How to Launch an Impact Investing Platform for Crowdfunding Projects

No time to read? Let AI give you a quick summary of this article.

“Recognize that every interaction you have is an opportunity to make a positive impact on others.” – Shep Hyken

Philanthropy, ESG investing, values-based investments, mission-related ventures – all these notions are links in the same chain.

Impact investing1 overlaps the related terms and constitutes for investments having positive, measurable social and environmental impact alongside a financial return. It refers to values-based investment activity allowing a wide range of angels and VCs to create a positive impact while meeting their financial goals.

Material perks are what sets impact investing apart from philanthropy.

The key feature of impact investing definition is that investments don’t refer to a particular asset class (debt or equity) with risk and return characteristics common to these groups of assets.

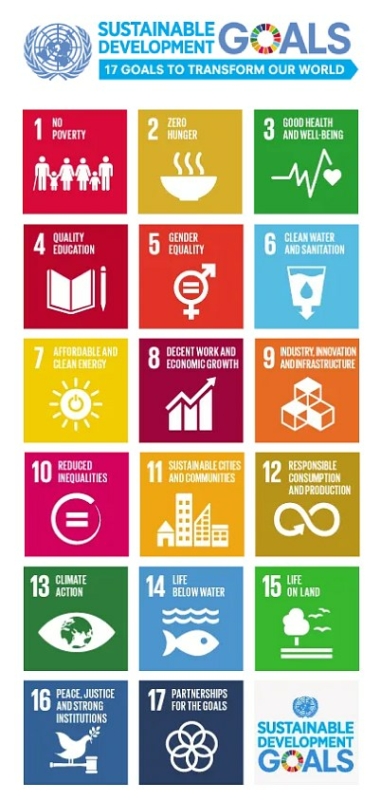

Instead, the activity demonstrates the approach of backers; angels put money into projects to contribute to the achievement of sustainable development goals (SDGs)2.

In a nutshell, the objectives outlined in the 2030 Agenda for Sustainable Development include:

- combating poverty

- ending hunger

- ensuring the quality of life, work and education

- making cities safe and sustainable

- reducing inequality within and among countries

The GIIN defines three characteristics of values-based investing that set it apart from other types of investment activities:

- backers have an intent to achieve a social or environmental and governmental impact. They identify the returns from investments made and specify who will benefit from possible outcomes

- the level of the impact defines the contribution an investor make, and it can take financial or non-financial forms

- investments imply return expectations across asset classes (cash equivalents, fixed income, venture capital, and private equity).

- backers use a measurement system allowing them to compare the expected impact and evaluate the achievement of this impact

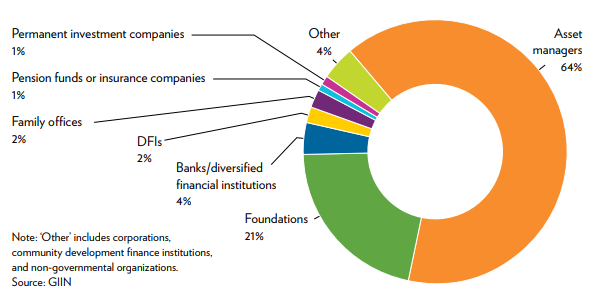

Types of impact angels: pension funds, institutional investors, ultra-high-net-worth individuals, foundations.

Industries3 of a major focus: affordable housing, health, education, small business, energy, workforce development.

The idea of values-based investments isn’t new. In their book, The Modern Corporation and Private Property4, Adolf Berle and Gardiner Means explain the pillars of investment activity: faith-based investing, negative screening, exclusion of “sin” stocks.

These principles then were translated into social investing, non-profitable organizations, mission-related and program-based ventures.

Check out the Deloitte report5 to learn more about each model.

The term “impact investing” got into the rotation in 2007 by The Rockefeller Foundation.

Since then the initiative has been transformed into the entire industry which is developing at breakneck speed.

What you will learn in this post:

A sneak peek into the impact crowdfunding market

The size of the current market at $715 billion with 1,720 impact investors (GIIN1).

The majority of organizations (64%) involved in values-based investing are asset managers.

The US and Canada are leaders in terms of global groups of investors. The second place is occupied by Western, Northern & Southern Europe.

One in four dollars of professionally managed assets (amounting to $13 trillion) now considers sustainability principles.

