Crowdfunding in Belgium: Market Overview, Platforms and Opportunities

No time to read? Let AI give you a quick summary of this article.

Crowdfunding has become an important way for Belgian entrepreneurs, property developers and community projects to raise money. Instead of going to the bank, project owners can present their ideas online and collect money from many people. For investors, crowdfunding offers a chance to support projects they like and, in many cases, earn a return.

In Belgium, crowdfunding has moved from being a new, “wild west” idea to a well-regulated, professional market. Today, there are strict rules for most crowdfunding activities, especially when people are promised financial returns. Let’s take a look at how the Belgian market works, the rules in place, and some of the best-known licensed platforms.

What you will learn in this post:

The Belgian crowdfunding market: An overview

Crowdfunding in Belgium comes in different forms:

- Donation-based, when people give money without expecting anything in return, often for charity or community projects.

- Reward-based, when backers get a product or a small gift in return for their support.

- Crowdlending (loan-based), when investors lend money to a company or project and are repaid with interest.

- Equity crowdfunding, when investors buy shares in a company and become part-owners.

The most regulated types are crowdlending and equity crowdfunding1, because they involve investments and financial returns.

Many investors like crowdlending because it offers diversification, and some projects provide attractive interest rates, often between 5% and 10% per year2. It’s a way for businesses to get funding quickly while marketing their brand to a crowd of supporters

How crowdfunding is regulated in Belgium

Since September 1, 20173, crowdfunding platforms in Belgium must be authorised by the Financial Services and Markets Authority (FSMA) to offer investment-type crowdfunding to the public.

In 2021, the landscape shifted again with the introduction of the EU Crowdfunding Regulation (EU) 2020/15034, which harmonises rules across all EU member states. Belgian platforms must now comply not only with the national framework but also with these EU-wide standards, which include:

- Providing a Key Investment Information Sheet 5

- Running an investor knowledge test before allowing someone to invest

- Putting in place professional procedures for complaint handling and risk management

Supervision of the sector is carried out by the (FSMA)6, Belgium’s financial regulator. The FSMA approves platforms, monitors their conduct, and ensures they give investors clear, accurate information. If a platform changes its management or key operations, it must promptly notify the FSMA.

Platforms must follow anti-money laundering (AML) rules. This involves verifying the identity of investors and project owners, often using ID cards or biometric checks, and monitoring transactions for suspicious activity.

Crowdfunding in Belgium also benefits from regional incentives, such as the Flemish Win-Win Loan scheme7. It encourages individuals to lend to local SMEs by offering a 2.5% annual tax credit on the outstanding capital (up to €75,000 per lender) and a one-time 30% tax credit if the borrower defaults. Loans run for 5 to 10 years, carry interest rates capped between 2.25% and 4.5% in 2025, and are structured as subordinated debt.

Combined with interest payments, these tax benefits make the Win-Win model a particularly attractive form of crowdlending in Flanders, often integrated into licensed platforms such as WinWinner8.

Top 5 licensed crowdfunding platforms in Belgium

Let’s look at five FSMA-licensed platforms that are active in Belgium. These platforms have gone through the approval process, meet ongoing requirements, and appear on the FSMA’s public list9.

