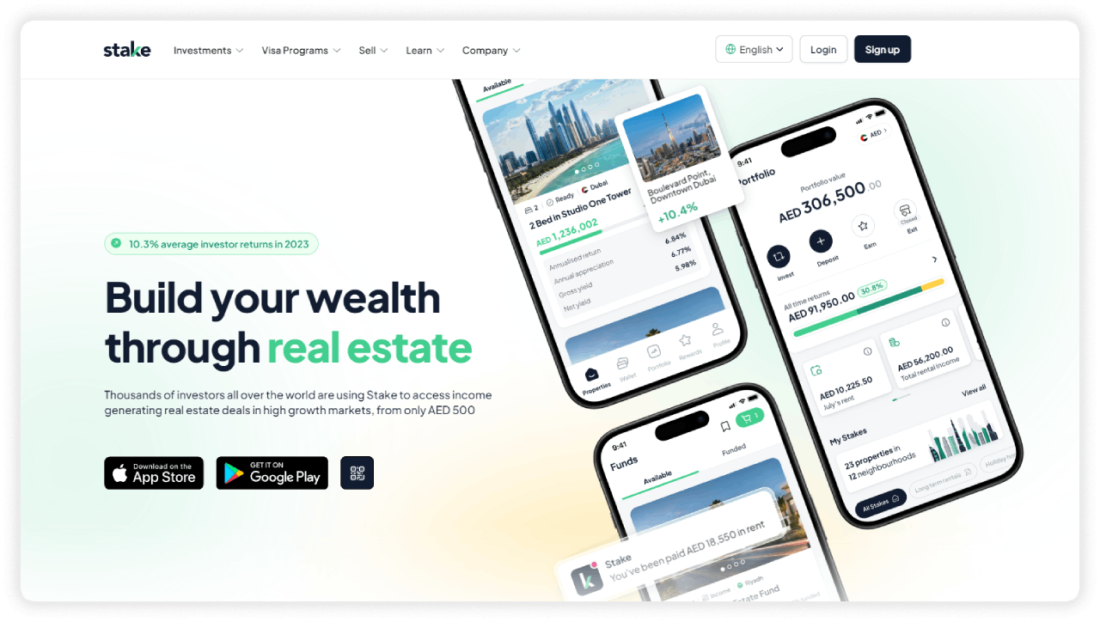

GetStake Crowdfunding Platform Review

No time to read? Let AI give you a quick summary of this article.

GetStake is one of the leading real estate crowdinvesting platforms in the UAE. The platform was launched in 2021 in Dubai by a team of experts with experience in real estate, finance, consulting and technology. And since its launch, GetStake has funded over 200 properties.

GetStake investment platform provides all types of investors with an opportunity to invest in residential buildings, commercial facilities and hospitality projects.

What you will learn in this post:

Legal Status

GetStake is regulated1 by the DFSA (the Dubai Financial Services Authority)2. The platform adheres to the DFSA standards which means that investors’ assets are kept separate from the GetStake business operations and are securely held by protected holding companies known as Special Purpose Vehicles (SPVs) within the Dubai International Financial Centre (DIFC). This ensures that all investors’ funds are safeguarded even if the platform faces financial issues.

In Saudi Arabia, the platform is regulated by the CMA (Capital Markets Authority).

Investment Mechanisms

When investing through the platform, investors get a Title Deed from the Dubai Land Department (DLD) and Share Certificates in the investor’s name — both papers serve as proof of ownership of the property.

SPVs hold investments in property free from any type of debt, lien, or encumbrance to ensure that no other institutions can make claims on the assets in which investors invest.

In Saudi Arabia, investors get subscription certificates and fund unit registries.

Investors have two options to exit their investments:

- Sell the stake during an exit window (every 6 months), to take early profits within the platform’s community. Exit windows act as secondary markets where investors can list their shares for sale and other community members can consider buying them. Exit windows are open for 2 weeks, in May and November. Investors can sell the property after a 1-year lock-in period from the date when the asset was purchased.

