Crowdfunding in Morocco: What You Need to Know

No time to read? Let AI give you a quick summary of this article.

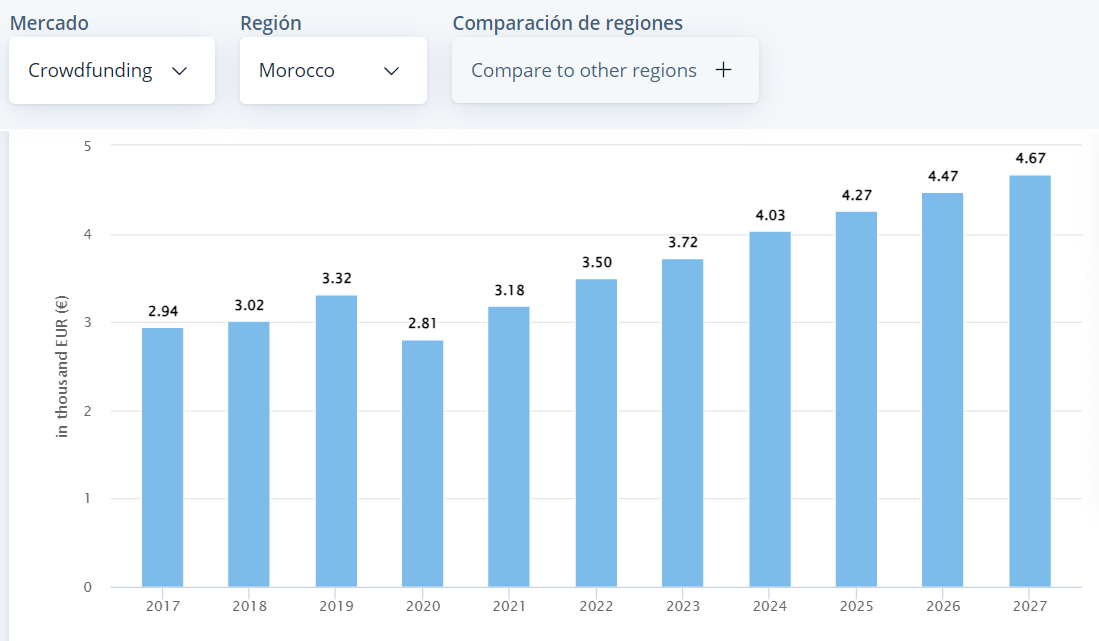

The crowdfunding market in Morocco is still in its infancy, with the volumes raised in 2023 reaching only 3.72K Euro. However, this sector is developing, and it is forecasted that the growth, even though not very rapid, will continue, and by 2027, the volumes raised with the help of crowdfunding will reach 4.67K Euro.

What you will learn in this post:

The history of crowdfunding in Morocco

The first crowdfunding platform in Morocco was a donation-based Happy Smala1. The platform was launched in 2014, and since then, it has been working to support innovative projects and individuals.

There, all types of companies can raise funds to develop and implement projects focused on citizen engagement, education, financial inclusion, and other innovative initiatives. Crowdfunding platforms in Morocco not only provide a space where one can raise funds but also offer mentoring and coaching to entrepreneurs and project leaders.

Crowdfunding platforms in Morocco

There are several crowdfunding platforms in Morocco that vary by the investment type and offer various types of projects for potential investors and backers.

- Cotizi2 (2015) – a platform for collecting donations and launching petitions.

- Wuluj3 (2017) – a donation-based platform.

- Flowingo (2019) – the first investment-based crowdfunding platform that focused on connecting entrepreneurs and investors. The platform is inactive now.

- Dealkhir4 (2020) – a donation-based platform.

Even though there have been several platforms, with some of them operating for almost a decade, crowdfunding activities were not regulated. Only on August 31, 2023, regulatory authorities of Morocco AM (Bank Al-Maghrib5) and AMMC (Autorité Marocaine du Marché des Capitaux6) issued a legal framework for crowdfunding which came into force on April 31, 2023.

