Evergreen Funds Explained: Are They the Future of Retail Alternative Investing?

No time to read? Let AI give you a quick summary of this article.

Evergreen funds are popular because they remove many of the hurdles that made private markets hard to access in the past.

Traditional private funds often ask investors to commit millions of dollars, lock their money away for years and deal with complex rules like capital calls and tricky tax forms.

Evergreen funds work differently. Money is put to work right away, the minimum investment can be as low as $2,5001, investors can withdraw money at set times and tax reporting is much simpler.

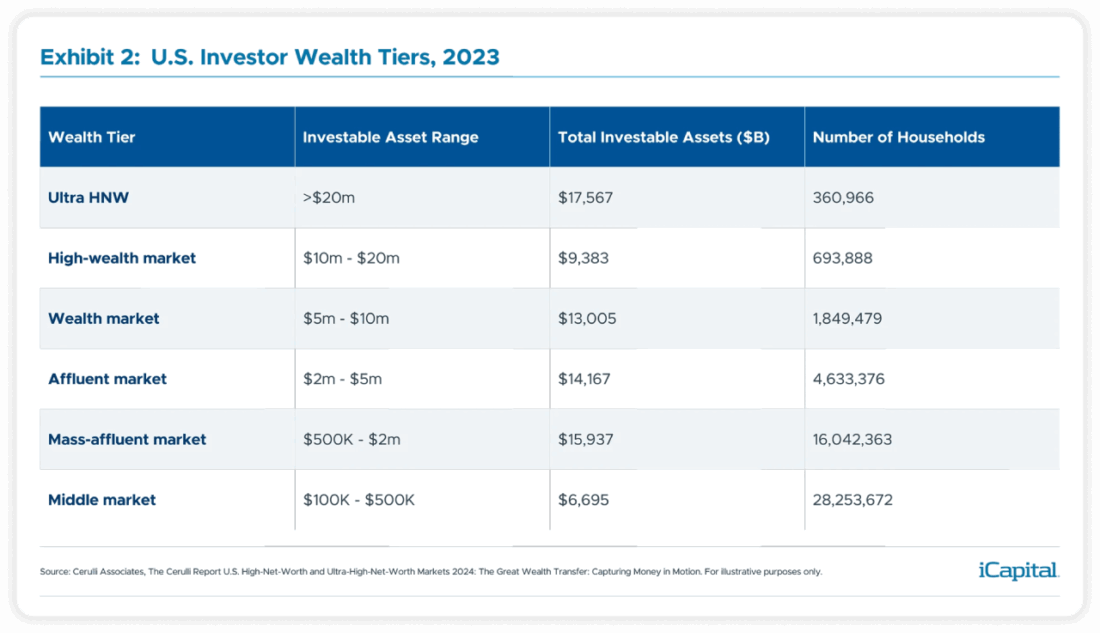

Instead of being limited to a small pool of ultra-wealthy households who qualify as Qualified Purchasers1 with $5 million+ in investable assets, most evergreen funds are available to accredited investors, a much larger segment of the U.S. population.

And the idea isn’t just limited to the United States. These funds are spreading across Europe, Asia and Latin America, giving millions of people around the world a new way to invest in private markets with more flexibility and fewer barriers.

What you will learn in this post:

What is an evergreen fund?

An evergreen fund2, also called a perpetual or open-ended private markets fund, is an investment vehicle with no fixed end date.

Traditional private equity and venture capital funds have a lifecycle3 and wind-down after about 10 years:

- Commitment phase

- Investment phase

- Harvest or exit phase

Unlike most traditional funds, evergreen funds are designed to operate continuously.

These structures can operate in different legal forms depending on jurisdiction and regulatory regime. Common types1 include interval funds, tender offer funds and non-traded REITs or BDCs in the U.S.

In Europe, special evergreen structures called ELTIFs (European Long-Term Investment Funds4) have been created to facilitate everyday investors’ participation in private markets across the EU and EEA.

Here is a short overview that will help to understand how evergreen funds differ from closed-end private funds:

| Aspect | Traditional Funds | Evergreen Funds |

| Fund Life | Fixed (typically 7–12 years, with possible extensions) | Indefinite; continues until wound up or triggered |

| Capital | Investors commit upfront; capital is called as needed | Fully funded or continuously raised; may manage cash for redemptions |

| Liquidity | Illiquid; exit via asset sales or secondary market | Semi-liquid; periodic redemptions with restrictions |

| Reinvestment | Proceeds distributed to investors; new fund raised | Proceeds reinvested or used for redemptions |

Fund life

Traditional funds usually have a fixed lifespan, often 7 to 12 years, sometimes with extensions.

Evergreen funds don’t have an end date; they keep going until the manager decides to wind them down or a trigger event occurs.

Capital commitments and calls

In traditional funds, investors pledge capital upfront (or over time) and the manager calls the money as needed.

In evergreen funds, investors may fund everything upfront, or the fund may continually raise and reinvest money.

