What Is AML and How Does It Work?

No time to read? Let AI give you a quick summary of this article.

Anti-Money Laundering (AML) refers to a framework of laws, regulations and procedures designed to detect, prevent and report illicit financial activities.

AML policies primarily target the concealment of funds derived from criminal activities such as drug trafficking, corruption, fraud, terrorism financing and tax evasion.

Money laundering is not just a financial crime, it also enables organized crime and terrorism to grow by giving criminals access to legitimate financial systems. So, AML measures become necessary tools that help fight against such global threats — affecting many industries, sectors and fintech players, including crowdfunding platforms.

What you will learn in this post:

Understanding AML and who enforces it

AML compliance is enforced by national and international regulatory authorities.

At the global level, the Financial Action Task Force (FATF)1 sets the standard for AML efforts. FATF monitors countries’ progress and places under review those that fail to comply.

In the European Union, the EU Anti-Money Laundering Directives2 provide a legal framework that member states must follow.

In the United States, the Financial Crimes Enforcement Network (FinCEN)3, under the Department of the Treasury4, is responsible for AML enforcement.

The UK relies on the Financial Conduct Authority (FCA)5 and the National Crime Agency (NCA)6.

Financial institutions, including banks, payment processors and crowdfunding platforms are required to follow these frameworks and perform due diligence on their users.

How AML works in practice

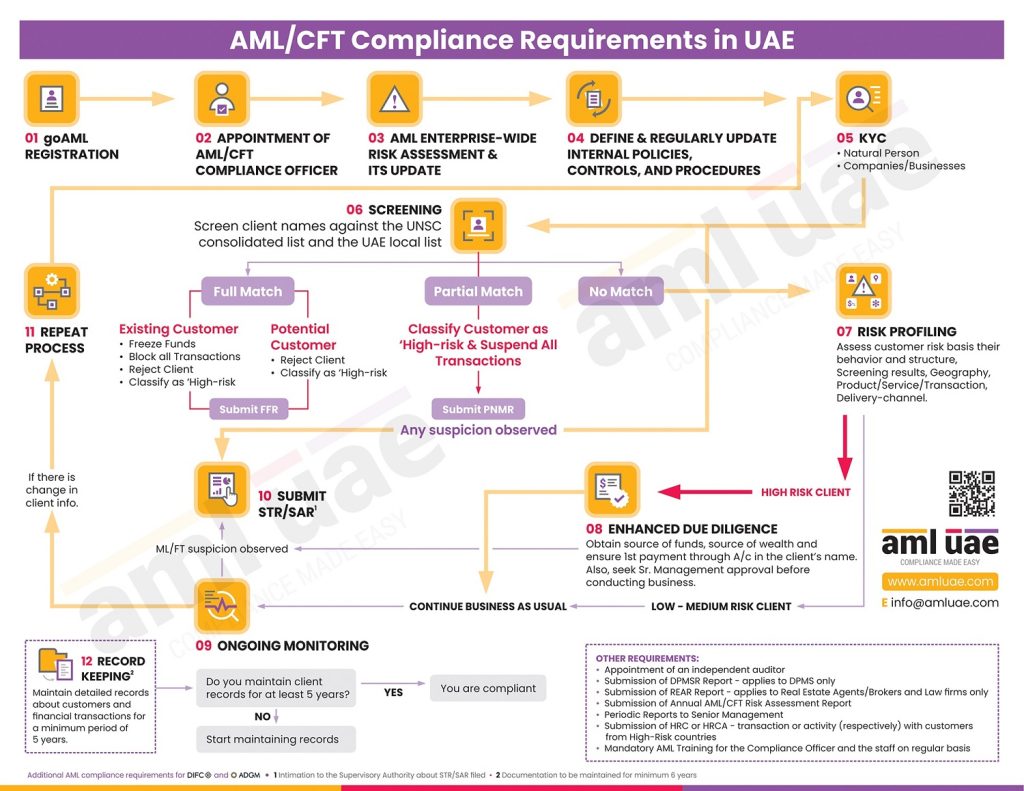

In practical terms, AML compliance begins with Know Your Customer (KYC) procedures.

KYC is the process of verifying the identity of clients before they are allowed to transact. Individuals must present government-issued identification and, in some cases, proof of address and source of funds. In contrast, businesses must verify their legal status, ownership structure and beneficial owners.

The verification process never really stops — not even when the customer is already onboardred.

Financial institutions monitor the customer’s account for suspicious activities and flag suspicious behavior.

For example, if a person makes repeated transactions just under the reporting threshold, sends large sums abroad with no clear economic reason, or transfers funds between unrelated parties, alerts are triggered. These alerts are reviewed by compliance officers, who may file a Suspicious Activity Report (SAR)8 with the relevant authority. In some cases, assets are frozen, and accounts are closed.

Many organizations also use data analytics and network visualization tools to detect hidden patterns of laundering. For instance, if the same IP address is used to create multiple accounts or if a series of transactions creates a circular money trail among fake companies, the system can detect it and raise an alarm.

How money laundering schemes work

Money laundering9 typically happens in three stages — placement, layering and integration.

