sectors to move forward.

Start a tokenized equity crowdfunding platform with LenderKit

To launch a tokenized equity crowdfunding platform, you need scalable crowdfunding software with an ability to use third-party integrations such as Polymesh, Tokeny, AllianceBlock and others.

LenderKit offers white-label crowdfunding software with tokenization capabilities enabled by reliable third-party providers that have been on the market for years. Our team behind the software can easily customize the software to make sure it aligns with your business vision and fulfills your end customer requirements, making tokenization and alternative investment opportunities accessible to your investors and companies.

Reach out to us to see how the software works out of box and what can be done to make it tailored to the asset tokenization platform.