What is Investment Crowdfunding?

No time to read? Let AI give you a quick summary of this article.

Crowdfunding has non-investment and investment models. The non-investment model is about reward- and donation-based crowdfunding, when project backers simply support a cause or a non-profit organization that resonates with them and do not expect any financial benefits in return. GoFundMe is one of the donation-based platforms that hosts family emergencies, legal defence fund, and disaster relief fundraisers among others.

By contrast, the investment crowdfunding model refers to p2p lending and equity crowdfunding and implies financial returns on contributions that investors expect to get under certain conditions.

In this article, we will explore investment crowdfunding in detail, see the differences between its types, get acquainted with popular platforms, and see what they offer.

What you will learn in this post:

Debt crowdfunding or P2P lending

Debt crowdfunding is similar to traditional bank loans but the difference is that individual entrepreneurs or companies get the funds not from a financial institution but from investors on a crowdfunding website. In return for their contributions, investors get bonds and expect fixed returns when the time to pay off the loan comes.

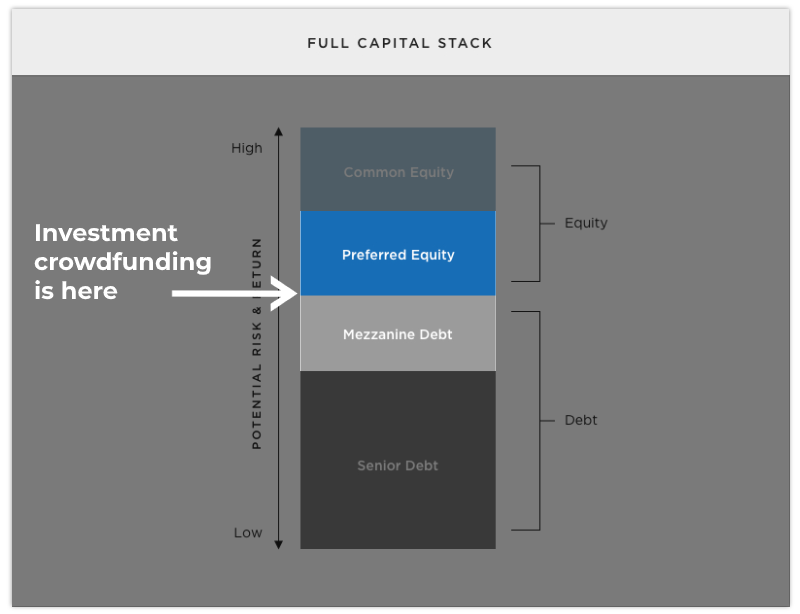

P2P lending covers senior and mezzanine debts that constitute up to 75% and 75-85%1 of required financing respectively.

In the case with real estate crowdfunding, for instance, senior debt2 is a loan covering the major financial need of a borrower (a property development company). This type of loan is the least risky because it’s usually backed by a collateral, and thus, investing in it bears moderate returns.

Senior debt is the playground of investment banks and large financial institutions which seek to diversify their long-term portfolio and minimize risks.

Mezzanine debt3 is a mix of capital that is partially a loan and partially an investment, follows senior debt and brings higher yields, but it has no collateral and its repayment depends solely on the cash flow of a borrower. Mezzanine debt is a “bridge” between equity and senior debt.

Equity crowdfunding

As a part of investment-based crowdfunding, equity crowdfunding refers to common equity which gives voting rights or preferred equity which doesn’t give voting rights to investors. A company that decides to raise capital under the Regulation Crowdfunding or Regulation A, sells stocks to investors with a promising IRR of around 10-20%.

Both the general public and institutions who support such projects through equity crowdfunding obtain a slice in the business through either common or preferred stock 5options.

Along with the partial ownership and the right to vote, the common type of equity bears the highest risk since the backers get their returns the last, after all other investors.

The preferred kind of stocks comes next in line and has comparatively lower risk and returns since the investors receive dividends ahead of common shareholders.

Basically, with equity crowdfunding, a company sources capital online from a crowd in return for its equity or shares. The pool of investors may consist of accredited and non-accredited ones. According to the SEC6, for example, investment crowdfunding platforms under Regulation CF, Title III can accept investments from either 2,000 accredited or 500 non-accredited investors.

As per the latest quarterly update by Equity Crowd Expert7 as well latest news, the UK’s and USA’s top 5 equity crowdfunding campaigns were:

- Chip, an investments platform and a savings app for the ‘smartphone’ generation, raising 11.3 million GBP8

- What3words, a geocode system called the life-saving app by BBC, securing 7.2 million GBP9

- Money Box, another saving and investment application, receiving 6.8 million GBP10

- Urban, a wellness appointment platform, got 5.9 million GBP11 in funding

- Miso Robotics, a manufacturer of artificial intelligence-powered robots for the restaurant industry, securing $16.7 million 12

Investment crowdfunding Platforms

Apart from earlier mentioned ones, there are numerous platforms that connect startups and mature businesses with potential capital they require either through loans with returns on investments or equity in businesses.

Kuflink

The UK’s lending platform promises up to 7.2% of yearly yields for those willing to support the real estate sector with loans. The company 13has a large portfolio of properties around the country offering lenders plenty of opportunities to grow their wealth. So far, through Kuflink investors have put around 96 million of GBP. The platform can boast of 250 years of subject matter expertise in property as well as banking experience.

Prosper

Prosper 14offers borrowers between 2,000USD and 40,000USD of credit to cover various needs e.g. special occasion or home remodeling that require large cash injections. The platform has its own loan classification system and has three types of offerings, where lenders can expect different returns15 depending on their risk tolerance.

Fundrise

With as low as 1000 dollars, Fundrise 16has a goal to create a better financial system for retail investors willing to build their portfolio with real estate projects. The platform has more than 130,000 of active investors that till date have earned close to 90,000,000 dollars. Dealing with institutional grade real estate, Fundrise has both residential and commercial real estates projects to choose from.

Seedrs

The UK’s Seedrs 17is on a mission to enable investors to support businesses they favor. The platform showcases different projects as well as has a secondary market option, where existing shareholders can resell their stakes in startups. From seed capital to IPO, Seedrs unites a large pool of the EU investors and helps both startups and established businesses.

Also read: "How to build a crowdfunding platform like Seedrs"Final thoughts

Investment crowdfunding is about preferred equity and mezzanine debt financing which bridges the gap between senior financing and common equity. For early-stage fundraisers, it’s hard if not impossible to get the senior debt from banks. Also, the common equity which is thought to be the “friends and family” financing doesn’t allow a business to grow bigger. And even after this type of financing, banks don’t see the startup as valuable until it has sustainable revenues.

Investment crowdfunding solves this problem by allowing firms to get the required capital and qualify for further rounds of financing and grow their business.

Crowdfunding is a great business opportunity for professional investment management firms that can fill in different niches and support real estate and SME projects of various sizes. If you’re looking to set up an investment-based crowdfunding platform in the USA, UK or Saudi Arabia, reach out to LenderKit to discuss your requirements.

Article sources:

- Mezzanine Debt: What It Is and How It Works -- With Examples | The Motley Fool

- Understanding Senior Debt: Risks and Payment Priorities

- Mezzanine Debt Vs. Senior Debt | Mezzanine Lending

- RealtyMogul.com™ | Real Estate Crowdfunding & Investing

- Common vs Preferred Shares - Difference, Investment

- Regulation Crowdfunding: A Small Entity Compliance Guide for Issuers

- PDF (https://equitycrowdexpert.com/client/reports/EquityCrowdExpertQuarterly2020Q3...)

- Just a moment...

- 7.2 million GBP

- Just a moment...

- Urban

- 403 Forbidden

- Award-winning Peer-to-Peer investment platform UK | Kuflink

- Personal Loans & Other Online Financial Solutions | Prosper

- Invest - Invest in helping real people Diversify & Earn

- Invest in private assets like real estate

- Invest online in startups via equity crowdfunding | Republic Europe