Crowdfunding in Ghana: Regulations Update and Market Overview

No time to read? Let AI give you a quick summary of this article.

On the 7th of March 2024, the Securities and Exchange Commission of Ghana (SEC)1 in collaboration with the United Nations Development Fund (UNCFD)2 issued comprehensive guidelines for investment-based crowdfunding in Ghana3. These guidelines are designed to unlock the full potential of investment-based crowdfunding in the country and to protect investors from scams. These guidelines do not apply to donation-based and reward-based platforms that are regulated by the Bank of Ghana.

Here are the main positions to pay attention to for entrepreneurs and companies willing to launch an investment-based crowdfunding platform in Ghana.

What you will learn in this post:

Licensing requirements for crowdfunding platforms in Ghana

An entity that wants to provide services as a crowdinvesing platform or a foreign crowdfunding platform willing to operate in Ghana should obtain a license from the regulator. To submit the application, the entity shall meet the following criteria.

- The applicant needs to have a risk management framework that allows to handle all operational and business risks.

- The platform has to submit an Operational Manual that provides a detailed description of how all operations are managed.

- The company then provides the rules of how all the operations are managed, because these rules are subject to approval from the SEC.

- Finally, the platform should have sufficient financial, human, and other resources to operate the business, including the minimum capital requirement of 250K of Ghanaian Cedi which is around $20,000.

Funds raised through a crowdfunding platform registered in Ghana shall be utilized in the country.

A company filing an application should have at least three directors including an executive director who:

- Has at least an undergraduate degree in Finance, Commerce, Accounting, Business, Administration, Law, or another field relevant to crowdfunding activities.

- Has at least 5 years of relevant experience in a similar role such as fund management.

- Meet the Fit and Proper Persons requirements4 (Conduct of Business) guidelines 2020, and the Securities Industry5 (Licensing guidelines) 2020.

Once all application documents are complete and submitted, the SEC revises them and makes its decision within 90 days.

The licensing fees are determined by the SEC and can be changed.

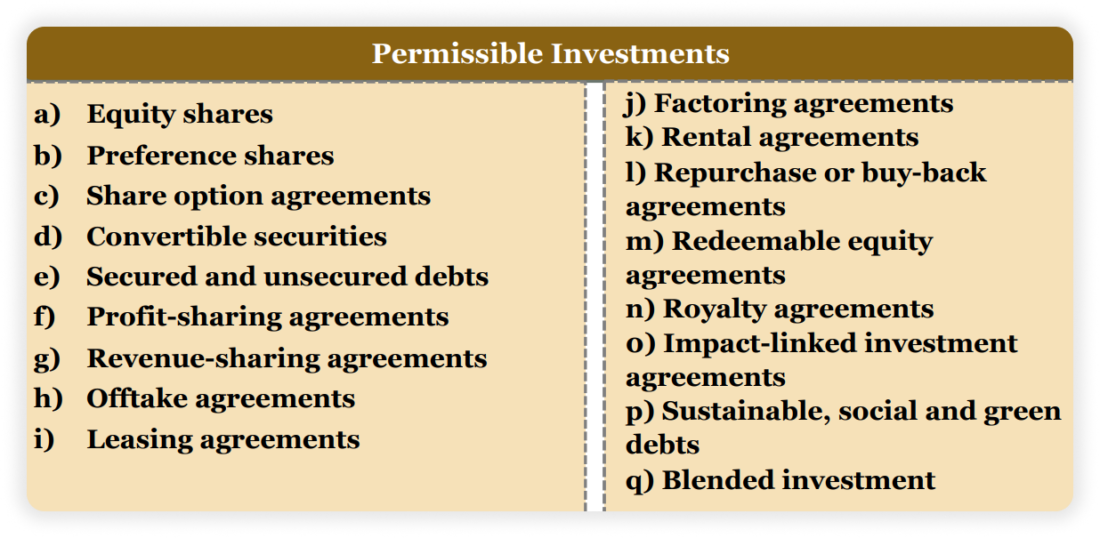

Permissible crowdfunding investments

The SEC in Ghana has a list of permissible crowdfunding investments which include a variety of instruments from equity shares and convertibles to retail agreements and blended investments.

If an investment instrument or activity requires additional approvals, including from other regulators, such approvals shall be obtained before offering it to investors.

Investment and capital raising limits in Ghana

The maximum amount to raise for an issuer is 6,000,000 GHS which is around. 390,000 USD. In the cases when funds are raised for agricultural commodities, physical assets, or agricultural projects, the maximum amount to raise is 10,000,000 GHS or about 652,000 USD.

