The Complete Guide to Private Debt for B2B

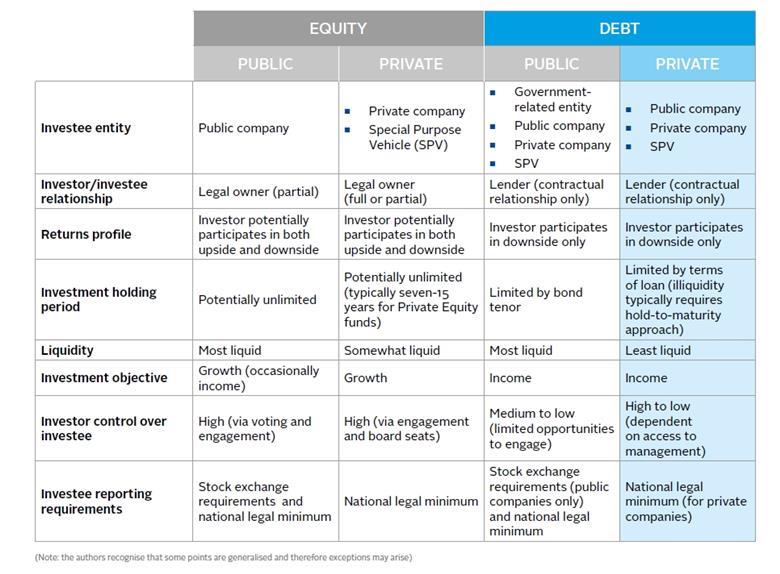

Private debt is a type of debt financing that is raised and secured by private entities such as corporations, partnerships, and individuals. It’s often used by companies to:

- fund expansion

- cover large investments

- refinance existing debt

- provide working capital

- finance acquisitions

Issued in the form of promissory notes, bonds, and other debt instruments, private debt is typically secured by the borrower’s assets, such as real estate and other property.

Private debt is considered more expensive than public debt, but offers more flexibility regarding the repayment terms and interest rates. However, recent news suggests that private debt is getting cheaper for “big-ticket leveraged borrowers.”

What you will learn in this post:

Private Debt Market Condition and Perspectives

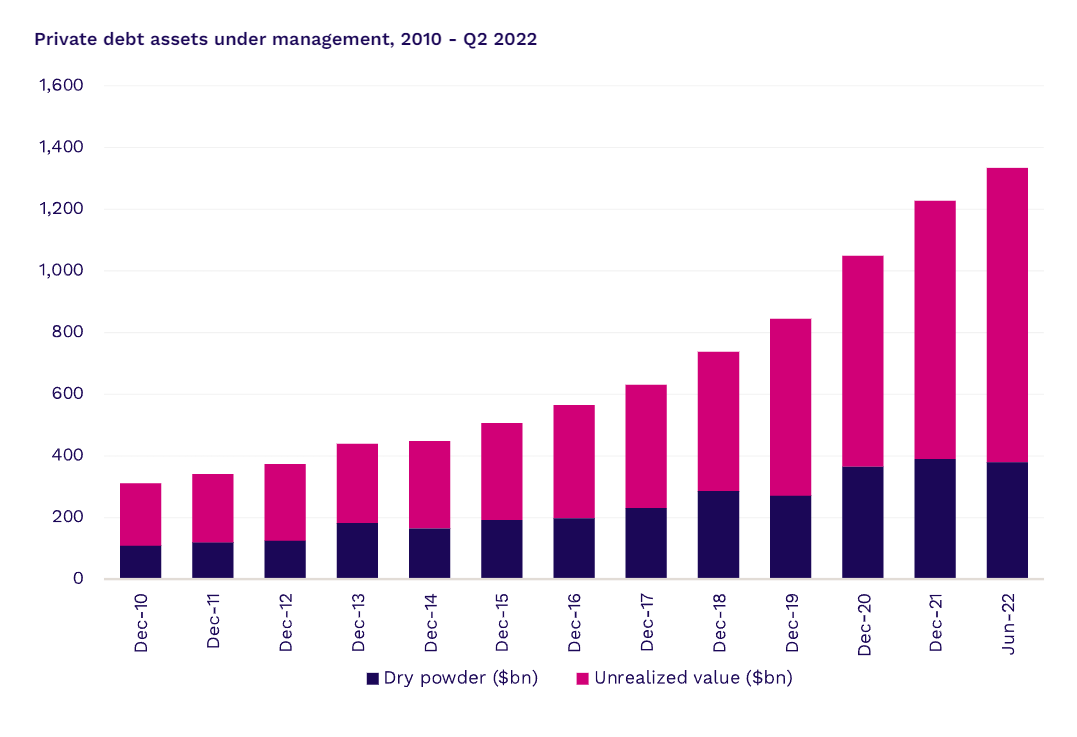

Even though traditional lending from banks and financial institutions remains the main source of financing for businesses, the private debt sector is growing constantly.

