ECSPR Compliance: Are Most European Crowdfunding Platforms Falling Short?

No time to read? Let AI give you a quick summary of this article.

The majority of European crowdfunding platforms are struggling to meet the regulation’s core requirements, according to EUROCROWD’s 2025 ECSPR compliance review1.

Average compliance score across all assessed platforms stood at 5/10, with scores ranging from complete non-compliance (0) to high compliance (9). This means that most platforms only meet half of the baseline standards for proper disclosures, investor protection mechanisms, and operational transparency.

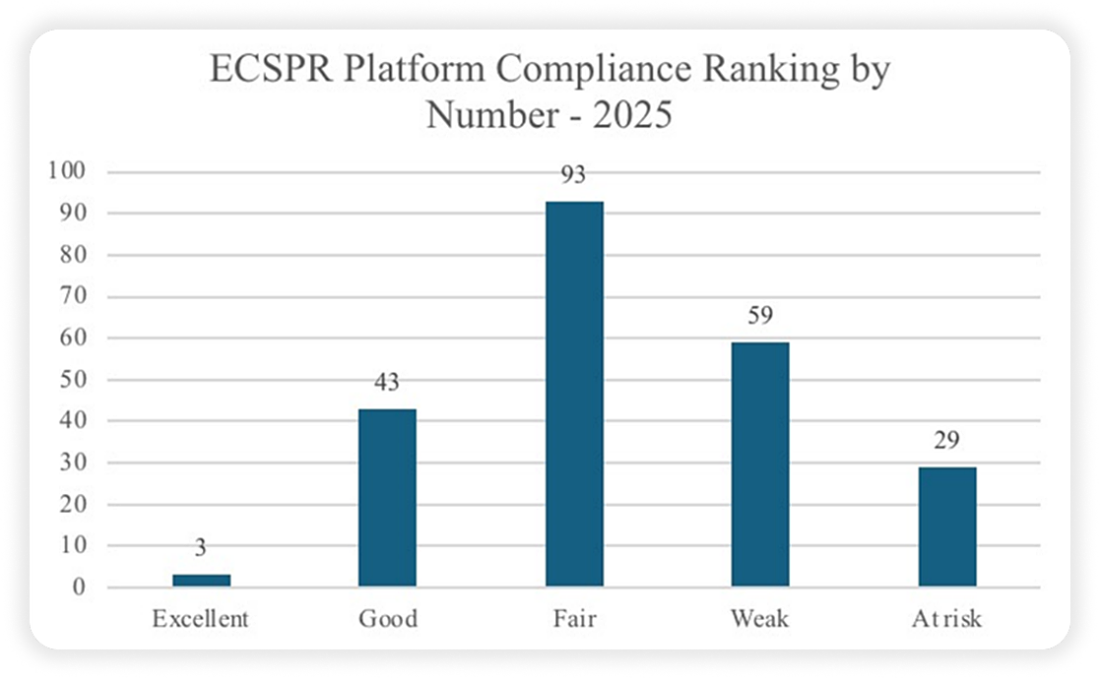

Only three platforms achieved what the report calls an “Excellent” rating, while 29 platforms fell into the “At Risk” category, either due to poor information practices or significant regulatory blind spots.

About 25% of platforms displayed strong adherence to transparency and other ECSPR standards, while nearly 40% failed to meet even baseline expectations.

What you will learn in this post:

Geographic disparities in compliance

One of ECSPR’s key goals was to break down national barriers and allow for seamless cross-border investment. However, the review highlights that compliance levels differ significantly by country.

- The top-performing country, which EUROCROWD did not name but reported as an outlier, averaged 7/10, demonstrating that high compliance is achievable.

- In contrast, platforms in 11 member states, including notable crowdfunding hubs Spain and France, scored below 5, revealing that many local ecosystems have not yet adjusted to the new regulatory environment.

Data from CrowdfundInsider emphasizes that France leads3 in the number of ECSPR‑approved platforms, followed by Italy, Spain, the Netherlands, Lithuania, and Belgium, while Germany, which is the EU’s largest economy, has lagged behind significantly. This weakness in Germany4 stems from divergent national regulatory preferences, delaying professionalization under ECSPR. 5

This uneven uptake of ECSPR undermines the very principle of harmonization. It creates a fragmented market where platforms face different compliance burdens depending on their home jurisdiction, and where investors cannot rely on consistent levels of protection across borders.

The hidden cost of compliance: A barrier for growth?

For many platforms, the cost of achieving full ECSPR compliance is too high. The process of becoming compliant requires not just legal and operational changes, but also significant investment in technology, risk assessment tools, documentation procedures, and customer onboarding systems.

In practical terms, platforms are now caught in a difficult position. They must navigate not just the ECSPR itself but also the residual licensing frameworks in their respective countries.