An issuer cannot raise funds on a platform where the platform’s officers, directors, significant shareholders or other associated persons own more than 5% of the issuer’s securities. Only if the issuer is a special purpose vehicle (SPV), these limitations do not apply.

Qualified investors are not limited to how much they can invest, but retail investors are permitted to invest in crowdfunding offerings not more than 10% of their gross annual income across all platforms in a 12-month period.

Top payment gateways for crowdfunding in Ghana

A crowdfunding intermediary needs to use an escrow or trust account provided by a bank licensed by the SEC as a custodian or have a contract with a partner custodian.

Here are the top payment service providers that collaborate with crowdfunding platforms in Ghana.

Paystack

Paystack6 enables Ghanaian businesses to receive and send funds online all around the world. This provider supports all the popular payment methods:

- Bank card

- Bank account

- Apple Pay

- Mobile Money, among others.

Platforms can opt for an API integration or custom options to increase customer loyalty. The integration is easy and fast, with no fees paid.

For both local and international transactions, Paystack charges only 1.95% of the transfer sum.

PaySwitch

PaySwitch7 was launched in 2015 and is a wholly Ghanaian company. It operates under the new Payment Systems and Service Act, 2019, and holds a license from the Bank of Ghana.

The provider mainly operates with banks, financial venues, and startups in fintech, including those operating in the crowdfunding sector.

For startups, the Payments incubator program by PaySwitch may be interesting. Within this program, startups can enjoy the widest array of payment options through a very simple programming interface without the hassle of communicating with multiple payment service providers and upfront fees.

Rates are negotiated with each business individually.

Flutterwave

Flutterwave8 allows businesses to accept payments from around the world in more than 30 currencies. Integration via an API enables businesses to make quick transfers, set up one-time and recurring payments, and perform payment verification and customer verification procedures. The provider supports over 15 payment options including bank cards, mobile money, payments to bank accounts, and others.

The provider charges 2.9% for a local transaction and 3.8% for an international transaction. Custom pricing is available, too, and depends on the business size and transaction volumes.

Interpay

Interpay9 is an electronic payment platform that enables simple, fast, and secure transactions. With it, businesses can facilitate payment collection, disbursement, and also authentication and reconciliation of payments received and outstanding.

The platform supports all the major payment options:

- Visa & Mastercard

- Mobile Money (MTN, Airtel Money, Mobile Money, Vodafone Cash, Tigo Cash)

- GHLink

- Cash at Interpay payment banks

- Slydepay

- Interpay wallets

All fees are transaction-based, and the integration is free.

Kowri

Kowri10 is a financial platform that evolved from Slydepay, a platform launched in 2021 to provide popular payment processing solutions to individuals and businesses across Ghana. Slydepay was a pioneering payment processor that worked with fintech companies in the country.

Now, Kowri offers an easy way to make transactions for individuals through a mobile app, and businesses can benefit from API integration.

While Kowri offers rather limited options for the crowdinvesting sector, it can be considered as an option that is popular among the Ghanaian population.

How to launch a crowdinvesting platform in Ghana

Launching a crowdinvesting platform is a lengthy process that requires a lot of resources, that’s why a white-label crowdfunding software from LenderKit may be of great help. You can consider a solution for SME lending, equity crowdfunding, private equity, real estate financing or even combine several models.

LenderKit investment software comes with a set of features that will help you make your platform operational as soon as possible. The platform comes with the required functionality to manage investors and fundraisers, create offerings, export data for reporting and more to run a sustainable crowdinvesting business.

Apart from that, it already includes important integrations for KYC/AML checks, document management and payment processing. And if you need custom integrations, design or functionality, our team can do the required adjustments for your specific setup.

Article sources:

- The Securities and Exchange Commission of Ghana (SEC)

- UN Capital Development Fund (UNCDF)

- PDF (https://sec.gov.gh/wp-content/uploads/Final-Regulatory-Laws/Guidelines/SEC_Cr...)

- PDF (https://www.bog.gov.gh/wp-content/uploads/2019/09/FIT-AND-PROPER-PERSONS-DIRE...)

- PDF (https://sec.gov.gh/wp-content/uploads/Final-Regulatory-Laws/Guidelines/Licens...)

- Paystack - Modern online and offline payments for Africa

- PaySwitch Company Ltd.

- Endless possibilities for every business - Flutterwave

- Interpay

- Kowri – Digital Financial App for Africa