How to Start a Crowdfunding Business in Singapore

Singapore is one of the smallest countries in the world. At the same time, this city-state is among the regions with the largest volume of alternative financing including crowdfunding.

During the last 5-6 years, the country has been transformed into the Asian highest-ranking FinTech hub with 100+ incubators, $861m of funding, and 239 Fintech firms. And even last year when COVID-19 turned the world upside down, the Singapore crowdfunding & FinTech ecosystem remained resilient.

What’s the secret of Singapore’s success? Startup-focused investor ecosystem, regulatory support, talent, tax treaties, ownership, and share structures – just to name a few positive factors.

What you will learn in this post:

Singapore Fintech Landscape

The University of Cambridge and Singapore FinTech Association have done deep research on the Singapore Fintech landscape by interviewing local alternative finance players.

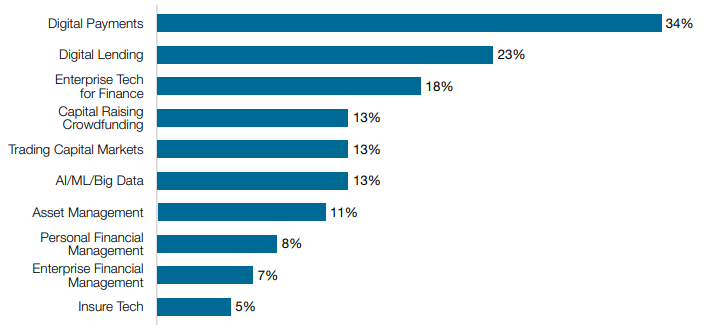

If you look at the Singapore Fintech market from the perspective of the business model, you’ll see that the majority of firms are involved in digital payments (34%) and digital lending (23%). “Capital raising/crowdfunding” is the fourth-most popular market segment presented by 13% of firms.

Interestingly, over the past 5 years, more than 60% of all Fintech investments in Southern Asia were made into Singaporean businesses.

Singapore is included in the Top 20 countries with the largest alternative finance per capita volumes.

Top Singapore crowdfunding platforms and Fintech players

The Singapore crowdfunding market is among the fastest growing, and new players keep joining the game.

There are also some of the mature crowdfunding platforms in Singapore by different category:

- Crowdlending platforms: Validus, Aspire, Incomlend, Finaxar.

- Equity crowdfunding platforms: Fundnel, Capbridge, iStox, InvestaX.

- Singapore real estate crowdfunding providers: EthisCrowd, Minterest.

Singapore crowdfunding regulations

The adequate regulatory framework is what forces enthusiasts to set up businesses in this country.

FinTech has been getting increased attention from Singaporean Government over the last few years.

The Monetary Authority of Singapore (MAS) is the central bank and financial regulatory authority. MAS administers the various statutes pertaining to money, banking, insurance, securities, crowdfunding and the financial sector in general, as well as currency issuance.

MAS provides tremendous support and encouragement for the Fintech sector. In 2015 alone, the MAS allocated S$225 million to boost the industry development. In 2019, this figure was S$1 billion.

Also, MAS has joined forces with local authorities and institutions to facilitate the market’s development and currently is creating the Smart Financial Centre.

