Crowdfunding in Germany: Business Ecosystem Overview

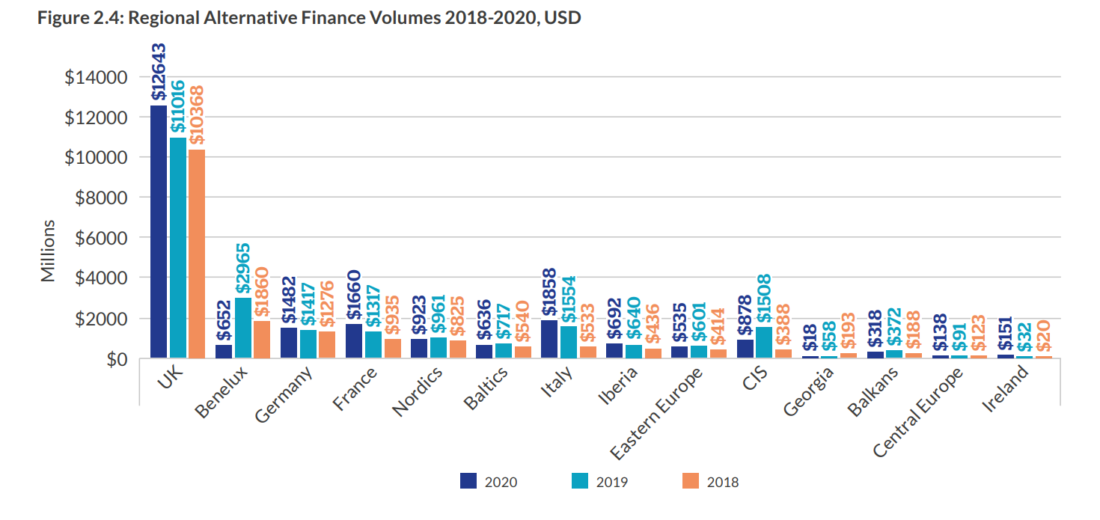

The German crowdfunding market is growing rapidly. In 2015, it amounted to over $272 million, from which above $189 million were allocated to lending-based crowdfunding. In 2019, this value grew to $1,417 million, and in 2020 – to $1,482 million.

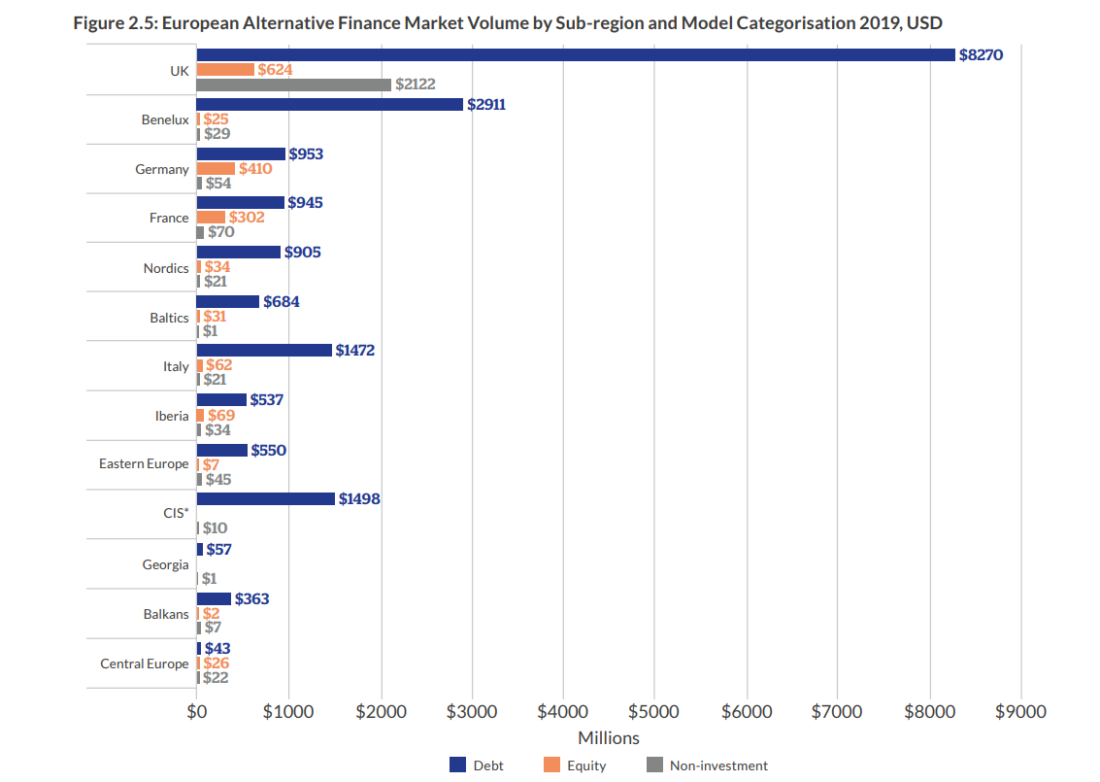

On the German crowdfunding market, there are two prevailing crowdinvesting models such as debt and equity-based ones.

