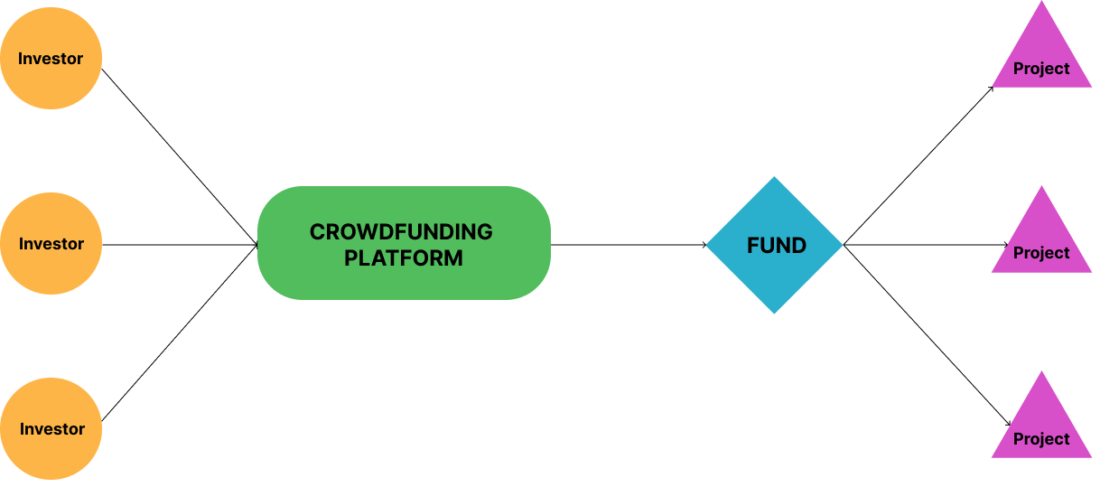

Crowdfunding for Funds: How It Works

Crowdfunding for funds is a promising business model because it allows a fund investment platform to work with wealth managers and offer investors access to large private funds.

Funds may invest in anything from buyouts and distressed debt to growth and expansion. But to do so, funds need to pool capital from accredited and institutional investors such as pension funds, banks, insurance companies, credit companies, and even crowdfunding businesses.

These funds invest the “crowdfunded money” in companies to generate a higher return over the next 10 years or so. The funds are injected into underperforming or growing businesses to increase their efficiency and profitability. After the company reaches the expected level in the matter of profit, investors can get their return after a liquidity event:

- An initial public offering (IPO) – the company goes public, and its shares grow in price.

- A merger or acquisition – when the company is sold for a profit to another business.

What you will learn in this post:

Who can invest in funds

The minimum investment in a fund is high and requires an investor to either have $1,000,000 in assets (excluding the primary residence place) or to have $200,000 of income per annum.

The minimum investments in a fund vary greatly. Retail funds allow to invest as little as $500 – $5,000 while higher grade, institutional level funds require anything around $200,000 – $1,000,000.

Individuals who can invest in private equity funds comprise 2% of the U.S population while 98% of people are restricted from investing in private equity funds and cannot benefit from more lucrative investment options directly.

However, this is where various crowdfunding platforms and intermediary investment platforms step in because they allow to invest in these funds through the investor portal.

Crowdfunding platforms enable retail investors to invest in private funds

Crowdfunding businesses can benefit from investing in private equity, hedge, or venture capital funds. Platforms use for it their own money and may raise additional financial resources from smaller investors for this purpose.

Crowdfunding for funds: examples

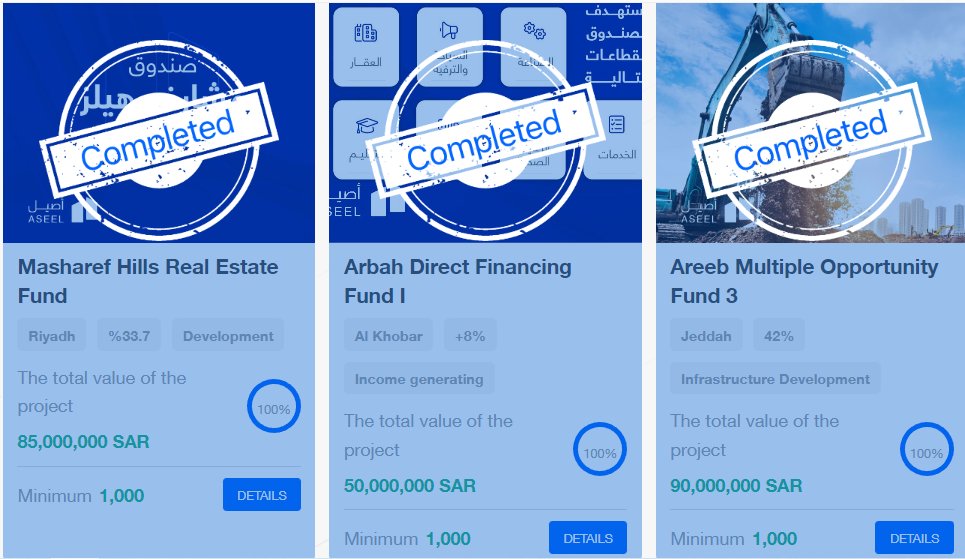

The investors’ choice differs on different platforms. Some platforms such as Aseel Finance focus on private equity fund crowdfunding and offer to choose from several funds.

