Private Equity in Renewable Energy: How it Works

No time to read? Let AI give you a quick summary of this article.

Investing in renewable energy seems to be a new trend nowadays, especially in the times of global warming and long-term plans of the leading countries’ governments to reduce carbon emissions by 2050.

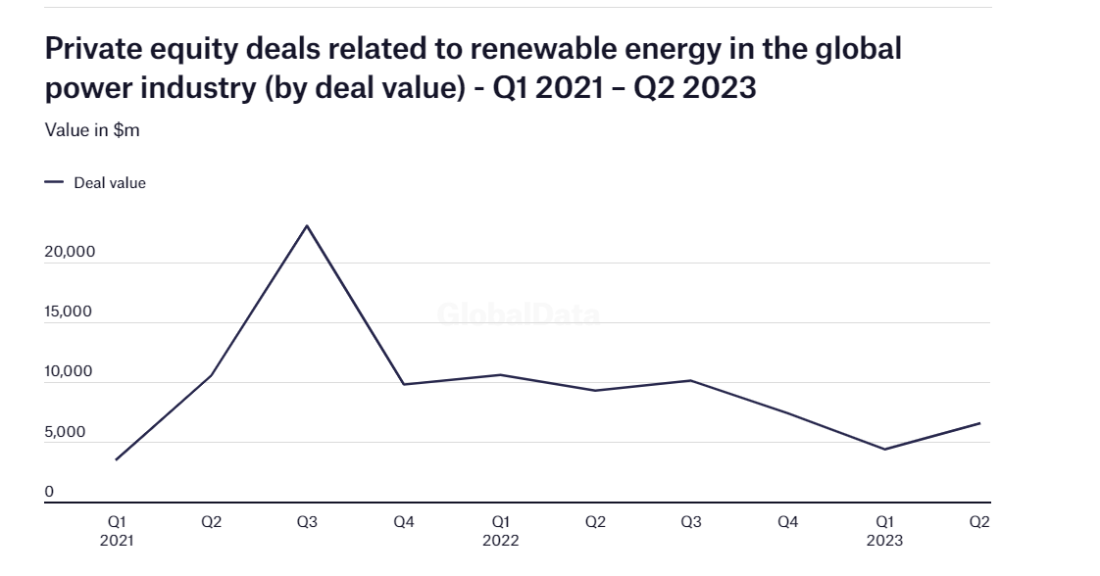

Investments surged in 20221 and reached the highest level in Q4, 2022 to drop after that to almost the level of 2021. In Q2, 2023, investing in renewable energy grew by 50% compared to the previous quarter, but fell by 29% compared to Q2, 2022.

What drives the fluctuations of the interest in renewable energy investments? Can this interest be sustained in the long run?

At first glance, there are no reasons for such a drop but, because the advancements in the renewable energy sector seem promising:

- Since 2010, the cost of manufacturing a solar panel has dropped by over 80%.

- Over the last decade, the cost of wind power has decreased by approx. 50%.

- Improvements in battery technologies made it possible to store renewable energy for longer periods and at a cheaper cost.

Finally, the support of governments and the zero-emission strategy2 that shall be reached by 2050 shall boost the interest of private equity investors in renewable energy.

So, what can be the underlying cause of that volatility and how it affects the private equity investments in the renewable energy sector?

What you will learn in this post:

Reasons why the interest of investors in renewable energy projects is declining

In 2022, the pressure on private equity companies to decarbonize their investment portfolios increased, motivating fund managers to focus on renewable energy projects. At the same time, the race to develop new sources of renewable energy also contributed to the growth of investment volumes in this area. It looked like renewable energy was the next gold mine for those who had free resources and wanted to put them to work.

Additionally, renewable energy investments create new jobs, contribute to economic growth, and increase energy independence.

While all the mentioned reasons are valid, we shall not forget that the main aim of any private equity investment firm is profit.

What profit can they count on if they invest in renewable energy now, when the clean energy hype is down?