As we can see from Ahrefs search results data for the last 12 months, Germans google about crowdfunding 2% more than French, Italians, or Americans.

It means that interest in crowdfunding is growing. Multiple foreign platforms are trying to expand their business to Germany or actively addressing German investors which also demonstrates that Germany is very important as a crowdfunding market. Nevertheless, the regulatory environment for crowdfunding private ventures in Germany was not optimal until recent times.

The lack of harmonized regulation was one of the major impediments to service provision on a cross-border basis, and when the EU regulation on Crowdfunding Service Providers (ECSPR) was adopted, it appeared that for Germany, it couldn’t be applied as straightforward as in other EU countries. Therefore, on 10 June 2021, the German Parliament adopted a law that transposes the EU regulation on Crowdfunding Service Providers into national law.

Why did Germans come up with the idea to adopt the law if it shall be directly applicable to all EU members?

There ECSPR has some provisions that permit a country to define some rules independently to adopt the law in the existing legal framework smoother. It was the case with Germany.

What you will learn in this post:

Overall changes to the German crowdfunding rules

Under existing rules in Germany real estate crowdfunding, both investor and fundraiser fall under the scope of other financial regulated services. Therefore, some adjustments were needed to bring the existing financial regulations and the ECSPR into the agreement.

Changes to the German Banking Act

Earlier, based on the German Banking Act (Gesetz über Kreditwesen, KWG), German crowdfunding platforms operated as financial investment brokers and therefore, needed a license to provide their services. To avoid triggering the need to be licensed, loans were brokered with the involvement of a bank that formally issued a loan to the fundraiser.

Further, the platform used to buy that loan from the bank via an SPV and provide investors with securities based on which investors would receive their share of income later. The income generated by successful fundraising projects was received by the crowdfunding platform and further, the platform distributed to the investors their income shares. It was an obstacle for the German crowdfunding business development because the process was complex, and it generated additional expenses.

With the adoption of the ECSPR, real estate crowdfunding platforms in Germany require a license in accordance with the new regulation only.

Those investors and fundraisers who use crowdfunding platforms authorized under ECSPR are not considered as lenders or deposit-takers, and the activity of the platform is not considered the same as the activity of regulated credit institutions such as banks.

In other words, the crowdfunding platform doesn’t issue a credit but serves as an intermediary that facilitates the loan agreement between an investor and a fundraiser. Therefore, all the parties do not need licenses under the KWG anymore.

Investment-based crowdfunding in Germany

In investment-based crowdfunding, investors provide funds in return on the company’s shares. In Germany, the transfers of private limited companies’ shares are subject to notarial authorization. That’s why the German legislator doesn’t consider shares as a suitable instrument for crowdfunding purposes.

The introduction of a “European Passport”

Also, for the first time, a “European passport” was introduced for crowdfunding service providers. Once a platform receives authorization from the national competent authority (NCA) in its country of establishment, it can provide crowdfunding services in all EU countries on a cross-border basis.

Civil liability

The ECSPR states that project owners are responsible for the accuracy of information about the project. They are imposed civil liability if the information provided by them is misleading, inaccurate, or incomplete. If a crowdfunding service provider provides the loan management services at a platform level and prepares the key investment information sheet (KIIS), civil liability is applied to the provider.

In Germany, the legislator has implemented the civil liability provision into national law. A project owner (or a CSP if the KIIS is prepared at the platform level) is liable for the accuracy and completeness of the provided information.

Criticism of new regulation

While in general, the ECSPR was aimed at facilitating crowdfunding operations in the EU, the German transposition law was criticized. The Federal German Crowdfunding Association even called it a “crowdfunding prevention law”.

The main drawback of amendments is the exclusion of private limited companies’ shares. It is expected that crowdfunding platforms, instead of performing investment-based crowdfunding activities in Germany, will start incorporating fundraising SPVs in other EU countries where no notarial authorization is required.

Another drawback is the severe provisions of civil liability which may prevent fundraisers from launching their crowdraising projects from Germany.

Final thoughts on crowdfunding in Germany

Even though there are some drawbacks in the crowdfunding regulation in Germany at the local level, it is expected that the strong German FinTech industry in general and crowdfunding specifically will not suffer from the new regulation. The conditions to launch and operate a crowdfunding platform are the same in all EU countries, and the amendments are not going to jeopardize the importance of the German crowdfunding market across the European Union.

While the ECSPR was introduced to facilitate the provision of crowdfunding services on a cross-border basis, there are still many things to consider for platform operators.

Launch a crowdfunding platform in Germany

If you’re looking to start a crowdfunding platform in Germany, LenderKit is a great white-label investment software to consider. LenderKit includes debt, equity and donation crowdfunding flows out-of-the-box and provides a flexible user interface for the admin as well as investors and fundraisers.

There are two product tiers to choose from or you can talk to us to build a fully-custom crowdfunding platform.