How Does Sukuk Crowdfunding Work?

Sukuk is a shariah-compliant Islamic financial certificate which has a unique structure, but in multiple sources, including Investopedia, is compared to a bond. Sukuk is not a debt obligation but it represents an ownership interest in a pool of assets. However, the investors don’t receive an interest. Instead, they get a portion of revenues generated by the assets.

Sukuk has been issued across 30+ countries including Malaysia, Indonesia, South Africa, Bahrain, Qatar, Dubai, Luxembourg and the United Kingdom.

The Sukuk investment market is growing worldwide, and according to Refinitiv, it managed to prosper even during the COVID crisis:

In 2020, the market has proved resilient to the impact of COVID-19. In the first nine months of the year, issuance reached a total of $130.5bn, compared with $127.3bn for the same period in 2019.

What you will learn in this post:

Types of sukuk certificates

There are 14 different types of sukuk certificates that have a unique structure and purpose. According to a publication on Springer, all the sukuk types can be divided into four basic groups including asset-based, asset-backed, exchangeable and hybrid depending on their structure.

A list of the most commonly used types of sukuk investments include:

| Sukuk type | Description | Secondary market eligible |

| Al Musharaka | Similar to a unincorporated joint venture, partners share profits and losses and investors also take part in decision-making | Yes |

| Murabaha | Islamic trust contract (debt), smallest number of international sukuk issuance, but bigger impact in domestic markets | No (if diluted with other non murabaha sukuk in a mixed portfolio, then yes) |

| Al Ijara | Rental-based Islamic bond, often required to be asset-backed | Yes |

| Mudharabah | Equity-based, often fixed cost, profit and loss sharing | ? |

| Al Istisna | Project-based islamic bond | No |

| Al Wakalah | Agency-based Islamic contract, among the most popular international sukuk after al-ijara. | No |

| Salam | Contract with immediate purchase and deferred delivery terms, requires an agent | ? |

According to one study, the Istisna contract has the highest chance of being suitable for crowdfunding. However, the pre practical side of its applicability is still in development and requires further research.

Sukuk investment regulations and Shariah compliance

Purchasing, reselling and collective due debt is considered haraam (forbidden). Basically, you can’t flip debt in the Islamic world and one potential workaround is using Sukuk. All sukuk investments are issued and priced against the asset underlying them.

Sukuk has to be compliant with the Islamic financial law Shariah and has a number of differentiators from the conventional bonds including:

- Ownership

- Underlying asset

- Pricing

- Returns to investor

- Sales and share of returns

- Guarantee on returns

- Nature of investment

In order to be compliant with the Shariah law, your sukuk crowdfunding platform is required to have:

- Shariah board of Islamic scholars

- Annual Shariah audit

- Make donations to charity to purify interest rates and other types of income

One of the examples of Shariah-compliant sukuk investments are the ones that meet the ESG (environmental, social governance) impact investing principles. In contrast, the restricted industries may include conventional finance, tobacco, alcohol, pork, gambling, adult entertainment, weapons and defence, etc.

Investment platforms can also focus on startup investing, real estate, private funds or other assets depending on how the investment is structured. The most popular sukuk contracts include Musharaka, Murabaha and Ijara.

All sukuk investments are usually structured through an SPV (special purpose vehicle)

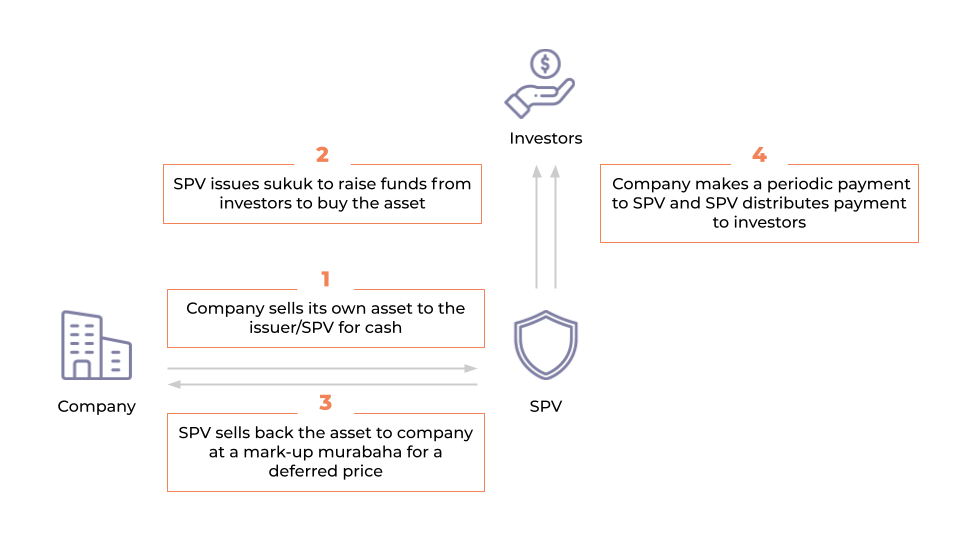

The purpose of SPV in sukuk investing

Since most if not all sukuk investments have to have a real underlying value, an SPV is created through which sukuk certificates are issued. In this case, the SPV offers protection for both fundraising companies and investors and allows the creation of an asset which underlies a sukuk investment.

Murabaha sukuk transactions can be based on bai al inah or tawarruq which are both believed to be controversial, according to Thomson Reuters dictionary and Dummies. As with any type of sukuk there are always two sides – one believes the transaction is compliant with the Shariah principle and the other objects this.