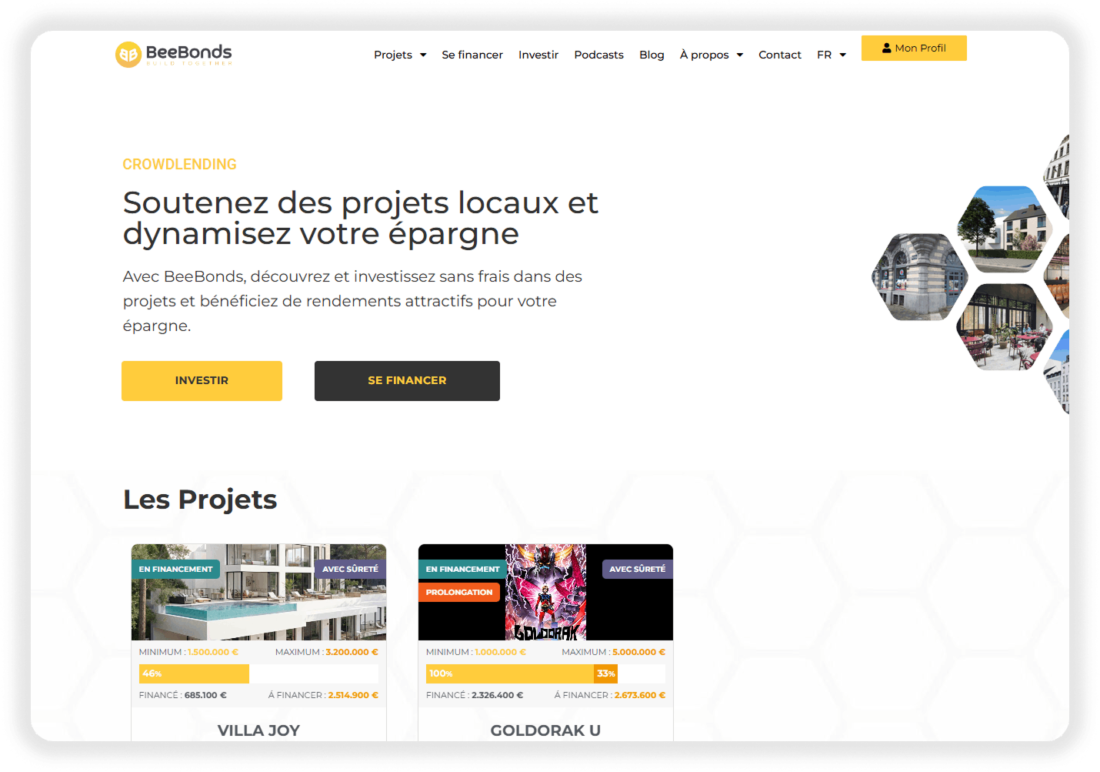

BeeBonds

- Type: Crowdlending (mainly real estate)

- Minimum investment: Around €100

- Typical returns: 8–10% gross per year

BeeBonds10 focuses on financing real estate projects in Belgium, Luxembourg, France, and Spain. It has a strong marketing angle, even linking projects to biodiversity initiatives such as planting beehives. Investors don’t pay fees, all costs are covered by the project owner. The platform is known for clear project descriptions and a professional interface.

