Benefits of Crowdfunding for Investors

No time to read? Let AI give you a quick summary of this article.

Crowdfunding offers multiple options for investors to earn money.

For example, P2P lending allows investors to lend funds and receive interest payments while equity crowdfunding enables funders to get dividends or benefit from business appreciation when it is sold at a higher price.

Real estate crowdinvesting allows getting a share in real estate and getting an income from it. Finally, one can always refer friends and colleagues and earn an affiliate commission or cashback.

Let’s explore all these investor earning opportunities in crowdfunding in more detail.

What you will learn in this post:

P2P lending

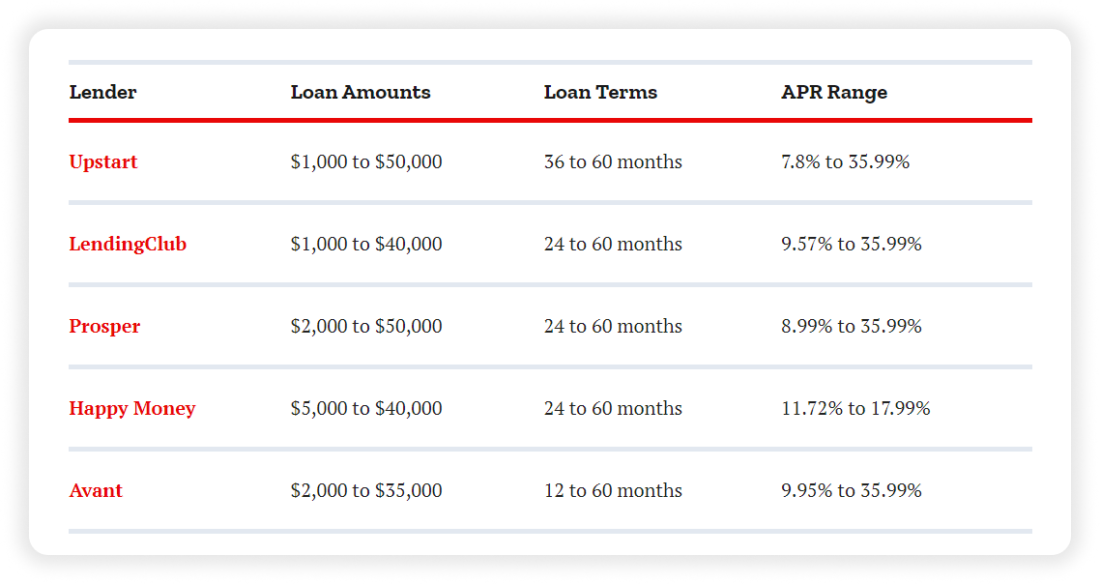

P2P lending allows individuals to invest in loans originated by lending platforms. The loans can be issued to businesses or individuals, and investors choose the investment size, in which loans they are willing to invest, and the loan conditions. Investors can also specify their requirements to a borrower such as a certain credit score.

P2P lending offers investors multiple benefits.

Steady source of passive income

Investors get paid when lenders make their monthly loan payments. If you as an investor have a portfolio of several loans, you can potentially generate a steady source of income. Most P2P lending platforms offer loans for 1 to 5 years, which means that by investing steadily, you can ensure a consistent income during a significant period.

The annual return varies from around 8% to over 30%1. Borrowers with a fair or lower credit score have to pay higher interest rates, and those with a high credit score pay lower interest rates that can be comparable to those offered by banks.

Thus, p2p crowdfunding loans can offer investors potentially very high returns at the cost of higher risks. However, compared to investing in a traditional stock market with an average annual return of 8%2, investing in P2P lending looks much more lucrative.

Compared to investing in bonds that normally have a much longer time horizon (common treasury bonds last from 20 to 30 years), investing in P2P lending allows you to see profits significantly faster, but it also comes with increased risks.

Predictability of returns

The predictability of returns is another benefit of investing in crowdlending. By investing in a loan, investors get a repayment schedule and can see what the expected returns are. This is one of the reasons for choosing P2P lending rather than any other form of investing.

Tax deduction

Income received from lending is taxed, however, investors may recover some of the expenses related to their peer-to-peer lending activity. For example, an investor can deduct any fees3 charged by the crowdlending platform, and if a borrower fails to repay the loan, an investor may claim a bad debt deduction on their tax return.

Low entry barrier

Many platforms such as Prosper allow investing in loans with as little as $254, while others, such as LendingClub5, require at least $1,000 to fund an account. Either way, this is much more affordable than traditional investment opportunities.

Equity crowdfunding

Equity crowdfunding is another source of income for investors. In equity crowdfunding, investors buy a share in a company that owns an asset: a plot of land, a construction, or any other property.

Investors get returns in the form of dividends or when the business valuation increases.

Here are the main equity crowdfunding benefits for investors.

