Crowdfunding for Biotech

No time to read? Let AI give you a quick summary of this article.

Crowdfunding is used to fund all types of projects and products, but when it comes to biotech crowdfunding, a question arises whether this financial instrument is suitable for this high cost and risk segment.

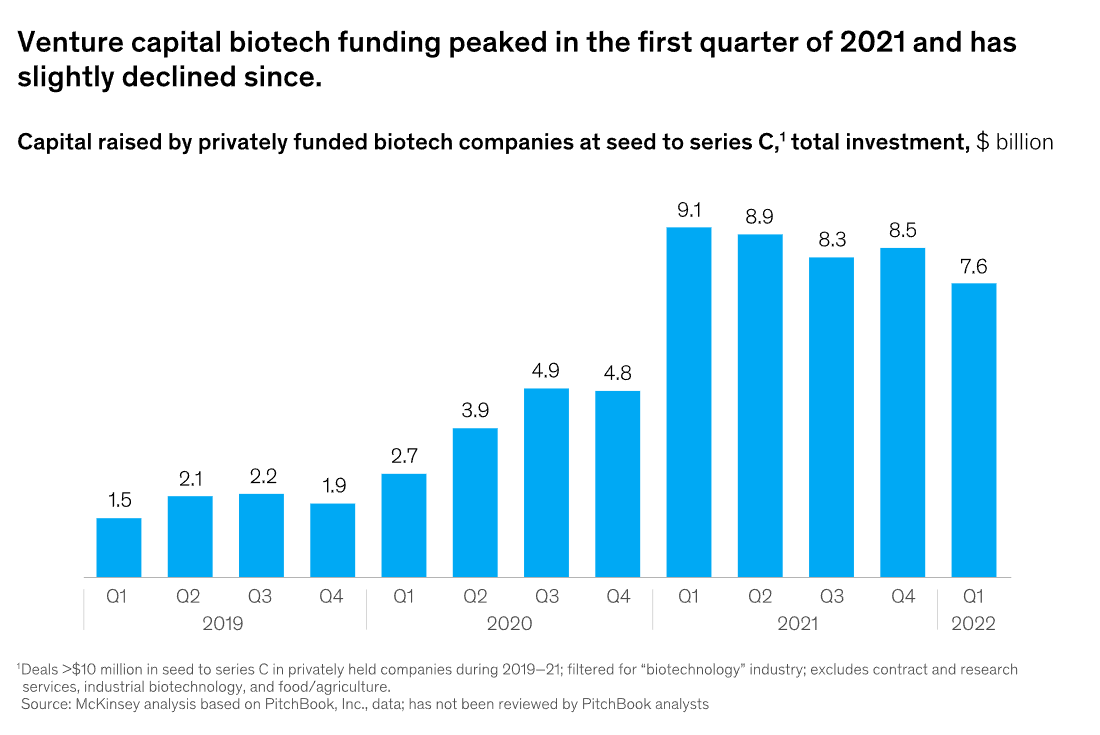

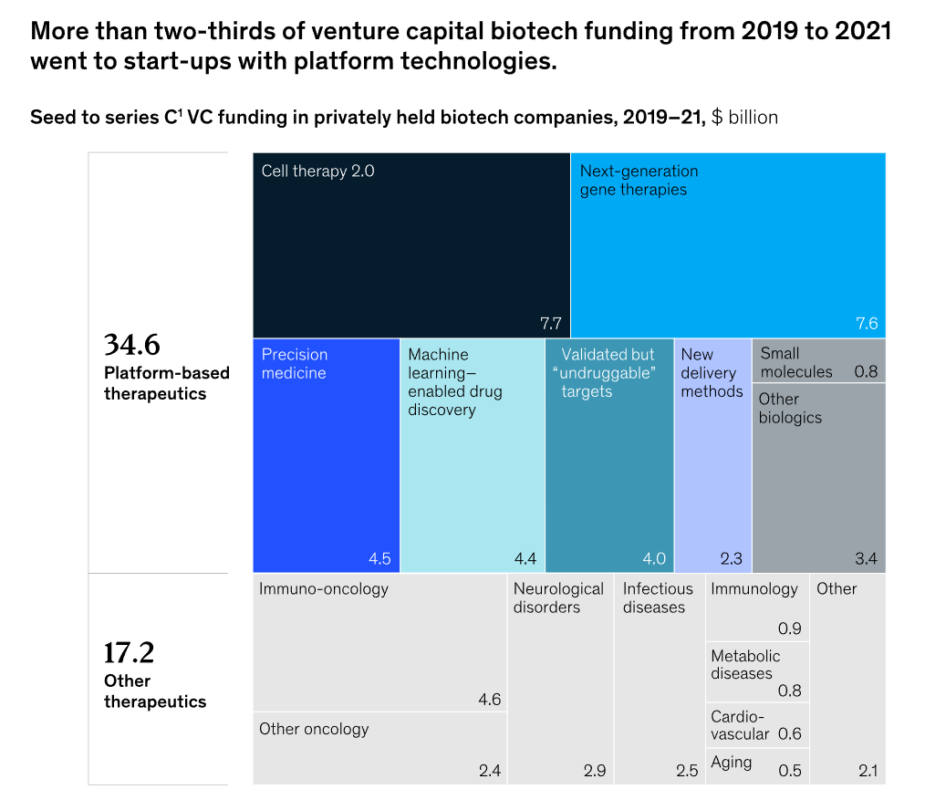

Biotech projects typically involve lengthy and costly research and development projects and complex regulatory hurdles, so crowdfunding alone may not be sufficient to finance the entire development process. Combining crowdfunding with other funding sources, such as venture capital1 or government grants, can provide a more well-rounded financial strategy for biotech endeavors.

VCs either fund a startup solely or create a consortium of investors. Frequently, VCs supply business leadership to a new company. In most cases, it happens when a scientist or a company comes up with an idea that may be commercialized at later stages. VCs are on the alert of such types of companies, and thus, businesses rarely raise capital through crowdfunding for biotech projects.

Also read: VC Fund Management: How it WorksHowever, crowdfunding for biotech is an emergent phenomenon and there are reasons why it’s getting bigger, with many biotech crowdfunding platforms appearing across the globe.

What you will learn in this post:

Crowdfunding for biotech startups

Grant writing and pitching to VCs is a long process, so it could be daunting and also punch companies to give away too much.

Crowdfunding for biotech, in contrast, doesn’t require so much preparation and allows getting funds from interested investors faster while also offering more opportunities to promote the idea or a product and build a loyal customer base.

