Katipult Alternatives – LenderKit

No time to read? Let AI give you a quick summary of this article.

Katipult is a Canadian-based company offering capital markets technology that streamlines private deal workflows for brokerages, investment firms and advisors.

The platform automates compliance, simplifies investor onboarding and accelerates fundraising, enabling faster, more efficient private placements and alternative investment transactions for high-net-worth, institutional and retail investors.

Developed by JOI media1 in 2015, Katipult transformed from a software company offering solutions for investment-based crowdfunding platforms to a private placements technology for investment dealers, wealth management firms and private equity funds.

In 2017, Katipult went public on the Toronto Venture Exchange under the symbol FUND, opting for a non-offering listing to accelerate its growth, enhance credibility and increase visibility in the capital markets technology space.

The same year, LenderKit was introduced to the market as a crowdfunding and investment software provider.

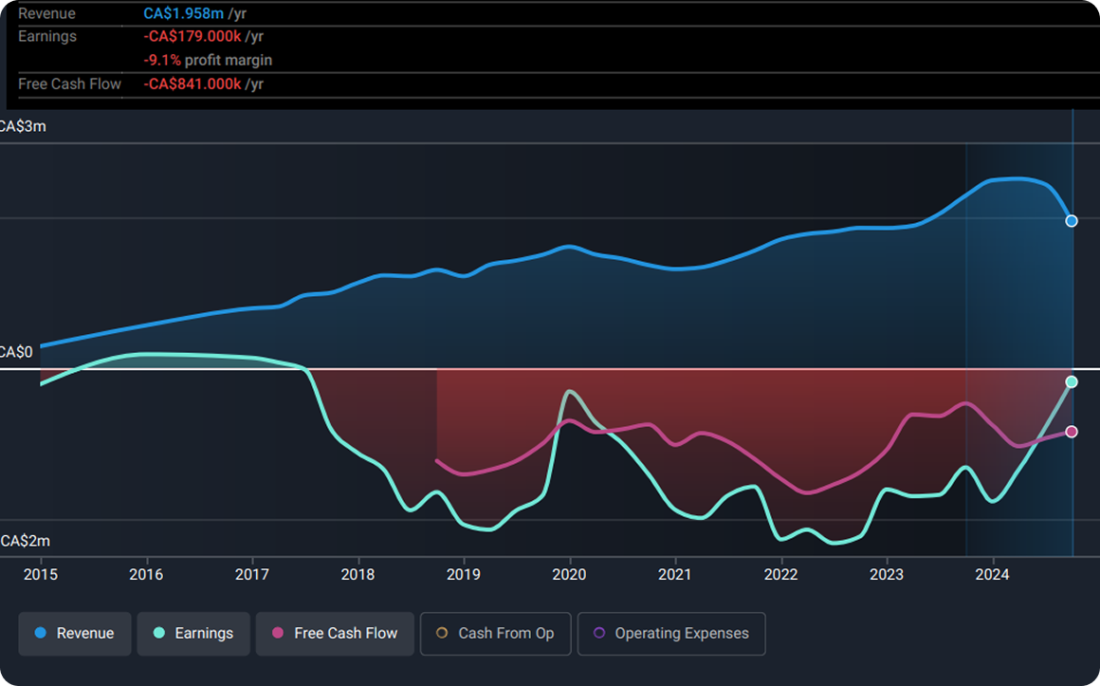

According to the data that can be found online today, it seems like 2017 was a turning point for Katipult’s financial health.

Although, there has been a promising trajectory in their earnings as of 2024 to break even, news websites report2 that Katipult received a “Demand Letter and Notice of Enforcement of Security From Senior Secured Lenders”.

Katipult will focus on sustainability and business continuity using all the available options to support and service existing clients, however “there can be no assurances it will be able to successfully do so.”

In the light of these events, businesses may be looking for Katipult alternatives and exploring various tech solutions.

Arguably, one of the closest alternatives to Katipult software is LenderKit — a white-label investment solution.

What you will learn in this post:

Katipult’s offerings and features

On a high-level, Katipult provides an investor portal where users can create accounts and browse deals and an admin back-office where platform operators can manage deals, transactions, documents and view analytics.

Some of the core features include:

- Full-cycle deal management from investor registration to deal management and fund disbursement.

- Issuer qualification tools for evaluating and approving issuers before they can present their offerings on the platform.

- Investor onboarding and KYC compliance tools to facilitate the process of bringing investors onto the platform while ensuring adherence to regulatory requirements.

- Deal brokering and syndication for structuring and distribution of investment deals among a network of investors.

- Useful integrations for marketing, payment processing and KYC/AML

LenderKit as a robust Katipult alternative

On the tech side, similar to Katipult, LenderKit offers a white-label investment management solution tailored to various crowdfunding models, including equity, debt, real estate crowdfunding and startup investing.

