How to Launch a Fractional Ownership Platform

Fractional ownership platforms allow investors to access large investment opportunities such as real estate, yachts or airplanes and generate passive income while often getting additional benefits and rewards. The terms and conditions depend on the fractional investing marketplace, but the business model is similar regardless of the asset class

Let’s have a look at how fractional ownership investment works and what benefits investors get.

What you will learn in this post:

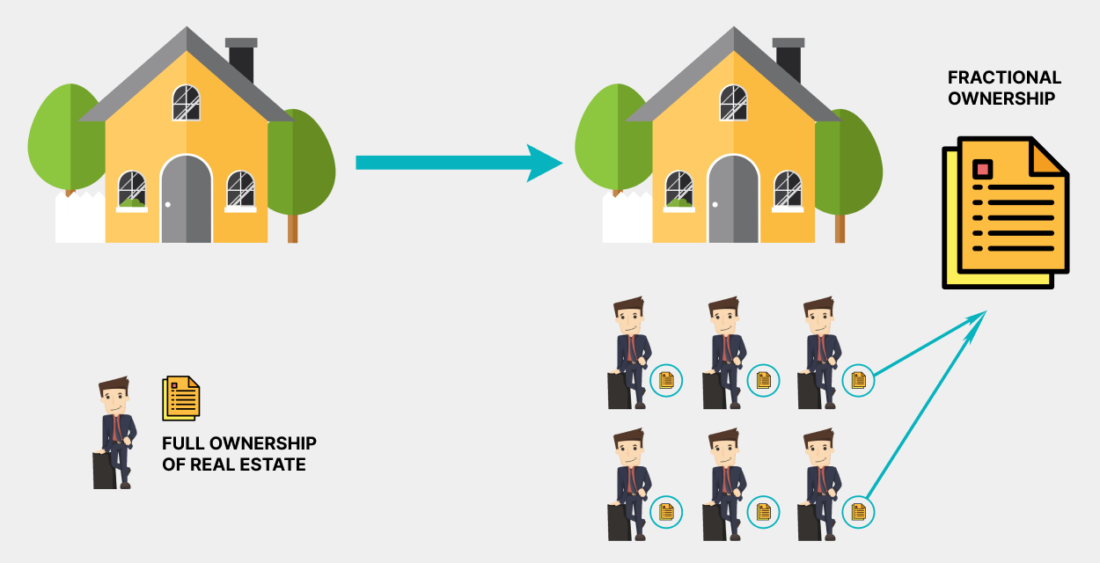

What is fractional ownership?

Fractional ownership is an investment approach in which the cost of an asset is split among several investors. The sums of investments may vary greatly from a few dollars to several hundred thousand dollars depending on the fractional investment platform and strategy.

How does fractional ownership work?

Fractional shares have paved the way for new investors in the market. Buying a fraction of a vacation home, for example, is more realistic than buying the entire house. In most cases, fractional shares work the same way as full shares, but represent only a “fraction” of a share.

Fractional owners share all the benefits and losses from the purchase. For example, if property grows in price over 10 years, each share grows in value, too. Investors share usage rights, income, losses, and access to the property they own.

Depending on conditions, investors may or may not have voting rights on a company’s business unless they have at least one full share. Access to liquidity is also reduced if you own a fractional share because they may be not in such demand as full shares.

In what cases may fractional ownership be beneficial? It depends on what to invest in.

Real estate fractional investing

For example, buying a luxury vacation home may cost around $1,800,000, but nobody uses a vacation home all year round. That’s why it is more profitable to buy a fraction of a home and use it depending on the terms and conditions allowed by this fraction.

Maintenance fees are also distributed among the real estate fractional owners based on the size of their fractions. Such fractional shares can be sold, and if the home grows in value, the difference results in profit for the investor. If investors don’t use the home within the time, they can rent it and make money on commissions.

Airplane fractional investing

If your business uses a private jet, its maintenance costs may be overwhelming. Add expenses for the crew, fuel and service and you will see that buying an aircraft fractional share may be much more profitable.

