Crypto Fundraising Trends to Watch in 2024 and Beyond

No time to read? Let AI give you a quick summary of this article.

The cryptocurrency market experienced significant growth in 2024 and its market capitalization increased above $2.2 trillion1 approaching its record-high in 20212. Investor confidence has grown with the approval of Bitcoin and Ethereum spot ETF by the SEC and BlackRock and Fidelity3 emerging as the early leaders in the Bitcoin & Ethereum ETF market. As a result, the investment activity revived, and the amounts invested continued growing.

In the article, we will have a look at how the investment landscape in crypto has changed, which project types raise the biggest amounts, and what crypto fundraising trends may rise after that.

What you will learn in this post:

Mega-rounds in crypto funding with infrastructure startups leading the way

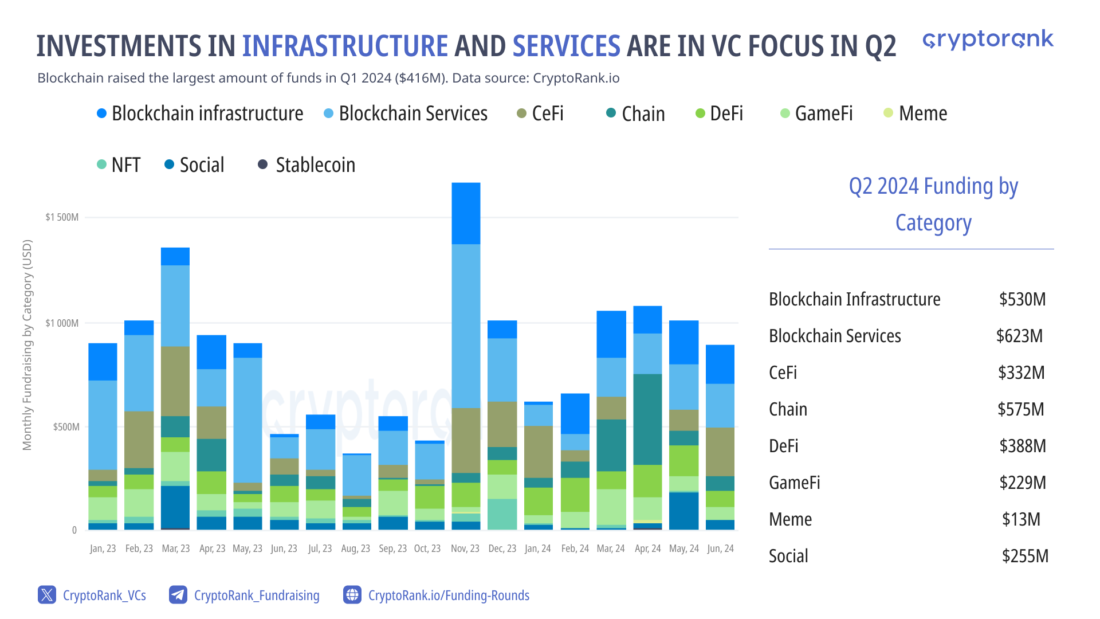

In the second quarter of 2024, startups raised $2.7 bln in 503 deals. While the investment amounts have increased by 2.5%, the number of deals has declined by 12.5% compared with the previous quarter. It means that deal sizes increased.

With positive market sentiment, it is expected that the crypto investment volumes will continue increasing.

Investments in infrastructure and services projects were the main focus of investors by leaving behind such popular in the past sectors as DeFi and GameFi, according to CryptoRank4.

GameFi, NFT, and meme coin sectors experience a downturn in venture capital attention. This means that venture capital attention is realigning towards projects with utility that address internal challenges and issues. This shift signals the industry’s growing maturity with a focus on projects with long-term potential.

So, among the 10 biggest funding deals, the following were for infrastructure projects:

- Monad5 (raised $255 million in Series A round): An EVM-compatible parallelization Layer1 platform that supports 10,000 transactions per second thus increasing throughput capabilities to enable distributed applications.

- Berachain6 (raised $100 million in Series B round): An EVM-compatible layer-1 platform that enables modular development of layer-q networks.

- Babylon7 (raised $70 million in an early-stage round): A native staging infrastructure for Bitcoin that allows users to stake BTC and earn rewards.

- Avail8 (raised $70 million in Series A and seed round): A Web3 infrastructure layer that allows modular execution layers to inter-operate in a trust-minimized way and scale better.

- Conduit9 (raised $37 million in Series A round): This crypto-native rollups-as-a-service platform is designed to support developers in the crypto space. It allows deployment of a chain in a matter of minutes by utilizing leading rollup frameworks.

The only large round for a crypto application was for a social media platform Farcaster10 which raised $150 million in May, and for a GameFi project, Zentry – the blockchain-based gaming platform raised $140 million in an early-stage round.

