Crowdfunding Software for Private Equity Investment Management

In its recent study, Deloitte highlights the role of private equity (PE) funds amidst the COVID-19 crisis.

Firms have accumulated enormous dry powder (approx. $1.5 trillion) and are ready to help companies with portfolio management guidance, and post-crisis strategies development.

PE funds are used to working only with professional accredited investors. But the recent trend towards retail investments shows that even solid fundraisers like Blackstone are exploring the power of individual backers.

But how can households and investment companies meet? On crowdfunding platforms.

A bit sudden, isn’t it? Given that, crowdfunding originally was considered as an alternative to traditional PE fundraising.

Keep reading to learn:

- the anatomy of PE and equity crowdfunding;

- similarities and differences between the two fundraising methods;

- how to build a private equity crowdfunding platform.

What you will learn in this post:

Private equity: the most popular fundraising method back then

There are loads (even tons) of info on the web related to private equity, venture capital and angels.

We’re not going to dig deep in the topic. We aim to explain the basics in layman’s terms so you can see how PE firms can take advantage of alternative financing.

What is private equity?

It’s a kind of capital or asset (precious metals, stocks or bonds) that is not listed on a public exchange. High-net individuals, banks, and other funds invest money in private equity to get high returns.

Capital firms raise funds for companies of every calibre: startups, SMEs, large corporations. They build a portfolio which may include projects from different areas: auto, pharma and health-related, IoT, infrastructure, etc.

Typically, private and public companies need capital to:

- launch innovations;

- arrange acquisitions;

- improve or optimize working capital;

- strengthen the balance sheet.

How do PE firms build investment funds? Funds are composed by investments of Limited Partners (LP) and General Partners (GP). The first group owns 99 per cent of shares and has limited liability. Typically, it’s PE firms’ clients.

The second – only 1%, full liability and, plus, it’s in charge of investment execution and operation. You might have already guessed that it’s the PE firm itself.

Most of the time, capital companies raise money from LPs for a fee, but they can also invest in listed companies, debt instruments and be passive shareholders.

For the entire XIX century (the first trust was created in 1901), PE was the best of the best ways to raise funds. But in the 2000s capital firms saw a new competitor.

The idea of crowdfunding was invented and distributed through Kickstarter and Indiegogo.

PE industry and crowdfunding in numbers:

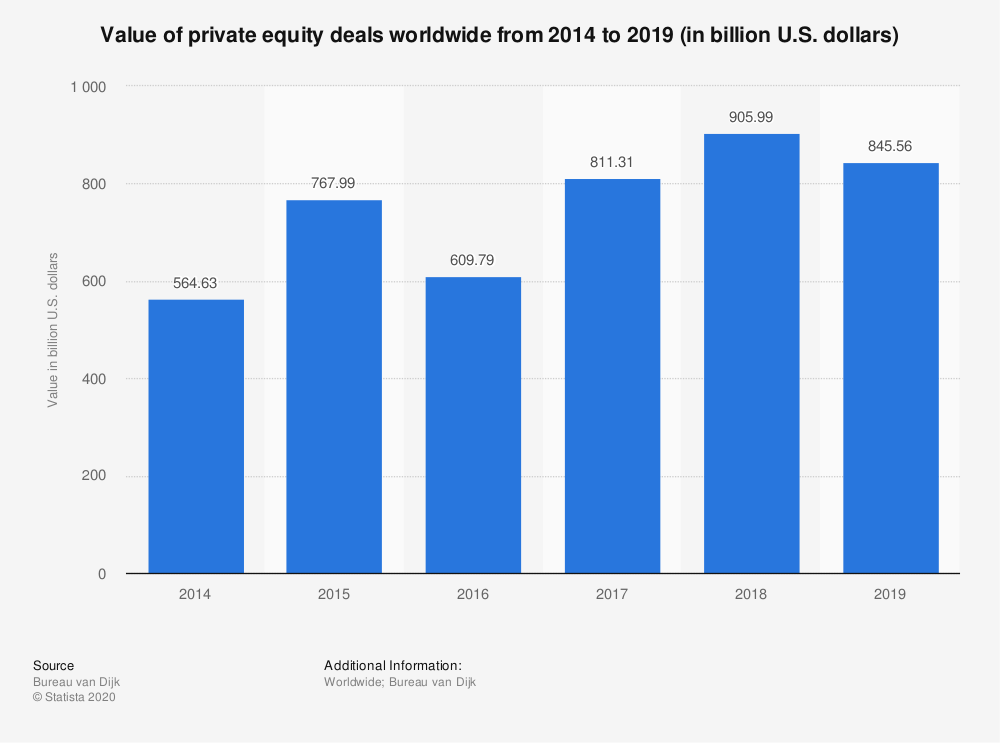

- as of 2019, the value of global private equity deals was about $845b.