56% of individuals from the UK who were interviewed say that they have a moderate interest in impact investing (Implementation Taskforce6).

55% of investment opportunities result in competitive, market-rate returns, which explains the popularity of this type of investments (GIIN7);

Top industry projects include renewable energy, green buildings, sustainable agriculture and forestry, affordable housing, education, health, inclusive finance (United Nations).

During COVID-19 pandemic most of the backers (57%) surveyed by GIIN said they weren’t going to change the volume of impact capital they previously planned to commit in 2020 (Forb8es)8.

According to Amit Bouri, CEO and co-founder of the GIIN “impact investing is more important now than ever before and …it can play a role in re-imagining capitalism and reshaping the future”.

Also read: "How to start a platform for crowdfunding vegan startups"Crowdfunding for social impact ventures

Crowdfunding and impact have always come hand in hand.

The concept of crowdfunding is based on the principles of the democratization of credit.

Debt is a complex financial product and in some emerging economies tends to be “deadly” due to high margins and strict terms.

Compared with traditional private capitalist credit systems, crowdfunding borrowers can obtain financial support at lower rates and under milder conditions, which positively affects their business and the local economy.

Equity and debt crowdfunding can be feasible methods when it comes to values-based investing. The point is that ordinary impact backers have less investment expertise and oftentimes are only led by their enthusiasm when it comes to social impact ventures.

When risks aren’t carefully analysed, an undertaking may fail as it happens with Uncharted Play, the social enterprise that invented the Soccket9.

Experts believe that the background and network of impact angel investors may lead deals to success. Retail investors may be called upon to complete rounds of investment led by impact angels – a common practice among European equity crowdfunding platforms.

The market for equity and debt crowdfunding is growing worldwide. There are numerous crowdfunding platforms in the US and Europe addressing social and/or environmental problems.

Here are some of them.

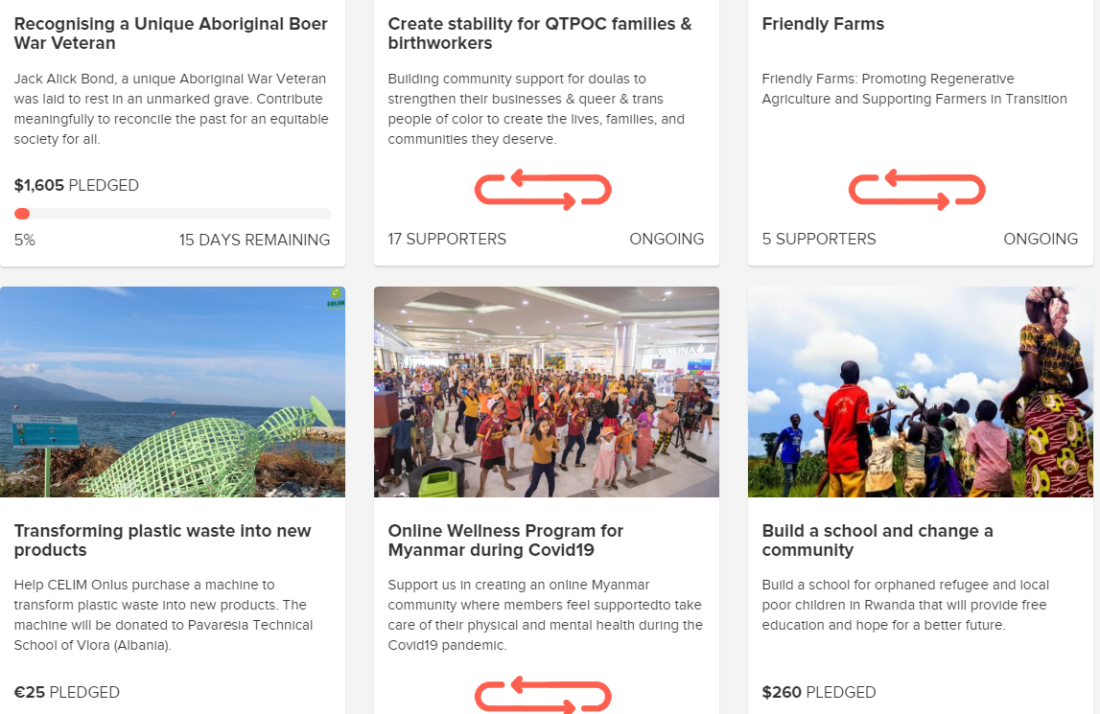

StartSomeGood

It’s a global crowdfunding platform for social entrepreneurs, nonprofits, changemakers and social good projects. The provider has funded 1137 projects and raised over $12m so far. Their 53% success rate is one of the highest in the industry. The provider offers Crowdmatch partnerships to backers to get access to co-investment opportunities.

