How to Register a Reg CF Funding Portal with the SEC

According to the SEC, backers can take part in crowdfunding investments only through middlemen – funding portals or broker-dealer companies.

Before the adoption of crowdfunding regulation, businesses willing to raise capital could do it only through broker-dealers. The latter would pay crazy compliance and oversight costs amounting to $100,000.

And what’s interesting, this figure didn’t change accordingly to the deal size. That’s why broker-dealers mainly focused on larger offerings ignoring small ones.

Naturally, they asked for high fees to compensate expenditures and pass costs to their clients.

Projects valued less than $1 million were the domain of traditional banks and institutions until alternative financing disrupted the industry.

To regulate small deals, in 2015 the SEC introduced requirements for a new squad of intermediaries – Reg CF funding portals.

What you will learn in this post:

What is a funding portal and how does it work?

A funding portal is a crowdfunding intermediary that, in accordance with Section 304(b) of the JOBS Act and Exchange Act Section 3(a)(80), can engage in only limited activities.

Reg CF portals are allowed to provide fundraisers with a digital account where they can create an offering and let investors take part in deals.

All the money is processed by third-party payment providers such as PrimeTrust or AssemblyPayments, etc.

The regulator doesn’t allow portals to perform activities of broker-dealer without specific registration, in particular:

- provide investment advice or recommendation;

- solicit securities purchases and sales;

- possess and manage securities on behalf of holders;

- compensate players for the sale of securities;

- conduct business analysis and valuation;

- seek investors, etc.

Under the JOBS Act, funding portals can offer a part of the service package provided by broker-dealers, which makes their cost structure simpler and fees more affordable to retail investors.

If the service portfolio of a company consists only of accepting and listing offerings, managing transactions through third-party providers, providing support to clients, it can be registered as a funding portal.

Otherwise, getting the status of a broker-dealer is a must.

Once a company has made a decision to serve as a funding portal, it should apply to the SEC and become a member of FINRA.

How to register a funding portal in the USA?

- Start with a name reservation. It should be unique and not copy the existing name in the FINRA’s listing.

- Next, fill in the SEC Form Funding Portal and send it to the regulator using the EDGAR database. A full registration process with the regulator can be found here. Once you’re done, the SEC will provide you with a special file number needed to gain access to the FINRA Entitlement Program.

- Proceed with assigning a Super Account Administrator (SAA) who will get access to the FINRA’s Web-based systems. SAAs are responsible for creating, managing and deleting accounts within the FINRA Entitlement Program.

- Make sure that all your associated persons (partner, director, officer or employee) have submitted fingerprints. Fingerprints must include your firm’s Organization ID#, assigned as part of the FINRA Entitlement process.

- Pay application fees by initiating ACH payment in E-Bill or via wire transfer. Find a breakdown of funding portal registration costs further in the text.

- Once you receive credentials, you gain access to Funding Portal Gateway and are welcome to complete the member application form.

To find a detailed registration guide, go to the FINRA official website.

How long does FINRA approve your funding portal application?

It generally takes about a month for FINRA to approve your application. After receiving your application, the regulator starts the review process.

The body checks whether your application is complete and meets the established standards of admission.

In case some info is missing or FINRA wants extra data, it may ask you to make some amendments to your application.

Then, an applicant is invited to an interview and FINRA issues the final decision about the membership afterwards.

How much does it cost to register a funding portal?

All the fees FINRA collects are to compensate it costs on supervision and regulation of its members-funding portals.

Each applicant should pay:

- $2,700 application fee when filing Form FP-NMA;

- $500 application fee to get approval of a change in ownership or control;

If in both cases an application is rejected or withdrawn, FINRA reimburses the application fee less $250, which is considered as a processing fee.

- $15 for processing and posting to the CRD system each set of fingerprints submitted electronically by the member, or $30 if submitted in non-electronic format;

Note, The SEC does not charge a filing fee at the time of registration. Incomplete applications are not considered “filed” and will not be accepted.

Further membership fees include:

- an annual gross income assessment (min $1,200 on annual gross revenue up to $1 million);

- an annual fee (the collection and disbursement of fees to participating regulators for renewing registrations). Fees are based on various parameters (state, applicant type and tier). More info can be found here and here;

- FINRA charges a fee of $1,575 max in case a funding portal member hasn’t timely reported about new disclosure event or a change in the status of a previous one;

- initiation of eligibility proceedings require extra fees: $1,500 to send an application and additional $2,500 for a full hearing for eligibility;

- if a member-funding portal continues to associate itself with any individual subject to disqualification or who is ineligible, it should pay $1,500 (for Tier 1 persons) and $1,000 (for Tier 2 persons).

TOP US-based funding portals

Crowdfund Insider has recently reported about the current state of the funding portals domain in the US.

Now FINRA has 62 members, both active and inactive (those who haven’t fulfilled the obligations).

Kingscrowd keeps publishing up-to-date statistics of crowdfunding commitments made by funding portals. And as of the beginning of December, Wefunder, StartEngine, Republic, Netcapital and Honeycomb were at the top of the list.

Wefunder

WeFunder is a crowd investing platform offering capital raising services. The provider enables non-accredited investors to invest in early-stage startups with $100 being the min investment amount.

