Reg CF and Reg A+ Redefined: How SEC Changes Could Revive Token Offerings

No time to read? Let AI give you a quick summary of this article.

With Donald Trump’s election in 2024, the financial landscape is expected to change. Trump is known as an avid supporter of financial and tech innovation, and he used to be so open about it that many in the Fintech industry supported his candidature. While the majority of expectations are about a wider market, there will also be implications for niche industries such as equity crowdfunding and cryptocurrency.

However, to understand better what is going on, let’s delve into the current state of matters.

What you will learn in this post:

About the Securities and Exchange Commission (the SEC)

The Securities and Exchange Commission is the regulatory body that supervises equity crowdfunding platforms in the USA. Each company selling securities must register with the SEC and report to the regulator1. Since equity crowdfunding involves selling securities, such platforms must register and file financial reports with the SEC. This part is pretty clear and doesn’t leave any space for questions.

The SEC and Initial Coin Offerings

Things become more complex when it comes to a phenomenon called an Initial Coin Offering (ICO), which can be regarded as a type of crowdfunding in which people buy the project’s tokens to help fund its development. The token issuer generates tokens and sells them for an established cryptocurrency such as Bitcoin or Ethereum. It is expected that the token price will increase when the token is listed on exchanges and is available for trading, thus generating income for early investors.

For example, Ethereum was launched with an ICO2 that was conducted from July 22 to September 2, 2014. The ETH price was $0.311, and over 60 mln Ethers were sold. Those who purchased ETH at the ICO have seen their investment grow more than 1,000 times.

However, soon after the ICO boom3 in 2017, the SEC got interested in the new crowdinvesting method, which resulted in multiple legal cases3 against companies that conducted ICOs. In most cases, the companies were accused of selling unregistered securities. As we remember, companies that sell securities shall be registered with the SEC.

Howey test is used to determine whether an asset is a security and has to be registered with the SEC. However, cryptocurrencies are difficult to categorize as securities. While some of them seem to fall under this category, others do not. This ambiguity was used by the SEC to press legal charges against many companies that had conducted sales of their tokens. In some cases (e.g., Ripple4), companies proved that their token sales shall not be regarded as the sales of securities, while in other cases3 (e.g., Telegram, Block.one) failed to do so and were forced to either abandon their tokens or stop their operations at all.

Over time, the number of legal cases increased5, with SEC chairman Gary Gensler6 becoming a symbol of aggressive enforcement.

What will the victory of Trump change?

Crypto deregulation

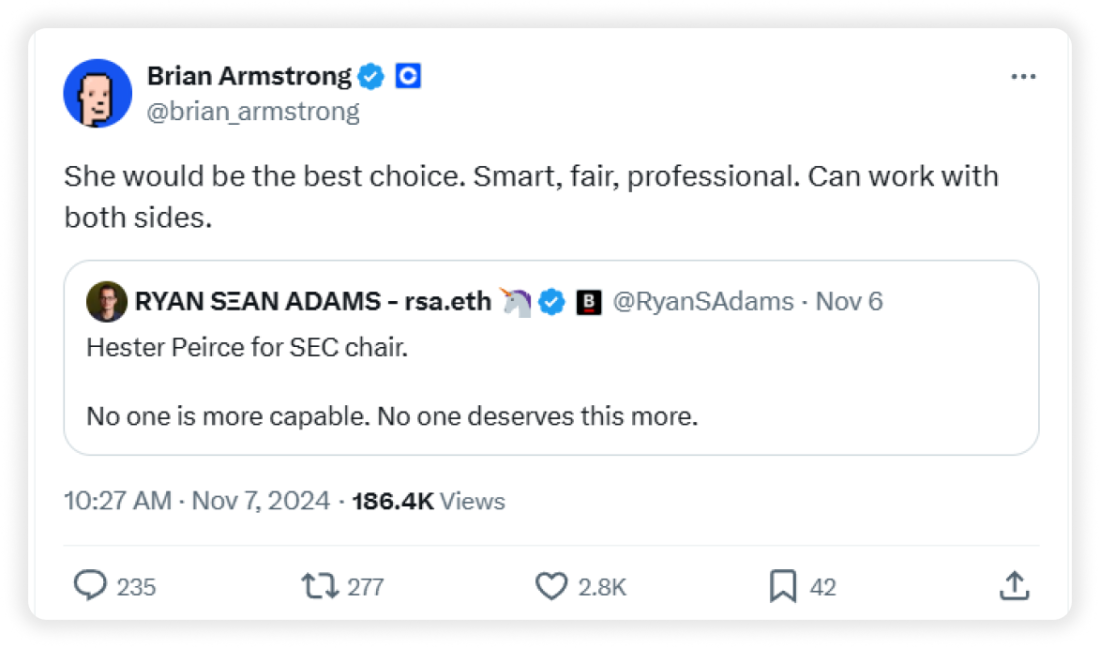

Trump’s victory means that cryptocurrency regulation is about to undergo a major shift, with the possibility of an ICO revival. Gary Gensler resigned as SEC chairman7, and a new chairman will be appointed in January 2025.