Crowdfunding regulations in Morocco

Even though the regulation is new and not all positions are developed, it establishes some clear norms and procedures that all crowdfunding platforms shall follow.

Types of crowdfunding in Morocco

So, based on the crowdfunding regulation7, all platforms that want to offer crowdfunding services in Morocco shall obtain authorization from the authorities. Businesses or individuals who conduct crowdfunding activities without permission are liable to criminal sanctions.

Crowdfunding financing is divided into three types:

- Donation or gift

- Lending-based, with or without interest

- Investment-based

Each of the crowdfunding forms has its specifics. This is why for each flow, a platform is required to have a separate permission which is issued by the Bank Al-Maghrib.

Platform authorization requirements

To register a crowdfunding platform in Morocco, business owners need to provide the following documentation to comply with the regulatory requirements:

- Comprehensive information about the company founder, and the company documentation.

- Documentation with detailed information about the company’s capital and its distribution among shareholders.

- Strategic objectives of the company and market research to demonstrate the viability of the company.

- A business plan for five years with pricing policy, growth strategies, and a clear roadmap.

- Anti-money laundering and counter-terrorism financing measures systems.

- Data protection measures aligned with regulatory requirements.

- Policies for selection and monitoring of projects.

In addition to the above-mentioned information, a crowdfunding platform in Morocco has to open an account for the Specialized Financing Company with a domiciliary bank and to ensure that the institution complies with the professional confidentiality requirements.

Finally, the platform must have at hand all documentation with clear rules about when the funds shall be returned to the contributors and the forms of doing so. A Moroccan crowdfunding platform must define the financial rights and obligations of the parties and lay out the principles of resolving disputes.

Projects and investors that can participate in crowdfunding

Projects of all types can raise funds in crowdfunding, including:

- Educational

- Social

- Cultural

- Environmental

- Technological

The only exception is real-estate development projects and any projects that involve any activity of a political or religious nature. Also, companies that are making public offerings or those that are subject to liquidation cannot raise funds on crowdfunding platforms.

Investors and fundraisers can be from Morocco or any other country, and investments can be made in Moroccan dirhams or any other currency that will be converted to the national currency. While investors and fundraisers don’t have to request a visa or other permissions from the local regulators, they have to pass a due diligence process conducted by the platform based on the regulator’s requirements.

Each individual who has enough experience and money can finance a crowdfunding project.

Maximum amounts for fundraising and investing in Morocco

The regulation imposes limitations8 on how much a project can raise. So, a donation-based project can raise a maximum of 450,000 dirhams or 40,800 Euro. Projects that opt for a lending model, are permitted to raise a maximum of 3,000,000 dirhams or 272,145 Euro. Finally, investment-based projects can raise a maximum of 5,000,000 dirhams or 453,575 Euro.

The maximum investment for an individual is:

- Donating – 250,000 dirhams or 22,670 Euro

- Lending – 300,000 dirhams or 27,200 Euro

- Investing – 400,000 dirhams or 45,300 Euro

These limitations are calculated for one project. Cumulatively, an individual can contribute to crowdfunding projects not more than 1,000,000 dirhams or 90,700 Euro.

Individuals with the status of an angel investor don’t have any limitations for investments.

Start a crowdfunding platform in Morocco

If you want to launch a crowdfunding platform Morocco, you need to choose between white-label crowdfunding software and custom development. Building a crowdfunding platform from scratch is a time-consuming process, requires strict budgeting and commitment. However, you could start with a ready-made crowdfunding software to save time and money while testing the market and building your online presence.

LenderKit offers 3 packages for businesses, so you can really pick the one that fits you best.

If you want to learn more about LenderKit white-label investment software and launch your online investment busienss in Morocco, don’t hesitate to reach out to us and book an online demo.