What is a Crowdfunding Regulatory Sandbox and How Does it Work?

A regulatory sandbox is a set of rules and procedures allowing crowdfunding companies to test their business ideas in the market under the simplified regulation. However, with certain requirements to the operations, target audience, and sandbox duration.

Regulatory sandboxes are very widespread in the US, EU, UK, Saudi Arabia and MENA region, Southeast Asia.

Alongside innovation hubs, the European Parliament consider regulatory sandboxes as innovation facilitators with the following expected benefits:

- knowledge exchange between regulators and innovative companies

- the provision of qualified assistance regarding licensing and registration questions to new entrants

- better understanding of regulatory expectations and getting feedback from adopters

- legal risk elimination and regulation-compliance activities for new players

- reduced time-to-market and improved financing opportunities for early-staged companies

- the enhanced visibility of innovation trends and healthier competition among participants

- lower entry barriers for newcomers

In practice, these benefits are transformed into real performance indicators.

The experts from the Monetary and Economic Department have surveyed how the FCA regulatory sandbox affects fintechs’ ability to raise funding.

Here are a few interesting findings:

- entry into the sandbox is followed by a 14-15% increase in capital raised over the following two years

- the number of new investors increases by 30% post-sandbox entry as regulatory sandboxes tend to remove information asymmetry which heavily impacts foreign investors

- the entry into the sandbox leads to a 4.4% increase in the demand for capital from each investor

What you will learn in this post:

Common features of crowdfunding platform regulatory sandboxes

The creation of regulatory playfields is stepwise and, typically, they consist of :

- scope (for crowdfunding sandboxes, it’s a model, target audience, licensing and reporting requirements, etc);

- access, which means that all market participants are treated equally;

- eligibility criteria set for access to the hub.

Most commonly applied eligibility criteria focus on such FinTech product/service features as the innovative approach, potential to provide benefits, project maturity and the need for testing, risk mitigation, commitment to investor protection, etc.

Before applying to any regulatory sandbox, crowdfunding companies have to do the homework and discover the eligibility criteria their sandbox operator has set.

In case an applicant fails to meet any/a few eligibility criteria, they’re not accepted to the cohort.

Also read: How to License a Crowdfunding PlatformCrowdfunding platform licensing sandbox: global approaches

Let’s see how these recommendations work in practice.

The UK: FCA regulatory sandbox

The UK’s sandbox is believed to be a great example of financial diversity and inclusion facilitator.

From August 2021, it is open to all types of propositions and companies from all sectors of the financial services market. Earlier it operated on a cohort basis – companies were able to apply only during two six-month test periods per year.

Who can apply to the sandbox?

Authorized firms, unauthorized firms that require authorization and technology businesses from different sectors located in the UK and outside.

How to apply the regulation sandbox for crowdfunding?

Firms should complete the registration form and meet the eligibility criteria (scope, genuine innovation, consumer benefit, need for sandbox testing, and readiness for testing).

The FCA has a detailed guide on how to prepare your application form and what info it should include: your crowdfunding model, target audience, resources to pass authorization process, business plan, and exit options.

Normally, applications are processed for six months.

What is the duration of the sandbox?

The testing duration is from three to six months.

What happens after the sandbox?

Before transitioning out of the sandbox, applicants should fill and submit a final report summarizing the outcomes.

The FCA reports that 90% of sandbox applicants continued with their proposition once they have transitioned out of the sandbox.

The USA

The US legislative framework for the FinTech market is different from the UK’s. It’s fragmented and lacks coordination between agencies on different levels.

That’s why there’s still no unified regulatory sandbox. Although some states like Arizona and Nevada have introduced regulatory playgrounds for financial companies, these frameworks are limited geographically and have no legal force in other states.

To solve this problem, in 2018, the Treasury Department reported that it is

“committed to working with federal and state financial regulators to establish a unified solution – a regulatory sandbox”.

This task is complex, but it can help in achieving several objectives:

- testing grounds for innovation

- providing access to companies at different stages of their business cycle

- maintaining consumer protection

- providing regulatory relief

Meanwhile, the concept is under consideration, 6 US states have passed sandboxes into law and 10 have introduced dedicated bills.

Arizona was the first state in the country to initiate a regulatory sandbox. Since 2018, 10 companies have participated in the program.

Nevertheless, when registering a crowdfunding platform, you should choose between registering a funding portal or a broker-dealer and follow the instructions and procedures formalized by FINRA.

Also read: Crowdfunding Broker-dealer vs Funding Portal: Which One to StartSaudi Arabia

Saudi Arabian Monetary Authority (SAMA) issues licenses enabling companies to raise funds through crowdfunding.

