Crowdfunding in the Baltic States

No time to read? Let AI give you a quick summary of this article.

The Baltic States — Estonia, Latvia and Lithuania are important players in the European crowdfunding landscape. Their strategic location, tech-savvy populations and supportive regulatory environments are the reasons why there are many crowdfunding platforms there.

In this article, we will have a closer look at the crowdfunding ecosystems of the Baltic states, explore platforms, regulators, licensing procedures and their costs and more interesting things for crowdfunding platform founders.

What you will learn in this post:

Estonia

Estonia, often called the “Silicon Valley of Eastern Europe1”, or the “Nordic Silicone Valley2”, boasts a strong startup ecosystem, and for a reason. Its e-residency program3 and advanced digital infrastructure have made it an attractive hub for fintech startups, including crowdfunding platforms.

The most popular crowdfunding platforms in Estonia

EstateGuru

beyond Estonia and operates in multiple European countries.

The platform operates with property-backed loans and offers an average return of approximately 11%.

Hooandja

Hooandja4 is Estonia’s crowdfunding platform that focuses on creative projects. It was launched in 2012.

The platform operates on an “all or nothing” basis, which means that projects only receive funding if they meet their target within the specified timeframe. The platform charges an 8% commission on successful campaigns and supports projects in arts and culture.

UFANDAO

UDANDAO5 was established in 2022 as a decentralized crowdfunding platform that allows users worldwide to raise funds for various purposes, from personal needs to innovative ideas. The platform operates on a Decentralized Autonomous Organization (DAO) model. It eliminates intermediaries between donors and fundraisers and ensures direct transactions. The platform does not charge any fees for fundraising or transactions, and a minimum donation amount is set at €25.

Regulatory framework

Estonia aligns with the European Union’s Regulation (EU)6 2020/1503, which standardizes crowdfunding operations across member states. The Financial Supervision Authority (FSA) oversees the licensing and regulation of crowdfunding platforms.

Licensing procedure and costs

To operate a crowdfunding platform in Estonia, entities must obtain authorization from the FSA. The application process7 involves submitting a comprehensive business plan, details about shareholders and management, and proof of sufficient capital. The application fee is €1,000. The FSA assesses the completeness of the application within 25 working days and makes a licensing decision within three months of receiving a complete application.

Latvia

Latvia’s crowdfunding sector has also experienced significant growth8 thanks to the favorable regulatory environment and a burgeoning fintech community.

Popular crowdfunding platforms in Latvia

Debitum

Debitum Investments9 was launched in 2017 as a P2P lending platform. Now, it is a licensed platform that facilitates investments in small business loans. With a minimum investment of €50, it has financed over €8.9 million across 337 loans, with an average annual return of slightly above 11 – 15%.

Mintos

Mintos10 is one of Europe’s largest P2P lending platforms. It was launched in 2014 in Riga, Latvia. Mintos offers retail investors opportunities to invest in a mix of traditional and alternative assets, including loans, exchange-traded funds (ETFs), fractional bonds, real estate, and Smart Cash.

Regulatory framework

The Financial and Capital Market Commission (FCMC) and the Bank of Latvia11 are the primary regulatory authorities overseeing crowdfunding activities in the country. The country adheres to the EU’s Regulation (EU) 2020/15036, which ensures standardized practices across member states.

Licensing procedure and costs

Prospective platforms must submit a detailed application to the FCMC, including a business plan, information on shareholders and officials, and proof of capital adequacy. The application fee is €2,500, with an annual supervisory fee of €4,000 plus up to 1.4% of gross revenue, capped at €100,000. The FCMC assesses the application within three months after confirming its completeness.

Lithuania

Crowdfunding in Lithuania has grown quickly alongside the local fintech sector. Friendly regulations and a strong startup scene have made the country a top player in the region.

Popular crowdfunding platforms in Lithuania

InRento

Launched in 2020, InRento12 is Europe’s first licensed rental properties investment platform. It enables users to invest in rental properties with a minimum of €500 and offers an average annual return of over 12.9%. The platform has attracted nearly 4,000 investors, collectively depositing over €41 million.