Biotech companies raising money through crowdfunding are able to get the necessary early-stage funding to launch the operations, products or projects and then to VCs later when they need more capital to scale.

Examples of biotech companies raising funds through crowdfunding

Antabio

Antabio2 is the very first biotech company that completed the seed funding round on WiSEED3, a French-based equity crowdfunding platform in 2012.

The company received funding from over 200 investors4 and was able to get financing for the validation of its drug candidate molecules.

The second investment was acquired from an angel investor who got interested in the project and provided resources for the further development of drug candidates.

At later stages, Antabio attracted the attention of VCs and institutional investors. So, for the company, crowdfunding was a way to raise funds at early stages and a good practice to raise larger sums further on.

EyeBrain Medical

In 2015, EyeBrain Medical raised $1 million5 to develop lenses that correct migraines. This South Dakota Startup took a different approach to migraine therapy based on emerging knowledge about the connection between vision problems and headaches.

The company developed NeuroLens6 – lenses that can be customized to synch up the imbalance between the brain and the eyes. This tool is meant to reduce chronic headaches without medication or surgeries.

Further, EyeBrain Medical raised $6 million7 more from 21 investors to continue with the development of the tool.

Bionure

Bionure is a clinical-stage biotech company that develops therapies for neurodegenerative diseases for which no treatment is available nowadays. Bionure raised $1.3 million on Capital Cell8 to complete the preclinical phase and begin clinical trials of their drug for multiple sclerosis.

