How Bond Crowdfunding Works: Use Cases and Platforms

No time to read? Let AI give you a quick summary of this article.

Bond crowdfunding is used by more established businesses to borrow larger sums of money from investors. These funds are normally used to fuel the business’ growth.

In bond crowdfunding, investors receive a fixed income over a fixed period of time. This makes this crowd-investing type more reliable, even though potential returns are limited.

What you will learn in this post:

Types of bond crowdfunding

There are different types of crowdfunding bonds, each one offering specific benefits.

Real estate bonds

Real estate bonds are a type of fixed-income investment instrument backed by land or property. Investors benefit from fixed interest paid until the bond maturity date. On the bond maturity date, the borrower pays the loan principal and the interest to the lender.

These bonds can be issued directly by the originating lender, a borrowing entity, or a special purpose vehicle through securitization. The funds obtained from issuing bonds may be used by the borrower to invest in residential, commercial, or industrial real estate.

Property bonds

Property bonds are high-yield bonds (the interest rate for some bonds may rise to 15%) issued for an intermediary period, normally for 1-5 years1. The borrower normally pledges a property as security for the loan. This is why a property bond is technically a secured bond.

Bond issuers use the raised money to invest in residential or commercial property or land. This may involve the construction of new buildings, refurbishments, property development, renovations, and similar activities.

Mortgage and mortgage-revenue bonds

Mortgage bonds are a type of property bond and can be commercial, residential, or hybrid, depending on what type of property is pledged as security for the loan. In the case of residential bonds, it is residential property such as houses. In the case of commercial bonds, it is commercial property. Finally, in the case of a hybrid bond, it may be a mixture of several property types.

Mortgage-revenue bonds, or they are often called housing bonds are often confused with property bonds or mortgage bonds. However, their main difference from property bonds is that they are often tax-exempt2, the tax doesn’t apply to the interest accrued on them. It allows investors to enjoy tax benefits, and issuers can support affordable home initiatives.

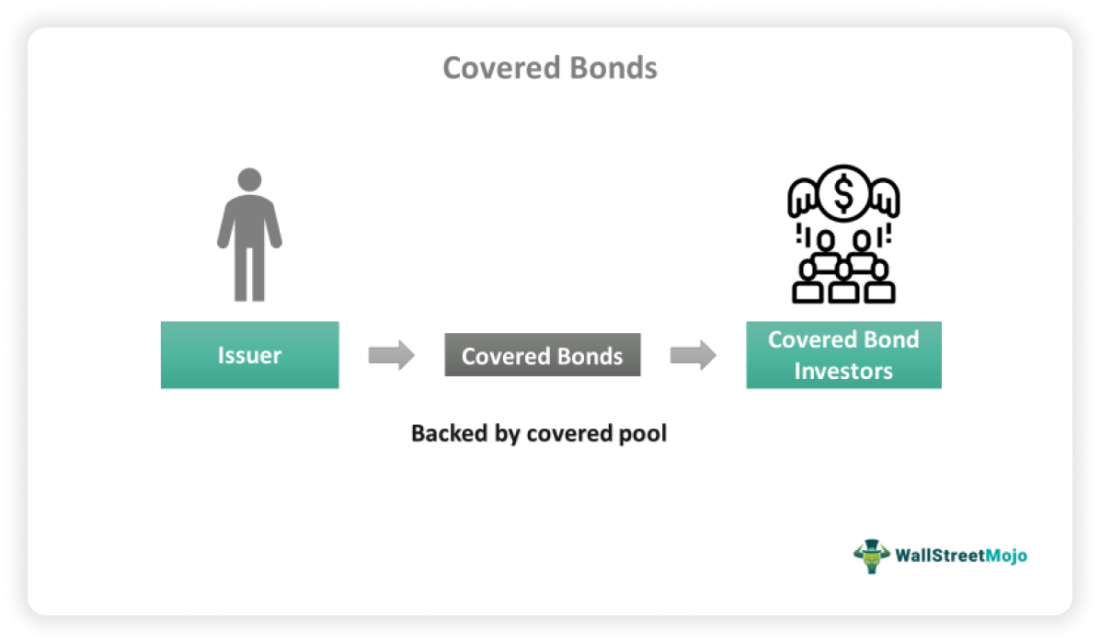

Covered bonds

A covered bond3 is issued to get an additional funding source to the issuer while offering investors a relatively low-risk investment opportunity.