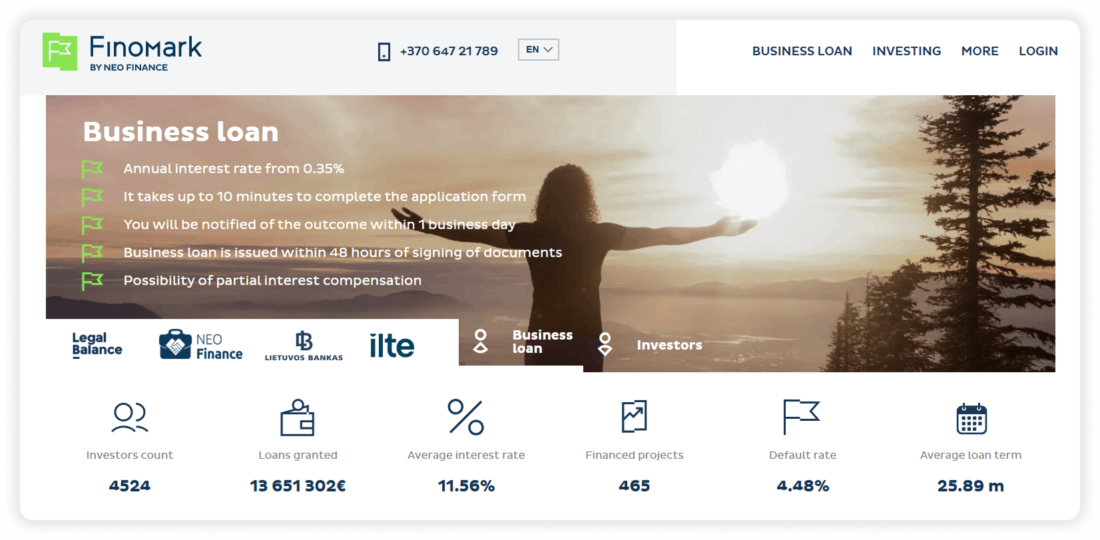

FinoMark

FinoMark13 is a P2P lending platform that facilitates investments in small business debt, starting from €25. Since its inception, FinoMark has financed loans totaling over €13 million across 465 issued loans, with an average loan term of 25 months and an average annual return of almost 12%.

Regulatory framework

The Bank of Lithuania serves as the regulatory authority for crowdfunding activities. The nation complies with the EU’s Regulation (EU) 2020/1503 which ensures a harmonized approach to crowdfunding services.

Licensing procedure and costs

To operate, platforms must apply to the Bank of Lithuania, accompanied by a fee of €710. Applicants are required to submit a comprehensive set of documents demonstrating compliance with the Crowdfunding Regulation. The Bank assesses applications within three months, after which successful platforms can commence operations.

How to launch a crowdfunding platform with LenderKit

The Baltic states are experiencing a surge in demand for regulated, scalable alternative investment platforms. LenderKit provides a market-ready, customizable white-label crowdfunding software designed for real estate and startup financing via equity and debt-based investments. Our investment software supports regulatory compliance, investor onboarding and automated transaction flows, helping you launch efficiently while ensuring long-term scalability.

With modular architecture, integrations, and limitless customizations LenderKit adapts to your business model — whether you’re expanding an existing financial service or entering the alternative investment market. Ready to get started with a fully branded, secure platform that grows with your business? Fill in the contact form and we’ll get back to you to discuss your vision and requirements.

Article sources:

- Why is Estonia the Silicon Valley of Eastern Europe? | XPRT MINDS

- The rise of estonia's startup ecosystem

- E-Residency of Estonia | Apply & start an EU company online

- Hooandja

- UFANDAO - the first fundraising platform for dreamers

- European Union's Regulation (EU)

- The operating licence for crowdfunding | FSA

- Best Crowdfunding Platforms in Latvia - Compare All Types

- Earn Passive Income with Debitum Licensed P2P Lending Platform

- Home Page

- Merger of the Financial and Capital Market Commission and Latvijas Banka - Latvijas Bankas gada pārskats

- InRento | Invest in buy-to-let projects!

- Crowdfunding and financing platform