5 Trends in Real Estate Investing

No time to read? Let AI give you a quick summary of this article.

Real estate is a vast sector with a lot of investment opportunities, but in this article we will talk about 5 latest trends in real estate investing, and explore why they are actually trending. While property investing trends can be anything, investors have been paying attention to the following segments:

- Investing in data centers

- Investing in real estate located in warm regions

- Investing in rental property

- Investing in single-family housing

- Investing in solar energy projects

Focusing on the latest real estate investing trends allows investors to stay ahead of the game with a potential to earn money in the long run, investment platforms benefit from additional marketing boost and project owners can get more funds due to the growing popularity of specific niches.

What you will learn in this post:

Data centers

Investing in data centers is increasing in volume1, even though investing in this sector is far from new.

Big tech companies such as Microsoft or Amazon normally spend billions on data centers on a yearly basis, Digital Realty2, a real estate investment trust, focused on financing data centers, and Equinix3, a company that operates over 200 data centers all around the world, have had big data center development pipelines for a long time.

However, now, data center development is charged with the growing demands of artificial intelligence technology that requires huge data volumes to be trained. Other factors that contribute to attracting the attention of institutional investors to the sector are the growing demand for cloud computing solutions and digital infrastructure. As more companies adopt AI into their processes or migrate their business information to the cloud, more data centers will be needed.

Sun Belt properties

People tend to purchase real estate located in the so-called “Sun Belt”4 more willingly than in regions with colder climates. The “Sun Belt”5 is an area that stretches from California to South Carolina. It encompasses 18 southern states and includes 7 of the 10 largest cities in the USA.

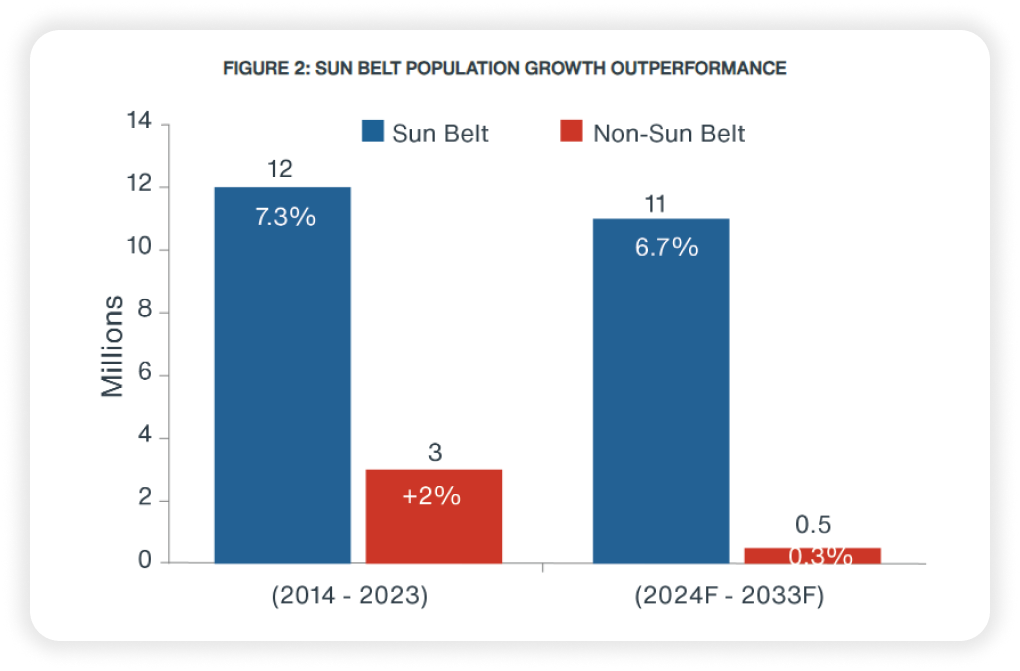

This area holds over 50% of the US population6, and over the last decade, this region accounted for 80% of the US population growth.

It is expected that this trend will persist in the future and affect the growth of these sectors:

- Office

- Industrial

- Multifamily

- Retail

- Hotel

Over the next decade, the “Sun Belt” population is expected to increase by another 7%, while other areas are expected to rise by just 0.3%.

Interestingly, many cities in the “Sun Belt” such as San Jose, Austin, and Houston have a lower homeownership rate than the national level (50%-60% compared to 65%, respectively). It means that there is a scalable opportunity to invest in rental housing in this region.

