How Loan Syndication Works

No time to read? Let AI give you a quick summary of this article.

Imagine, there’s a company X that turns to Citibank to get funding for a new project. Citibank approves the application and invites BNP Paribas and Mizuho in the pool. The point is that the loan size is large and exceeds Citibank’s risk tolerance.

The Citibank is a loan originator, its co-lenders make up a syndicate issuing a syndicated bank facility, in simple terms, a loan.

The first banking pools appeared in Europe in 1950-1960s as a result of the relaxation of financial controls. Bank capital began moving freely and financial activity increased.

What you will learn in this post:

Understanding banking pools and syndicated loans

The number of syndicate members may vary and there’s no cap for the group size. Experts say that the largest syndicate consisted of 43 banks dated back to 1991.

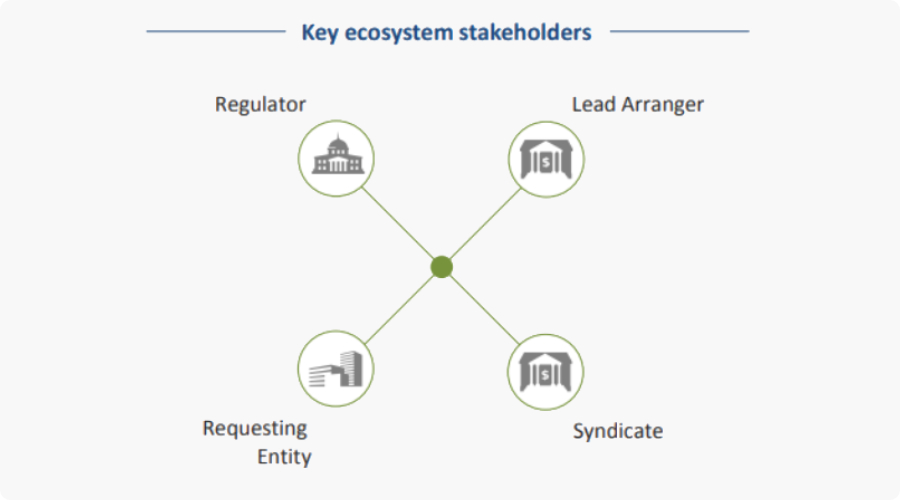

Key participants and their roles

Lead arranger. A bank/financial institution that guides the group through loan underwriting and financing.

Syndicate/group. Several investors united into one entity to distribute the risk across institutions for large transactions.

Requesting entity. A borrower (company, corporation, trust) requesting a bank loan.

The regulator. A governmental body monitoring the process and verifying the compliance of activities to AML standards.

Also, there may be other participants – Agent and Trustee. The first is in charge of exercising the rights of the borrower and lender, the second holds the security of the assets of the borrower on behalf of the lenders.

The lending process stages

Loan request and syndication

Once the borrower has requested financial support from the originator, it conducts KYC checks. To reduce the risk, the bank sources prospective members to fund the loan.

Due diligence

To determine the loan risk and the client’s solvency, the originator checks the client’s financial health and runs due diligence.

Underwriting (loan pool creation)

Each member provides funds according to the percentage of the overall risk they agree to take. A stake is based on the banks’ credit tolerance levels. For instance, the Citibank can pledge 30% as the originator while the other member’s stake varies from 20% to 25%. Each lender’s liability is limited to their share of the loan interest.

Loan closing and servicing

The lead arranger, the CitiBank, takes on the administrative responsibility for the entire loan life cycle (loan funding, dispersing principal and interest payments to syndicate members).

With specialized loan management software, banks can put some steps on autopilot.

In the theory of syndicated loans there are three types of products:

Club deal is frequently used for small-scale loans where syndicate members share equal or almost equal parts of the loan.

Fully underwritten loans are fulfilled entirely by the lead arranger. If some part of the deal isn’t subscribed, the lead arranger can cover it.

In the best efforts deals, the lender doesn’t provide any guarantees. If some part of the loan isn’t covered, the group waits until the market conditions change. If it doesn’t happen, the borrower is offered a smaller loan.

