Crowdfunding Platform Audit and How it Works

A regular financial audit is one of the compliance requirements that the SEC and FINRA impose on crowdfunding platforms and issuers.

Market players usually see it as time-consuming, expensive and a total pain in the neck, but it’s the only way to make sure that financial records represented by a company are fair, accurate and reflect real transactions.

All financial audits in the US are done by the book. Companies follow Generally Accepted Accounting Principles (GAAP) or the International Financial Reporting Standards (IFRS).

If you google the information on crowdfunding annual reporting, you’ll probably find a lot on how issuers report on their financial statements and very little on how platforms do this.

We’ve tried to fill in this gap. Please don’t consider this guide on crowdfunding audit as financial advice, it’s for informational purposes only.

What you will learn in this post:

Audit requirements for crowdfunding platforms

First things first. What’s a financial audit?

It’s the internal or external examination and evaluation of companies’ financial statements done to understand if the statements meet the established criteria (common standards).

The financial audit of crowdfunding companies helps them comply with the regulatory framework, increase investors’ trust and credibility, and minimize crowdfunding risks.

In the Regulation Crowdfunding: A Small Entity Compliance Guide for Crowdfunding Intermediaries, the SEC states that one of the requirements for crowdfunding intermediaries is to:

Maintain and preserve certain books and records relating to its business for a period of not less than five years and in an easily accessible place for the first two years.

Funding portals

Under Funding Portal Rule 300 (c), FINRA obliges funding portals to complete the Statement of Revenue and pay Gross Income Assessment (GIA).

Statement of Gross Revenue

Each funding portal member shall each year report to FINRA, in the manner prescribed by FINRA, the member’s gross revenue on Form FP-Statement of Revenue, no later than 60 calendar days following each calendar year-end. The statement of gross revenue shall be prepared in accordance with U.S. GAAP.

The FINRA assesses GIA using a seven-tiered rate structure with a minimum amount of $1,200. On the websites, FINRA proposes the following annual fee structure based on the gross revenue of the business:

| Fees requirements | Annual gross revenue greater than |

| $1,200 (fixed) | Up to $1M |

| 0.1215% | $1 – $25M |

| 0.2599% | $25 – $50M |

| 0.0518% | $50 – $100M |

| 0.0365% | $100M up to $5B |

| 0.0397% | $5 – $25B |

| 0.0855% | $25B+ |

The GIA alongside other FINRA fees is used to fund FINRA’s regulatory activities, examination and enforcement programs.

Apart from the regular financial reporting requirements that your business needs to follow, FINRA also says that it can insist on conducting the financial audit by an independent public accountant or examine your business according to the AICPA standards. This procedure may be required to double check your financial reports and make sure the crowdfunding platform operates lawfully and doesn’t trick investors.

Also, if you’ve missed the reporting deadline, you’ll have to pay the “late fee” as set in the Schedule A Section 4(g)(1) to the FINRA By-Laws.

Broker-dealers

The broker-dealer must have an audit system that identifies when original and duplicate records are input onto the storage medium and when any changes to existing records are made.

In addition, SEC and SRO staff must be able to examine the results of such an audit system, and the broker-dealer must retain the audit results for the same amount of time required for the audited records.

Since broker-dealers offer a wide range of services and have more duties than funding portals, requirements for their financial audit are stricter.

The SEC has extensive broker-dealer financial guidelines with extra audit requirements imposed on broker-dealers by other regulators.

The Code of Federal Regulations (CFR) Rule 17a-5 defines the way and format of broker-dealer FOCUS Reports and Annual Audits.

Just like funding portals, broker-dealers should pay GIA.

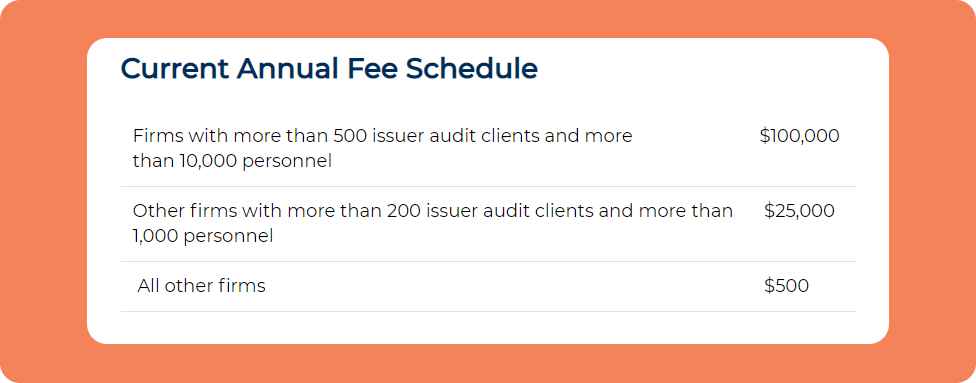

The Public Company Accounting Oversight (PCAOB) oversees the audits of SEC-registered broker-dealers. Companies that undergo the PCAOB audit should pay its annual fees.

Smaller broker-dealers in good standing are now exempt from this oversight due to the recently introduced Small Business Audit Correction Act.

Large financial audit agencies like PwC, KPMG, Deloitte and others charge crazy sums of money. Smaller broker-dealers opt for cheaper services. However, PCAOB reports that cheap low-quality audit reports have a lot of deficiencies.