An interesting fact: StartSomeGood began as an Indiegogo campaign 11 years ago.

UpEffect

UpEffect is a crowdfunding platform for companies dedicated to improving lives and the planet. The company helps business enthusiasts with purpose-driven ideas, raising funding and taking their products to market. All campaigns on this platform are intended for social business purposes and aim to drive social or environmental impact.

UpEffect acts as an incubator. Social entrepreneurs take part in a three-month program and are committed to present weekly deliverables.

Also read: "How to start healthcare crowdfunding business"Charm Impact

Charm Impact offers a hybrid approach to fundraising for impact. By combining donations with debt financing, the company helps entrepreneurs collect money to create life-changing solutions in Sub-Saharan Africa and Southeast Asia.

The company focuses on climate change and green energy projects. The minimum investment amount is £250 with loans repaid within 6 – 24 months. The average return rate is 8% interest per year.Charm Impact is our client who deployed LenderKit, a white-label software, to kick-start crowdfunding for impact startups.

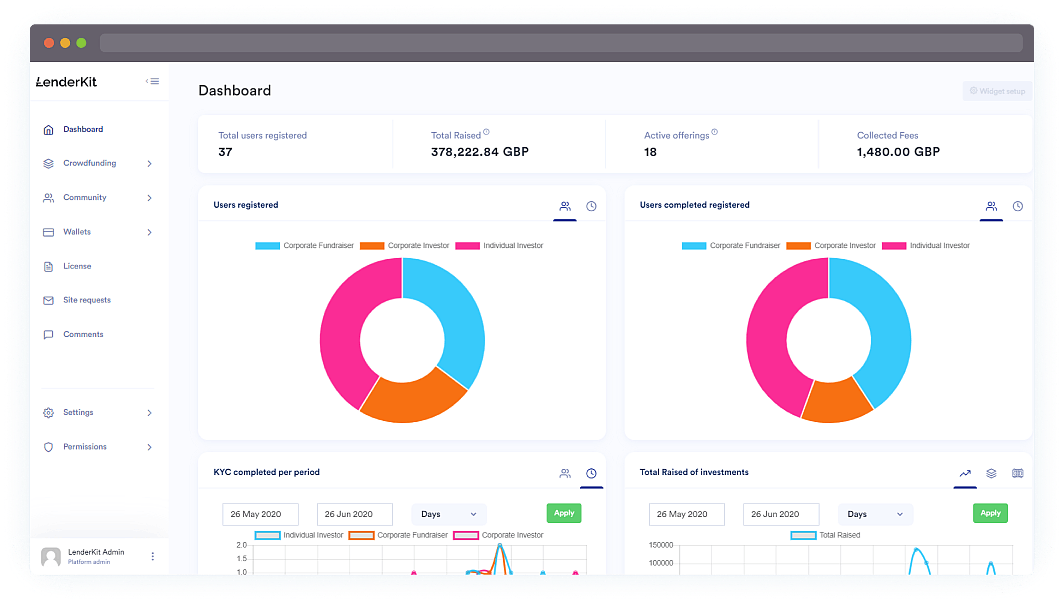

LenderKit – turnkey crowdfunding impact investing software

When Charm Impact reached out to our team, they needed a fast go-to-market solution, so we used one of the pre-built LenderKit themes and customized it.

Charm Impact was in the quest of a tech partner and expert who would help them digitize offline operations. The goal was to start as an MVP and then scale up.

LenderKit turned out to a perfect match for this goal.

The solution comes with responsive website layouts, friendly personal dashboards for investors and fundraisers, a powerful back-office, automated flows and identity checks for p2p lending and equity crowdfunding deals. It has a built-in secondary market and can be integrated with third-party providers.

The customizable software package is a real time- and money-saver. On the one hand, it includes the basic functionality to build an impact investing platform from scratch. On the other hand – LenderKit is flexible and can be adjusted to any business need.