Placement

Illicit money is introduced into the financial system. This might be done by depositing cash into a bank account, making small online payments or purchasing prepaid cards.

Layering

The money is moved around through complex transactions to make it hard to trace. This includes wire transfers between shell companies, using cryptocurrencies or converting funds into assets like artwork or real estate.

Integration

Finally comes integration, when the “cleaned” money is reintroduced into the economy as legitimate income.

It is used to buy luxury items or real estate, invest in legitimate businesses, give loans or fund further criminal activity.

How AML applies to crowdfunding platform

Regardless of the crowdfunding model, crowdfunding platforms help to solicit money from numerous individuals to fund projects. There are many tricks and crowdfunding fraud, but scams often exploit platforms with limited AML controls.

A typical example involves a scammer creating a fake campaign on a crowdinvesting platform. They might present a seemingly legitimate business idea and collect funds from users. These funds, which may also include illicit money injected by the fraudster under fake user accounts, are then withdrawn and moved to other countries. Without proper AML checks, such platforms can become an easy target for scammers.

Therefore, crowdfunding platforms must adopt AML practices similar to those used in banking.

Normally, KYC/AML requirements are covered by integrating identity verification and licensed payment processing providers which help platforms to onboard clients securely and compliantly.

A licensed payment institution that handles payments for crowdfunding and marketplaces, AML procedures include verifying identification documents, assessing the legitimacy of the project and ensuring the origin of funds is lawful.

In addition, continuous monitoring of funding patterns, transaction behavior, and beneficiary details helps uncover suspicious activity. If a fraudulent campaign receives a sudden surge of small donations from related accounts, this may indicate an attempt at layering.

Payment systems integrated with crowdfunding platforms often act as intermediaries, holding and transferring funds only after AML verification. They may also run enhanced due diligence on high-risk users or those from jurisdictions with weak AML controls.

Fighting money laundering — tools and strategies

To effectively combat money laundering, platforms and institutions combine technology, legal compliance and human oversight.

Thanks to the automated systems that can monitor transactions in real-time, detect anomalies and assess risk based on user behavior and transaction history — life has become easier.

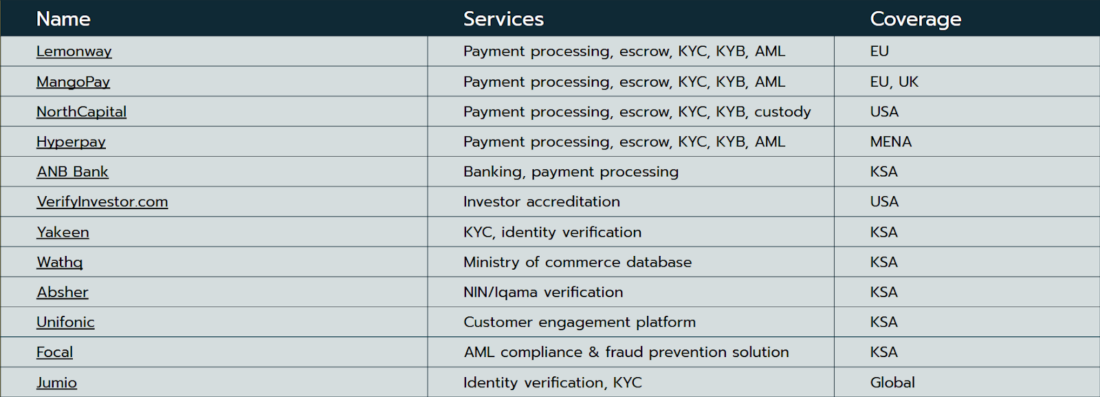

Many crowdfunding platforms and fintech players rely on strategic and tech partnerships with payment processing systems, identity verification providers, credit scoring systems and alike.

All these tools can be integrated into your crowdfunding platform, solving you a ton of headaches and keeping you free from the hassle.

So, it all comes down to:

- Find the right tool for the job

- Learn what it does

- Integrate it

- Hire the right people

- Train your team

- Monitor the results

Here are some of the tools used in LenderKit:

Build an AML-compliant crowdinvesting platform with LenderKit

When it comes to building your own crowdfunding platform, there are many things you need to control that take a lot of your time. LenderKit offers white-label crowdfunding software that helps you make this journey smoother. From launching a branded prototype to building a custom platform — LenderKit does it all.

Catering to various markets like the UK, Europe, US and MENA, LenderKit supports debt, equity and donation crowdfunding. With the help of essential integrations, you can significantly reduce the operational burden and legal risks associated with AML compliance, allowing you to focus on business growth while ensuring that you meet all anti-money laundering requirements.

Ready to launch your crowdfunding platform in weeks and not years? Get in touch to discuss your project.

Article sources:

- The FATF

- New EU rules to combat money-laundering adopted | News | European Parliament

- United States Department of the Treasury Financial Crimes Enforcement Network - Home | FinCEN.gov

- Front page | U.S. Department of the Treasury

- Financial Conduct Authority | FCA

- Home - National Crime Agency

- What is Integration in Money Laundering?

- Suspicious Activity Reports (SAR): Role, Challenges & Future

- Money laundering schemes: 7 common criminal tactics

- KYC has never been so easy & fast!