P2P Lending Software or a Business Plan: What Should Go First

No time to read? Let AI give you a quick summary of this article.

Entrepreneurs and creatives have many tools which can be used to tackle a particular problem effectively. Having some many tools at their disposal, the perception of the early-stage entrepreneurs gets altered to such an extent that the chicken-egg problem arises.

Should you get the P2P lending software first and then build your business around it? Or should you plan out your business and sales strategy before starting to use any Fintech tools?

In the software-first approach, the entrepreneur gets a tool which theoretically should lead to an idea of how a P2P lending business works and what its daily routine looks like. The use of the software shapes the business reality and creates a measurable asset which the entrepreneur is using to build expertise and confidence upon.

In the business-plan-first approach, the entrepreneur has to deal with a lot of uncertainty – natural to an early-stage business. It’s not clear where to get started, how to find clients, how to connect them and what to offer.

Considering the situation where money and time are limited, how do you determine what is the right way to start a P2P lending business?

What you will learn in this post:

Understanding the role of the P2P lending software and whether it’s worth an investment

For every P2P lending business, the role of the P2P lending software will be different percentage-wise. From the assets standpoint, your business may be 100% built upon the software which means that the only asset you have is the platform. That also means that there is no strategy, business plan, sales and revenue because they were not developed yet to a measurable state.

In another scenario, P2P lending software can be 50-75% of the business which means that there is something going on on the operational side. However, should the software be taken away, nothing would be left except for a few assets like customer base, connections, several team members, etc.

Finally, the software side can account for around 33% of the business where it’s still meaningful for an online business to have it and it drives ⅓ of your business performance. In this case, there is a strong customer base, partnership network, team, intellectual property and other assets which account for the major 67% of your business.

The value of the P2P lending software for your business is determined based on the level of improvements it brings to your operations, brand equity, and direct revenue. The software can solve or it can add to the bag of problems you’re dealing with. So, when determining the value of the software, you have to weigh all pros and cons and create a clear framework, paragraph in your business strategy related to the software.

What problems does P2P lending software solve?

Acquiring or implementing the software in your business operations should have clear and measurable goals. It’d be too hasty to find the P2P lending software provider and purchase the solution simply based on its price or trendiness.

The list of problems to solve may vary depending on the business magnitude:

- Creating an asset to show to the board of directors, regulators, investors, etc.

- Building the software around existing operations in order to automate them

- Getting access to advanced data and analytics to identify investing and fundraising patterns, user behaviour, minimum and maximum amounts, etc.

- Increasing brand equity and aesthetics

- Disrupting the market with unique and innovative features and platform’s capabilities to establish market dominance

Every business has unique goals which the P2P lending software should help to achieve, otherwise, there is no point in having the software.

Also read: “What problems does crowdfunding solve?”Are there any alternative solutions to your business problems?

Since many entrepreneurs start a P2P lending business without an understanding of the market, their target audience, pricing and payment processing, it’d be strategically important to cover the essentials first before purchasing the software.

A common scenario is to invest in expensive software and have absolutely no idea what to do with it. The reality is that the software doesn’t solve the “approach” or “uncertainty” problems.

It’s an entrepreneur’s responsibility to conduct the required market analysis, understand the regulatory framework of the country of operations, find reliable or considerable payment processing providers and determine the monetization strategy for the lending services. These are the things that are worth a preliminary investment.

How to go from an idea to a functioning P2P lending business with LenderKit

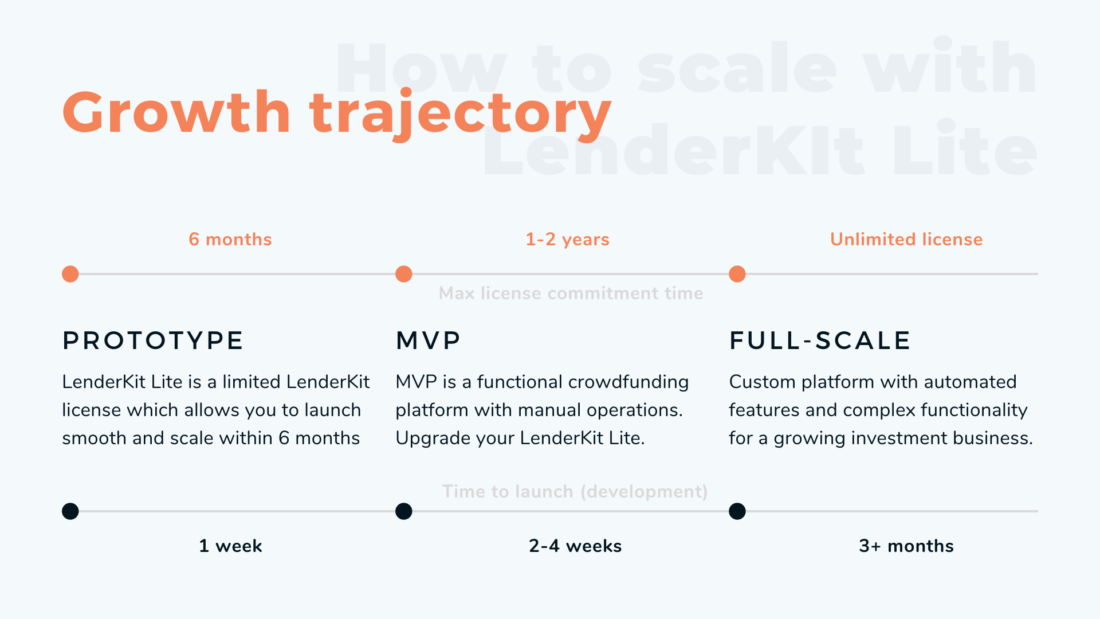

LenderKit Lite is a simplified version of the LenderKit software which fills in the uncertainty gap and creates a solid foundation for future growth. Technically, LenderKit Lite includes a simplified Admin Portal and a WordPress-based marketing site for early-stage business promotion, investor and fundraiser contact information gathering idea validation, and market testing. This stage can be called a “Prototype”.

LenderKit Lite is an entry-level opportunity which allows you to launch cost-effectively and smoothly. The seamlessness is achieved through guiding you from the “Prototype” stage to “MVP” where you can start actually using the software for profit, work with real customers, and register the platform with the regulator.

Since the “Prototype” is used for representational, promotional, and idea-testing purposes mostly, the growth line leads to the higher level of the P2P lending software as the business matures and creates valuable assets like customer base, network, and expertise.

From LenderKit Lite you can upgrade to the MVP and request to develop additional functionality on demand. Out-of-the-box, the MVP will allow you to conduct manual fundraising operations and manage your investors and fundraisers, create offerings, set up transactions, and generate repayment schedules. By integrating a payment provider of your choice, you’ll be able to automate the flows.

Ultimately, our mission is to become your strategic partner until you’re good to go on your own as well as become your technology partner in the early stages of your business and beyond.

If you’d like to learn more about the LenderKit Lite offer or LenderKit in general, reach out to us here.