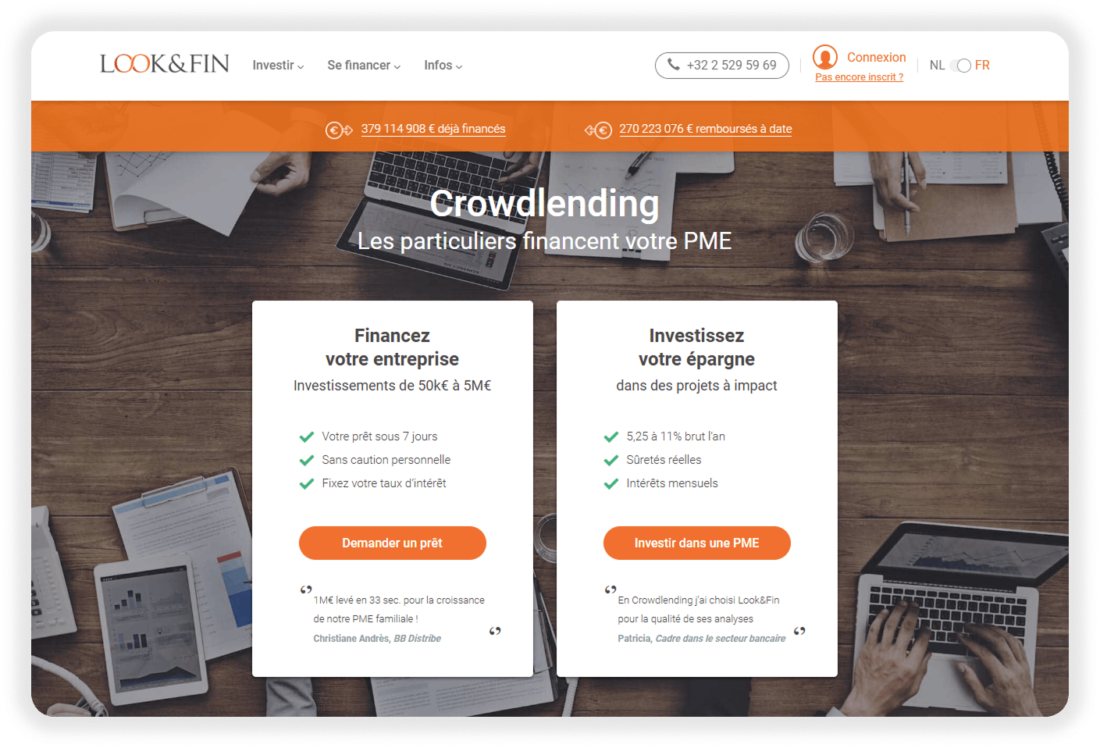

Look&Fin

- Type: Crowdlending (SMEs and real estate

- Minimum investment: Around €100

- Typical returns: Often above 6%

Look&Fin11 is one of the larger Belgian platforms. It focuses on funding a mix of SME loans and property projects. It attracts both retail and institutional investors. The platform offers detailed information on each loan, and some projects are asset-backed. It has a strong track record and a solid reputation in the Belgian market.

Spreds

- Type: Equity crowdfunding

- Minimum investment: Varies by project

- Fees: Around 5% subscription fee + share of gains

Spreds12 lets investors buy shares in startups and growth companies. It’s a higher risk than lending because returns depend on the company’s success, and shares may be illiquid for years. The platform is suitable for investors who understand venture-style risk and want to support innovative Belgian and European businesses.

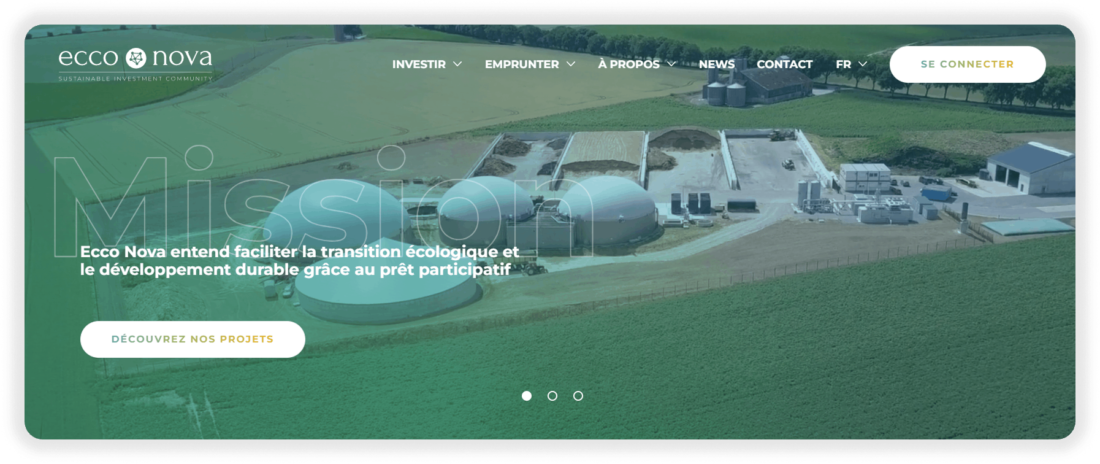

EccoNova

- Type: Lending

- Minimum investment: €50

- Typical returns: 4–8%

Ecco Nova13 is a Belgian crowdlending platform established around 2015–2016, centered on financing sustainable and eco-friendly projects such as renewable energy, energy-efficient housing, and environmentally driven SMEs.

