SPV in Crowdfunding and How It Works

An SPV or a Special Purpose Vehicle is a legal entity created to ensure easier investor management and legal protection for the fundraiser.

When an SPV is used on a crowdfunding platform, investors are not putting their money directly in a crowdfunding offering, instead they buy ownership units in an LLC which later invests the pooled capital in the offering.

The use of SPVs has been broadly criticized by regulators as it may impose certain risks such as unfair use of funds and arbitrage. But that was like 10 years ago. Things have changed, and now, SPVs are used more commonly in crowdfunding. However, they still compete with the direct crowdfunding model.

What you will learn in this post:

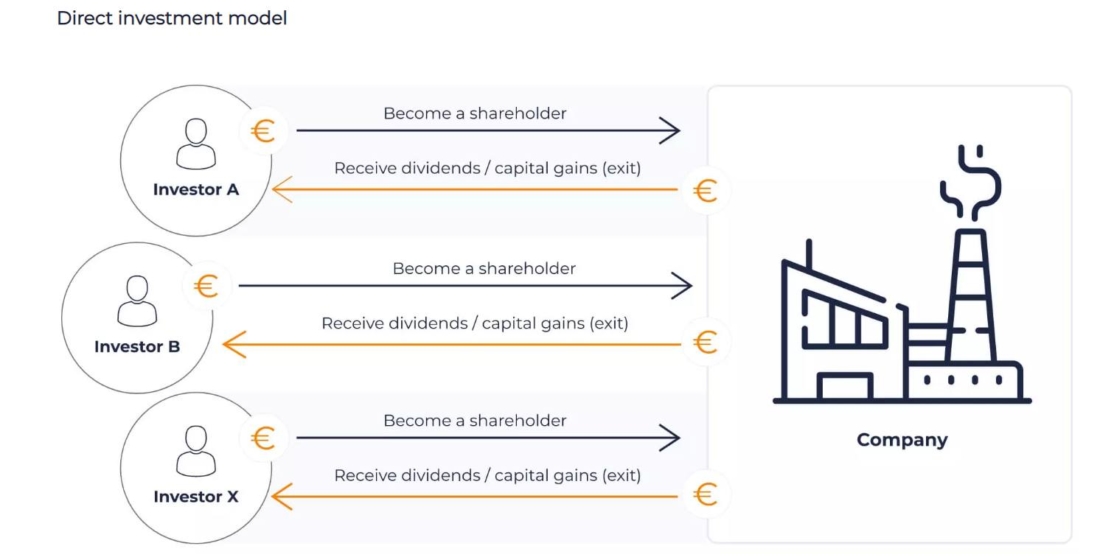

Direct crowdfunding

In the direct crowdfunding model, startups are raising funds from multiple individual investors via a crowdinvesting platform. The platform works as a facilitator of the transactions or a deal manager and transfers the collected funds to the startup while ensuring all of the legal and reporting requirements.

When the crowdfunded company makes a profit and needs to distribute dividends or when it is sold and the profit from the sale of the shares is to be paid to investors, it is done via a crowdinvesting platform.

However, the direct crowdfunding model is not always efficient and comfortable for startups if they raise funds from hundreds or thousands of investors or if the raised sums exceed limits established by regulatory bodies.

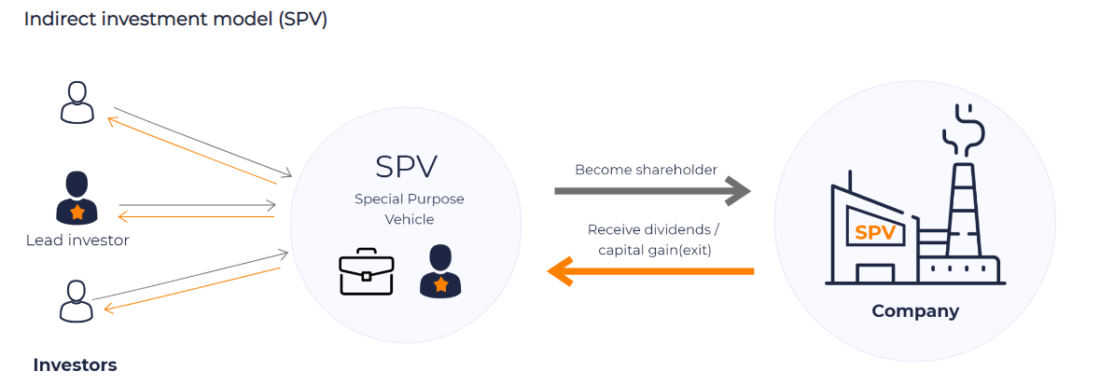

SPV-based crowdfunding

To ease the management burden and allow for higher efficiency of crowdfunding deal management, opening an SPV has become a better solution exercised by startups to raise funds in crowdinvesting campaigns.

