Estateguru’s Recovery Strategy: Rebuilding Investor Confidence in Lending Platforms

No time to read? Let AI give you a quick summary of this article.

Every business has its ups and downs, and Estateguru — one of Europe’s leading property lending platforms — has quite the story to tell. In the past few years, the company has experienced difficult times that have shaken the trust of many investors. Now, Estateguru is working hard to rebuild that trust, and we are going to take a look at the what, why and how.

This journey is not only about Estateguru — it’s an opportunity for other lending and crowdfunding platforms to learn about risk, recovery and investor confidence.

What you will learn in this post:

What is Estateguru?

Estateguru1 is a European real-estate lending and crowdfunding platform where investors can lend money to borrowers in building, renovating, and selling property projects. The loans are backed by mortgages (real estate serves as collateral), this is why they are considered relatively safe.

Investors expect returns via interest and repayment of principal, and Estateguru handles defaults, auctions of collateral, legal recovery etc. 2

What went wrong

Estateguru has had significant problems in recent years that damaged investor confidence. One of the main issues was a high rate of defaults and non-performing loans funded in some markets3, such as Germany and Finland. Delays, borrower defaults, deterioration of collateral value, and legal/regulatory issues led to a large number of loans going into recovery.

Germany in particular has been problematic. Estateguru paused new lending3 in Germany in early 2023 due to underperformance of its German real estate portfolio. Some German properties were not being developed, loans were delayed, borrower companies lacked additional assets, cost pressures increased, and regulatory or market risk rose. Investors grew frustrated4 by slow recoveries, unclear or infrequent updates, and the long wait times for default resolutions. Many investors felt expectations had not matched reality.

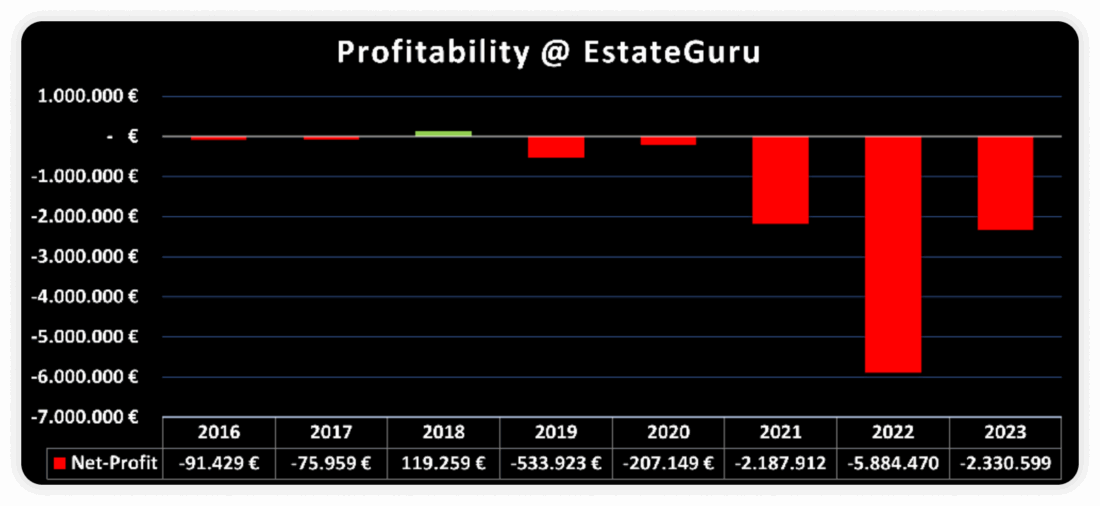

Because of defaults in earlier periods (especially 2021-2023), Estateguru has had a backlog of loans in recovery, and those weigh on both investor sentiment and financial performance. The company has also reported losses for several consecutive years, which highlights the ongoing financial strain.

How Estateguru is trying to fix things: Their recovery strategy

Estateguru has taken several measures to rebuild trust, improve recovery outcomes, and strengthen their business. These are the key parts of their strategy.

Rigorous risk policy and stricter underwriting

New loans are being selected more carefully. Estateguru has updated their credit policies7: lower loan-to-value (LTV), more conservative risk criteria, more detailed evaluation of borrowers’ exit plans, and stricter scrutiny of collateral. At the same time, the platform highlights that its recovery strategy is starting to show results.

In July 2025 alone, Estateguru recovered €3.1 million8 in principal from defaulted loans. Since the new risk policies were introduced, the share of defaulted loans has been gradually decreasing. The company has also crossed an important milestone by reaching €900 million in total funded loans across Europe, which shows that both borrowers and investors continue to trust the platform despite past challenges.

Focusing on core markets

They reduced exposure in markets that had poor performance (for example, Germany). They have paused new lending in Germany7 and are largely pulling back from unprofitable markets.

Active recovery of defaults

Estateguru has put more effort and resources into recovering defaulted loans9, which has become a central part of its strategy. The company works closely with legal partners, debt collection agencies, and local enforcement bodies, and also organizes auctions to sell collateral properties when necessary.

Instead of selling large groups of defaulted loans at a steep discount, each case is handled individually to maximize the amount recovered. The main element in this process is that the loans are secured by first-rank mortgages, which gives investors stronger protection and a better chance to get their money back if the recovery process is successful.