Major cities in the “Sun Belt” region have reported housing costs lower than in gateway cities. With the growing population, the demand for housing will increase and push prices up. These are the main reasons why this area attracted the increased attention of real estate investors.

Rental property

The growing mortgage rates and prices of residential property push prices up. For example, the difference between owning an entry-level house ($3,587 per month4) and renting one ($2,178) is $1,400. This is one of the main reasons why tenants do not hurry to buy their own residential property.

Another reason why young adults do not buy their own homes is student debt and other similar obligations. Some people also want to enjoy all the benefits of owning a home without the associated responsibilities of a homeowner.

The growing demand for residential rental property leads to the influx of capital from real estate investment trusts, private equity companies, and even individual investors.

However, the situation is different in commercial rental property.

Since the COVID-19 pandemic, commercial real estate has been impacted heavily7 by changing working patterns. In Q3 2023, the number of office vacancies rose to 19.6%, and 70% of Americans prefer a working arrangement fully or completely in person. This is why the demand for rental office space is dropping.

The same cannot be said about the shopping center spaces. The national level of rent for shopping centers is the highest since before the onset of the pandemic in early 2020, and this trend is likely to stay.

Single-family housing

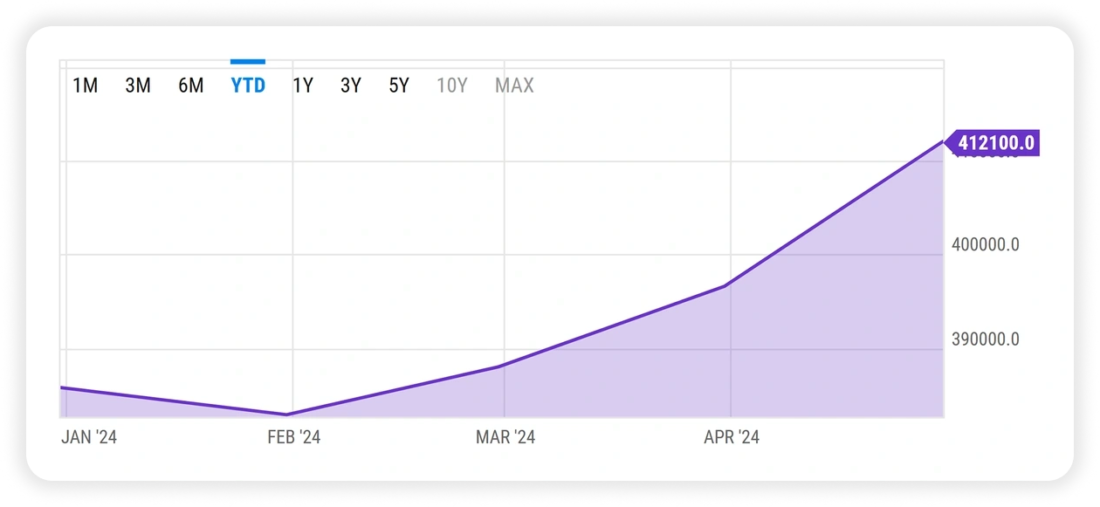

Due to the growing demands in single-family housing and unstable supply, prices for single-family homes have increased by 43% over the last 4 years8. Since January 2024 only, prices for single-family housing in the USA have increased by 7.6%.

While for first-home buyers this trend doesn’t look optimistic, homeowners and investors can literally observe how their assets are increasing in value. This fuels the interest of investors.

