How Smart Contracts in Crowdfunding Work

No time to read? Let AI give you a quick summary of this article.

Smart contracts in crowdfunding aim to solve three major problems – ease up KYC/AML verification, eliminate dependency on third-parties such as banks due and speed up pay-in and pay-out transactions in the crowdfunding offerings.

In crowdfunding, a smart contract is a self-executing agreement between investor and fundraiser, platform and user, or between other parties depending on which process needs to be automated and put into the blockchain ecosystem.

As a part of the bigger concept such as blockchain integration in crowdfunding, smart contracts is one of the ways you can enhance your platform’s technological capabilities and attract investments and new users.

What you will learn in this post:

How crowdfunding platforms use smart contracts

Currently, there aren’t too many market players that offer crowdfunding powered by blockchain, so there’s a lot of room for maneuver as well as a lot of uncertainty.

Tecra

And yet, some crowdfunding platforms like Tecra mention smart contracts as the future of crowdfunding1 and have plans on implementing this technology soon.

TecraCoin, Tecra Space or Tecra says that it will use smart contracts to link the online wallets as well as the web interface (apparently, a user portal). If we understand this correctly, Tecra will use smart contracts for transactions and payment processing linking the external payment gateway with the Tecra’s crowdfunding portal.

TaoDust

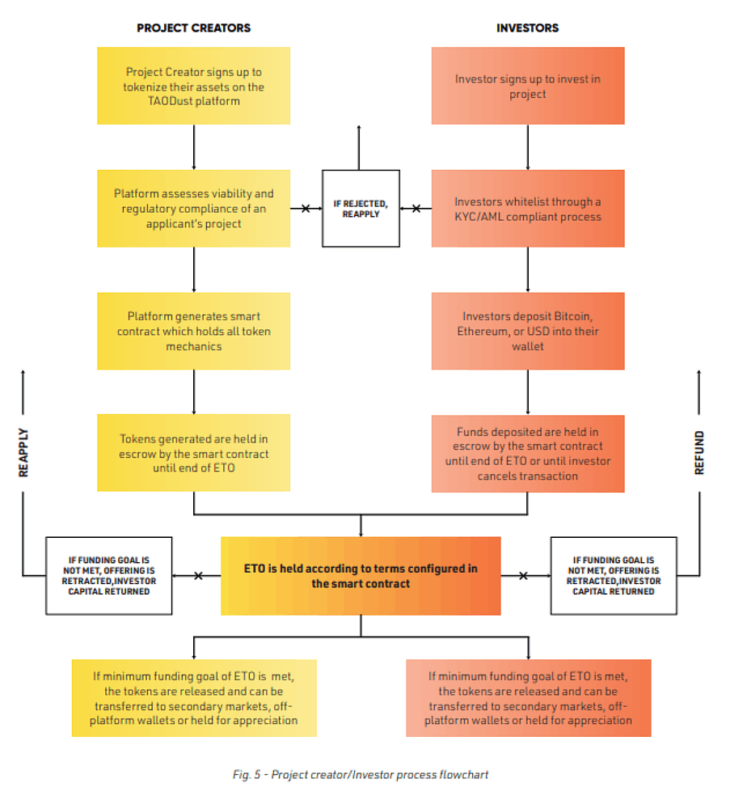

TaoDust is a blockchain-powered equity crowdfunding platform in Malta that uses Ethereum smart contracts2 to “mimic” the process of due diligence as well as dividend payouts and finally shares distribution.

According to their white-paper3, TaoDust is using ERC20 tokens to issue tokenized assets of equity shares in startups. The actual use case of smart contracts in crowdfunding looks something like this:

Finally, TaoDust also mentions that the tokenized assets will help to improve the liquidity on the platform by enabling tokenized asset trading on a secondary market.

Bloomio

Bloomio is another investment platform which uses asset tokenization. In 2018, they also released a blog article which provides a link to the smart contract templates on Github4.

What are the benefits of using smart contracts for crowdfunding

Different crowdfunding platforms describe various advantages of using smart contracts for crowdfunding processes optimization. The three major things that every platform highlights are:

- Higher speed of transactions or identity verification checks

- Better liquidity for previously illiquid assets via asset tokenization

- Enhanced security – which apparently comes from a larger “secure blockchain” concept

- Faster funds disbursement – however at the cost of skipping the verification, according to this white-paper5

Smart contracts are essentially a digital version of a traditional contract and enable the crowdfunding platform to automatically execute the terms of the agreement, such as the distribution of funds to the project creator, or the payment of rewards to investors, based on the conditions of the agreement.

The smart contract can also automate the issuance of tokens or other digital assets to investors as part of the crowdfunding campaign. Smart contracts can help reduce costs associated with the crowdfunding process, as well as reduce the risk of fraud and other malicious activities.

Risks of smart contracts

Since a smart contract requires heavy standardization of the fundraising process, this may be limited to a certain type of asset classes, industries, investor types, financial flows and due diligence procedures.

Since very few sources outline the actual risks of smart contracts, common sense tells that if something is strictly formalized it may eliminate the necessary or optimal flexibility of terms for different types of capital raising companies.

Basically, all the deals have to be conducted within one framework or at least documented as such using the blockchain or smart contract technology.

This however may not be too bad for the “template” projects which comply with certain types of regulations in the USA, for example, but then if there’s any flexibility that is necessary to win the deal, smart contracts may also be limiting.

For example, TaoDust has outlined these risks of using tokenized assets:

Those are valid concerns, so you, as a blockchain crowdfunding platform owner, should definitely explore further your specific business case with an experienced blockchain provider as well as legal consultant and your product officer.

How to integrate smart contracts in a crowdfunding platform

Technically, integrating smart contracts in a crowdfunding platform can be done via different services providers such as Polymath, TokenD, directly with Ethereum or other solutions.

In each case, the implementation of smart contracts will depend on the process which needs to be improved or added:

- KYC/AML via smart contracts

- Asset tokenization

- Secondary market contracts, etc.

At LenderKit, we work with Polymath to provide blockchain solutions for crowdfunding platforms worldwide.

Polymath works with broker-dealers, marketplaces, cap table managers and KYC/AML providers.

So depending on the requirements, our team can integrate Polymath with the LenderKit crowdfunding software, so you can launch your crowdfunding platform prototype or a market-ready operational platform.

If you’d like to learn more about smart contracts and blockchain crowdfunding development or even blockchain crowdfunding software, reach out to our Fintech Strategist and we’ll discuss further details to help you reach your goals.

Article sources:

- Smart Contracts — the future of crowdfunding

- Introduction to smart contracts | ethereum.org

- PDF (https://taodust.com/wp-content/uploads/2019/09/TaoDust-Whitepaper-English.pdf)

- Development Update: Bloomio’s Ethereum smart contracts are available on Github under GPL3 license.

- PDF (http://www.warse.org/IJATCSE/static/pdf/file/ijatcse83932020.pdf)