How to Create a Crowdfunding App

No time to read? Let AI give you a quick summary of this article.

All crowdfunding app development projects start with a discovery phase that allows the development company to establish a deeper understanding of the client’s business goal, application complexity, and scope of the project.

The discovery phase requires two sides to take part in the session. These are the client and the development company. On the client side, there’s usually a CEO and/or CTO or project manager, while on the development company side, there are 4 participants in the most advanced cases:

- Business analyst

- Project manager

- UI/UX designer

- Tech engineer

All these folks serve different functions and may or may not be present during a discovery session depending on the project complexity. The discovery phase may take between 1-4 weeks and around 4-12+ hours of client’s personal involvement.

For a crowdfunding app project, there are usually 3 types of discovery sessions:

- Express

- Standard

- Advanced

Each discovery session has a different set of deliverables, durations, and pricing.

What to know the details of each package? Don’t hesitate to contact us.

What you will learn in this post:

Crowdfunding app architecture

The discovery sessions aim to understand what the client’s project will look like, what will be the architecture of the crowdfunding application and what will be the best way to make it come to life.

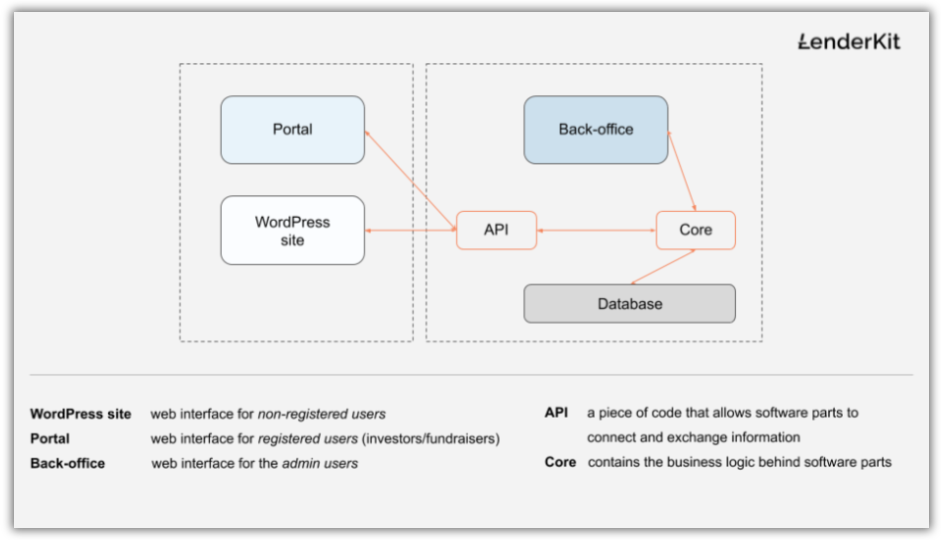

One of the ways to imaging a crowdfunding app behind the scenes is to look at the current LenderKit’s architecture:

In the picture, there are essential components of the LenderKit’s crowdfunding software such as Portal, Back-office, API, Core and Database, and secondary components – WordPress site.

The essential stack is required if you’re working with a private crowdfunding portal – that is a non-public one – usually for accredited investors or limited users. And the essential stack with secondary features is required for mass-market operations – usually with a focus on non-accredited or retail investors.

As a user, you pretty much work with 3 major software parts:

- Back-office – for daily admin operations – offering and user management, fees settings, etc.

- Portal – for fundraisers to create offerings and for investors to invest in the offerings

- WordPress site – a promotional website where your marketing manager uses their creativity to attract new investors and fundraisers. This is also a place where users register on your crowdfunding platform.

Types of crowdfunding apps

There are plenty of crowdfunding platforms on the market – lending-based, equity-based, donation, and reward-based. These platforms can either be mobile-oriented or web-based applications.

Certainly, a mobile crowdfunding app can be a rather unique offer, so going with this option would definitely be something interesting.

The benefits of a mobile-focused crowdfunding app include:

- Using Google Play or App Store to attract investors and fundraisers

- Being portable and innovative

- Accessing already competitive niches but with a new technological solution

- Going hand in hand with apps like Plaid or other banking apps

- Having an opportunity to be acquired by bigger brands

Speaking about the “desktop-oriented” crowdfunding web applications – they’ve become a standard in the industry and many providers have expertise creating them.

The benefits of a web-based crowdfunding app include:

- Broader vendor selection opportunities

- Proven record of businesses operating in this domain

- Easier platform support (no need to support several environments like with mobile apps – iOS, Android)

- More room for creative design and functionality, etc.

Check out this article to learn what features a crowdfunding app should have.

Crowdfunding app development with LenderKit

LenderKit provides 3 main approaches to crowdfunding app development:

- Basic – white-label crowdfunding software

- Professional – white-label + customisations

- Enterprise – a fully custom platform with source code access

The image above is pretty self-explanatory. The main difference between the packages is for what business objectives they are used.

If you were to choose among “Time to build”, “Software independency/Functionality” and “Price” you’d be able to get the two options set and compromise on the remaining option. This is a classic opportunity cost1 phenomenon which happens naturally when you choose one option among others.

At LenderKit though, we work hard to solve that dilemma – that’s why we’re able to provide flexible solutions rather than a rock-solid one. That means, when you start with a “Basic” solution, you can gradually move to the “Professional”, “Enterprise” and beyond.

In this case, instead of compromising on a crucial factor, you’re able to prepare yourself and actually grow to the required level of crowdfunding platform and business magnitude. This means, your business and your platform go hand in hand.

Wanna see exactly how LenderKit works and what we can do for you? Contact our manager.

Article sources: