When Trust Breaks: Lessons from Koregraf’s Shutdown for B2B Crowdfunding Platforms

No time to read? Let AI give you a quick summary of this article.

Koregraf, once a prominent French real estate crowdfunding platform, ceased operations in May 20251. Despite its promising start and regulatory compliance under the European Crowdfunding Service Providers (ECSP) framework, the platform’s closure has raised concerns about the stability and transparency of B2B crowdfunding platforms.

This event is more than an isolated misfortune. It is a case study in what can go wrong when strategic focus, communication, risk management and investor trust are mishandled. As the industry continues to grow under the European Crowdfunding Service Providers (ECSP) regulation, Koregraf’s downfall offers valuable lessons for platform operators and investors alike.

This article delves into the factors that have led to Koregraf’s shutdown, the missteps that contributed to its downfall and the broader implications for all participants in the crowdfunding industry.

What you will learn in this post:

Koregraf’s rise and fall

Established in 2014, Koregraf2 positioned itself as a bridge between investors and real estate developers. It offered investment opportunities in property development projects across France. The platform allowed both retail and institutional investors to invest in real estate bonds, offering fixed returns over periods typically ranging from 12 to 36 months. With a reported €232 million raised and a low default rate, Koregraf appeared to be a reliable option for investors seeking alternative assets.

However, in mid-2024, Koregraf was acquired by Inter Invest, a move that signaled potential shifts in the platform’s strategic direction. By May 2025, Koregraf announced its decision to cease operations leaving many investors wondering about their invested capital and returns.

Factors that led to the shutdown

How could a platform this big cease to exist? Let’s explore the factors that might have led to the collapse of a large crowdfunding platform.

Overreliance on market conditions

Koregraf’s business model was heavily dependent on the French real estate market, particularly residential development projects. While the platform reported an average annual return of 9% and funded 399 projects2, its focus on a single asset class made it vulnerable to market fluctuations.

As France’s property market began to slow3, so too did project returns. Rising interest rates, construction delays, and inflationary pressures squeezed developers. It ultimately affected their ability to deliver on promises to investors.

Limited project diversification

This lack of diversification across asset classes and geographies left Koregraf vulnerable. A more resilient model would have included exposure to multiple sectors, such as renewable energy or technology and expansion beyond French borders.

Diversification is a key strategy in investment to spread risk. By focusing solely on one sector and region, Koregraf’s investors were more susceptible to localized economic downturns or sector-specific challenges.

