Equity Crowdfunding in Malaysia: Market Overview

No time to read? Let AI give you a quick summary of this article.

Equity Crowdfunding in Malaysia is becoming an integral part of the national capital market. Since its inception in 20151, when the Securities Commission Malaysia (SC) approved the first batch of licensed platforms, equity crowdfunding platforms have helped many businesses to secure funding.

Over time, its importance has grown, particularly as Malaysia seeks to accelerate industrial transformation through initiatives like the New Industrial Master Plan 2030 (NIMP2030)2. The Malaysian equity crowdfunding market is entering a new phase with new government-backed programs, rising campaign sizes, regulations and maturing investor behavior.

What you will learn in this post:

Market performance and growth trends

By the end of 2023, equity crowdfunding in Malaysia had cumulatively raised RM 686.7 million (over $162 million) through 381 campaigns3.

These campaigns originated from 377 unique issuers, which showed a healthy repeat engagement with the market. Although 2023 showed a slight slowdown compared to previous years, with RM 126.3 million (almost $30 million) raised across 51 campaigns, the average size of campaigns increased, indicating greater investor confidence and more ambitious fundraising goals.

Investor participation in the same year also reflected a maturing market. A total of 4,095 investors participated3, with 76 percent making their first-ever investment through equity crowdfunding platforms in Malaysia. Of the total investor base, 56 percent were retail investors, while 34 percent were aged below 35, pointing to growing interest from a younger, digitally savvy demographic. These trends suggest that equity crowdfunding serves as a capital-raising tool for businesses and an accessible entry point for new investors.

Regulatory framework

Malaysia’s regulatory framework is developed to provide transparency and investor protection. Only Malaysian-registered private companies or limited liability partnerships are eligible to raise funds through equity crowdfunding.

Each issuer can raise up to RM 20 million (approximately $5 million) over its lifetime, subject to an annual limit of RM 3 million (approx. $708,000) unless it meets specific criteria that permit a higher raise.

On the investor side, retail investors may invest up to RM 5,000 (approx. $1200) per company and no more than RM 50,000 (approx. $12,000) annually across all campaigns. Angel and sophisticated investors have higher caps, which allows them to invest in larger or multiple campaigns.

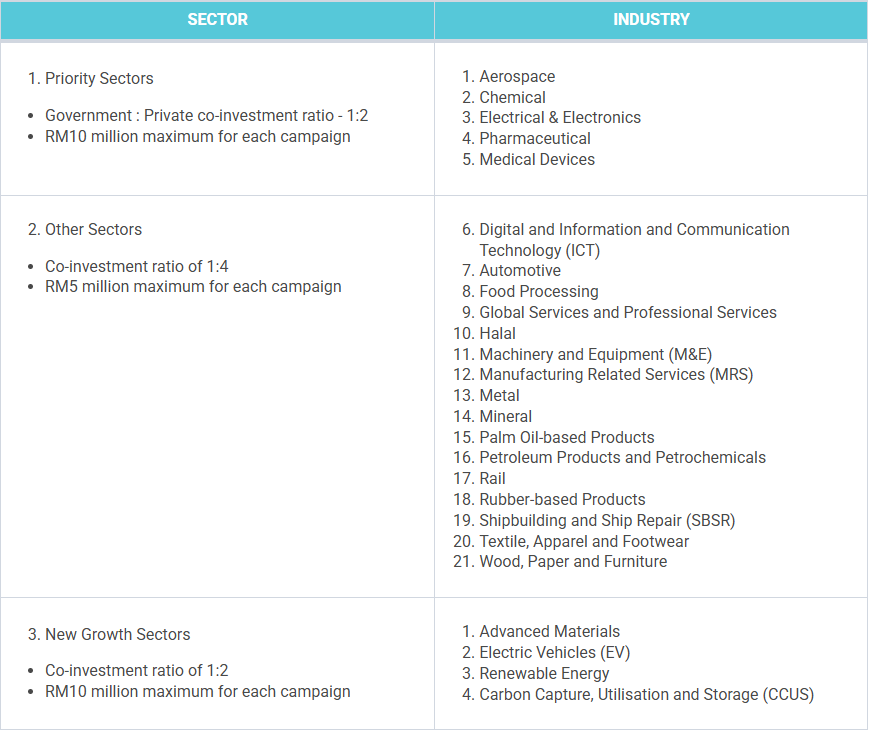

NIMP2030 Co-Investment Fund

In 2025, the market received a substantial boost with the introduction of the NIMP2030 Co-Investment Fund (NIMP CoSIF)4. This initiative was launched by the Ministry of Investment, Trade and Industry (MITI) and the Securities Commission Malaysia.

The CoSIF allocates RM 131.5 million (approx $31 million) to support fundraising campaigns conducted by Small and Medium Enterprises (SMEs) and Mid-Tier Companies (MTCs) that operate in sectors identified under the NIMP2030 framework. The NIMP covers 21 sectors5, with aerospace, chemical, electrical and electronics, pharmaceutical, and medical devices recognized as priority sectors.