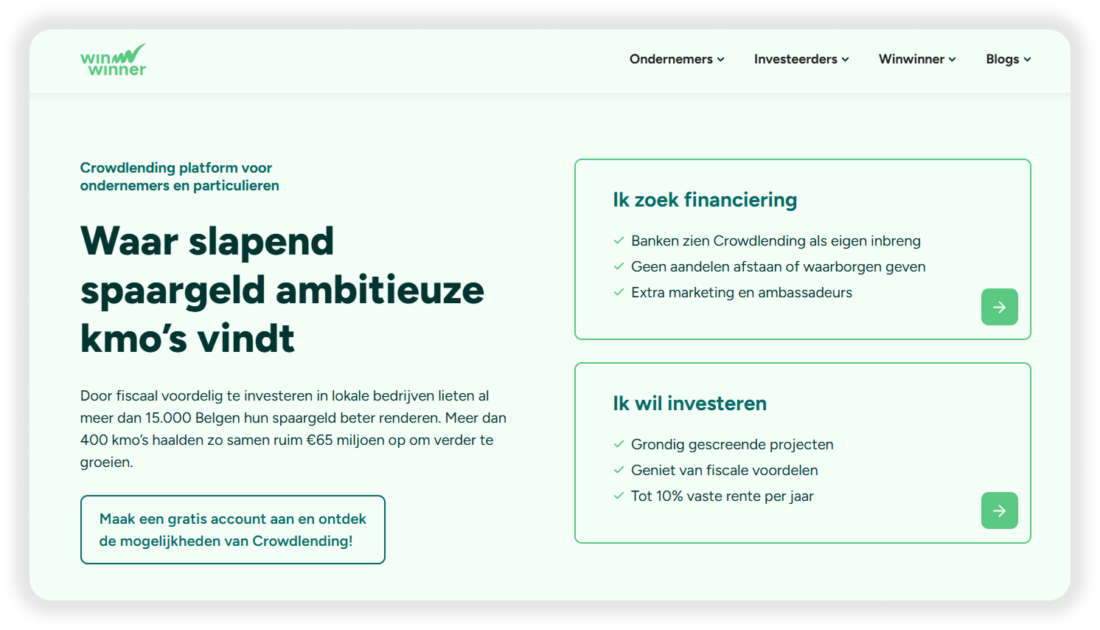

WinWinner

- Type: Crowdlending (SMEs, especially in Flanders)

- Minimum investment: Around €500

- Typical returns: 4–8%

WinWinner8 is known for structuring loans that qualify for the Flemish “Win-Win” tax credit. This means some investors can get annual tax benefits in addition to interest income. It works mainly with SMEs and is a good fit for those who want fixed-income investments and are eligible for the regional incentives.

How to launch a crowdinvestment platform in Belgium with LenderKit

Starting a crowdinvesting platform in Belgium means navigating both national and EU regulations. You’ll need to incorporate a Belgian company and apply for authorisation from the FSMA as a regulated crowdfunding service provider under EU Regulation 2020/1503.

For this, you need to demonstrate that your management team meets “fit and proper” criteria, set up strong governance processes, comply with anti-money-laundering rules, and prepare Key Investment Information Sheets for every campaign. Most new operators also work with legal and compliance experts to speed up the licensing process and avoid costly mistakes.

LenderKit offers a practical solution for entrepreneurs who want to get to market faster. Its white-label crowdfunding software supports equity and lending models, integrates KYC/AML checks for investor onboarding and complies with the ECSPR requirements when it comes to the tech side. The platform’s back office lets you manage campaigns, monitor transactions, and handle investor communications, while its front end can be fully customized to your brand.

By combining a ready-to-use, compliant tech infrastructure from LenderKit with a clear understanding of the Belgian and EU regulatory landscape, new platforms can launch more quickly, reduce operational risk and attract both local and EU-wide investors from day one.

To find out details, please get in touch with our team.

Article sources:

- Crowdfunding | FSMA

- Belgium crowdfunding market overview: TOP platforms you need to know - Article | Crowdinform Investment Guides Crowdfunding

- Le cadre réglementaire du crowdfunding

- Crowdfunding - Finance - European Commission

- Marketing requirements | FSMA

- About the FSMA | FSMA

- Belastingaangifte 2025: Welke uitgaven zijn aftrekbaar?

- Winwinner: Crowdlending Platform België

- Crowdfunding service providers licensed in Belgium (under Regulation (EU) 2020/1503) | FSMA

- BeeBonds crowdlending - Investissez à partir de 100 €

- Look&Fin

- Spreds — Investment for everyone

- Crowdlending durable en Belgique | ECCO NOVA