Lack of transparency and communication

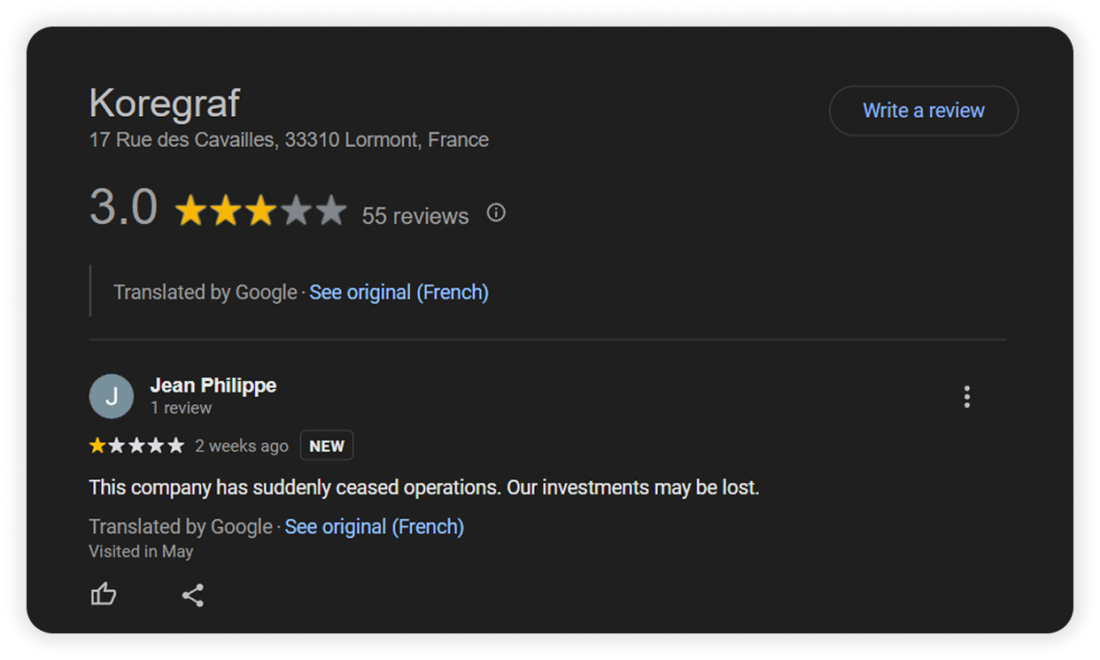

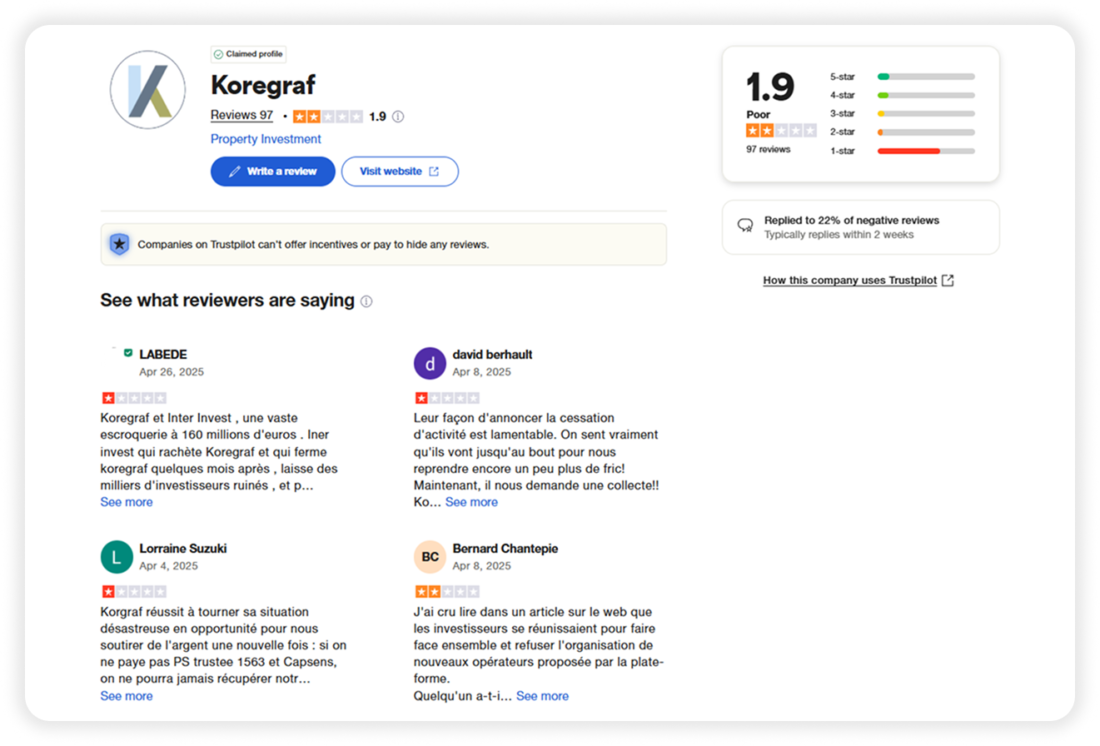

Investor trust is easily shaken when updates are delayed or incomplete. Reviews on Google4 and TrustPilot5 point to significant dissatisfaction around transparency, especially concerning delayed or stalled projects.

Investors reported not hearing from the platform for extended periods and not receiving clear updates about the status of their funds.

In crowdfunding, where participants often lack direct control over their investments, trust is maintained primarily through timely and honest communication. Koregraf’s silence during critical moments was a red flag.

