Crowdfunding Infrastructure Projects: Opportunities and Challenges for Platform Operators

No time to read? Let AI give you a quick summary of this article.

The demand for new and upgraded infrastructure is growing very rapidly, so is the financial appetite of this sector. Roads, bridges, water systems1, clean energy grids, and transit networks — you name it — there’s a lot of niche infrastructure projects to invest in.

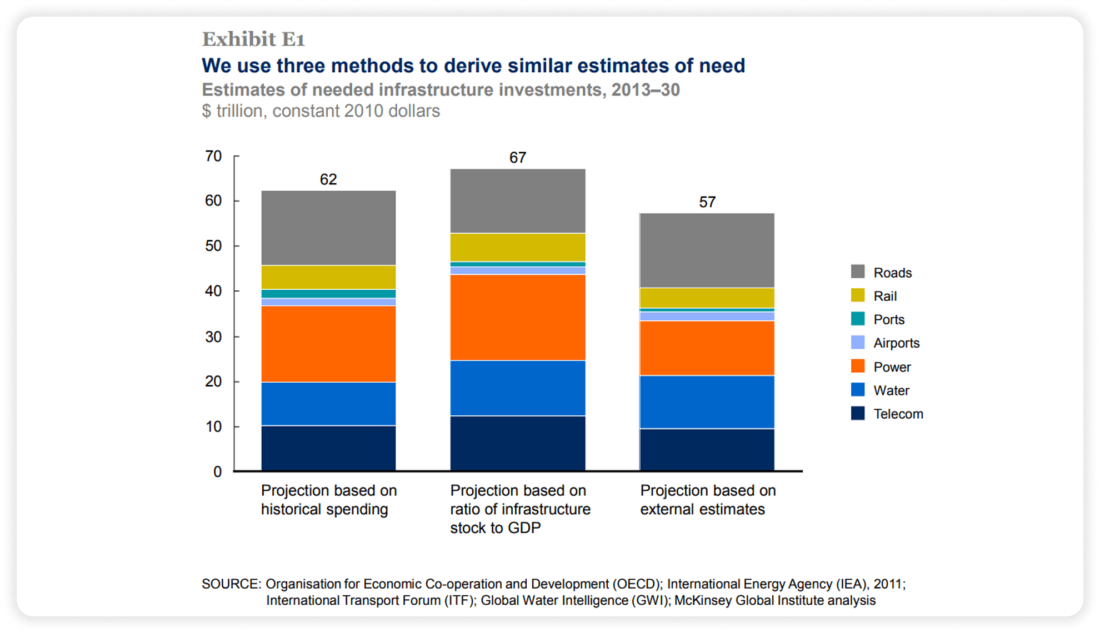

According to McKinsey, global infrastructure investment needs will exceed $57 trillion by 2030. However, governments alone cannot bridge the gap. This challenge opens the door to alternative financing mechanisms, with crowdfunding being one of them.

Crowdfunding, long associated with startups, creative projects and consumer products, may become a viable funding model for infrastructure-related projects. For platform operators, this creates both new business opportunities, but successfully navigating this space requires an understanding of what works, where the pitfalls lie and how to build scalable models that serve communities while meeting investor expectations.

What you will learn in this post:

Crowdfunding in infrastructure financing

Crowdfunding for infrastructure allows individuals and local stakeholders to financially support projects that directly impact their environment. These range from large-scale energy and transport projects to small civic improvements such as parks, bike lanes, and EV charging stations. It not only democratizes the financing process but also builds a sense of shared ownership among citizens.

Use cases

One of the widely cited examples is Rotterdam’s Luchtsingel pedestrian bridge, which was partly financed through citizen crowdfunding. Community buy-in helped secure additional grants.

Across the globe, there are more dedicated platforms that have emerged to support infrastructure crowdfunding at various scales:

- OnePlanetCrowd4 (Netherlands) has supported over 250 projects focused on sustainability and social impact. Now part of the Invesdor Group, it uses debt and equity models for projects like solar parks and energy-efficient housing.

- Convergence Finance5 (Canada) aggregates public and private capital for large-scale infrastructure, including blended finance models targeting ESG-aligned outcomes.

- Citizenergy6 (Europe) connects citizens with renewable energy projects across EU countries, making clean energy investments accessible.

- InfraShares7 (USA) offers debt-based crowdfunding for public-private infrastructure partnerships, with a focus on compliance and investor protection in regulated U.S. markets.

These cases demonstrate how infrastructure crowdfunding not only complements traditional financing but also signals strong community support to public and institutional stakeholders — increasing project inclusivity, resilience and funding potential.

Financial benefits for investors

Infrastructure crowdfunding also offers returns that can be attractive to small investors.