LenderKit can help you start a crowdfunding platform for impact investing and ESG projects financing.

Want to launch a demo platform to test the waters or ready for a full-scale impact crowdfunding business? Contact us to discuss the details of your project.

Impact investing: Profits, Problems and Perspectives

Alongside one major benefit of addressing social and environmental issues, values-based investing offers other profits to all parties involved in this process.

- Governments and charities obtain sufficient capital and the necessary skill sets to solve the world’s challenges.

- Financing greatly contributes to sustainable and equitable global economic development.

- Creators get a chance to expand the pool of capital available to fund innovative solutions.

- The amount of impact is multiplied through grants and mezzanine financing.

- Profitable investment portfolios of pioneer backers boost the development of the sector.

- Investors experience personal transformation taking part in ethical, sustainable and responsible investing.

- Successful cases of impact investing motivate other angels to start their investment journeys.

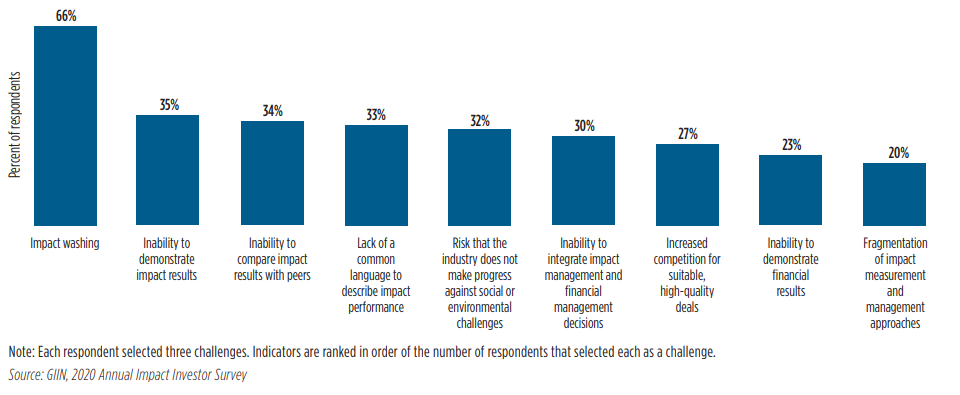

If it weren’t for some challenges, the potential of impact financing would be unleashed at a greater speed.

The bottlenecks of the industry are the lack of adequate impact-return assessment for investors, undeveloped regulatory framework, the risk of “impact washing”, disadvantage middlemen’s fees, etc.

Source: GIIN13

Despite all this, experts believe14 that the future of impact investing is going to be bright with more clarity, discipline, and transparency accompanying the process of eliminating threats and growing inequities.

GIIN predicts that by 2030 the effectiveness and efficiency of achieving impact increases, contributing to the achievement of the SDGs.

Resume of the impact investing niche

The topic of financing and crowdfunding for impact startups is multifaceted. This article is just an attempt to explain the basics and provide you with an industry snapshot.

The niche is experiencing significant momentum. A growing number of people are feeling that their capital can do much more than just generate returns. Startups and companies join forces with governments and social organizations to meet the growing demand.

As a result, humanity and the global economy have already recognized the impact made. And who knows, maybe values-based investing will define a new development path for the entire financial industry.

Article sources:

- PDF (https://thegiin.org/assets/Sizing%20the%20Impact%20Investing%20Market_webfile...)

- Sustainable development goals (SDGs)

- PDF (https://www.pacificcommunityventures.org/wp-content/uploads/sites/6/2017/08/U...)

- The Modern Corporation and Private Property - Wikipedia

- PDF (https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Financial-Ser...)

- PDF (https://assets.publishing.service.gov.uk/government/uploads/system/uploads/at...)

- What you need to know about impact investing - The GIIN

- Forbes (https://www.forbes.com/sites/annefield/2020/06/16/with-715b-in-aum-impact-investors-stay-the-course-despite-the-pandemic-says-the-giin/)

- Crowdfunding for Impact?

- GiveMeTap - Reusable BPA-free Water Bottles that Fund Water Projects

- UpEffect

- Home | Charm Impact

- PDF (https://thegiin.org/assets/GIIN%20Annual%20Impact%20Investor%20Survey%202020.pdf)

- PDF (https://thegiin.org/assets/GIIN_Roadmap%20for%20the%20Future%20of%20Impact%20...)