Regulatory compliance and adaptability

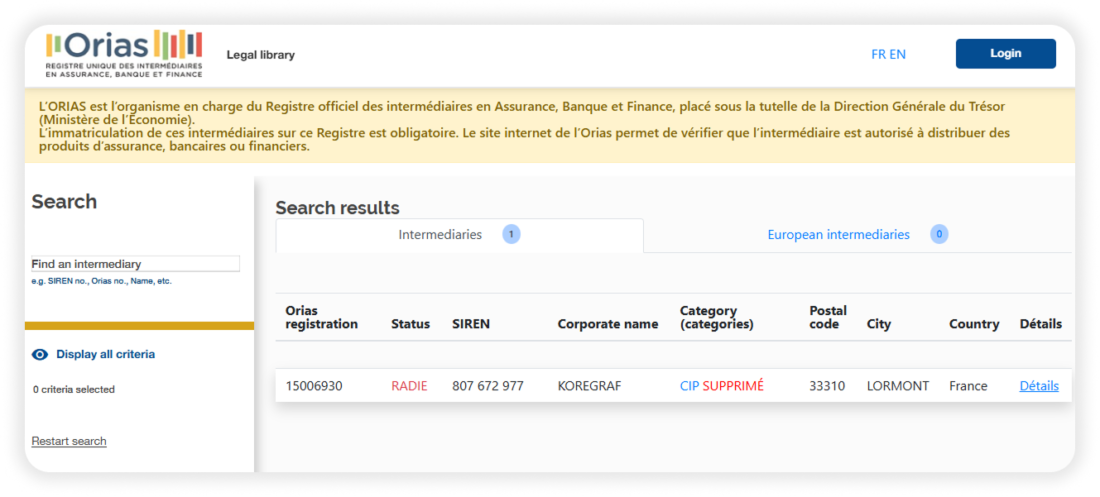

Koregraf was a regulated crowdfunding platform in France. It operated under the authorization of the Autorité des Marchés Financiers8 (AMF) as a Participative Investment Advisor9 (Conseiller en Investissement Participatif – CIP) and was registered with the Organisation for the Single Register10 of Intermediaries in Insurance, Banking, and Finance (ORIAS) under number 15006930. This regulatory status required Koregraf to adhere to specific guidelines concerning investor protection, transparency, and risk management.

In addition to its CIP status, Koregraf was also licensed under the European Crowdfunding Service Providers (ECSP) regulation11, which came into effect in November 2021. This regulation aimed to harmonize crowdfunding rules across the European Union and allow platforms like Koregraf to operate in multiple EU countries under a single regulatory framework.

Despite holding these licenses, the platform’s eventual shutdown indicates that regulatory compliance alone does not guarantee operational success or investor protection. Factors such as market conditions, project diversification, transparency and robust risk management practices are equally important to ensure the sustainability of crowdfunding platforms.

What platform owners may learn from Koregraf’s shutdown

Koregraf’s downfall is not just a story about one company failing. It is a warning for platform owners across the crowdfunding sector. At its core, Koregraf showed that a polished interface and regulatory license alone are not enough to sustain trust or operational longevity.

Many platforms focus too heavily on onboarding new projects and scaling up quickly, but they don’t build a solid foundation of due diligence and portfolio stress testing. This is especially true in sectors like real estate, where delays, cost overruns or economic shifts can derail timelines and returns.

Equally critical is active investor communication. Crowdfunding is not a “set it and forget it” service. Investors expect visibility not just when things go well, but especially when projects run into trouble. Koregraf’s reputation suffered partly because investors felt ignored or misled during periods of uncertainty. So, crowdfunding platforms owners must establish clear, consistent lines of communication and deliver updates even when the news is unfavorable.

Another key lesson is not to over-rely on favorable market conditions. Koregraf grew in an era of low interest rates and real estate optimism. When market momentum slowed, it lacked the agility to pivot or protect investors. Crowdfunding platforms should build resilience into their business model by diversifying both their investment offerings and their revenue sources.