The minimum investment on this platform is 1,000 SAR (approx. 266 USD) which is affordable to retail investors, too. The platform charges a fee (up to 2% of the invested sum).

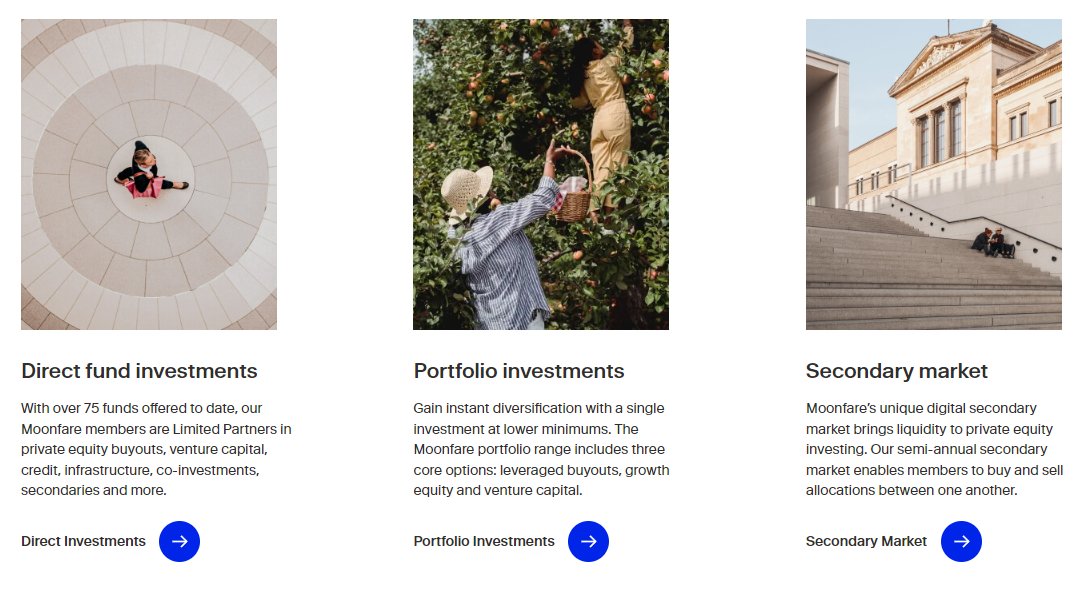

Others, such as Moonfare, focus on crowdfunding for hedge funds, VC funds, and private equity funds. There, investors can choose a direct investment with a fund, invest in the platform’s portfolio (leveraged buyouts, growth equity, and venture capital), or use a secondary market option.

With a minimum investment of $50,000, the platform is accessible to accredited investors only.

Even though the majority of such platforms work with accredited and institutional investors only, the minimum investment level is lower than the one with funds. That’s why crowdfunding for funds enables smaller investors to participate in promising projects that aren’t available to them otherwise. Additionally, such an investment allows one to benefit from the experience and knowledge of a fund manager.

How to launch a crowdfunding platform for a fund

If you are thinking of raising money to invest later in a PE, VC, or hedge fund, you need to have a platform built specifically for such needs. Since a fund is created for at least 10 years, the fund crowdfunding platform will easily pay off in the long run.

With white-label investment software solutions from LenderKit, you can launch a fund investment platform quickly and reliably.

A powerful admin back office for your investment platform allows you to organize your team in the way you want. It enables you to assign different permissions to your staff members depending on their positions and responsibilities to:

- Manage deals and campaigns

- Manage investors and fundraisers

- Work with advisors and affiliates

- Handle documents

- Set up commissions

A user-friendly investor portal enables investors to access your platform, browse investment options, and choose the offerings they are interested in. Among others, there are features to enable investors to:

- Set up automatic investments

- Manage wallets

- View the history of transactions

- Pledge money or invest

- Request withdrawals

LenderKit white-label fund investment software can operate under various regulations in the UK, USA, EU, and MENA regions. If you want to see how the LenderKit software works, please contact our sales team for a demo.