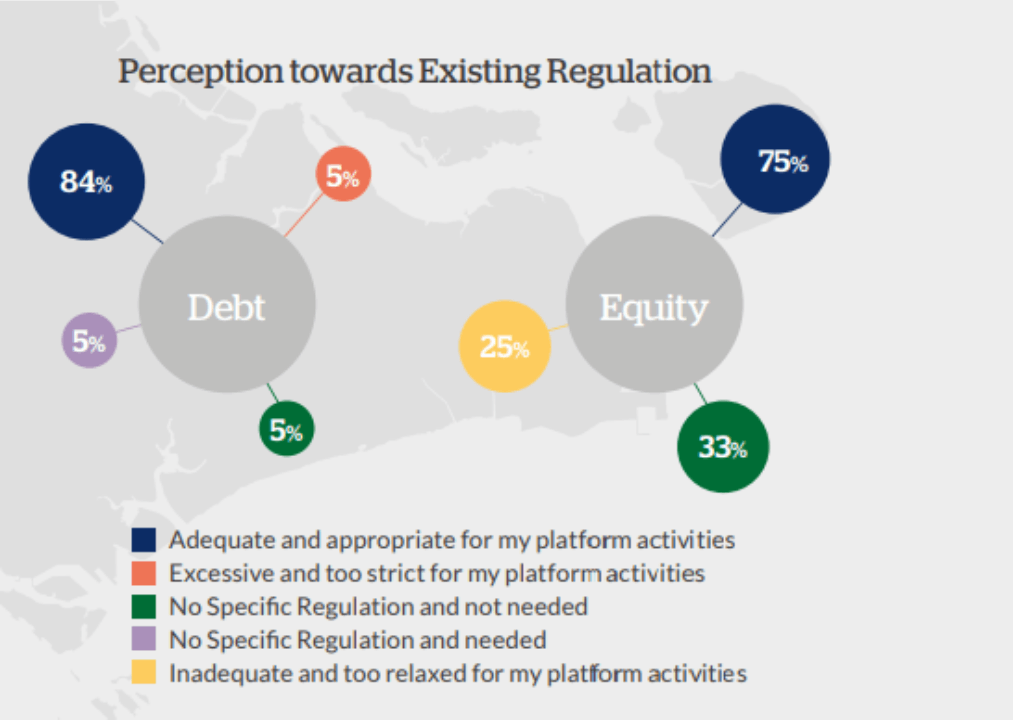

The most important contribution of the MAS is FinTech friendly rules and regulations. The University of Cambridge reports that 79% of firms-respondents perceive existing regulation as ‘adequate and appropriate.

MAS not only strives to transform Singapore into the Fintech leader but, also, allocates significant resources to turn the country into the leader across the ASEAN market.

The regulator is developing connections with the UK, US, Japan and many of our ASEAN neighbours. As a result, Singapore is becoming the major “springboard” for Fintech firms across ASEAN and globally.

Also read: "Asian Crowdfunding Market: Who is Leading the Game?"Doing Crowdfunding in Singapore under MAS regulations

Similarly to other countries, companies who are going to help enterprises raise funds in Singapore should register with the major Fintech regulator – MAS.

MAS has a list of requirements for equity- and lending-based models. Reward- and donation-based operate as ordinary Singaporean companies and don’t need any MAS licence.

To conduct regulated activities with securities like fund management, financial advising, custodial services, product financing, companies should be granted a capital markets services (CMS) licence.

Admission criteria and financial requirements for applicants:

- fitness and propriety of the company’s top management and shareholders

- track record and management expertise of the applicant

- min financial requirements (they differ by the type of CMS licence holder)

- internal risk management and compliance systems overview

- a business model/ plan and projections and the associated risks

MAS allows the below capital market entities to conduct activities with securities in Singapore:

- broker-dealers

- corporate finance advisers

- SCF operators

- credit rating agencies

- REIT managers

P2P lending and equity crowdfunding providers in Singapore operate as broker-dealers. To start an alternative finance business, you’ll need from S$50,000 to S$5 million. The capital base depends on the types of products offered, clientele type, membership with a clearing house/exchange and other criteria.

If you’re planning to conduct more than one activity, your min capital base may reach the max limit of S$5 million.

According to the MAS crowdfunding consultation paper, a crowdfunding company may be required a licence for other regulated activities such as advising on corporate finance under the SFA, and/or be subject to relevant business conduct requirements as an exempt financial adviser under the FAA.

Applicants should pay a $1,000 fee for non-refundable applications. Process reviewing normally takes up to 4 months.

In case MAS approves the application, the applicant is granted the CMS licence, listed on the Financial Institutions Directory and is authorized to conduct crowdfunding deals.

How to Create an Online Platform for Crowdfunding SG

While researching the MAS crowdfunding regulations, it’s a good idea to prepare in advance and think about the tech aspect of your future crowdfunding platform.

Building a sophisticated crowdfunding portal from scratch can be tiresome and pricey in a developing market, but there’s a way out – white-label software like LenderKit.

LenderKit is a turnkey solution for cross-border crowdfunding platforms of any type – p2p loans, equity deals, real estate fundraising.

It works well for starting in a growing crowdfunding market like Singapore, applying to the Regulatory Sandbox for registration, setting up a custom crowdfunding platform or expanding cross-border investment business.

LenderKit comes with 3 software tiers:

- Basic

- Professional

- Enterprise

With the Basic package, you can launch a platform prototype to test the market demand, get early capital and start growing your investment business.

The Professional package is ideal for upgrading white-label software, adding new features like currency exchangers, payment gateways, KYC/AML solutions, etc.

If your goal is to launch several platforms in different countries with different licensing options, try the Enterprise tier.

How can LenderKit benefit your business?

- the platform is equipped with the necessary functionality to serve your crowdfunding business (pre-designed layouts, user portals, admin back-office, etc)

- can be fine-tuned to fit your regulatory framework

- flexible and can be adjusted to custom technical and non-technical requirements

- compatible with third-party solutions that help you with asset processing, payments, currency exchange, KYC/AML checks, e-documents

Final thoughts on the Singapore crowdfunding market

Singapore can rightfully be considered as the epicentre of Fintech in SouthEast Asia. During the past 5 years, this small country has grown into the complex Fintech ecosystem partly thanks to the government’s initiatives, rapid digitalization, a large cluster of investors, and talented entrepreneurs.

The industry has been evolving rapidly and even the global crisis didn’t make it slow down. Today equity and P2P crowdfunding in Singapore are very appealing niches to international countries as they promise high returns on business investments.

To enter the new market, companies should be aware of the MAS securities crowdfunding requirements and registration procedure. Consult your lawyer for more information on how to start and register a crowdfunding business in Singapore.

And if you need tech assistance and setting up a crowdfunding platform, reach out to LenderKit.