- Sell the properties and funds after 2-5 years of holding, depending on the project conditions, to realize the full investment appreciation at maturity.

Investors can start investing in offerings listed on the platform with as little as AED 500 (slightly over USD 136). After the investment is made, investors are given a 48-hour cooling period during which they can withdraw their investments without fines.

Return on Investment

The advertised average return on investment in 2023 is 10.3% which is generated on receiving a share from monthly rental payments or by realizing capital appreciation when the shares are sold. Since the launch of the platform, GetStake has paid over AED 15.7 mln (over USD 4 mln) of rental income.

GetStake Fees Charged to Investors

The fee structure of GetStake is rather complex and needs a more detailed explanation. Investors pay one-time transaction fees, transfer fees upon exit, annual fees, and additional performance fees.

One-time transaction fees

An acquisition fee of 1.5% of the funding target is paid at the time of property acquisition.

KYC and AML fee of 0.20% of the funding target is paid at the time of property acquisition.

An exit fee of 2.5% of the funding target or the sale value (whatever is greater) is paid at the end of the investment term, with a minimum exit fee always applicable.

Transfer fees upon exit

A transfer fee of 2.5% of the transfer price, is paid by the seller.

Performance fee of 7% of the net sale value minus transaction costs and funding target, including:

- Stake exit fees

- PC liquidation expenses

- Brokerage/agency fees

Annual fees

Administrative fees of 0.5% of the funding target per annum.

KYC and AML fees of 0.1% of the funding target per annum, starting from the second year after the property acquisition.

Additional performance fee

The additional performance fee of 7% of the excess return is paid if the sale value or the share price at exit exceeds the funding target or original purchase price, net of transaction costs.

Other Details

- Fees may change, be reduced, be waived, or have rebates, subject to fair treatment rules.

- Sellers may be charged separate fees for selling property through the platform, ranging from 0% to 6% of the purchase price.

- All fees will be rounded up to the nearest whole number.

- Any fee changes will be notified 14 business days in advance via email.

Property Management Fees

Along with the mentioned fees, investors pay property management fees. These costs include both the direct fees associated with transactions and the operational expenses necessary for maintaining and setting up the properties under management.

Here is the list of management fees.

- DLD transfer and registration fee3: 4% of the property price + AED 580

- DIFC transfer and registration fee4: 5% + AED 367

- Trustee5 fees: AED 4,000 – 6,300

- Brokerage/Agency fees: 2%

- Legal translation: AED 210

- Property insurance: AED 750 – 5,000

- Valuation fee: AED 1,500

- Listing cost: AED 420 – 750

- Certificate of incumbency6 fee: AED 367

- DIFC PC7 incorporation fee: AED 367

- DIFC PC annual licensing fee (first year): AED 3,674

- DIFC NOC8 fees: AED 1,837

- Pro-rata service charge9: AED 1,000 – 10,000

- Reserve fund: AED 5,000 – 25,000

- VAT: 5%

- Stake acquisition fee: 1.50% of the property price

- KYC charge – front end: 0.20% of property price

- Refurbishment and maintenance: AED 10,000 – 250,000

- Holiday home refurbishment and set-up: AED 10,000 – 250,000

- MC charges: AED 30 – 120

Utilities set-up costs:

- Chiller: AED 1,000 – 2,500

- DEWA10: AED 2,000

- Gas: AED 500

- Internet & TV: AED 500

The fees vary depending on the property price, size, condition, and charges imposed by the property management.

Who Can Invest

Anybody can invest in real estate with GetStake. International investors can do it after applying to a Golden Visa program. To do so, they shall invest a minimum of USD 545,000 (AED 2 mln) in property through the platform. With it, they become eligible for a 10-year renewable residence permit.