The fundraising campaign was supported by multiple sclerosis patients and their relatives and friends, who saw it as an opportunity to help.

On the other hand, the business opportunities of this project are impressive. So, such projects are not only interesting to those who want to make a positive social impact but also to those who want to earn.

Top biotech crowdfunding platforms

Crowdfunding platforms don’t always exclusively focus on Biotech, but they may incorporate it in the main list of trendy propositions and investment products. Currently, there are not many platforms that offer biotech crowdfunding and investing opportunities. However, as this sector grows and develops, more platforms are entering the market and offering biotech crowdfunding.

Here are the loop biotech investing platforms.

Capital Cell

Capital Cell8 focuses exclusively on healthcare, medical devices, and biotech. The platform was launched in 2015 in Barcelona and expanded to the UK in 2017.

Before listing any project, the platform passes it through a series of filters, such as patents, regulatory compliance, scientific background, and others.

The company also collaborates with the best specialists in relevant fields, such as drug development, commercial genomics, neurocomputing, and others, that independently assess and evaluate each project. This doesn’t guarantee a profit but increases the chances that investors will deal with the most promising projects.

The average project size is around 1 million Euros, and the minimum investment is 100 Euros.

WiSEED

WiSEED3 is a French-based crowdinvesting platform launched in 2008. Since its launch, WiSEED has been providing individuals and companies with opportunities to invest in projects in health, real estate, food, environment, renewable energy, and other sectors.

The main difference of WiSEED from other crowdinvesting platforms is that it enables one to invest not only in early-stage projects but also in mature companies. With a minimum investment of 100 Euros, investors can expect around 9% of ROI.

Experiment

Experiment9 is a crowdfunding platform that allows to invest in all types of scientific projects, including biology, medicine, chemistry, and similar fields. Experiment allows browsing projects by institutions, among which one can find the leading universities in the world and other categories. Along with standard offerings, the platform gives additional grants to projects that can make a positive impact, such as biotech for conservation or ocean solutions.

The platform allows everybody to participate in funding a project they like. For now, through the platform, almost 11 million Euros have been raised to assist science-related projects to get their funding.

Fundinno

Fundinno10 is a leading Japanese equity-investment crowdfunding platform launched in 2017. Among all the projects available there, one can pick those in biotech and medical care. This is an entrepreneur-led platform that follows an all-or-nothing route. If a project doesn’t reach the target funding, all the funds are returned to investors.

For now, Fundinno helped over 300 projects to raise funds, and the total raised on the platform exceeds $70 million.

Start a biotech investing platform with LenderKit

Biotech investing is a promising niche which is only getting its momentum. If you have a loyal customer base or want to attract a pool of investors interested in biotech, then starting a biotech investing platform might be a good way to enter the alternative investment market.

If you want to start a biotech crowdfunding platform, LenderKit investment software will get you covered. With LenderKit, you’ll be able to launch a prototype or a full-scale biotech investment platform with a focus on donation, debt or equity financing.

The crowdfunding software by LenderKit comes with many out-of-box features that will help you launch a match-funding investment marketplace, private equity platform or a crowdfunding website.

From investor onboarding and payment automation to full-cycle investment campaign management and fund disbursement, LenderKit may become your one-stop investment solution and a potential tech partner.

Schedule an online demo with our fintech strategist to learn more about how LenderKit investment software works and how it can be used for your biotech investment business.

Article sources:

- What are the biotech investment themes that will shape the industry?

- Antabio

- WiSEED - Investir dans le Crowdfunding immobilier et la transition énergétique

- Antabio and WiSEED announce the first successful round of crowdfunding applied to biotech start-up financing - Antabio

- South Dakota startup raises $1M for its "eyegraine" system that treats vision-related migraines - MedCity News

- Neurolens

- EyeBrain Medical raises $6M for lenses that correct migraines

- Capital Cell | Smart Investments, Healthy Returns

- Experiment | Crowdfunding Platform for Scientific Research

- 日本初の株式投資型クラウドファンディング - FUNDINNO