The funds will be distributed through Equity Crowdfunding and Peer-to-Peer (P2P) financing platforms.

The fund is run by the Securities Commission Malaysia6 and follows a public-private model. This means the government will invest alongside private investors. CoSIF is meant to provide new ways of funding for businesses that often struggle to get support.

Through the CoSIF, the government will match private investments made via approved crowdfunding and peer-to-peer lending platforms. The matching ratio stands at 1:2 for strategic sectors and 1:4 for other qualifying sectors. Strategic sector campaigns can receive up to RM 10 million (approx. $2.236 million) in matched funding, while others are eligible for a maximum of RM 5 million (approx. $1.180 million).

Helping these businesses is an important part of reaching the goals of NIMP 20305 and making Malaysia a stronger player in manufacturing and services.

Eligibility criteria

To be eligible for CoSIF support, companies must meet specific criteria3, such as having shareholders’ equity over RM 2.5 million (approx. $590K) or having a workforce of at least 75 full-time employees in the case of manufacturing firms. The government co-investment is triggered once a campaign reaches its private fundraising threshold. With it, companies can receive higher funding.

Approved equity crowdfunding platforms under CoSIF

SC and MITI selected seven platforms8 to administer campaigns under the NIMP CoSIF program. Four of these are equity crowdfunding platforms: pitchIN, Mystartr, Leet Capital, and Crowdo. Each platform brings unique strengths and specializations to the table, and their inclusion in the CoSIF initiative signals both their reliability and their alignment with Malaysia’s broader industrial goals.

pitchIN

pitchIN9 was among the first crowdfunding platforms approved by the Securities Commission Malaysia and has helped many businesses raise funds to grow. pitchIN is known for hosting high-quality campaigns, with some raising over RM 5 million.

It offers opportunities in a wide range of sectors, including food and beverage, tech, education, and services. The platform is also part of the government’s Co-Investment Fund (CoSIF) under the NIMP2030 plan, which means eligible campaigns can get matching investments from public funds.

The minimum investment on pitchIN is usually around RM 500 (approx. $120), which makes it accessible for many retail investors.

Mystartr

MyStartr10 is an equity-crowdfunding platform licensed by the Securities Commission Malaysia. Initially launched in 2012 as a reward-based platform, it transitioned to equity crowdfunding in 2019, enabling startups and SMEs to raise capital from the public. The platform has facilitated over RM100 million in funding for more than 59 companies, with a network of over 5,400 investors.

MyStartr offers a user-friendly online experience, allowing investors to browse and invest in campaigns starting from as low as RM 500. It supports a diverse range of sectors, including technology, green energy, health, and education. The platform also provides end-to-end support for campaign preparation, marketing, and regulatory compliance. MyStartr is part of Malaysia’s Co-Investment Fund (CoSIF), which allows to offer matched funding for eligible campaigns.

Leet Capital

Leet Capital11 was founded in 2019 and is a licensed equity crowdfunding platform regulated by the Securities Commission of Malaysia. It focuses on Malaysian startups and small to mid‑sized enterprises (SMEs) that operate in fintech, health tech, real estate technology, and renewable energy sectors.

Investors can participate with a minimum investment of RM 15,000 (approx. $3,500). This is why Leet Capital is suited for experienced or sophisticated investors rather than retail users.

Leet Capital is also one of the approved platforms under Malaysia’s NIMP2030 Co‑Investment Fund (CoSIF) initiative, which co-invests alongside private investors in aligned strategic sectors.

How to launch an equity-based crowdfunding platform in Malaysia with LenderKit

For those looking to enter Malaysia’s growing equity crowdfunding ecosystem as platform operators, LenderKit offers a tailored white-label crowdfunding software solution.

To launch an equity crowdfunding platform in Malaysia, you have to secure approval from the Securities Commission, which involves meeting stringent compliance, governance and capital adequacy requirements. On the tech side though, LenderKit streamlines the investor onboarding process, offers issuer dashboards and deal management tools.

LenderKit’s modular architecture enables new platforms to focus on deal sourcing, investor relations and marketing rather than infrastructure development. As the Malaysian market grows in sophistication and scale, solutions like LenderKit help new entrants quickly establish credibility and operational efficiency.

To find out how it works, get in touch with our team.

Article sources:

- Update: More Details Regarding Crowdfunding Platforms Approved By Malaysia Securities Commission | Crowdfund Insider

- PDF (https://www.nimp2030.gov.my/nimp2030/modules_resources/bookshelf/NIMP_20303/N...)

- Equity Crowdfunding Malaysia (ECF)|

- RM131-Million Fund Launched to Support SMEs and Mid-Tier Companies in Strategic NIMP Sectors - Media Releases | Securities Commission Malaysia

- Skrine - Advocates & Solicitors

- Securities Commission Malaysia | Home

- CoSIF - MSME and MTC Roadmap | Securities Commission Malaysia

- Malaysia Picks 7 Crowdfunding, P2P Platforms For NIMP2030 Co-Investment Fund | Crowdfund Insider

- PitchIN

- Mystartr: Crowdfunding in Malaysia

- Leet Capital