GetStake differentiates between two types of investors:

- Retail

- Professional

All investors are considered retail on default. The status of a professional investor is assigned to those who have a proven track of investing in property or have a personal net worth of more than USD 1 mln, excluding the primary residence. Though each investor who qualified for the professional status may opt to be treated as a retail investor.

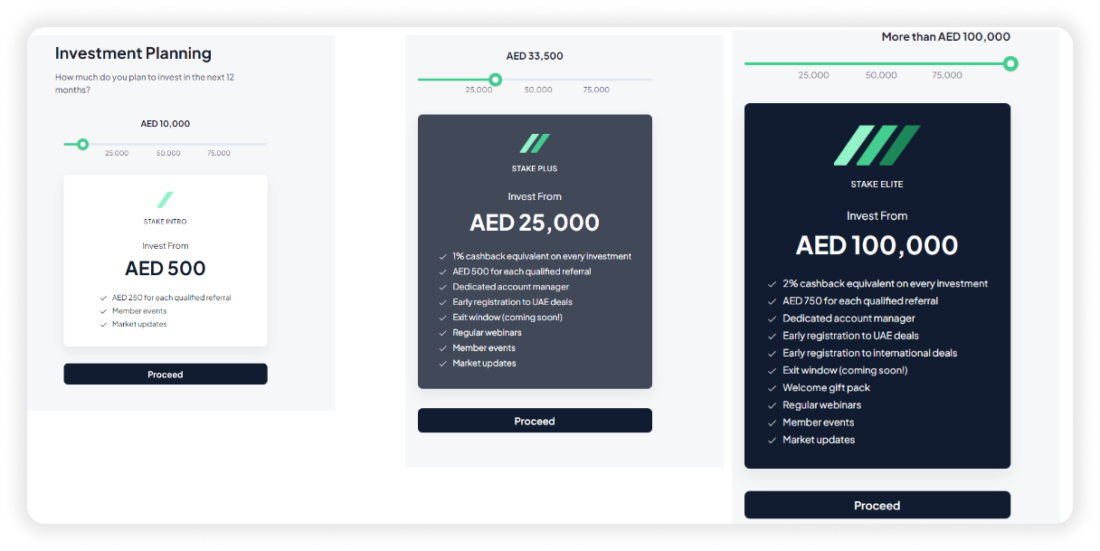

Investment Plans

The platform offers three investment plans to choose from, each of them is suited to the needs of different investors and offers different benefits.

Stake Intro

With this plan, one can start investing in real estate projects with AED 500. Investors receive invitations to member events and get market updates. For each qualified referral, an investor gets an AED 250 reward.

Stake Plus

This plan allows to invest starting from AED 25,000. On every investment, an investor receives 1% cashback, gets access to early registration to UAE deals, the exit window, member events, market updates, and regular webinars. Such investors are assigned a dedicated account manager and receive a reward of AED 500 for each qualified referral.

Stake Elite

With this plan, investors can participate in deals with a minimum investment of AED 100,000 and get 2% cashback on each investment. They also get access to early registration to UAE deals, early registration to international deals, the exit window, a welcome gift pack, regular webinars, member events, and market updates. For each qualified referral, the Elite investor receives an AED 750 reward.