Key features of LenderKit

LenderKit offers businesses a suite of features designed to support the needs of crowdfunding marketplaces and investment platforms:

- Full-cycle campaign and deal management

- Investor and borrower or fundraiser registration and management

- Creation and curation of offerings

- KYC/AML compliance tools to effectively onboarding users

- Transaction monitoring and management either via bank transfers or payment gateway integrations

- Document management and e-signature integration for simplifying the handling of necessary documentation with digital solutions

- Comprehensive analytics with detailed insights into platform performance and helps to make informed decisions.

Investment software flexibility

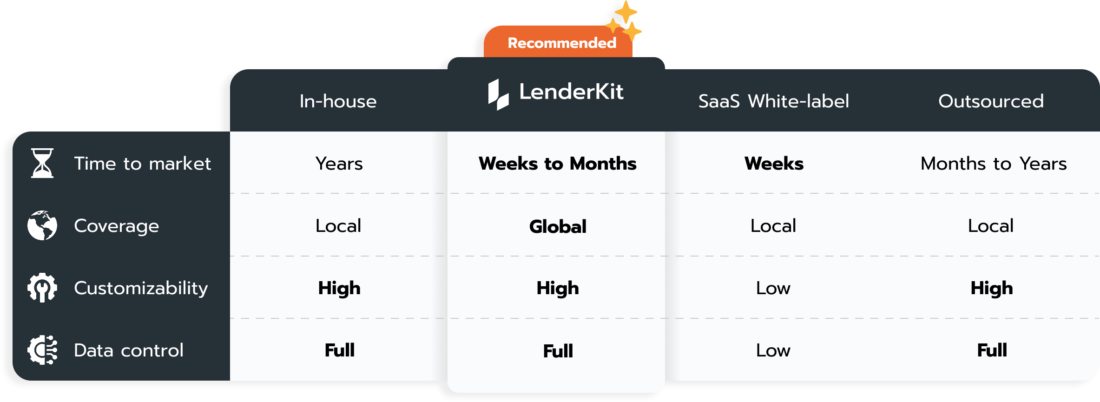

What sets LenderKit apart from competitors is a tier-based approach to meet the needs of businesses at various stages and extensive customizability of the software.

We don’t just offer a white-label solution, we also provide access to API and some parts of the source code which allows your team to do things autonomously. However, if you need an expert pair of hands to get things done quickly — our team of business analysts, designers, developers, QAs and project managers is ready to help.

So an important aspect of LenderKit is its emphasis on customization and adherence to regulatory compliance.

We have several modules tailored for SEC/FINRA compliance in the US, ECSPR in Europe, FCA in the UK and an infrastructure for KSA compliance.

As many US-based platforms consider European expansion, while bigger firms enter the KSA market, you might look into LenderKit as your strategic and tech partner.

If you need help with data migration, setting up a prototope or a unique platform — our team will be happy to help.

The platform can be tailored to meet specific business processes and regulatory frameworks, accommodate various jurisdictions and ensure that businesses operate within legal boundaries. The adaptability is particularly beneficial for companies that want to provide a unique user experience while maintaining compliance.

Scalability and support

LenderKit offers solutions that cater to businesses at different stages of growth.

- Basic, ideal for prototyping and testing business ideas — it allows companies to pitch to stakeholders and apply to regulatory sandboxes.

- Pro is designed for launching minimum viable products (MVPs) with integrations to handle more users and automate processes, facilitating capital raising and enabling a quick market entry.

- Enterprise is suited for scaling operations with a fully customizable white-label platform.

A tiered approach ensures that businesses can select a solution that aligns with their current needs and future plans.

Why LenderKit stands out

Several factors contribute to LenderKit’s position as a preferred choice over Katipult:

- Financial stability: LenderKit’s consistent performance and financial health provide clients with confidence in the platform’s longevity and reliability.

- Customization flexibility: Unlike most competitors, LenderKit offers extensive customization options. This allows businesses to tailor the platform to their branding, unique business needs and regulatory requirements.

- Comprehensive feature set: LenderKit’s all-encompassing features eliminate the need for multiple tools, streamlining operations and reducing costs.

- Regulatory compliance focus: The platform’s design prioritizes adherence to various regulatory requirements, which is crucial for businesses operating in multiple jurisdictions.

- Scalable solutions: LenderKit’s tiered offerings ensure that businesses can scale their operations seamlessly as they grow.

Conclusion

While Katipult has played a notable role in the crowdfunding software industry, its recent financial downturn may raise concerns about its ongoing viability. In contrast, LenderKit offers a robust, customizable and scalable white-label crowdfunding software equipped with comprehensive features and integrations tailored to meet the evolving demands of investment platforms worldwide.

For businesses seeking a sustainable investment solution to launch or enhance their private capital raising operations and deal management, LenderKit stands out as a reasonable choice.

To find out how you can launch a crowdfunding platform or investment marketplace, book a product demo or a strategic consulting session, please get in touch with us.