- in Europe alone, the total number of private capital deals doubled during 2010-2017;

- Blackstone is a leading PE company with a fundraising sum of $95.95b between 2014 and 2020;

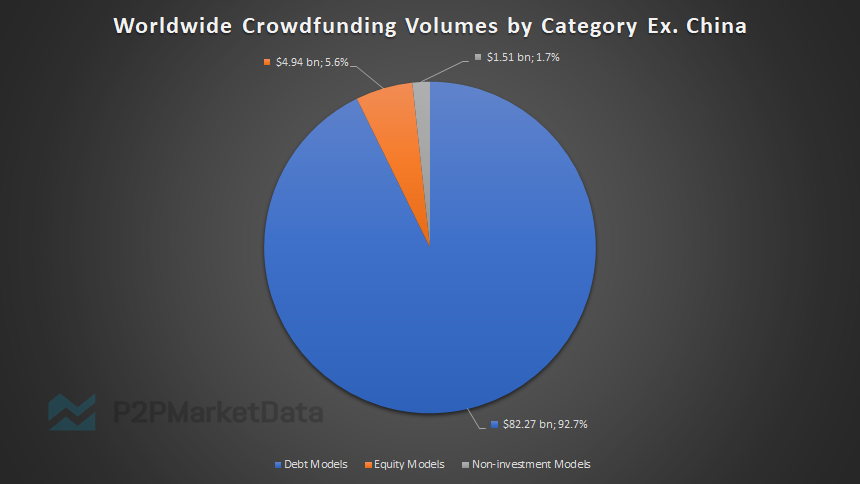

- In 2018, the global crowdfunding market was valued at $10.2b and was forecast to almost triple by 2025;

- equity-based crowdfunding was valued at $1.5b in 2020 – P2PMarketData reports.

The two shapes of investment crowdfunding

PE wasn’t ideal, neither were bank loans.

Small firms participating in traditional schemes had to pay high administrative fees to fund managers and might have lost the company ownership.

Banks organized the lending process the way startups would wait for years to get capital at astronomical interest rates.

Equity crowdfunding (crowdinvesting) and crowdlending were to eliminate these drawbacks.

The basic concept of crowdfunding is to attract funds from a wide audience or limited community through an online portal. Started as donations- and reward- based campaigns, crowdfunding gradually spread to private equity and business loans.

Crowdinvesting

This type is a perfect fit for growth-based companies from industries with a high potential of returns. Many investors pay a large amount of money in return for an equity position in the campaigner’s business. If the company performs well, the value of your shares will go up, if not – you’ll lose your money.

P2P and P2B loans

Creators can collect money in a form of a loan that they have to pay back to the lenders along with the interest. Crowdlending seems to be more appealing for backers since they expect to get returns. Also, lenders are offered attractive returns compared to other savings and investment products.

Private equity investment crowdfunding has some limitations. Apparently, because of them, crowdinvesting volume falls behind loans:

- startups don’t get any mentoring or professional advice from the shareholders due to the lack of communication;

- equity crowdfunding platforms usually don’t attract institutional investors since the latter requires specific investment conditions;

- creators don’t feel financial stability as lenders donate small sums of money and are unlikely to take part in further rounds.

There are other differences between traditional PE and equity-based crowdfunding (check the table).

| PE | Equity crowdfunding | |

| Clients | startups, SMEs, large corporations | mainly startups and SMEs |

| Investors | high-net individuals, banks, investment, insurance and pension funds | accredited (professional) and non-accredited (individuals and households) backers |

| Objectives | buy and restructure companies | fund companies and projects |

| Investment period | 10-15 years | 3-5 years |

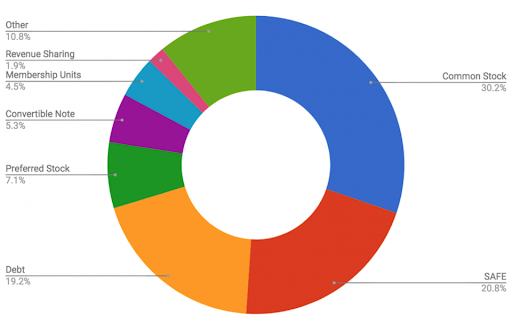

| Strategies | leveraged buyouts, venture capital, growth capital, distressed/turnaround | securities selling |

| Charges/fees | management and performance fees | initial application and upfront “success” fees |

The technology helps both financial relationships and the regulatory framework transform.

Through online portals, everyday and corporate investors can take part in private equity fund crowdfunding.

The crowd’s money attracted by capital firms is poured into early-stage startups which are further resold to potential stakeholders. To do this effectively, firms may incorporate an investment management software – an online crowdfunding portal – to manage deals more efficiently. This can either be a white-label or custom platform that helps firms to reach new audiences and get a larger market share.