To shift to a zero-carbon emission world, we would need a lot of natural resources, and these resources shall be extracted from the earth.

So, to cover the need for silver in the amount sufficient for the transition, 300 silver mines with an area of around 100 square kilometers will be needed. Needless to mention what harm it would cause to nature.

Lithium, cobalt, manganese, copper, silicone, and other rare materials production shall increase 100-fold to cover the needs for resources needed for the transition.

To replace a single 50-megawatt gas turbine, 15 wind turbines of the size of the Washington Monument building are needed. To construct such a farm, 15,000 tons of iron, 25 tons of concrete, and 450 tons of non-recyclable plastic are required.

While these numbers alone make investors think about the feasibility of investing in renewable projects, we will go further. Let’s have a look at the costs of installing and running one wind turbine.

A typical turbine would cost roughly $2 – 3 mln3, plus around $50K for maintenance yearly. A standard wind turbine generates approx. 4,400,000 KWh4 per year, while a standard coal plant can generate 3.5 bln KWh per year. It means that investing in a standard coal plant looks more lucrative than investing in a wind turbine.

Now, let’s have a look at solar energy. It takes around 10 – 20 years5 for a solar battery to pay back, the time depends on the availability of incentives, energy costs, tax credits, and similar, while the service life of one solar battery is 15-25 years. So, investors will benefit from their investment within only 5 to 15 years.

For a quick comparison, the payback period of investment in housing is also approximately 10 years, but the lifespan of a housing property varies from 50 to 100 years, depending on the property quality, location, maintenance, etc. Even in the worst case, the payback period is much longer than in the case of investing in a solar installation.

With such data, it becomes clear that only the strongest private equity investors can afford to invest in renewable energy even considering all the initiatives and benefits.

Private Equity Investment in the Renewable Energy Sector

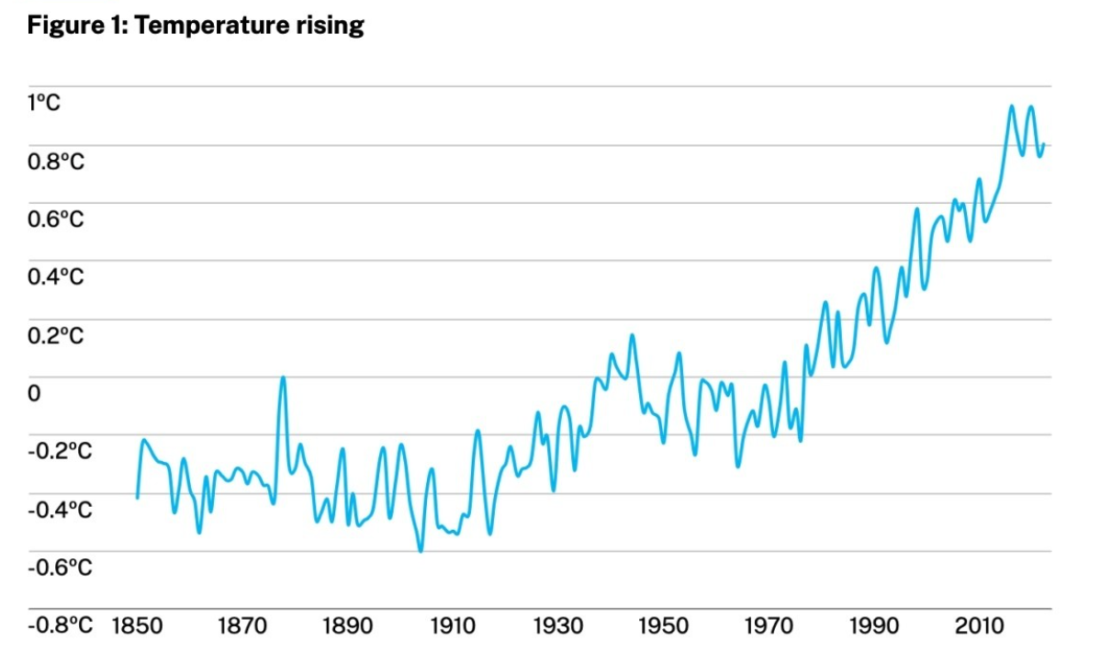

Even though the flow of private equity investments in renewable energy has slowed down recently, the interest didn’t vanish completely. Indeed, the climatic changes urge governments to take measures to motivate the development of alternative energy sources.