The number of assets under management involved in private debt direct lending has increased almost tenfold in the last 10 years.

With banks reducing lending, in particular to smaller businesses, and limiting the source of capital for growing companies, the demand for private debt is increasing. This attracts more investors and fuels the growth of the sector as a whole.

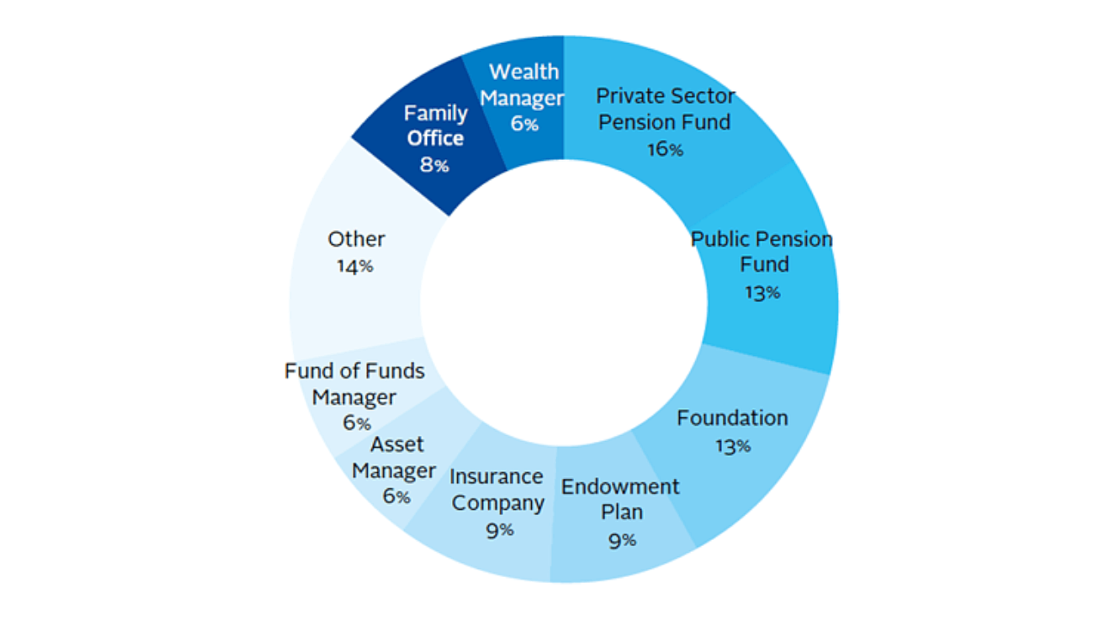

Who invests in private debt and why

All types of investors are becoming interested in private debt. The most active players are private and public pension funds, foundations, endowment plans, insurance companies, asset managers, and fund managers.

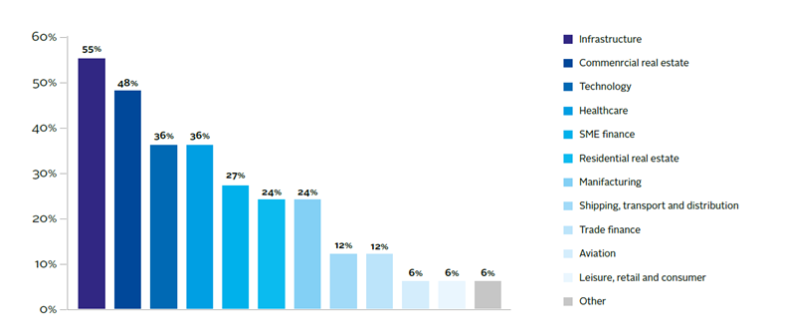

Investment in infrastructure, commercial real estate, technology, healthcare, and SME finance has grown significantly over the past few years, with these sectors receiving the largest allocations from investors.

In addition, residential real estate has become increasingly attractive to investors, as it offers a high return on investment and a relatively low risk.

As these sectors continue to grow and develop, it is likely that investment in them will remain strong and allocations to them will continue to rise. Furthermore, as new sectors are developed, such as renewable energy, they may become increasingly attractive to investors, providing an even wider range of opportunities for those looking to invest their money.

So, why are investors considering private debt and what are they looking for to build their wealth and access high-tier financing instruments?

Portfolio diversification from traditional asset classes and lower risks

Compared to traditional assets, private debt offers investors more flexibility and a wider range of options because it includes private debt funds, high-yield bonds, hedge funds, collateralized loan obligations (CLO), and more. Compared to venture capital or private equity investing, private debt is considered less risky.

Floating interest rates and protection of funds during unfavorable market conditions

Historically, private debt has proven to be more resilient in unfavorable market conditions than other investment classes. When inflation and interest rates are growing, private debt tends to have a floating rate which prevents investors from losing funds because of their depreciation. A shorter debt duration compared to traditional loans makes private debt investment less risky.

