How Much Does it Cost to Register as a Broker-Dealer?

We continue talking about SEC and FINRA registration procedures for crowdfunding businesses and their cost. The previous article was devoted to funding portals, this piece is going to shed light on the other squad of market players – broker-dealer platforms.

We’ve studied the current legislation and made a snapshot of what’s needed for registration of your crowdfunding business as a brokerage services provider.

What you will learn in this post:

Comparing funding portals with broker-dealers

Broker-dealers have always been considered by the SEC (Securities Exchange Act of 1934) as third-party intermediaries (agents) trading securities on behalf of clients or for their own interest.

The rapid evolution of alternative financing forced the authorities to create a specific framework for governing and controlling the market.

The adoption of the JOBS Act was an important step to this end.

The act aimed at presenting crowdfunding exemptions introduced a new business model for market players called “funding portals”.

For a company intending to be a funding portal or broker-dealer, it’s important to understand the difference between two models.

According to the SEC, a broker is “any person engaged in the business of effecting transactions in securities for the account of others.”

Under “person”, they mean “individuals and entities”.

For example, brokers can be entities or persons that find or refer investors or customers to investment companies or other securities intermediaries. Also, brokers can be entities or people who operate or control electronic platforms for security trading.

And dealers are defined as any person engaged in the business of buying and selling securities for his own account, through a broker or otherwise.

What is forbidden to funding portals is the core of brokers’ activity:

- investment advice and recommendations;

- securities offering, selling or buying;

- compensating employees or other related persons for securities solicitation;

- securities management on behalf of clients.

Although crowdfunding companies do not purchase securities for their own purposes and simply match crowdfunding opportunities with investors, the SEC uses the term “broker-dealer” for online platforms.

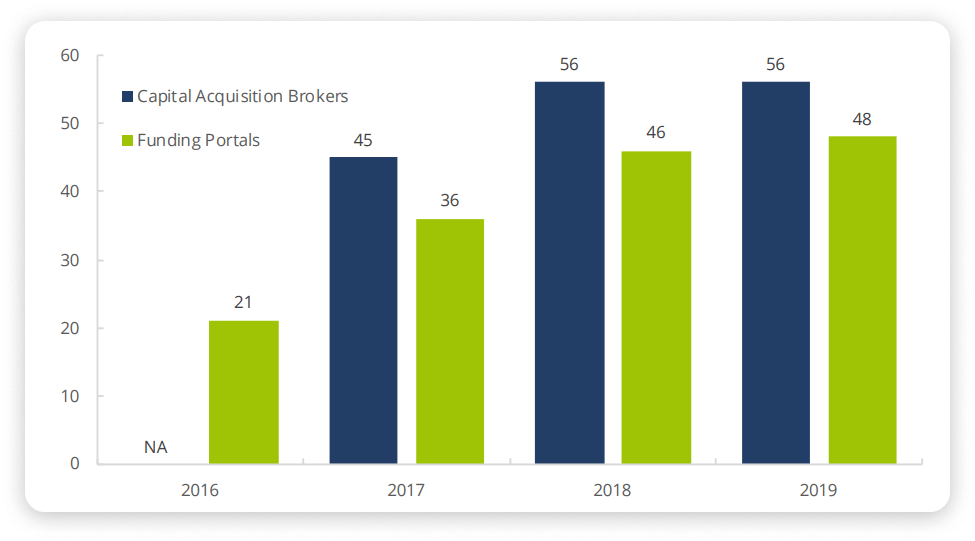

Compared to funding portals, brokerage firms have to satisfy stricter requirements, in particular, those related to due diligence checks. Their nature is more complex, yet it delivers more opportunities, which is proved by a prevailing number of broker-dealer companies on the market.

Benefits of being a brokerage crowdfunding firm:

- profitable revenue options;

- flexibility;

- clearly defined regulations;

- stronger retail and accredited investor protection;

- enhanced client service;

- and attractiveness to issuers.

Typically, a platform presents its status (funding portal or broker/dealer) on the “About Us” page or in the FAQs section.

Compared to funding portals, capital acquisition brokers engage in a limited range of activities:

– advising on capital raising;

– corporate restructuring;

– acting as a placement agent for sales of unregistered securities.

Examples of US-based broker-dealer crowdfunding portals

CircleUp is a licensed FINRA broker-dealer portal matching backers and investors. The provider focuses on consumer products and retail companies and introduces offerings under Reg D. CircleUp has the Credit Advisors feature for borrowers to help clients raise working capital. Those clients who hesitate to choose credit or equity financing, get expert advice.

Not so long ago, StartEngine received a broker-dealer status approval for its subsidiary dealing with Reg A offerings. As the company explains, the major reason for this was “more customers raising capital through Regulation A+”. A new status is to enable StartEngine to conduct larger raises and bring a greater variety of investment opportunities.

In 2019, SeedInvest joined the list of American broker-dealers. The platform received FINRA approval to operate an Alternative Trading System (ATS) to facilitate secondary trading of startup investments. All securities-related activity is conducted by SI Securities, LLC dba SeedInvest.

How to register a broker-dealer company: a stepwise guide

In its blog post-announcement, StartEngine mentions that getting an official approval is exhausting and time-consuming.

Let’s see what it takes to become an officially registered crowdfunding brokerage company.

Just like funding portals, brokerage firms have to register with the SEC to effectuate any security transaction.

Here’s a full SEC guide for broker-dealer portal registration including essential steps, financial responsibilities, extra requirements and special registration rules.

The prime requirement for applicants is a net capital of at least $50,000 to $100,000. This amount will increase if you’re going to trade for your own account.