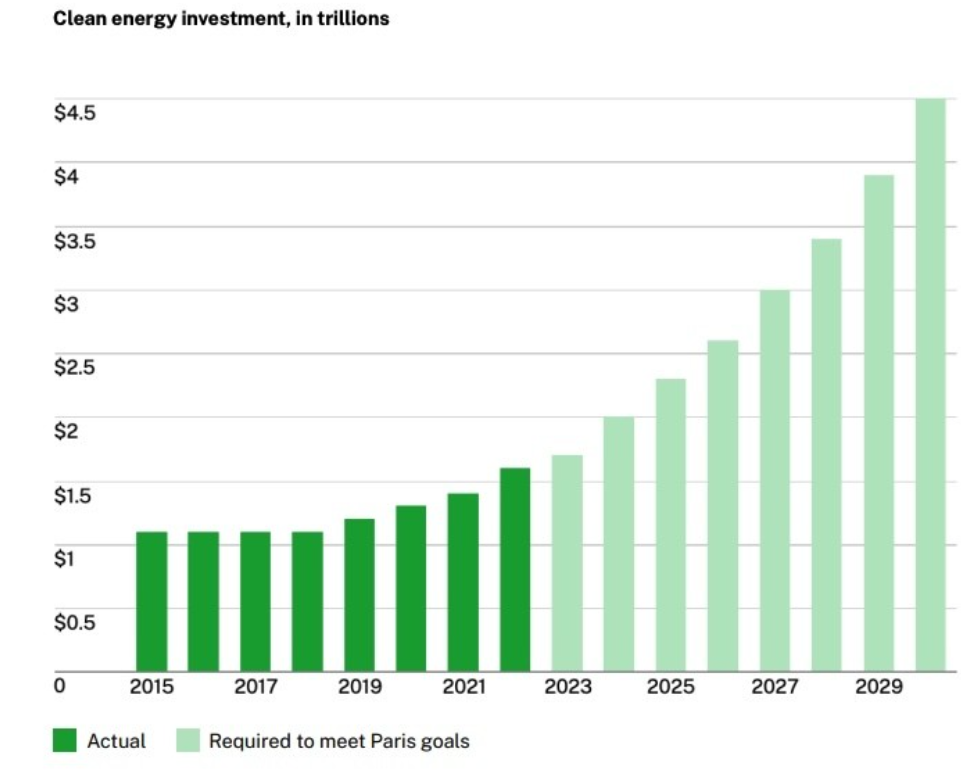

The global temperature6 rose from -0.3oC to almost 1oC within a century which is an unprecedented increase. To meet the goals set by the zero-emission strategy, the increase in clean energy use shall look like in the graph below.

Now, developed countries outsource their energy needs to China and Africa to reach the promised decrease in carbon emissions. However, this is not a solution. This is why it is expected that 2023 may be the pivotal point in the development of the renewable energy sector, and private equity may play an important role in it. Another reason to believe so is technological advancement. For example:

- The cost of manufacturing a solar panel has dropped by 80% since 2010.

- The cost of wind power has decreased by 50% just over the last decade.

- Improvements in storage technology and cost reduction of battery manufacturing allow for more efficient storage of accumulated solar and wind energy.

Multiple incentives from the governments such as:

- Investment and production tax credit reduces the cost of renewable energy projects and offers benefits for those who sponsor the projects.