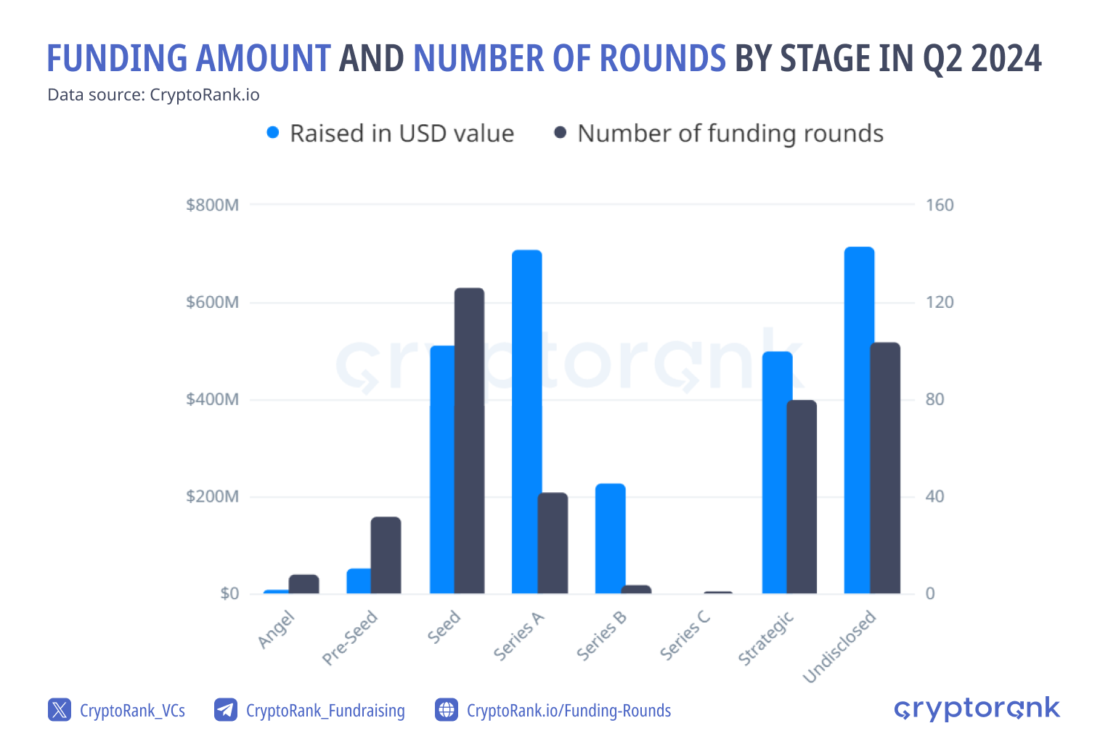

Early-stage crypto investments are booming while late-stage funding slowing down

Crypto fundraising is currently more active at the early stages of project development, particularly in the Seed and Series A stages. According to CryptoRank11, the Seed stage leads in the number of funded projects, while the Series A stage takes the top spot in terms of the total funded amount.

The Seed stage represents an initial round of funding, typically occurring when a startup is still in the product development phase and has not yet generated revenue. Investors at this stage are often drawn by the potential for high returns on relatively small investments, with the average deal size being around $2.85 million. The appeal of early-stage investments lies in the opportunity to get in on the ground floor of innovative projects, particularly as the crypto space continues to evolve rapidly.

Series A financing follows the Seed stage, with investment amounts ranging from a few million to hundreds of millions of dollars. In Q2 2024, the average deal size at this stage is around $4.55 million. However, as projects move into later stages, the risks become more apparent, and the capital required increases significantly. This, combined with factors like market maturity, economic uncertainty, and a more cautious investor environment, has contributed to a slowdown in late-stage funding.

In contrast, early-stage investments are booming due to a higher risk tolerance among investors eager to capitalize on the next big thing in the crypto world. The lower capital requirements and the excitement surrounding new technologies and innovations make early-stage investments particularly attractive in today’s market, even as late-stage funding faces headwinds.

Real-world-asset tokenization are redefining the crypto investment landscape

In May, Securitize announced a successful $47 million funding round12 led by BlackRock. The strategic investment also includes funding from Hamilton Lane, ParaFi Capital, and Tradeweb Markets.

Securitize is a blockchain company that specializes in tokenizing real-world assets and helped BlackRock launch BUIDL13, a tokenized fund. This commitment of BlackRock may signal a broader trend that could redefine not only crypto fundraising and investment strategies but also investment strategies in general.

RWA tokenization allows to convert the rights for assets (bonds, cultural assets, real estate, equity, among others) into blockchain-based tokens. This technology enables enhanced liquidity, transparency, and evidence of ownership and allows retail investors to access investment options that were earlier open only to high-net-worth investors and investment funds.

White-label crowdfunding software with tokenization potential

Now, when a new crypto fundraising boom is observed, it may be the right time to launch a crypto crowdfunding platform. You opt for building a custom crypto fundraising platform or leverage white-label crowdfunding software from LenderKit that can be integrated with the crypto infrastructure.

LenderKit initially focuses on fiat-based features that enable you to automate your investment business operations and manage deal flow smoothly. The investment software solution comes with an admin back office where your team can manage deals and offerings, transactions, investors and fundraisers, set up fees, and perform other activities. A user-friendly investor portal allows investors to access the platform, invest in campaigns, view transaction history, etc.

Platforms powered by LenderKit are operating under various regulations. Your investment software will be tailored to fit a required compliance framework.

To learn more about the available options, please get in touch with our team.

Article sources:

- Crypto Market Cap Charts | CoinGecko

- Crypto Market Cap Surges to Record $2.7T

- BlackRock and Fidelity

- Crypto Fundraising Recap Q2 2024

- PDF (https://files.pitchbook.com/website/files/pdf/Q2_2024_Crypto_Report_Preview.pdf)

- Berachain (BERA) Funding Rounds, Token Sale Review & Tokenomics Analysis | CryptoRank.io

- Babylon (BABY) Funding Rounds, Token Sale Review & Tokenomics Analysis | CryptoRank.io

- Avail (AVAIL) Funding Rounds, Token Sale Review & Tokenomics Analysis | CryptoRank.io

- Conduit Funding Rounds, Token Sale Review & Tokenomics Analysis | CryptoRank.io

- Farcaster Funding Rounds, Token Sale Review & Tokenomics Analysis | CryptoRank.io

- Crypto Market Recap: May 2024

- Securitize | Securitize Announces $47 Million Strategic Funding Round Led by BlackRock

- Yahoo ist Teil der Yahoo-Markenfamilie.