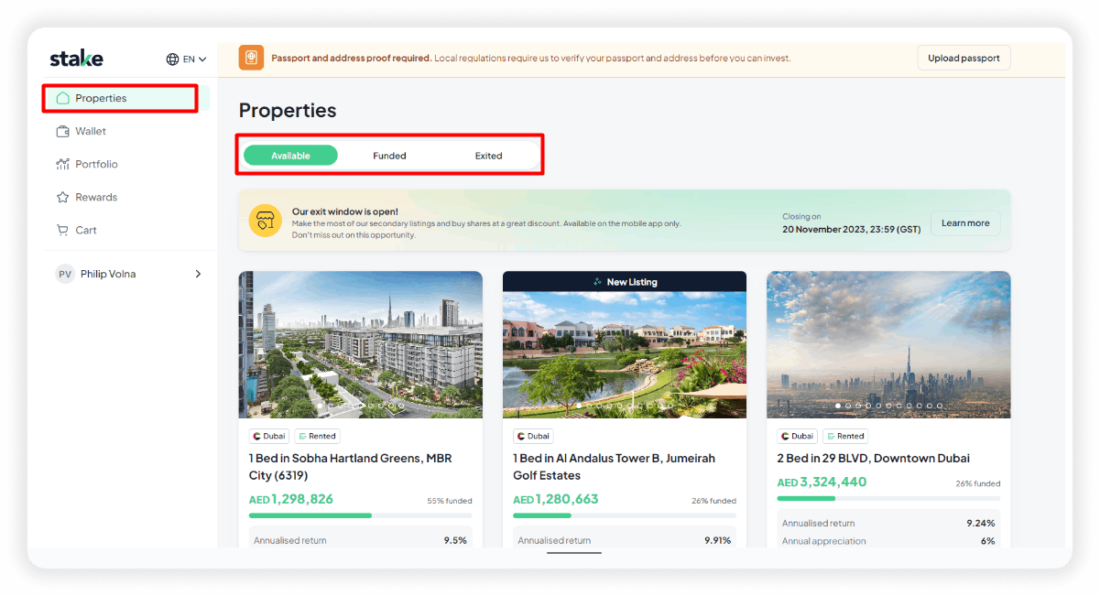

GetStake Investor Dashboard

The platform’s dashboard is easy to use and provides access to all the functionalities. Investors can check properties and filter them based on the investment status: available, funded or exited.

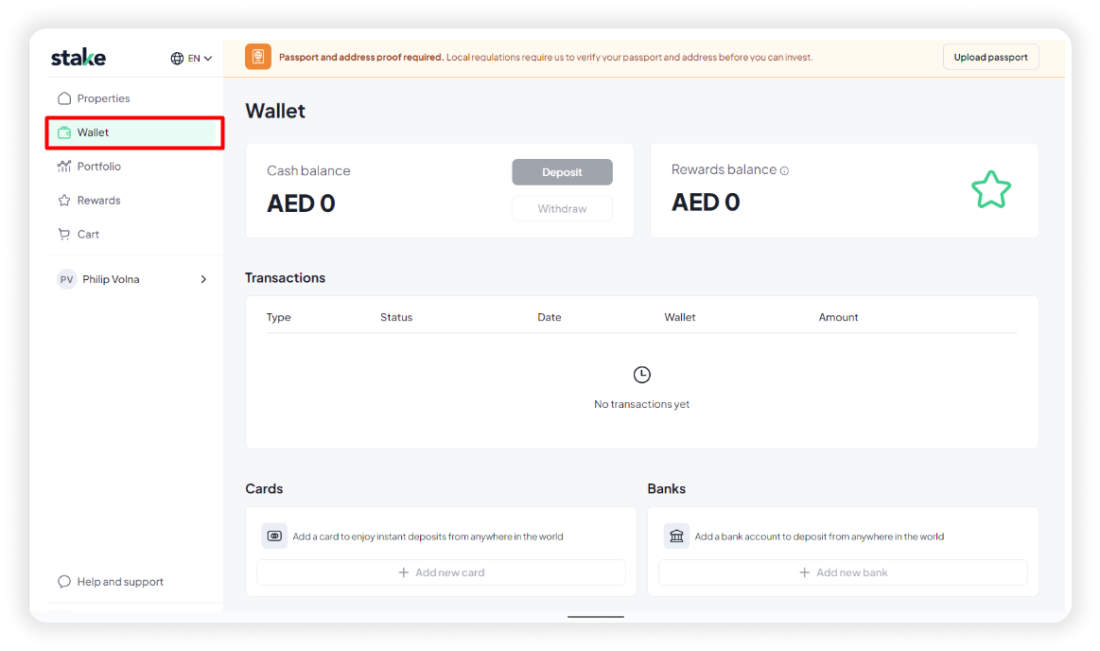

Further, investors can move to the Wallet tab where they can check their cash balance and reward balance, as well as to browse the transaction history and filter transactions based on their type, status, date, wallet, and amount, as well as connect and manage bank cards and bank accounts.