Liquidity and redemption

Traditional funds are mostly illiquid. Investors usually get money back when the fund sells its holdings at the end of its life, or they can try to sell their stake on a secondary market.

Evergreen funds are semi-liquid. They offer redemption windows from time to time. To prevent runs or mass exits, many structures impose caps (e.g., only a certain % of assets may be redeemed in a period), or require advance notice of redemption. Liquidity risks still exist.

To handle redemptions, the fund may maintain a “liquidity sleeve” — a portion of the assets in liquid or near-liquid investments (such as cash, public securities, short-term fixed income, etc.). If many investors request redemptions, the fund can draw on that sleeve rather than force sales of illiquid assets.

Reinvestment and deployment

In traditional funds, once investments mature and are sold, the proceeds are returned to investors. If managers want to invest in new deals, they typically launch a new fund.

In evergreen funds, proceeds can be reinvested into new assets or used for redemptions. However, there are concerns that assets allocated for evergreen funds5 may not be the top-tier private deals, because the manager has to balance liquidity, risk, and returns.

Main players in the market

Here are the major players in retail alternative investing.

Hamilton Lane

Hamilton Lane’s Evergreen Strategies6 platform is a private markets investment service designed for wealth professionals, accredited investors, and retail/non-professional investors (in some products) who want exposure to alternatives without the traditional long lockups and complexity.

The platform includes a suite of evergreen funds (both U.S. registered vehicles (e.g., under the 1940 Act) and European ELTIFs) that cover private equity, infrastructure, secondary investments, credit, growth, etc. Some funds allow investing with as little as 500$.

The funds also provide regular limited liquidity (monthly or quarterly repurchase or tender offers) and immediate exposure: once you invest, your capital is deployed without waiting years for capital calls.

The Hamilton Lane ELTIF is tailored for EU-based retail and non-professional investors under the ELTIF 2.0 regulation7. It combines regulation-friendly structures with a multi-manager investment strategy.

The Bow River Capital Evergreen Fund

The Bow River Capital Evergreen Fund8 was created to give individual (accredited) investors access to institutional-quality private equity, particularly focused on the middle market. It offers broad diversification across sectors, geographies, and markets. Investors get opportunities to invest in private equity, private credit, and more liquid securities. 8

For accredited U.S. investors, the entry is $50,000, with subscriptions accepted monthly. The fund provides immediate deployment of capital (i.e. money is invested quickly, it is not held for years waiting for deals), and offers periodic repurchase/liquidity opportunities. However, investments remain relatively illiquid and there are limitations (for example, there are no secondary market for shares).

As of mid-2025 the fund had roughly $850 million in assets9 under management, executed over 120 private market transactions, and delivered strong returns (annualized net return since inception ~16.9%) with low drawdowns.

StepStone Group (StepStone Private Wealth Solutions)

StepStone Private Wealth Solutions (SPWS)10 is the private-wealth arm of StepStone Group.

It offers a suite of evergreen/semi-liquid private market funds where individual, accredited, and smaller institutional investors can access investments in private equity, infrastructure, venture, growth, and private credit.

The minimum investment is just 25,000$. These funds also feature quarterly liquidity windows, providing flexibility that traditional private funds typically lack. Tax reporting is also simplified, which further reduces the complexity for individual investors.

How to launch an evergreen fund for retail alternative investing

Launching an evergreen fund for retail alternative investing involves addressing regulatory, operational and investor engagement challenges. While LenderKit does not currently offer a turnkey solution for evergreen fund structures, its modular architecture and domain expertise can potentially be used to develop a tailored platform that supports such models — including interval funds, tender offer funds, or private market vehicles for accredited investors.

LenderKit’s components — such as investor onboarding, KYC/AML, digital subscriptions, and reporting tools — can be adapted to support evergreen fund requirements like periodic liquidity windows and transparent investor communication. The platform is designed to be configurable and flexible, enabling development of features aligned with evergreen investment strategies.

In regions where evergreen structures like ELTIFs are emerging, LenderKit’s experience in compliance workflows and customizable interfaces can provide a foundation for building region-specific solutions.

If you’re exploring this kind of fund structure and need a technology partner to help shape a platform around it, we invite you to connect with our team.

Article sources:

- The Road to Mass Adoption – Evergreen Funds: Amplifying Client Adoption - iCapital

- Evergreen Funds: An Introduction | Hamilton Lane

- Fund Lifecycle Explained: Key Stages from Fundraising to Exit | Esinli Capital

- Capital markets union - Finance - European Commission

- ‘Retailisation’ of evergreen funds raises concerns - Alternative Credit Investor

- Private Markets Solutions Provider | Hamilton Lane

- PDF (https://iqeq.com/wp-content/uploads/2025/01/IQEQ_ELTIFWhitepaper.pdf)

- Bow River Advisers

- Bow River Capital Evergreen Fund Achieves 5-Year Track Record, Continues to Expand Team

- StepStone Private Wealth Solutions (SPWS)