Instead of investing directly in a company, investors provide funding for an SPV which transfers the collected investments to the company. An SPV is also responsible for leading the communication with individual investors and distributing dividends if the company makes a profit.

Startups believe that lengthy capitalization tables are less appealing to institutional investors. So, one of the main advantages of raising capital through an SPV is that it reduces the number of investors listed on the company’s capitalization table.

The purpose of the SPV crowdfunding

According to Fundify, the functionality of an SPV created by the fundraising company is designed to help with:

- Administering shares issued during a crowdfunding campaign

- Keeping records of shareholders

- Investing the raised funds into the company that created the SPV

- Issuing annual reports about the SPV and the company to investors

- If voting rights were granted to shareholders, an SPV is responsible for soliciting votes

- Providing tax forms for income events to the SPV

- Voting on behalf of shareholders. However, the SPV votes proportionally to actual votes, not as a block that reflects the interests of a majority of its participants

There are also some downsides of using SPVs in your crowdfunding deal management, as StartEngine, a US-based equity crowdfunding platform, explains in their article:

- Investors can only trade shares on the secondary market if the SPV manager permits

- Carry fees for the SPV management of around 5-20%

- More filing because SPVs are “co-issuers” with the parent company

In both Europe and the USA, the use of SPV was not permitted for crowdfunding. The situation changed only in 2021 when ESMA published the first set of FAQ on the use of SPV in crowdfunding, and SEC adopted amendments to the Investment Company Act in 2020.

SPV for crowdfunding in Europe

According to ESMA, an SPV serves as an intermediary between a project owner and investors and is used to enable investors to acquire a share in an illiquid or indivisible asset that would be otherwise not available for investing.

An asset is considered illiquid when it cannot be converted into cash easily, for example, when:

- There is no suitable market for selling the asset.

- Selling and purchasing of the asset are conducted over the counter.

- There is no established value for the asset.

- Selling it implies significant costs (fees, taxes, auditing, legal costs, etc.) or involves procedures that may take weeks or months.

An indivisible asset is one that cannot be easily divided into smaller components that can be sold to investors or when this division leads to a significant reduction of the asset value because it prevents the asset from serving its economic purpose, for example:

- An asset cannot be divided into smaller pieces due to its legal nature (e.g. units, shares).

- When an asset is divided into a limited number of components, the value of each component exceeds the value that is normally expected for a component (e.g., a residential building cannot be divided into components smaller than one apartment).

- When an asset, if it is divided, stops serving its purpose (e.g. a solar panel divided into separate components).

When an offering is made via an SPV, investors receive either transferable securities or admitted instruments for crowdfunding purposes. Loan-based crowdfunding offers are not made via SPVs.

SPV for crowdfunding in the USA

The SEC defines SPVs as a crowdfunding vehicle as a co-issuer that is formed by or on behalf of the underlying crowdfunding issuer (a startup or a company). It cannot have a separate business purpose and can be used solely to enable investors to invest in the mentioned crowdfunding issuer. The SPV and the person operating it don’t have to be registered as a broker.

Investing in an SPV gives investors the same economic exposure, voting power, and Regulation Crowdfunding disclosures as if the investors invested in the crowdfunding issuer directly.

For an investor, investing in an SPV shall not differ significantly from investing in a regular Reg CF campaign because the economics should be the same in all matters except taxes and probably exit conditions.

For fundraisers, using an SPV is more beneficial in cases where funds are raised from more than 500 unaccredited investors, and the invested sum equals or exceeds $10M. In such a case, the company must report financial information as if it were a publicly listed company on a quarterly and annual basis. Those reports require additional accounting resources and audits and are time- and cost-intensive, and they may be a significant burden on a startup.

Using an SPV for crowdfunding allows a company to pool investors from one campaign and list this group in one line in a cap table. From the reporting point of view, such a group counts as one investor which insulates the company from triggering the Exchange Act Reporting Requirements.

Before SPVs became available for Reg CF offerings, companies could avoid triggering the Exchange Act Reporting Requirements by using the services of a registered transfer agent and only if the company has assets whose value doesn’t exceed $25M.

White-label crowdfunding software for investment businesses

Whether you are going to host campaigns that will use an SPV or your aim is to assist young businesses in their fundraising efforts, a white-label crowdfunding software from LenderKit will allow you to create a perfect crowdinvesting platform for any type of campaign.

With it, you get a comprehensive kit of functionalities for efficient and accurate investor management.

A powerful admin back office enables you to manage all campaign-related activities, and a user-friendly investor portal will enable investors to navigate offerings, invest in them, top-up wallets, and trade investments on secondary markets.

To see how it all works, you can take a virtual tour right away or contact our sales team to discuss available options and see which one is suitable for you.