- Renewable portfolio standards according to which a part of sourced energy shall be supplied from renewable sources.

- Fixed prices for the electricity produced by renewable energy projects.

- Bans and targets for fossil fuels also drive the transition to renewable energy.

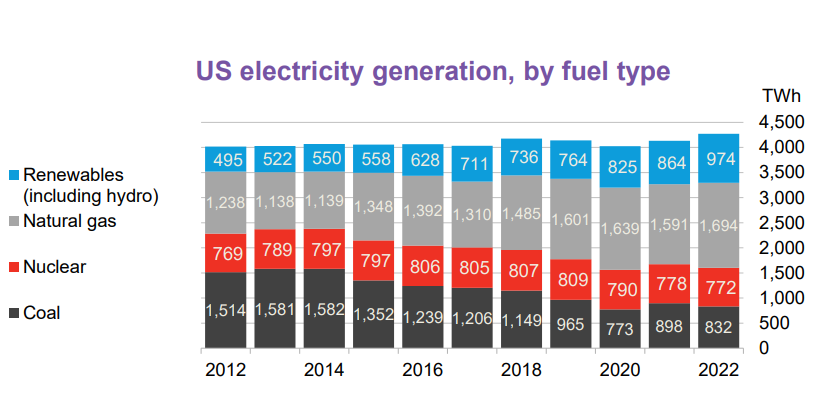

The share of renewable electricity in the total amount of electricity consumed in the USA is increasing7.

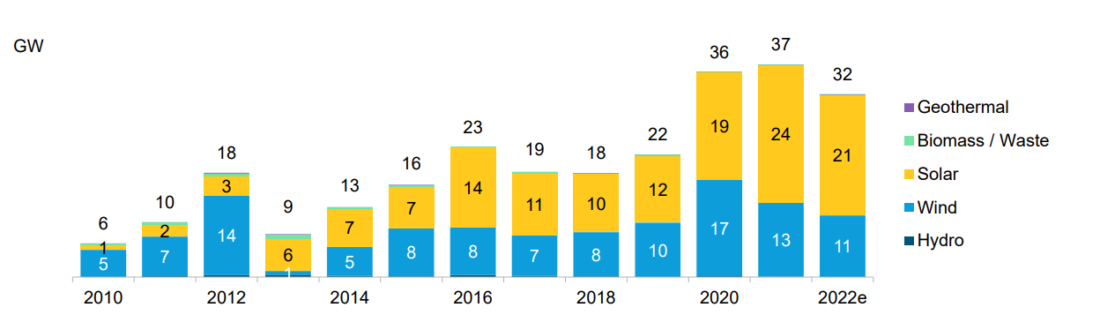

Among all the sources of renewable energy, wind and solar prevail.

Thus, these sectors attract the most attention from private equity investors. Indeed, solar and wind energy is unlimited, and as soon the technology develops enough to replace coal and gas installations, the sector will become a goldmine.

How to Build a Private Equity Investment Platform with LenderKit

If you are thinking about benefiting from investment opportunities in renewable energy, you can launch a private equity investment platform with a LenderKit white-label private equity software.

With LenderKit, you can reduce paperwork and automate all investment operations from user onboarding to campaign running and transaction management. The software comes with the regulations-friendly features that help you facilitate compliance with the local regulatory requirements in the USA and EMEA region.

If you want to see how LenderKit investment software works, feel free to schedule a live demo session, or get in touch with us to discuss details and pick the optimal set for you.

Article sources:

- Q2 2024 update: renewable energy related private equity activity in the power industry

- 2050 long-term strategy - Climate Action - European Commission

- Wind Turbine Cost: Worth The Million-Dollar Price In 2022?

- How Much of Each Energy Source Does It Take to Power Your Home | 29th September 2017 | News | MSS Infrastructure Ltd

- Solar Panel ROI Guide (2025) | ConsumerAffairs®

- Here’s why 2023 could become a turning point for the energy transition

- Increasing