A covered bond is normally issued by a bank or another lending institution and is backed by a pool of high-quality assets such as commercial or residential mortgages.

The main distinguishing feature of covered bonds is that they offer the bond-holders the following benefits:

- have a claim on the bond issuer’s creditworthiness

- backed by a pool of high-quality assets such as residential or commercial mortgages.

Because covered bonds are more secure than other lending instruments, they may offer lower yields3.

Green bonds

Now, when the world is focusing on environmental challenges, green bonds are growing in popularity. A green bond4 is a fixed-income investment instrument used to fund projects with a positive environmental impact. Investors get a fixed interest, and the loan principal is repaid at maturity.

Projects funded by green bonds include energy efficiency, renewable energy, pollution prevention and control, wastewater management, sustainable water consumption, and similar.

Pros of bond crowdfunding

Bond crowdfunding offers the following benefits to investors.

- They offer a fixed income for a predetermined time.

- Some of them offer a high interest rate.

- They are secured by property.

- They are more predictable and less volatile than other investment types.

- They offer a way to get income on the property without purchasing the property.

For issuers, bond crowdfunding offers such benefits as:

- A possibility to collect more money than a bank would offer.

- A possibility to fund riskier projects for which banks are not willing to provide funding.

Risks of bond crowdfunding

As with any investment, there is a possibility of losing money if the issuer doesn’t meet its obligations. This is why performing due diligence on the issuer’s financial situation before investing is important. It is also recommended to diversify the investment portfolio to reduce risks.

Bond crowdfunding platforms

BeMyBond

BeMyBond5 was launched in 2022 and is the first bond crowdfunding platform in Lithuania. It holds the ECSP license and allows EU investors to benefit from top real estate projects with as little as EUR 100. One can invest as an individual and as a legal entity (a company). The advertised return on investment is 8.5%.

The platform charges 0.5% of the investment amount, the fee is charged as soon as the investment is made.

The interest rate varies from 7 to 10%.

The income from investments can be either reinvested by the platform or sent to the investor’s bank account, depending on the investor’s choice.

GreenCrowd

GreenCrowd6 is an Irish-based green bond crowdfunding platform that allows financing a portfolio of projects and companies located in Ireland through a Convertible Loan Note. The company is granted authorization by the Central Bank of Ireland to act as a crowdfunding service provider.

Renewable energy projects provide backing for the investment, the platform also diversifies investments by dividing them into two distinctive asset classes: renewable energy projects and well-established trading businesses.

The investment term is 5 years, and the interest rate is just 5% per year. Investors can receive monthly payments or a cumulative payment at the end of the year. The minimum investment is EUR 5,000.

ZonnenpanelenDelen

ZonnenpanelenDelen7 is a Netherlands-based platform launched in 2014. It connects solar energy projects with individuals and companies willing to invest in them. The minimum investment starts from EUR 25, the interest rate is variable and depends on the generated solar power.

Villyz

Villyz8 is a French-based bond crowdfunding platform that allows citizens to support community projects, health establishments, and public companies with as little as EUR 1, and the advertised return is 1% per year. It offers several investment instruments, among which you can find bonds, equity securities, and loans.

Villiyz was launched in 2020, and it is the first French platform approved as a crowdfunding service provider (ECSP) that replaced its status of a crowdfunding advisor and crowdfunding intermediary.

Innexta

Innexta9 was launched by the Italian Chamber System in 2023 to enable investing in sustainable alternative finance and fintech services. The platform allows SMEs and startups to launch equity crowdfunding campaigns or issue minibonds. Investors can start investing with EUR 250.

How to launch a bond crowdfunding platform with LenderKit

Launching a bond crowdfunding platform is a demanding task if you do it all from scratch. However, using white-label crowdfunding software from LenderKit will help you to launch a fully-functional platform faster and without excessive expenditures. All solutions come with an extensive set of features and all required integrations. Additionally, our team can fully customize the platform to fit your needs and regulatory requirements.

To find out how the product works or discuss details, please get in touch with our team.