Perks for the borrower

Except for flexible price and terms, borrowers gain other advantages.

First, dealing with the syndicates is a way easier than with several lenders separately. The client meets only with the Lead arranger and negotiates the contract terms. The rest is done by the arranging bank.

The beauty of these loans is that they consist of different assets, loans and securities. They even might include several currencies, which significantly reduces inflation and regulatory risks.

And, of course, syndicated lending allows getting funding for large projects such as energy, transport, natural resources, environmental infrastructure, agribusiness, etc.

Sometimes, alternative funding sources just don’t work for these purposes.

At the end of the day, if you successfully pay off the loan, you get some points for your business karma. Big investment guys are likely to support your new undertakings if they know that you’re responsible.

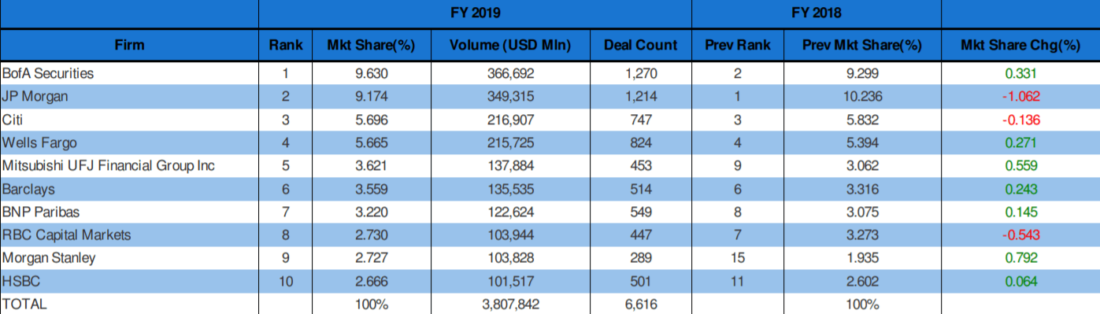

The leading providers of global syndicated loans: JP Morgan, Wells Fargo, BofA Securities, BNP Paribas.

Loan syndication risks and limitations

Every rose has its thorns. Here are a few obstacles1 making syndicated loans less effective than you wish.

Too lengthy process

Lead arrangers just can’t make up an investment group without prior research. Financial health, expertise, due diligence of both investors and the client – everything is taken into account. Since the majority of checks is done manually, it greatly increases the time of processing.

Labour-intensive activities

Documenting the loan life-cycle requires a hell lot of manual and paperwork. Instead of being focused on risk management and strategy development, the team does the dirty work.

Default risk

The arranging bank not only rules the roost it also poses a great risk for other parties. It measures the borrowers’ default risk and incorrect results may badly influence the disbursement of funds throughout the loan.

Extra costs for investors

Since the arranging bank has a lot on its plate, it gets fees from other backers. Besides, third-party organizations and intermediaries taking part in operations demand service charges.

Lack of tech integration

There are three critical issues in the tech aspect of lending.

- Due diligence analysts use different apps and data sources, which results in the extra time needed for processing and integration.

- Underwriting systems oftentimes aren’t compatible with KYC/AML solutions, which leads to potential errors.

- Operations and data duplicate since systems don’t communicate with each other.

Legal risks

Meeting all established KYC/AML requirements is a hard task for financial organizations. This is particularly true for international deals since the regulatory framework varies from country to country. No one wants to be fined, so incumbents do their best to vet partners and clients properly.

Lead arrangers can turn these limitations into advantages. They just need the right software.

LenderKit – versatile syndicated loans and P2P lending software

Finance and insurance industries are one of the latest adopters of tech innovation. Nevertheless, incumbents have already taken notice of profit-driven collaborations with FinTech startups.

For lead arrangers and their partners, loan syndication software is a great helper when it comes to streamlining processes and managing multiple deals simultaneously.