In this case, you purchase a fraction of an airplane, along with many other people. Depending on the company, the fraction may be 1/16 or 1/32. With this fraction, you get a specific number of flight hours per year. The share owner has a guaranteed access to a jet with 4 to 48 hours’ notice. This is why the entire fleet may consist of multiple similar jets – to interchange them amongst owners.

Owners pay not only the share but also a management fee. This fee is paid on a monthly basis and includes upgrades, hangaring, and salaries for the crew. Fuel is also up to the fraction owner.

For how long fractional shares can be bought?

The time for which fractional shares can be purchased depends on the requirements on a specific platform and on a project type. In real estate, it rarely exceeds 5 years.

How to buy fractional shares

The process of purchasing fractional shares depends on a broker or the platform that you’ve chosen. Normally, the general process looks like this:

- Register an account on a brokerage company or a platform that works with fractional ownership projects.

- Deposit funds.

- Select the project.

- Choose the sum you want to invest. Some platforms offer to buy a part of stock while others enable investing of a specific sum. Many platforms also impose a lower limit for investment.

Fractional investing platforms

There are not many fractional investing platforms on the market, however, here are some examples in different asset classes.

Luxury Shares

Luxury Shares claims to be the first-of-its-kind crowdfunding platform that enables investors to purchase fractional shares in a luxury property. All investors have the right to use the property based on the share size.

The platform doesn’t limit itself to offering real estate fractional ownership options only.

Luxury Shares uses blockchain technology to create a system that would allow property developers to manage the entire buyer’s journey from registration to purchasing fractional shares, to receiving ownership documents, paying maintenance expenses, and similar.

SeaNet

SeaNet claims to provide investors with an easy and pleasant yacht fractional ownership experience without maintenance costs, decking fees, service costs, and similar. The fractional investing platform enables investors to sell the ownership share at any time. Yachts are fully equipped and managed by SeaNet to ensure the maximum use of the yacht. The platform also provides investors with the annual budget that outlines the expenses over the coming year.

As a comparison, purchasing a Benetti Delfino 95’ yacht may cost around €9.7 million.

The annual running cost may amount to approx. €500,000. With SeaNet’s smallest share of 25%, the fractional ownership will cost approx. €2.4 million in a joining fee, and additional costs of approx. €125,000 with the build, supervision, coordination, owner supply, etc.

NetJets

NetJets offers fractional jet ownership without the hassle associated with airplane ownership. The company takes responsibility for the crew, ensures that safety requirements are met, and addresses market challenges swiftly.

The company recommends opting for a membership card for those who fly less than 50 hours per year. The minimum price of one hour in the air is 6,500 USD.

But for those who fly more than 50 hours per year, fractional ownership may be a reasonable choice. The fractional jet ownership cost depends on its size and the jet’s characteristics. The smallest share one can purchase is 1/16. It gives the investor 50 hours of flight time per year. The biggest upfront cost is a one-time acquisition fee which is $550,000. The largest share is ½. It offers an investor 400 hours of flight time per year, and the minimum acquisition fee is $4,4 million.

In addition to the acquisition cost, fractional owners pay a monthly management fee, and an occupied hour fee. These fees cover the cost of fuel, maintenance, landing, and catering costs. The occupied hour fee is fixed and equals $1,950 per hour.

The fractional shares are sold for 5 years minimum. After that, the ownership may be prolonged or NetJet buys the shares back.

How to launch a fractional ownership platform with LenderKit

With white-label investment software solutions from LenderKit, you can launch a fractional ownership platform with minimum effort and with lower costs than if you were developing it from scratch.

LenderKit offers a powerful back office for your investment platform and a user-friendly investor portal. Your team can manage full cycle fractional ownership investing from user onboarding to campaign funding and payment distributions.

Easily manage deals, offerings, transactions, investors, documents, and all of the related activities.

The user-friendly investor portal enables investors to handle their investment portfolios smartly. The portal enables you to view transaction history, wallets, browse offerings and filter them based on predetermined requirements, and whatever else you need.

Enter the market with a powerful investment management platform, expand the base of your customers and grow your market share.

If you would like to see how our crowdfunding software works, you are welcome to schedule a demo session with us.