Compliance with regulations like the ECSP is necessary but not sufficient. Being licensed might bring credibility on paper, but without real operational discipline and governance, that license becomes meaningless when cracks begin to show.

Crowdfunding platform owners should view Koregraf’s closure as a mirror: it reflects what happens when trust is broken, communication breaks down and strategic foresight is missing. The path forward lies in rebuilding the model with greater discipline, stronger investor safeguards and humility in the face of risk.

Lessons for investors after Koregraf’s collapse

Koregraf’s shutdown also serves as a hard lesson for investors who use crowdfunding platforms, particularly in high-stakes sectors like real estate. While crowdfunding democratizes access to investments, it does not eliminate risk, and Koregraf’s story proves that even regulated platforms can go dark.

Investors must understand that crowdfunding is not a guaranteed or passive income source. Many individuals attracted by Koregraf’s sleek branding and promises of strong returns got a false sense of security. The lesson: always read the fine print. Promised yields are not assured outcomes, especially when tied to construction timelines, market fluctuations or developer performance.

Secondly, diversification is critical. Some investors reportedly put large sums into only one or two Koregraf projects, and when those projects underperformed or became illiquid, losses became personal disasters. Investors should spread capital across multiple projects, platforms, and even asset types to reduce their exposure to single-point failures.

Another key takeaway is to check project fundamentals, not just the platform’s promotional materials by asking:

- Who is the developer?

- What is their track record?

- What guarantees are in place?

- What happens if delays occur?

Koregraf’s collapse showed that some investors didn’t fully grasp the operational or financial risks behind the façade of digital efficiency.

Importantly, regulation does not mean protection. Koregraf held an ECSP license, which gave it regulatory cover but did not shield investors from poor project selection, market downturns or the platform’s missteps. Investors must distinguish between platforms that simply meet legal requirements and those that go beyond with real transparency, active risk management, and investor-first governance.

Finally, stay informed and involved. Passive investors are the most vulnerable when things go wrong. In the case of Koregraf, many investors were blindsided due to a lack of consistent communication.

In short, Koregraf’s collapse reminds investors to treat crowdfunding with the same seriousness, scrutiny and caution they would apply to any high-risk investment class. The opportunity remains, but only for those who understand the risks and do their homework.

How to build a transparent and compliant crowdfunding platform with LenderKit

Koregraf’s collapse taught the industry that trust, transparency and compliance are non-negotiables. Building a crowdfunding platform that can endure regulatory scrutiny and investor expectations requires the right technological and operational foundation for new entrants and established firms. This is where LenderKit steps in.

LenderKit offers white-label crowdfunding software tailored for regulated investment platforms in real estate or startup investing. Combining debt, equity, donation and rewards models, it helps firms build platforms that are fully compliant with ECSP regulations, integrate robust KYC/AML workflows and support multi-level user permission models for administrators, project owners and investors.

With customizable features, flexible frontend and data-rich backend, platform operators can easily enforce project vetting, automate onboarding, streamline transactions, access analytics and ensure real-time visibility of investment activity.

By working with LenderKit, companies can confidently launch platforms that meet both legal standards and investor expectations. But of course, your business is in your hands and even a robust tech solution does not guarantee a crowdfunding platform’s success.

Clearly, we might not know all of the nitty gritty details behind Koregraf, but if you want to do it right or do it better in terms of the tech setup — start with LenderKit. Get in touch with us to explore the crowdfunding software and see how it can be applied for your business.

Article sources:

- France: Real Estate Crowdfunding Platform Koregraf Ceases Operations | Crowdfund Insider

- Koregraf Review - Real Estate Crowdfunding in France - Overview, Analysis & Statistics | Crowdinform

- Just a moment...

- Bevor Sie zur Google Suche weitergehen

- Koregraf Reviews | Read Customer Service Reviews of www.koregraf.com

- Bevor Sie zur Google Suche weitergehen

- Orias

- Autorité des marchés financiers (AMF): Protection of savings, Investors' information and proper functioning of financial markets | AMF

- Conseiller en Investissement Participatif CIP

- Orias

- Crowdfunding - Finance - European Commission