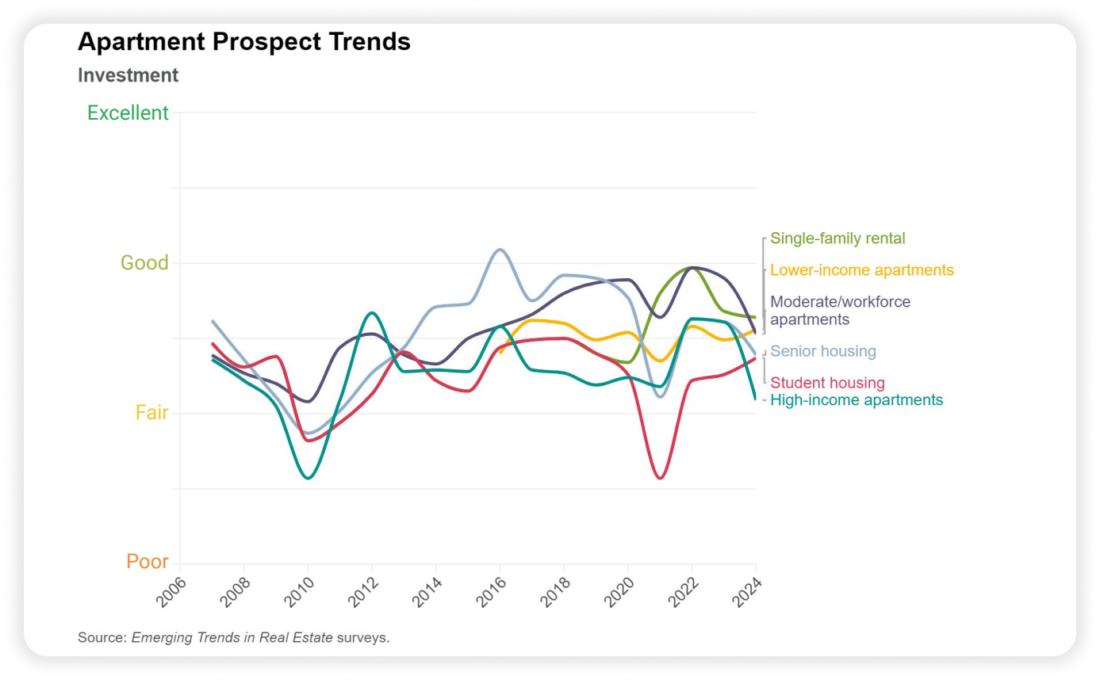

Special attention shall be paid to the single-family home rental market. High mortgage rates and elevated costs make it difficult to purchase housing, and renting a single-family home is suitable for those who grew out of an apartment but cannot afford to purchase a house or for those who prefer to enjoy living in a house without bearing the responsibilities of a homeowner.

The growing interest of tenants also attracts investors to this sector. Real estate investment trusts and private equity firms have been acquiring and managing such rental properties actively recently. Considering the growing cost of housing4 and the fact that young adults constitute a significant part4 of the rental market, investing in single-family rental housing looks promising in the long term.

Solar energy projects

The private real estate industry turns its face to solar energy. New York-based CBRE Investment Management9 announced its willingness to scale the development of solar projects within its own portfolio. Vancouver-based QuadReal Property Group10 made its first direct investment in solar energy projects by installing rooftop solar in their warehouses.

Decarbonization efforts of governments, dropping costs of solar installations, and increasing interest of tenants in the reduction of the carbon intensity of their properties motivate real estate developers and investors to choose solar installations instead of traditional ways of getting electricity.

Along with residential real estate, commercial real estate developers and owners are getting increasingly interested in solar energy. For example, data centers consume plenty of energy, around 1% of global usage11. Considering that the industry strives toward zero emissions, and the growth in the number of local, state, and federal tax incentives aimed at providing support to projects with lower emissions, solar energy investment is becoming increasingly attractive.

Launching a real estate crowdinvesting platform with LenderKit

Considering growing investing rates in real estate, it may be the right time to launch a real estate crowdinvesting platform. With real estate crowdfunding software from LenderKit, you can launch your online real estate investment platform faster than if you were building it from scratch.

Our real estate investing software comes with a set of ready-made features that allow you to create investment campaigns, onboard investors, manage deals, transactions, KYC data and leverage analytics to improve your platform performance while closing more deals online.

LenderKit has powerful integrations with third-party KYC/AML providers, payment gateways, custodians, e-Sign, security and usability tools. Moreover, we also offer robust platform customization and development, so your real estate investment platform can become a unique and competitive market player.

If you’d like to learn more about our white-label real estate investment software – don’t hesitate to fill out the contact form and our team will get in touch with you.

Article sources:

- Increasing in volume

- Digital Realty | Data Center Services & Colocation

- About Us | Global Platform for Digital Infrastructure | Equinix

- PDF (https://www.pwc.com/us/en/industries/financial-services/images/pwc-2024-etre-...)

- Sun Belt - Wikipedia

- Sun Belt Real Estate Boom | Clarion Partners

- 9 Top Real Estate Trends In 2024

- US Median Price for Existing Single Family Home (Monthly) -…

- CBRE Investment Management | Institution Profile | PERE

- QuadReal Property Company | Institution Profile | PERE

- Property owners take a shine to solar