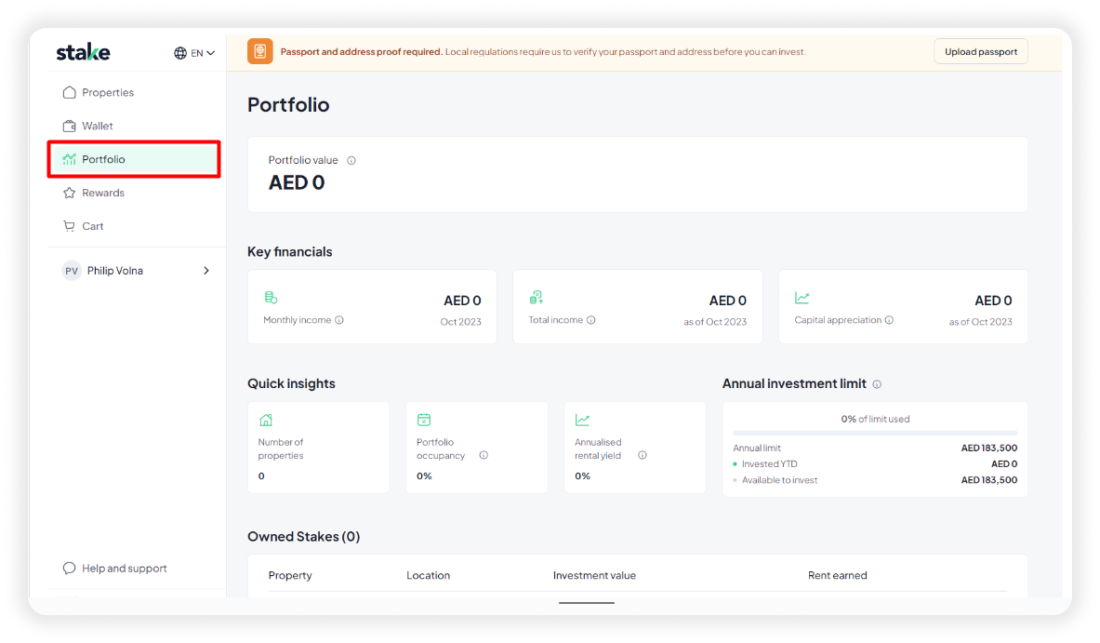

In the Portfolio tab, investors can get a detailed look at their portfolio details such as portfolio value, and key financials such as the monthly income, the total income, and the portfolio appreciation.

They can also get quick insights on such details as the number of properties, portfolio occupancy, and annualized rental yield. From there, it is possible to set up the annual investment limit and track how much of the limit has been used.

Also, investors can have a quick overview of the owned stakes and pending investments.