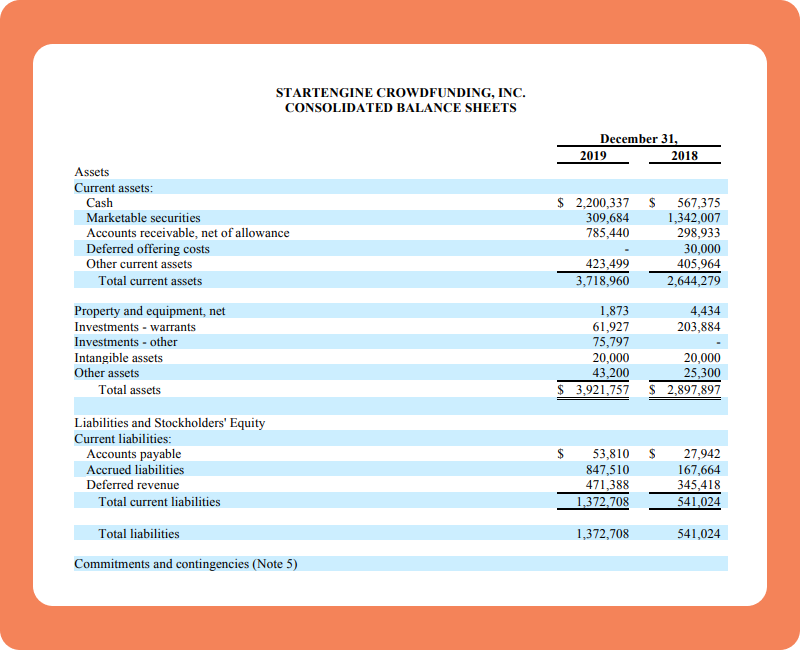

Crowdfunding companies include audited financial statements into their crowdfunding annual reports submitted through EDGAR to the SEC.

Here’s a fragment of the StartEngine’s 2020 annual report including a financial audit prepared by the DBBMcKennon, PCAOB Registered Certified Public Accounting firm.

Crowdfunding contract audit rules

Crowdfunding issuers have to comply with reporting requirements once they complete a crowdfunding offering, in particular the audit of financial statements.

There are certain key disclosure requirements for issuers under Regulation Crowdfunding:

- The financial statements are included in the offering statements on Form C electronically reported to the SEC via the EDGAR system.

- The financial statements requirements correlate with the amount offered or sold by the issuer within a 12-month period.

For issuers offering $107,000 or less: financial statements should be certified by the principal executive officer. In case they were prior reviewed or audited by a public accountant, the issuer should provide them to the regulator.

For issuers offering $107,000-$535,000: financial statements should be reviewed by a public accountant that is independent of the issuer.

For issuers offering more than $535,000: financial statements should be reviewed by a public accountant that is independent of the issuer.

Fundraisers create guides on how to complete financial statements for issuers.

That’s interesting how some crowdfunding companies comment on the SEC proposed disclosure rules for issuers.

WeFunder, for example, proposes to implement the below thresholds of total up the amount raised across all years and disclosure requirements:

- Under $250,000: cash accounting.

- $250,001-$500,000: GAAP required.

- $500,001 – $5million: GAAP & CPA Review.

- Over $5 million: GAAP & Audit.

WeFunder says that companies with early-stage offerings often start out with cash accounting. Transforming financials into GAAP format takes some time and money, at the same time it doesn’t fully evaluate the potential of the earliest stage investments.

On the contrary, WeFunder suggests aggregating amounts raised across all years, it will give a better understanding of the company’s stage and the amount of capital investors have at risk.

After successfully closing a crowdfunding round, issuers are obliged to fill in the Form C-AR. The disclosure requirements are substantially similar to those established by the Form C.

You just need to update the previously reported in the Form C financial statements and GAAP financials for the next fiscal year. They shouldn’t be necessarily reviewed or audited

Equity crowdfunding audit costs for issuers

The financial audits for issuers under Reg A and Reg CF are done by Crowdfund Audit & Review Experts (CPA).

According to CPA average mid-sized company audit fees are ~$50k-$150k for an audit and minimum $5,000 for a review.

CPA doesn’t provide accurate estimates for all sizes of businesses, they offer to use their crowdfunding calculator instead.

Crowdfunding platform software

Building a crowdfunding portal which allows you to pack the necessary data for the reporting isn’t rocket science.

We’ve got a feasible crowdfunding solution which can be customized to fit the reporting requirements you need to follow. Apart from the full-cycle crowdfunding campaign management be it debt or equity, the software is fully customizable to match your business needs.

LenderKit is a flexible white-label crowdfunding software that we use to help you build p2p lending sites, equity crowdfunding platforms or real estate investing portals.

If you’d like to learn more about the LenderKit crowdfunding software, check out the virtual tour or reach out to our fintech strategist for a live demo.

Final thoughts on crowdfunding audit requirements

Let’s take the stock on fundraising platforms and crowdfunding contract financial audits:

- The external and internal financial audit is one of the requirements the SEC and FINRA impose on funding portals and broker-dealers. For the latter group of companies, the requirements are stricter.

- The financial audit of fundraisers is conducted by PCAOB or other independent auditors or agencies. The audit is a vital part for minimising crowdfunding risks and investor protection.

- Issuers also undergo financial audit: their financial statements are completed according to crowdfunding GAAP requirements and reviewed by CPA.

- Crowdfunding contract audit costs may be high, but crowdfunding companies keep suggesting amendments to the current regulation to make it more relaxed for startups with early-staged offerings.