For example, Abundance Investment8 allows UK residents to invest in green infrastructure projects through regulated debt instruments offered by local authorities. With returns typically ranging from 4% to 6%, these projects not only let investors feel that they work for a purpose but also earn.

Most common crowdfunding models in infrastructure projects

Reward-based models are often used for civic and social infrastructure. They rely on contributions in exchange for symbolic rewards or participation perks.

One of such platforms is Spacehive9 in the UK. It uses the reward-based model to raise funding for playgrounds, markets, and street improvements. While these campaigns seldom exceed £250,000, they carry high community visibility and positive press.

Debt-based crowdfunding, particularly in the form of community bonds, is more suitable for public infrastructure. Investors lend money to municipalities or developers with the expectation of repayment plus interest. These models work best in stable regulatory environments with clear accountability.

Equity-based crowdfunding has been used in cases where infrastructure has revenue potential, for example, renewable energy plants, fiber optic networks, or data centers. However, regulatory complexity11, long return timelines12, and low liquidity13 have kept adoption limited.

Tokenization and blockchain are becoming important as a solution to the inefficiencies in equity crowdfunding. Platforms use smart contracts and tokenization including fractional tokens to lower the entry barrier for smaller investors and improve liquidity.

Should launch a crowdfunding platform for infrastructure financing?

The development of infrastructure crowdfunding opens exciting avenues for platform operators. The most important ones include market expansion, social impact and diversification.

Market expansion

Traditional crowdfunding markets are focused on creative or tech ventures, so they might be close to saturation. Infrastructure opens the door to large-ticket investments, recurring revenue and multi-year partnerships with government bodies or ESG-oriented institutions14.

Social impact and brand reputation

Hosting infrastructure campaigns allows platforms to position themselves as contributors to environmental sustainability and community welfare. This alignment with ESG goals can attract a wider base of investors and even corporate sponsors.

Engagement and retention improve when people feel their money is tied to tangible local outcomes. A user who funds a bike lane or solar installation in their own neighborhood is more likely to return to the platform and become its advocate.

Diversification of income sources

Platform operators can diversify their revenue streams beyond commission fees — including offering campaign design consulting and licensing anonymized crowdfunding data to public agencies. This data can support urban planning efforts by revealing which projects have the most community support and engagement.

Key challenges and constraints

Even though crowdfunding infrastructure offers significant benefits, it also comes with challenges.

Project complexity

Infrastructure initiatives require preparations15 that include feasibility studies, environmental assessments and permits. They also have long timelines. Unlike consumer products or creative campaigns, these projects are not easily summarized in a three-minute pitch video. This is why platform operators must offer deeper due diligence and technical support, which increases overhead costs.

Regulatory challenges

Regulatory challenges are another issue. Infrastructure crowdfunding often involves the sale of securities16, and this triggers oversight from financial authorities. The European Union’s new crowdfunding regulation, which allows offerings up to €8 million, has created some clarity, but operators must still ensure licensing, investor protection rules, and comply with anti-money laundering requirements.

Fraud risks

Fraud risks and investor protection are serious issues as well. Without proper vetting and transparency, backers may lose money or even confidence in the model. Given the history of failed P2P platforms in Europe17 and Asia18, crowdfunding platforms must ensure trust through governance, insurance mechanisms, and clear disclosures.

Liquidity limitations

Liquidity limitations create further issues. Infrastructure assets are not easily sold, and investors often commit funds for years. Secondary markets are underdeveloped, and platforms that promise liquidity without supporting trading infrastructure may mislead users.

Strategies for sustainable growth

To thrive in this space, platform operators must take a strategic, long-term approach.

It is very important to build strong partnerships with municipalities, engineering firms and legal advisors. A campaign backed by a credible city authority or vetted by a known urban planner will be far more attractive to potential investors.

Offering multiple investment models, from reward to debt to tokenized equity, can help match the diversity of infrastructure needs and attract different types of investors. For example, smaller civic projects may be suitable for reward-based models, while large utilities require debt issuance or digital securities.

A platform that aims at improving operational efficiency shall consider such technologies as blockchain-based contracts, digital identity verification, and secure digital wallets. They all support faster and cheaper campaign administration. Still, platform operators must ensure regulatory compliance and prioritize user education to avoid confusion or noncompliance.

It is important for a platform to ensure that there is a secondary market or another liquidity option. Platforms should work with regulators and partners to enable safe trading of crowdfunded bonds or tokens. Even limited exit options increase investor confidence and can improve campaign conversion rates.