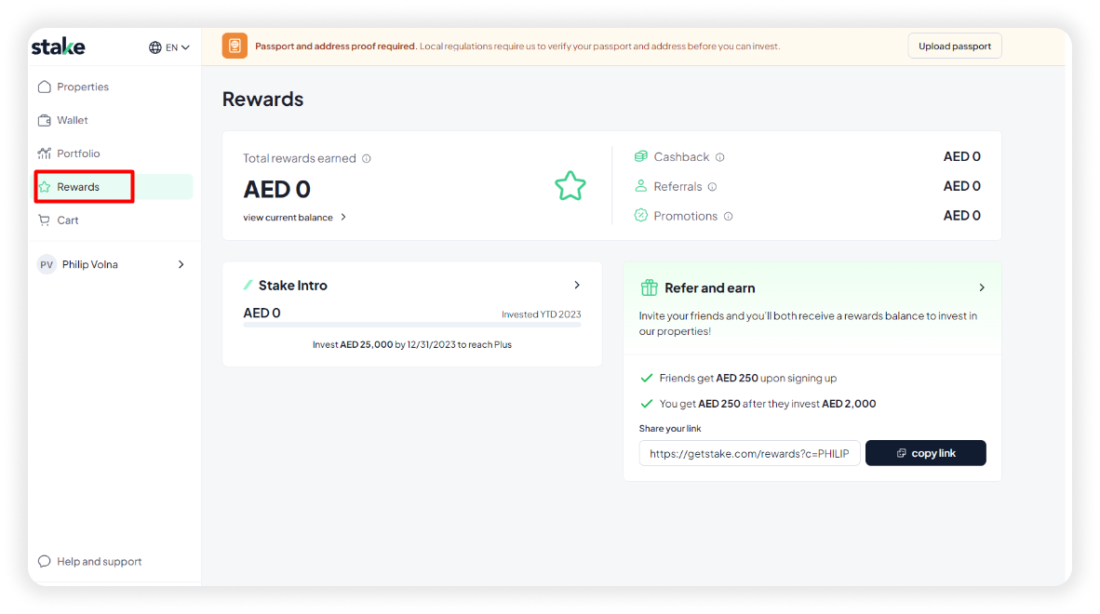

In the Rewards tab, one can access the referral link and check received cashbacks, rewards for referrals, and promotions.

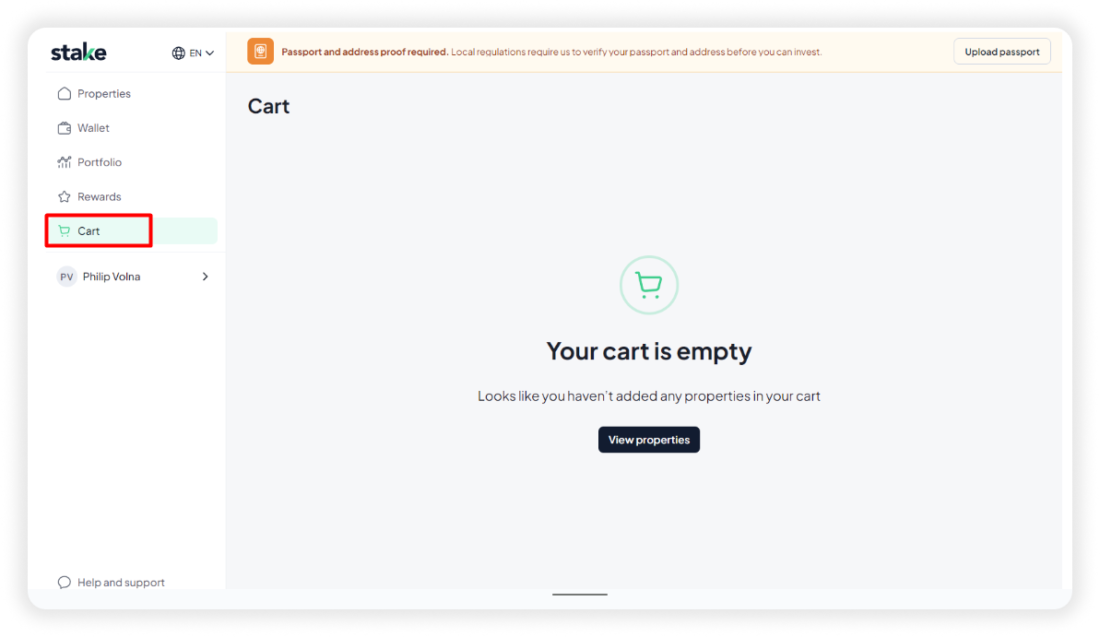

In the Cart tab, one can check the added properties.