Brokerage agents register by submitting Form BD which is also used for becoming a member of a “self-regulatory organization,” or SRO such as FINRA.

The SEC has 45 days to make a decision whether an applicant can be granted a registration certificate.

Even though you receive an affirmative answer, your status won’t be confirmed until you become a member of FINRA or another SRO.

First off, applicants should explore FINRA standards for admission. All the requirements are explained in FINRA Rule 1000 Series and FINRA Rule 1014.

Next, an agent-to-be is to complete an accurate membership application and its principal officers must pass a qualifying exam.

FINRA established this requirement to make sure that applicants have competence in particular securities activities. Exams test how well applicants are aware of securities markets and the regulatory framework.

In 2019, FINRA announced that its exam functions would be consolidated into a single, unified program. Each exam is tailored to a specific business model of FINRA’s member firms: retail, capital markets, carrying and clearing, trading and execution, diversified.

What else is needed for becoming a FINRA member?

- Forms U-4 and U-5 to establish the registration or terminate it;

- a firm’s business plan;

- information and documents under FINRA rule requirements;

- information provided during the membership interview.

After you apply, FINRA proceeds with an application review and processing. It may take up to half a year (180 calendar days).

Alongside the approval of the SEC and FINRA, companies should comply with separate state securities laws (called “blue sky laws“). The broker/dealer and its principals must be registered in the state in which the firm’s home office is located.

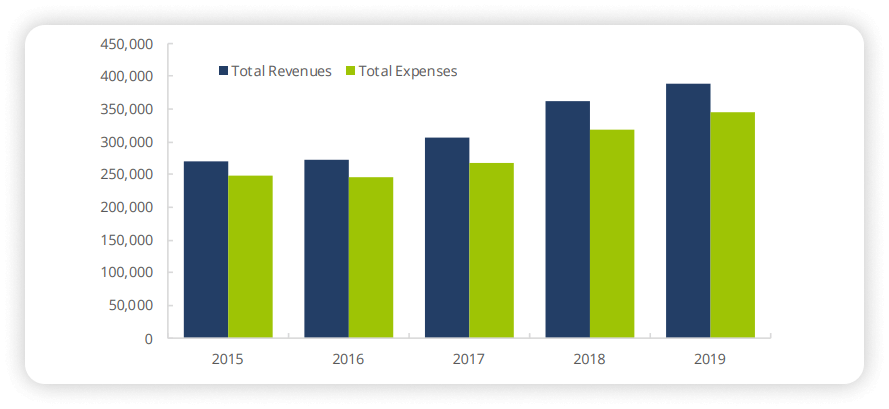

The price of registering FINRA and SEC broker-dealer

There are two options.

You can hire a professional who has years of experience of advising on setting up new broker-dealer firms. In this case, be ready to pay a pretty penny for consultative work.

Or you can walk along the registration path on your own.

No matter what you choose, you should be aware of registration fees FINRA collects.

The SEC does not charge a filing fee, but the SROs and the states may (read about it below).

- Filing Form BD – no fee;

- Firm name reservation request form – no fee;

- Application (forms U4, The New Member Application (NMA))- ranges from $7,500 to $55,000 depending on the size of the new member applicant;

- fingerprints fee ($26.25 per person for fingerprints submitted electronically and $41.25 per person for a hard copy of fingerprints);

- Additional fees for principal and representative registrations and exams.

Costs, in total: $7,500 – $55,000+

FINRA requires each applicant to have sufficient capital to cover 6-12 months of fixed expenses.

The takeaway

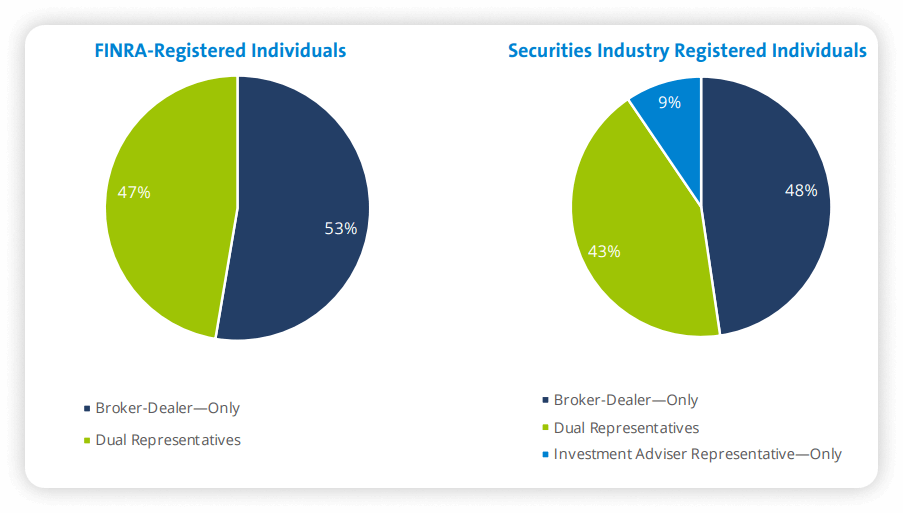

Brokerage crowdfunding firms doing business with the public in the United States are governed by the SEC, FINRA or similar SROs.

To effectuate security transactions, crowdfunding companies should be registered with FINRA and meet all its requirements.

Broker-dealer registration and compliance standards are time-consuming and costly. But, in comparison with funding portals, brokerage firms can provide better investor protection and deliver extra revenue options.

That’s why more and more crowdfunding companies are initiating the registration process and successfully addressing all the challenges.

Already have a FINRA registration and want to kick-start an online crowdfunding portal? Try out LenderKit, a white-label software for funding portals and crowdfunding brokers.