How to launch a private equity crowdfunding platform with LenderKit

Any modern company sooner or later feels the necessity to automate and digitize everyday activities.

It’s challenging, but it results in cost reduction, higher client satisfaction and faster business flows.

The PE industry is one of the late adopters of tech innovations. Private placements (pre-selling of securities) are complex, therefore firms need specific software to cover the needs of both – investors and backers.

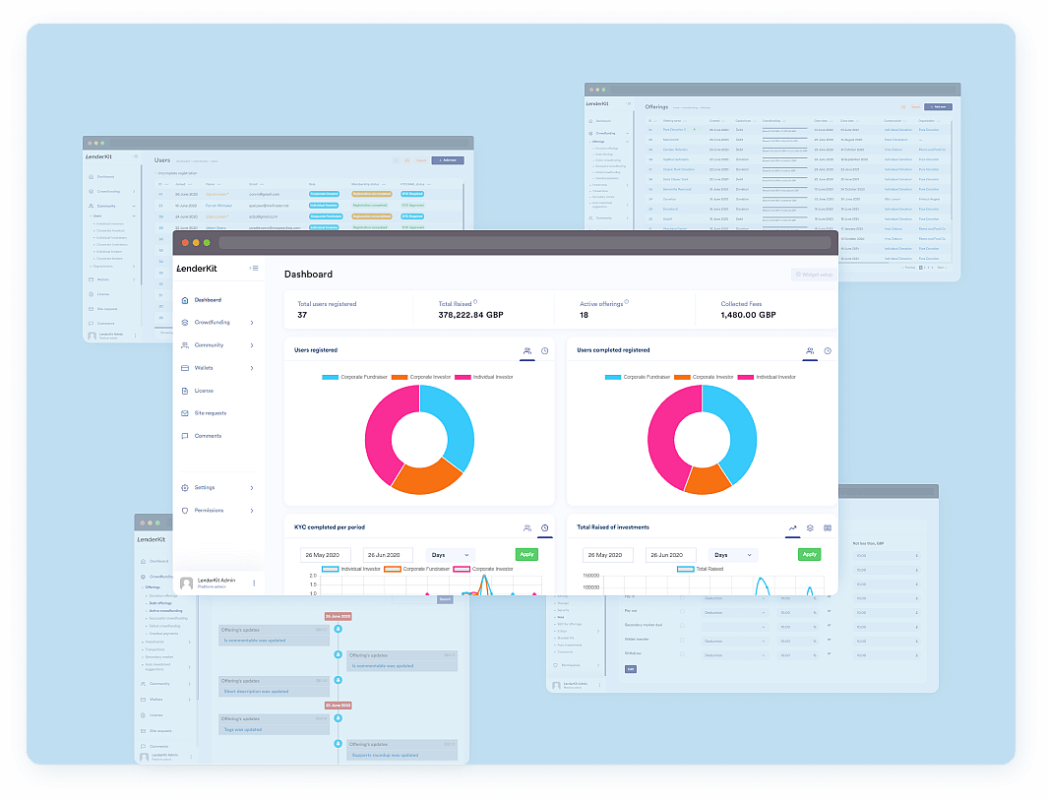

LenderKit is a tool tailored for private equity crowdfunding platforms.

It can help automate investment management for Real Estate or SME crowdfunding.

Core features of LenderKit

Admin back-office. It’s a powerful tool to manage the entire investment cycle where you can monitor clients, check reports, control overdue payments, etc.

Multiple investment flows. With LenderKit, you can fine-tune every step from offering selection to contract signing and dividend payouts. You can combine donation, debt, and equity flows in your platform to offer more diverse options to your customers.

If you want to see the real project based on LenderKit, visit Camly. It is a real estate crowdfunding platform with debt and equity-based products.

Camly offers US-based real estate investment opportunities for Vietnamese investors.

Payment facilitation. We can connect LenderKit with any third-party service to help you with the verification of your customers, offer ISA or IRA, streamline payouts. We closely collaborate with Goji investments and LemonWay – providers of secure payment transactions and domain-specific client money management. We can also integrate a payment and KYC/AML system of your choice.

Document management via DocuSign integration. Electronic signatures are to help you improve investor onboarding and reduce the paperwork, of course, at a bank-level security level.

There are plenty of other features which LenderKit offers for private equity investment management firms. Schedule a demo to see its full capacity.

Final thoughts

Whether you’re looking for private equity fund crowdfunding or private equity investment management software, LenderKit can become a reliable technology partner.

A crowdfunding solution based on LenderKit is protected because we offer software by installments. That means, at some point, you can scale independently and grow your business without third-party providers or plan an exit strategy without headaches.

Ready to explore our offerings and learn more about pricing options? Reach out to us.