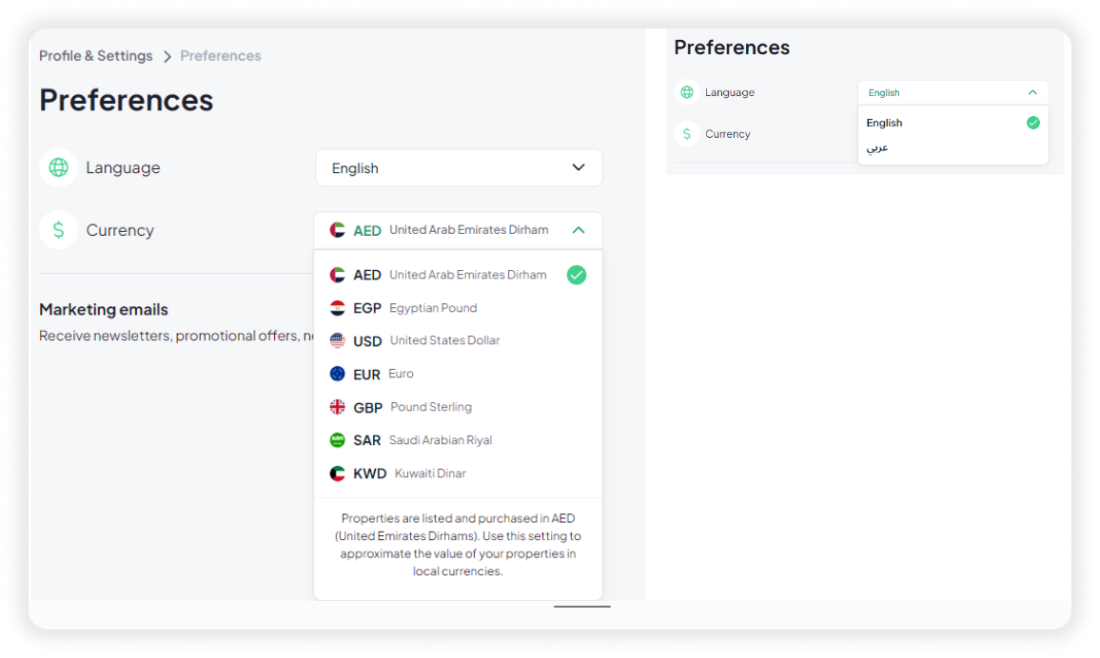

Users also have various settings in their profile, including currency controls and language preferences. While they can pick English or Arabic, the currency options include AED, USD, EUR, EGP, SAR and more.

Launch a Real Estate Investment Platform in the UAE

If you want to start a crowdfunding or investment platform in the UAE or even build a GetStake clone or maybe find a white-label crowdfunding software in UAE — check out LenderKit.

LenderKit provides a ready-made solution that can be fully customized on the front-end and back-end, so you can build a truly competitive investment marketplace in the UAE.

We’ve set up different investment platforms for our clients in the UAE and Saudi Arabia, so we know first-hand the challenges that you can face, the integrations you need, hosting requirements, etc.

If you’d like to learn more about how LenderKit works and see how we can help you launch a crowdfunding platform in the UAE, don’t hesitate to reach out to us.

Article sources:

- Page not found - Stake Blog

- DFSA | Firms

- Dubai Land Department - Transfer of registration fees from one property to another application

- DIFC | Leading Financial Hub in the MEASA Region

- Dubai Land Department - PT Offices

- Certificate of Good Standing / IC | Dubai Development Authority

- DIFC Announces Consultation of updated Prescribed Company Regulations

- Dubai Land Department - Electronic No Objection Certification (eNOC)

- Service Charge Index in Dubai 2025 - DLD Service Fee for Properties

- DEWA