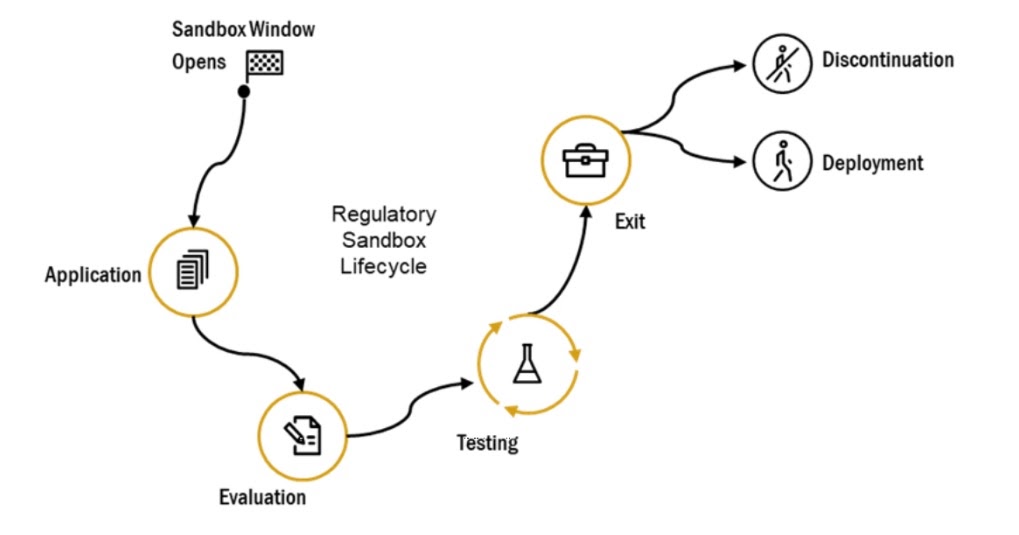

To get a license, you need to apply to the SAMA’s Regulatory Sandbox. The application process has 4 stages:

- Application stage. Companies submit a package with entity details, innovative concept description, testing plan, risk assessment, and exiting plan. SAMA checks the application for compliance with eligibility criteria.

- Evaluation stage. SAMA’s advisors work closely with participants helping them in choosing tools deployed inside the sandbox. Those participants who have been successfully assessed are let to be a part of the cohort.

- Testing stage. Applicants have 6 months to test their ideas in the “safe place”. If necessary, the period can be extended.

- Exit stage. After the sandbox, SAMA and the applicant decide together whether or not the idea/technology/product is mature enough to enter the market.

Who can apply to the sandbox?

All applicants of the SAMA crowdfunding platform regulatory sandbox fall into several categories:

- SAMA-licensed innovators who already have a permission and wishing to test a solution:

- non-licensed local FinTechs / start-ups;

- non-licensed international FinTech companies.

What is the duration of the sandbox?

The first 3 stages last approximately for 9 months. The exit stage has no set duration.

Also read: What is SAMA’s Regulatory Sandbox and How to ApplyEuropean countries

The Council of the European Union considers sandboxes and experimentation clauses as tools for an innovation-friendly, future-proof and resilient regulatory framework that masters disruptive challenges in the digital age.

The EU authorities encourage countries members of the union to implement sandbox practices in order to increase supervisor’s understanding of new FinTech activities and their business models, risks and incentives.

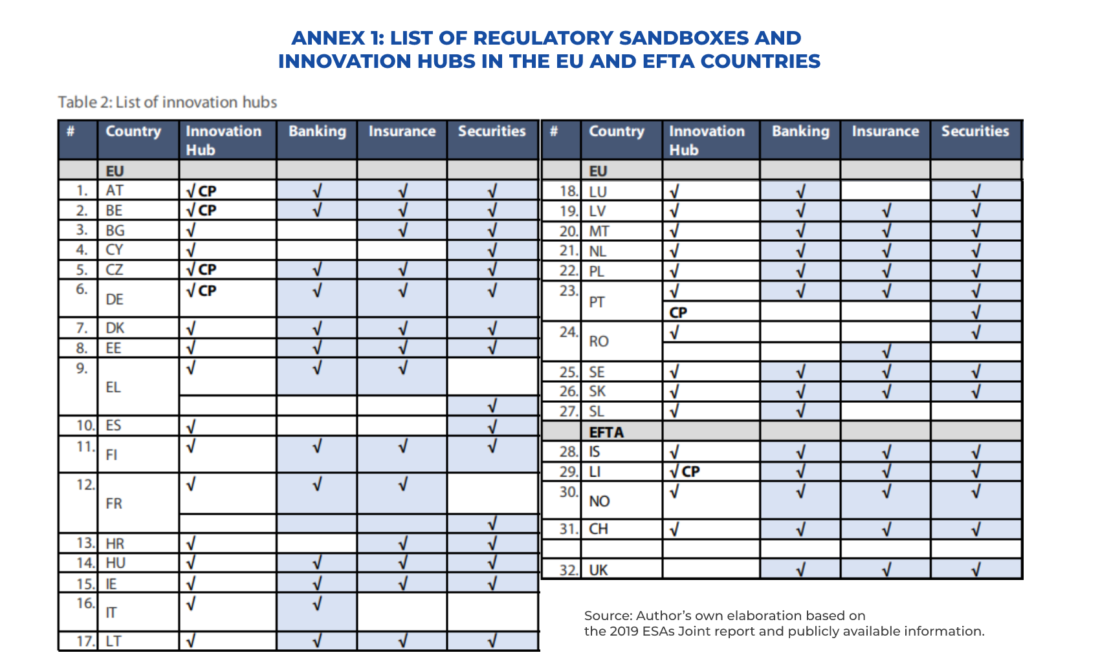

Currently, the existing Sandbox roadmap by countries looks something like this:

Final thoughts

Here’s a brief summary of all above said:

- Fintech regulatory sandboxes are aimed at creating a safe juridical environment where young and mature companies can test new innovative ideas, products, and business models;

- The majority of sandboxes have common features: application process, eligibility criteria for applicants, duration and exit opportunities;

- “Safe playgrounds” benefit both parties – bodies, applicants. For the former, there is a chance to better understand trends on the Fintech landscape and get feedback on the established licensing and authorisation schemes. The latter get a chance to implement the business idea and test it faster;

- Sandboxes shouldn’t be simply “playgrounds” with relaxed legislation, they should serve as “innovation facilitators” and address the risk of developing fragmented FinTech regulation frameworks.

If you’re looking to start a crowdfunding platform and apply into a regulatory sandbox, reach out to LenderKit for an online demo of the crowdfunding software.