How to invest in private debt

Most investors allocate capital to private debt funds which, in turn, invest in private debt deals with companies seeking funding. These private debt funds differ based on their strategies (e.g., direct lending, fund of funds, etc.), type of debt (mezzanine, senior, etc.)

The following instruments can be used to invest in private debt.

Private debt fund

A private debt fund specializes in lending activities. They raise money from multiple investors and lend these funds to multiple companies. Investing in a private debt fund differs from direct investing in private debt because private debt funds provide and manage portfolio loans rather than invest in private debt. So, the loan that companies obtain from such a fund may be worth millions of dollars.

Private debt funds may impose minimum investment limitations on investors that can vary from $1 thousand to $1 million.

Collateralized loan obligation (CLO)

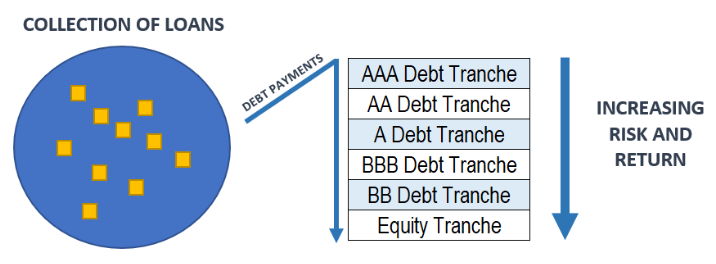

Collateralized loan obligations are securities backed by a pool of loans. In other words, when debt payments from various loans are pooled together and distributed to different investors in various tranches, it is called a CLO. The majority of loans that form a CLO are first-tier bank loans. Others are second-tier loans and unsecured debt.

Investors can pick in what tranche to invest. The higher rate the tranche has the fewer risks it involves and the lower the returns are.

Payments are distributed to investors starting at the top of the tranche to the bottom. Investors at the bottom receive their revenue in the last turn that’s why the last tranche is the riskiest and generates the highest revenue.

Business development companies (BDC)

Business development companies are organizations that invest in promising small- and medium-sized businesses or distressed companies. BDCs raise funds (there are multiple ways to do so, and issuing loans is one of the possible options) to boost the development of a struggling company. In the case of private debt, a BDC issues a loan to the company that needs investments. However, purchasing equity in such a company to resell it later at a higher price when the business recovers is also one of the ways how a BDC earns money.

Investing in a BDC can bring higher yields if the market conditions are favorable, the sponsored companies are managed properly and can repay loans on time. However, the risks that a borrower may default are high and thus, investing in a BDC is risky.

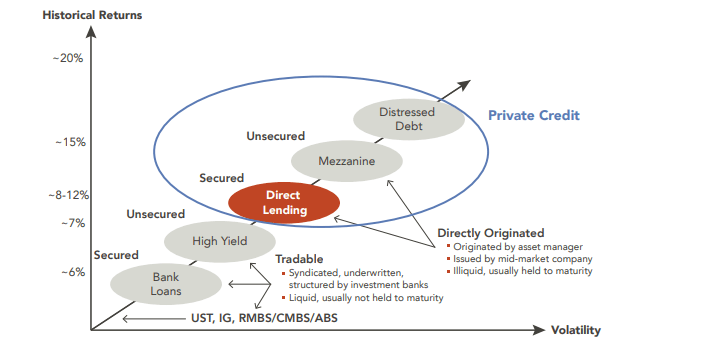

Direct lending vs private debt

While direct lending is used interchangeably with private debt, these two terms do not mean the same. Direct lenders normally invest in secured loans. In contrast, private debt includes not only secured loans, but also mezzanine debt and distressed debt. Therefore, private debt has a broader meaning than direct lending.

Direct lending involves lending directly from the lender to the borrower, while private debt involves a middleman or intermediary to facilitate the loan.

With direct lending, the lender has more control over the loan terms and the borrower, while private debt is often structured with the intermediary taking on some of the risk associated with the loan.

Additionally, direct lending typically involves shorter terms and higher interest rates than private debt, since the lender is taking on more risk.

How to create a private debt investment platform with LenderKit

Platforms developed for loan and funds administration are complex solutions with a lot of functionalities. That’s why if you are thinking of about launching your private debt investment platform, it is crucial to find an experienced company that can handle all the technical challenges.

With LenderKit, you can get fully customizable white-label private debt software that will enable you to launch your platform within the minimum time without excessive expenses.

The private debt investment software provides:

- A full-cycle loan automation

- Credit scoring via the third party

- Automated KYC/AML verification

- On-demand calculations

- Payment processing automation, and other functions needed to make your platform work efficiently.

A specialized portal enables borrowers and investors to manage payments, investments, personal data, connect wallets, and perform all the actions required to either invest or get a loan.

A powerful back-office allows you to manage the private lending and investing campaigns, repayments, integrate CRM, set up new roles for advisors, managers, etc.

To schedule a demo or discuss conditions, please contact our sales team.