Improved transparency & communication

Estateguru has been reporting more detailed portfolio overviews, regular updates on recoveries10, monthly or periodic repayment/recovery metrics. They also released “video review” reports11 to allow investors to see with more clarity what is happening. 12

Business strategy refocus and product innovation

They are introducing or expanding new products8 (for example, “EG Grow”) designed to offer more stable or diversified returns. The company focuses on markets where the performance is better, such as the Baltic states, rather than risky or weak markets.

Are things improving?

There are signs that Estateguru’s recovery strategy is making progress. Here are some metrics that prove it:

- In June 202510, loan repayments and recoveries were at their highest levels so far this year. Estateguru originated about €5.77 million in loans that month, and investors saw €11.26 million in repayments (which included fully repaid loans and recovery from defaulted loans).

- For loans issued in 2023-2024, a very high percentage are performing well8. In one report, 99.47% of loans originated in the past 12 months were performing as expected, only 0.53% delayed or defaulted.

- In Estonia, the recovery team was recovering on average €490,000 per month in defaulted loans during 202313, with yearly returns over 10% (on those recovered loans).

- Estateguru’s total funded loan volume has reached about €900 million8 since founding.

These are promising signs, though some sources still warn of large exposure to non-performing or defaulted loans5, especially older ones and especially in markets with more risk.

What risks remain

Even with recent improvements, Estateguru still faces risks and obstacles.

Recovery times remain long5 in some countries, such as Germany, where legal, auction, and insolvency procedures can take years to resolve. In many cases, recovered amounts may be less than full outstanding claims (principal + interest + fees) because the collateral may drop in value, and legal fees and collection costs further reduce the final payout.

Estateguru is also exposed to broader market and regulatory risks3. Real estate markets move in cycles, interest rates can rise or fall, and property valuations are never fixed. In addition, rules and regulations vary across countries, and changes in these frameworks can directly affect loan performance and recovery strategies. All of these factors make the environment even more uncertain.

What lessons can other lending and crowdfunding platforms take

From Estateguru’s experience, here are some lessons that other platforms should take.

Don’t expand too fast before you study the market

Aggressive growth in new markets can bring higher defaults, especially when the legal and regulatory environment, borrower quality, and collateral enforcement are less familiar or less favorable. It’s better to scale by originating new loans only after you are confident about handling defaults and legal recovery in each market.

Keep strong underwriting and conservative risk policies

Lower LTVs, solid exit plans, good collateral, experienced borrowers: don’t shortcut these just because you want more volume. Risk can end up being expensive later.

Secure lending with a first-rank mortgage or other strong collateral

If a default happens, you shall have collateral that can be sold easily. It’s part of a good risk management strategy.

Be transparent and communicate with your investors

Investors are more likely to stay when they understand where things are, even if there are problems. Regular updates, clear reports, and realistic expectations are much better than optimistic spin with missing facts.

Active recovery, not passive write-offs

Don’t let huge numbers of loans sit in default; make reasonable recovery efforts. Law firms, auctions, legal enforcement, etc., must be part of the process. Also, avoid selling off a large portfolio of bad loans at a steep discount unless no better option remains, because it often means a large loss.

Use own capital or reserves to show skin in the game

When a platform invests in recovery (e.g., puts its own money into defaults), that shows commitment to investors and shared risk.

Is Estateguru rebuilding confidence?

Yes, it does, but the process is slow.

Estateguru has taken responsibility for past mistakes. They have changed underwriting, pulled back from weak markets, increased transparency, and improved recovery efforts. Some numbers are clearly improving, especially for newer loans. That suggests the new strategy is working.

However, the legacy of old defaults, slow recovery cycles, especially in jurisdictions with complex legal or real‐estate markets, and partial recoveries still weighs heavily. For many investors, those old losses or delays still hurt trust. Estateguru’s reputation was damaged, and trust is harder to rebuild than to lose.

Launching a platform like Estateguru with LenderKit

If you’re interested in launching an investment platform similar to Estateguru, check out white-label crowdfunding and investment software offered by LenderKit.

LenderKit supports a full capital raising cycle from investor onboarding to deal creation and fund disbursement. With compliance modules tailored to the ECSPR framework, integrations for KYC/AML and automated payment processing, LenderKit provides a ready-made, yet highly customizable platform for businesses of all sizes.

If you’re interested to learn more about it and schedule a demo, don’t hesitate to contact us.

Article sources:

- Start Investing in Property-Backed Business Loans - Estateguru

- How We Deal with Defaults at Estateguru | Estateguru P2P lending Blog

- Estateguru warns of losses on German RE portfolio - Alternative Credit Investor

- EstateGuru review | Our investors experience with this platform

- Estateguru Review: Worst Portfolio Quality in P2P Industry

- How We Deal with Defaults at Estateguru | Estateguru P2P lending Blog

- Estateguru Reports Steady Recoveries, Lithuanian Expansion, And Strategic Business Refocus | Crowdfund Insider

- Estateguru Reports Steady Progress In July And €900 Million In Total Funded Loans | Crowdfund Insider

- The state of German loan recoveries | Estateguru P2P lending Blog

- June Results: Loan Repayments and Recoveries Reached Their Highest Levels

- 2025 Half-Year Video Review

- June Results: Loan Repayments and Recoveries Reached Their Highest Levels

- Estonian Recoveries 2023: Overview and Selected Case Studies | Estateguru P2P lending Blog