Blockchain-Based Securities in the UK: Regulation of Crypto-Assets

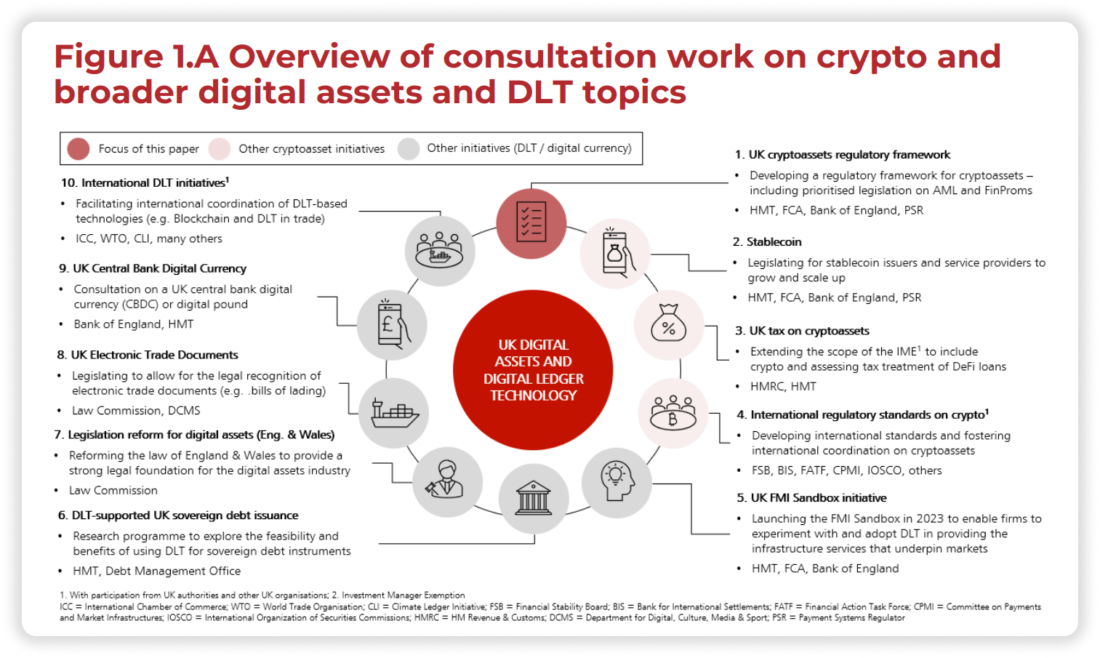

As the crypto and asset tokenization industry develops, many countries strive to regulate crypto assets to mitigate fraud and provide a clear operational environment for online businesses. The HM Treasury has been working on a regulatory framework for some time and, in 2023, published the Future Financial Services Regulatory Regime for Cryptoassets document where they describe the main goals, prerequisites and requirements for regulating crypto assets in the UK.

At the moment, the HM Treasury is collecting public feedback on the proposed regulatory framework of crypto assets, but it is clear once the document is formalized, the future of crypto-assets in the UK will be determined.

The HM Treasury states in the document, that 5-10% of adults own crypto-assets which is an increase by 100% over the last few years. And even though the market was down by 75% in 2022, a couple of lending firms and trading platforms failed such as Celsius Network and Voyager Digital, the regulator believes this is the right time to outline the major crypto assets guidelines and requirements.

What you will learn in this post:

What is the Future Financial Services Regulatory Regime for Cryptoassets document by HM Treasury?

The crypto assets document by HM Treasury tackles such matters as the classification of crypto assets in the UK and possible ways to regulate them.

It is specified that the closest parallel to the crypto assets creation, issuance and distribution exists in the securities market. However, regulating them as securities is difficult because their creators can be located anywhere and cannot be identified in most cases.

Even if it is possible to find out who the asset creators are, they don’t have such control over the created crypto assets like companies have over the issued shares. And the assets don’t behave like traditional securities such as equity instruments or bonds.

That’s why for the admission of crypto assets to trading venues, the HM Treasury offers to apply a multilateral trading facility (MTF) model. This term is used for a trading system that facilitates exchanging of financial instruments between multiple partners.

The FCA will prepare a list of principles and requirements for asset admission by a crypto trading venue, and crypto trading platforms will prepare detailed disclosure documentation and content requirements.

Each trading venue willing to list an asset will have to perform its own due diligence on the entity that issues the asset, and if there is no such entity, the trading venue accepts all the responsibility of an issuing entity.

All public offers of crypto assets including ICOs are considered security offerings and will be regulated by the Financial Conduct Authority (FCA) within the existing framework. There is a general prohibition on public offerings of securities with some exemptions. Within the exemptions, securities can be:

- Admitted to trading on a UK-regulated market

- Offered via a public offer platform such as a crowdfunding platform

- Admitted to trading on MFTs operating primary markets.

Also offers that are made to qualified investors, within a limited monetary minimum, or to less than 150 persons also are within the exemptions.

The offerings of crypto assets that don’t meet the definition of a security token will be permitted only through a regulated platform. The platforms will be responsible for performing due diligence according to their rules.

Are crypto assets and tokenized securities regulated in the UK?

The proposed document, Future financial services regulatory regime for cryptoassets, contains ideas, suggestions and a draft of the regulatory framework of crypto assets in the UK. That’s why the institution requests all interested parties to participate in the discussion of future regulation and share their propositions.

What law firms and businesses think about the regulation of crypto assets in the UK?

The publication has caused heated discussions among law consulting firms. So, the UK Jurisdiction Taskforce of LawtechUK has expressed its ideas on the proposed regulation in their UKJT Legal Statement on Digital Securities. They believe that the UK legislation has always been clear and transparent and always ahead of technology. In the case of crypto assets, the UK also aims at being as transparent as possible.

The UK Jurisdiction Taskforce of LawtechUK believes that blockchain, crypto and security digitalization is a great technology that can be applied in a wide range of fields. But to speed up its acceptance, clarity in regulation is needed. The UKJT Legal Statement on Digital Securities aims to add the required clarity, and facilitate making the preferred standard for the governance of digital securities in general and tokenized debt and equity securities specifically. This narrow focus will allow to create clear regulation principles and guidelines.

Another leading legal company Arthur Cox also believes that the document published by LawtechUK provides an accessible view of the legal status of cryptocurrency assets. With the defined regulatory framework for crypto assets, the uncertainty around them will start dissipating, and it means that in the near future, regulators will be able to assess what measures they need to take to establish security in the crypto market.

How to access the UK crypto market with LenderKit

It looks like it is the right time to enter the UK market with a properly developed debt or equity securities tokenization platform. That’s why if you are thinking about launching your own platform, picking a white-label crowdfunding software solution by LenderKit may help you to do it asap and without excessive expenses.

LenderKit crowdfunding solutions come with integrations with all the required third-party services including tokenization, digital signatures, payment solutions, and identity verification providers. All payment providers enable your platform to work with big volumes of data and are authorized by regulators. The integrations with KYC/AML make the due diligence processes more effortless and ensure compliance with the regulators’ requirements.

Each investment solution comes with a set of features that ensure the basic functionality of your platform, with customization options available to match your crypto-lending business or asset-tokenization platform’s requirements.

If you want to learn more about the LenderKit investment solutions, you can book a virtual tour or reach out to our fintech strategist for an online demo.