Potential for high returns

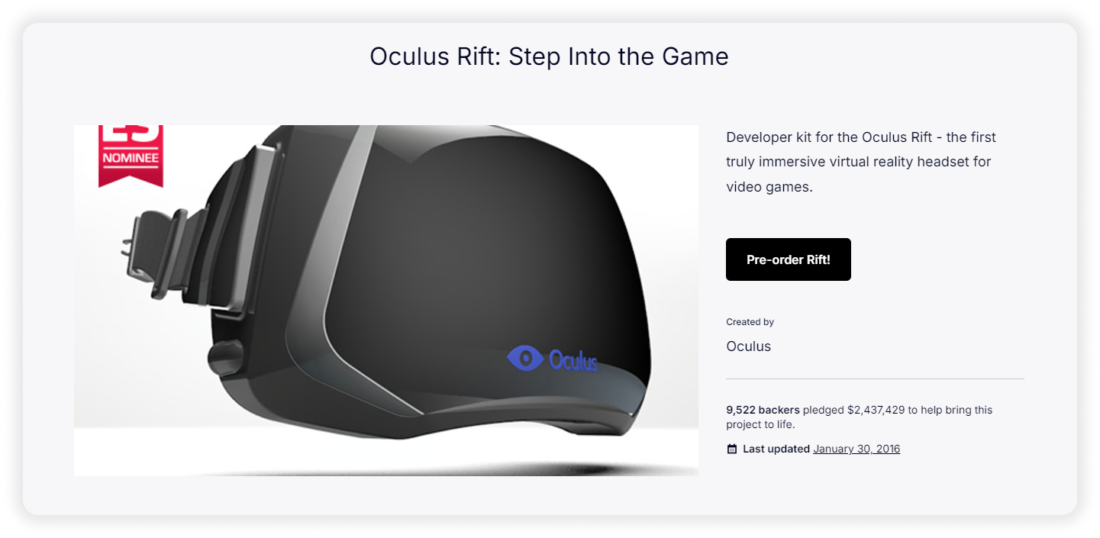

Investment returns depend on the business’s success and are potentially unlimited. Take for example the case of Oculus Rift that was funded on Kickstarter6.

Over 9,500 backers funded more than $2,400,000 for the device development, and later, Meta purchased the project for $2 bln7. If instead of being donors, funders were investors, they would realize significant profits on the project acquisition event (an investment of $250 would result in somewhere between $36,000 and $50,0008)

Investor protection

The Securities and Exchange Commission (the SEC9) adopted rules to regulate equity crowdfunding (Reg CF10). This regulation sets requirements for crowdfunding platforms, businesses raising funds, and investors to ensure maximum transparency and protect investors.

Tax relief

Investors can benefit from up to 30% tax relief11 on their equity crowdfunding investments, and they can also claim loss relief if the company they’ve invested in enters administration or is sold for less than its initial value.

Real estate crowdfunding

Real estate crowdfunding models can include both lending and equity crowdfunding. Investors don’t need to purchase the entire property, they can buy a share of it, and receive a part of the profit that the property generates. Along with the advantages offered by the equity crowdfunding model, real estate investors can benefit from a rental income and property appreciation when it is sold.

Affiliate programs for investors

Investing in promising projects and lending funds are not the only ways to earn with crowdfunding platforms. Many platforms offer lucrative affiliate commissions for referring investors and fundraisers.

CrowdCube12 pays up to EUR 10,000 for each business that was successfully funded on the platform. All the communication, campaign planning, and other processes are managed by the platform directly, and payments are made 30 days after the crowdfunding campaign is closed.

StartEngine13 pays a $10,000 bonus for any company that starts raising funds on the platform. The bonus is payable within 60 days from the day when the agreement with a fundraising company is signed.

Donorbox14 pays a 15% commission on the referral’s Donorbox fees for their first three years on Donorbox. For this commission, all fees charged by the platform are considered except Donorbox Premium payments.

GoGetFunding15 pays a 2% affiliate commission on everything that referrals raise. For example, if a referral raises $5,000 you get $100.

Kuflink16 is a platform that offers investing in loans secured by British real estate. The platform pays a bonus on each investment made by a referral within 14 days of opening an account. The rate starts at 2% for investments of 500 pounds and goes up to 4% for larger investments.

Sign-up and registration bonuses and cashback

Some platforms offer bonuses for opening an account, and some give cash back on the first investment. Here are some of the offers to benefit from.

EstateGuru17 offers a 0.5% cashback bonus for both a referred and a referring party on all investments that a referred party makes in the first 90 days following their registration. Additionally, if a referred party invests at least $500 in the same period, both parties get an EUR15 investment credit.

Lande18, a platform offering loans secured by farmland offers investors a 1% cashback on all funds invested within 90 days from opening an account.

Bottom line

If you want to launch your own crowdinvesting platform, you can benefit from the experience of other market players and combine the best advantages to attract investors and projects. And LenderKit can assist you with the technical side by offering a white-label crowdfunding software solution that fits your business model and expectations. To learn more, please get in touch with us.

Article sources:

- 8% to over 30%

- P2P Lending: Why You Should Add It To Your Portfolio in 2023

- Peer to Peer Lending: A Modern Approach to Investment Income - FasterCapital

- Invest - Invest in helping real people Diversify & Earn

- Online Personal Loans + Full-Service Banking | LendingClub

- Kickstarter

- Facebook to Acquire Oculus

- Invest through Equity Crowdfunding: Risks and Rewards

- SEC.gov | Home

- SEC.gov | Regulation Crowdfunding

- 30% tax relief

- Just a moment...

- StartEngine Scout - Find Investment Opportunities

- Donorbox

- Crowdfunding Affiliates, White Label Crowdfunding & More

- 403 Forbidden

- Robot Challenge Screen

- LANDE