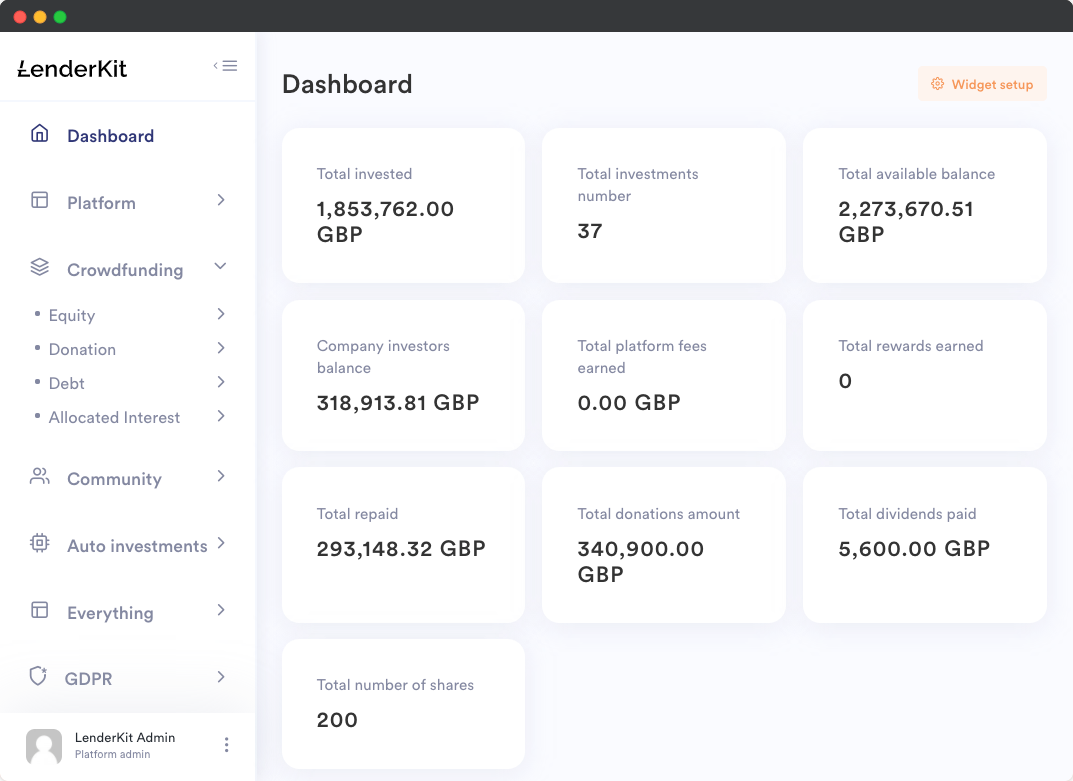

LenderKit – our in-house white-label solution for lending, crowdfunding and financial business – is your reliable tech partner in syndicated deals.

What is LenderKit capable of?

- it helps you adapt to any regulation in the USA, UK, and the MENA region (per request, our team tailors your investment management software to fit the required compliance framework);

- it can be integrated with any reliable third-party payment gateway for P2P lending like LemonWay to process payments;

- it’s equipped with smooth investor and borrower onboarding process through KYC-oriented registration;

- it can provide borrowers with rough quotes with pre-built calculators;

- it comes with powerful admin panel to manage offerings, deals, payments, security trading;

- it’s compatible with extra tools like CRMs, marketing automation, KYC/AML, eSign, currency exchange, crypto, and payment processing.

Explore projects built with LenderKit: Forus, Calmly, Charm Impact.

The bottom line

Here are the main takeaways of today’s topic:

- When there’s a large project with big funding appetite on the horizon, incumbents form a group called syndicate to provide a loan to this company. The lead arranger (arranging bank) is the principal.

- Syndicated loans have different shapes: club deals, fully underwritten, the best efforts.

- Syndicated lending benefits both – backers and borrowers. The first can diversify risks, the second fully satisfy funding needs sometimes at a lower price and under flexible terms.

- There’s plenty of risks and limitations related to syndicated loans, however, some of them can be solved with automated software like LenderKit.

Ready to see LenderKit loan crowdfunding software in action? Don’t hesitate, request a demo.