While ECSPR was intended to replace fragmented national laws with a single, unified regime, many national regulators have retained or added local requirements that platforms must also comply with. This creates legal uncertainty and can discourage platforms from operating across borders, and this is the outcome ECSPR was designed to prevent.

Many platforms lack the resources to overhaul their operations to meet the ECSPR requirements while also maintaining a viable business. This is especially problematic in an industry founded on the principle of providing small investors and entrepreneurs with broader access to capital markets.

Problem areas: Where platforms fall short

There are several key areas where crowdfunding platforms are underperforming.

Transparency6 is a major issue. Less than 25% of platforms1 adequately disclose risks, fees, and investor protections. Many provide only limited or vague information, leaving investors without a clear understanding of the potential risks associated with their investments.

Another major issue involves the inconsistent implementation of investor protection mechanisms2. While ECSPR mandates that platforms offer retail investors safeguards such as cooling-off periods and warnings for risky investments, many platforms fail to explain how these features work in practice or do not offer them at all. As a result, retail investors may be unknowingly exposed to higher-than-expected risks.

Licensing confusion is another area of concern. The report notes that some platforms operate under transitional regimes or claim compliance based on incomplete interpretations of the ECSPR rules. This creates a legal gray zone where the actual enforceability of investor rights may be questionable.

Equally concerning is the fact that many platforms lack proper systems to handle conflicts of interest2, conduct due diligence on projects, and manage complaints or fraud. These gaps expose not only investors but also issuers and platform operators themselves to legal and reputational risks.

Consequences for investors and SMEs

The consequences of weak compliance go far beyond regulatory infractions.

Investor risks

Poor platform practices can directly harm investors, particularly those new to crowdfunding and inexperienced in assessing high-risk, early-stage ventures. Without proper disclosures and safeguards, these investors may make uninformed decisions, fall prey to misleading campaigns or lose funds without recourse.

SME funding limitations

For small and medium-sized enterprises (SMEs), this situation is equally damaging. Platforms that are unable to meet regulatory standards risk being shut down, losing access to key markets or failing to attract investor trust. This in turn limits SMEs’ ability to raise growth capital and hinders innovation in the broader economy.

Market fragmentation

Market fragmentation is also a growing concern. Rather than creating a level playing field across the EU, ECSPR has inadvertently revealed and deepened national divides. If these disparities persist, Europe may be left with a patchwork of crowdfunding environments, with some countries fostering vibrant ecosystems and others lagging behind or remaining closed off entirely.

What can be done

According to Eurocrowd, the solution lies in a coordinated effort from platforms, regulators, and policymakers. National competent authorities need to standardize their approaches to licensing and supervision. While local flexibility can be valuable, the current inconsistencies only add confusion and cost. A true harmonized market requires clear and uniform enforcement.

In addition, platforms must raise their own standards. This means adopting clear transparency practices, including full disclosure of risks, fees, project details, and governance mechanisms. It also means building the internal capacity to handle regulatory obligations, whether through in-house expertise or trusted third-party providers.

More public funding and support are needed to help smaller platforms make the transition. Given the importance of crowdfunding in financing startups and small businesses, it is in the EU’s broader economic interest to ensure that the industry is not stifled by over-complex or under-supported regulation.

ECSPR has unlocked the framework. Now it’s on the ecosystem to build a trusted, unified crowdfunding future across Europe.

Launching a compliant crowdfunding platform in Europe with LenderKit

Launching a new crowdfunding platform in Europe may appear challenging due to widespread compliance gaps revealed in the 2025 EUROCROWD review. However, this environment creates a prime opportunity for newcomers. While legacy platforms fight with outdated infrastructure and ECSPR retrofitting, new entrants can build compliant, transparent, and scalable operations from the outset.

LenderKit offers a significant advantage in this context, providing white-label investment software tailored for EU-regulated platforms. With built-in or easily adaptable ECSPR features, such as investor onboarding, KYC/AML, disclosure management and audit-ready admin tools, LenderKit reduces time to market and helps avoid costly missteps.

The message from regulators is clear: platforms must embed compliance from the start or risk falling behind. LenderKit equips founders with the tools to meet ECSPR standards, offering multilingual support, modular architecture and technical guidance that aligns with evolving regulations.

Article sources:

- ECSPR Compliance: Uneven Ground - Eurocrowd

- PDF (https://eurocrowd.org/wp-content/blogs.dir/sites/241/2025/07/EUROCROWD-compli...)

- Eurocrowd: ECSPR Slowing Crowdfunding In EU As Compliance Requires Significant Investment, Undermines Online Capital Formation | Crowdfund Insider

- Cracks in the Foundation: Retail Investor Risks in Real Estate Crowdfunding - Eurocrowd

- Reality Check in Platform Risk

- Legal Insight: Crowdfunding in Germany – Consumers as Fair Game – Fintech Lenders