The road ahead

Infrastructure crowdfunding is still a young sector but is maturing quickly. Investor interest in climate-resilient and socially valuable assets continues to grow. With public-private partnerships gaining ground, crowdfunding could become an essential complement to traditional infrastructure finance.

Platforms that specialize in these areas and build the right legal and technical infrastructure will likely lead the sector.

How to launch a crowdfunding platform for infrastructure projects with LenderKit

Looking to launch your own crowdfunding platform for infrastructure-related project financing? Check out LenderKit.

As a white-label investment software provider, LenderKit equips you with the core technology, including customizable investor portals, back-office tools, deal management and compliance modules such as KYC/AML, payment processing and digital document signing.

Whether you plan to engage institutional investors, retail backers or both, the platform offers the technical structure needed to support complex investment flows such as debt or equity, but can also be used for donation and rewards-based crowdfunding.

While the legal and operational setup remains your responsibility, LenderKit helps reduce the technical overhead and time to market — so you can focus on building traction and trust in the infrastructure space. To explore if LenderKit is the right fit for your use case, get in touch with our team.

Article sources:

- Moonfare invests in a secondary deal for a leading producer of water pump systems

- PDF (https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Operations/Our...)

- Luchtsingel by ZUS is an elevated pathway across Rotterdam

- Oneplanetcrowd becomes Invesdor

- Convergence - The Global Network for Blended Finance

- Geriausi Kazino Internetu Lietuvoje 2025 – Top 10 Sąrašas

- Infrashares | Community Equity Investment in Public Infrastructure Projects

- Abundance Investment

- Spacehive: the home of community fundraising.

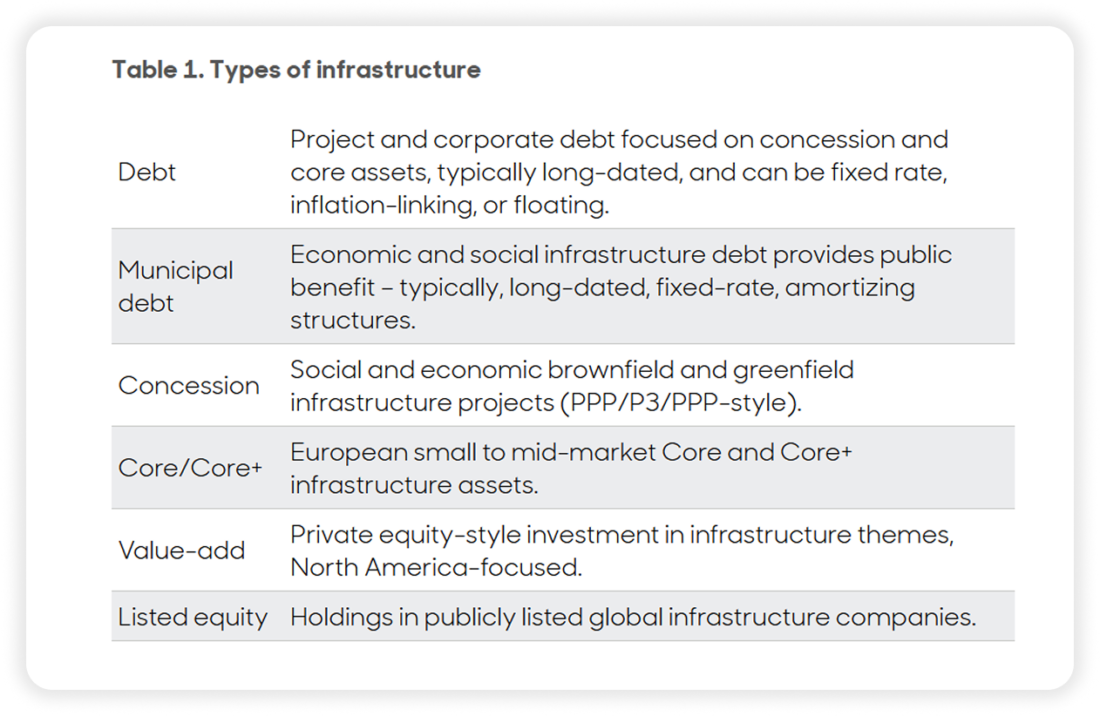

- Infrastructure: Improving quality of life | Aberdeen

- Regulatory complexity

- From Investment to Exit: Realistic Returns and Exit Strategies in Crowdfunding - AloneReaders.com

- Creating Liquidity in Equity Crowdfunding - FasterCapital

- ESG-oriented institutions

- Page not found – Cervitude™

- The new investment landscape: Equity crowdfunding

- 👎 Worst P2P Platforms in Europe - Platforms That I DON’T Trust

- Massive P2P Failures in China: Underground Banks Going Under