There are already speculations6 about who will become the next SEC chair, with all possible candidates being crypto-friendly.

Trump pledged to protect Bitcoin and put an end to what is considered the “crypto crackdown,” during which the SEC actively investigated numerous crypto companies. The season of deregulation is approaching, and as Doug Ellenoff, Managing Partner of the law firm of Ellenoff, Grossman, and Schole (EGS), claims9, “the impact of deregulation will be seismic”.

Mario Lattuga, General Counsel at Republic, the largest securities crowdfunding operator in the world, stated that big changes are coming, and the SEC will finally have to switch from regulation by enforcement to innovation. He also expects a surge in “Reg A offerings which will no longer be a graveyard of token offerings,” and an increase in Reg CF offerings.

Crowdfund Capital Advisors (CCA) founder and Principal Sherwood Neiss, the one who helped to draft the JOBS Act of 2021, also believes that Trump’s administration holds great promise for the investment crowdfunding industry.

Reg CF offerings

Under Trump’s previous leadership, less regulation and better funding access helped bring equity crowdfunding into the spotlight. It is expected that with his focus on boosting American businesses, the sector of equity crowdfunding could see even more growth.

Also read: Reg A vs Reg D vs Reg CF what’s the differenceTrump’s stance on Federal Reserve policy10 is expected to play a key role in the rise of equity crowdfunding. His promise of lower interest rates may drive economic growth, which would mean cheaper capital for local businesses. This, in turn, would give startups more flexibility to raise funds through equity crowdfunding, bypassing traditional financing methods such as bank loans.

Less regulatory oversight will simplify companies’ compliance processes and is expected to have a positive impact on equity crowdfunding development.

Another factor that may impact equity crowdfunding is the management of national debt. Trump is expected to prioritize lower interest rates, and with the U.S. facing nearly $1 trillion in interest payments, cutting rates would save hundreds of billions annually and stimulate economic activity. This environment could benefit equity crowdfunding by reducing the cost of capital.

Donald Trump also proposed tariffs on foreign goods11 to boost domestic manufacturing. However, this may pose challenges for startups that depend on foreign components, especially tech companies. It will lead to higher costs, which will, in turn, make some businesses less appealing to investors.

On the other hand, “Made in America” startups might start attracting more attention from investors who are looking for domestic options. This could drive interest in equity crowdfunding for businesses focused on local production.

This evolving landscape offers both challenges and opportunities, but in any case, it positions equity crowdfunding as a key player in the future of business financing.

How to launch a crowdinvesting platform with LenderKit

Considering all the changes, it might be the right time for equity and crypto crowdfunding to become active in the US market.

If you are looking to launch your own platform, check out white-label crowdfunding software from LenderKit to streamline your go-to-market strategy and digitize your operations.

Our investment software supports equity and debt crowdfunding, donations and rewards, can have multiple integrations like payment systems, e-sign, KYC/AML services, tokenization infrastructure and more.

If you’d like to learn more about LenderKit and see how it works, reach out to us via the contact form.

Article sources:

- Reg A+ Offerings: FAQs - Barton LLP

- History of Crypto: The ICO Boom and Ethereum's Evolution

- History of Crypto: The ICO Boom and Ethereum's Evolution — TradingView News

- SEC v. Ripple: When a Security Is Not a Security | Insights | Holland & Knight

- Cyber, Crypto Assets and Emerging Technology

- Who Will Lead The SEC Next? Gensler’s Exit Sparks Speculation For 2025

- SEC Chair Gensler to Depart Agency on January 20

- X

- Crowdfunding Insiders Comment On Forthcoming Leadership Change At Securities And Exchange Commission (SEC) | Crowdfund Insider

- Private Site

- Live updates: China, Mexico warn against trade war after Donald Trump vows to hike tariffs - BBC News