524 startups have already raised funds through the portal amounting over $199 million.

StartEngine

StartEngine is a marketplace where everyday people can support startups and early-stage companies. The minimum investment is $100.

StartEngine is one of the largest investment crowdfunding platforms, using Reg CF, Reg A+ and Reg D for offerings. $250 million funds have been invested in more than 375 companies.

Republic

The provider was one of the pioneers of open-to-all equity crowdfunding. Republic deals with individual and institutional backers.

The Republic’s community consists of 800,000 members who have poured $150 million in A, CF, D, seed and pre-IPO deals in 2020 alone.

Republic raises funds for a variety of projects: startups, video games, real estate, crypto.

Netcapital

Netcapital makes it easy for the crowd to support startups they fancy before they go public.

The investment size varies from $99 to $10 million. Netcapital does investment crowdfunding under Reg CF (and Reg D for side-by-side offerings).

Honeycomb

Honeycomb is a peer-to-peer lending platform designed to allow friends and family to fund small businesses by donating as little as $100.

The funding portal operates under Reg CF that implies dealing with all investors including retail backers and offering very low investment amounts.

Funding portal software to launch your own crowdfunding platform

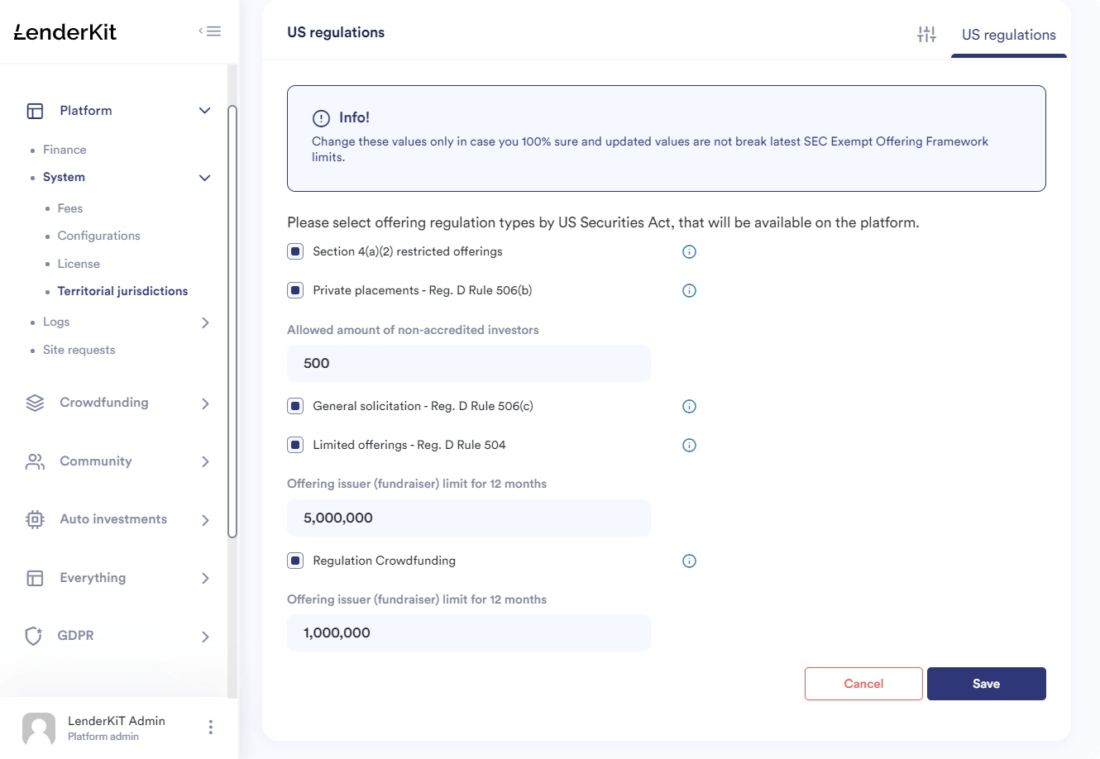

LenderKit facilitates your compliance process with the SEC requirements to funding portals by providing customisable crowdfunding software. Our Reg CF software has in-build features which help you control all sorts of things:

- Funding limits

- Min and max investment amounts

- Number of investors who can participate in a Reg CF offering

- Secondary trading rules which prohibit immediate resale of the securities

There are many more features which allow you to choose between different offering types in case you’re also working with Reg D or Reg A Tier 1 or Tier 2 offerings. In other words, our crowdfunding software allows you to combine different offerings on the platforms and operate either a funding portal or broker-dealer depending on your licensing requirements.

Already have a list of requirements for your funding portal? Feel free to get in touch with us.

Wrapping up

In a nutshell, the SEC distinguishes two types of crowdfunding providers: funding portals and broker-dealers. Funding portals focus on small-scale offerings while broker-dealers serve big investment appetites.

Unlike broker-dealers, funding portals can only bring fundraisers and backers together, and let them take part in crowdfunding deals on an online platform.

To start crowdfunding activities as a funding portal, a company should register at the SEC and become a FINRA member.

FINRA charges application and membership fees. To become a FINRA member, be ready to pay at least $3000, the future fees will vary.

If you’re launching a funding portal or a broker-dealer platform and looking for software solutions, reach out to LenderKit.