The key to Shariah-compliant investments is to find out which type of sukuk is accepted within your region and structure it correctly.

Sukuk trading platforms on the market

We haven’t found any Sukuk crowdfunding platforms, however, there are several sukuk trading platforms and listing directories on the market which you can explore.

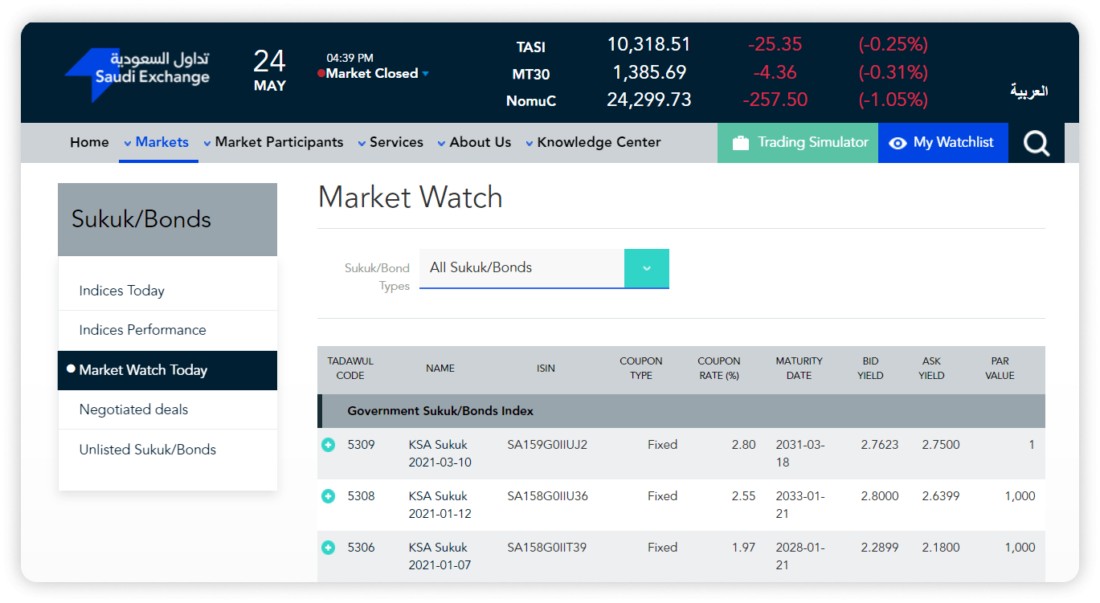

Saudi Exchange

Saudi Exchange, also known as Tadawul, is a Saudi Arabian stock exchange platform owned by Saudi Public Investment Fund.

The stock exchange has information on the listed sukuk on the market and includes government and corporate sukuk and bonds.

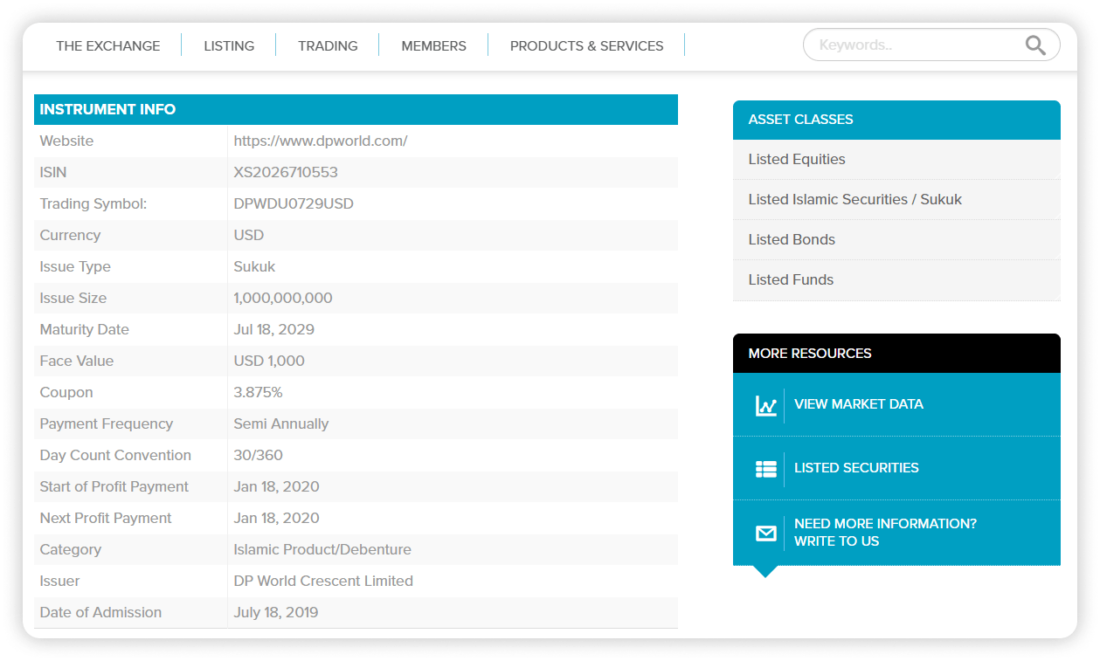

NasdaqDubai

NasdaqDubai is the international financial exchange company and platform in the Middle East. It provides the information about the listed sukuk deals and provides companies with the tools and activities to facilitate the decision making process of the investors.

CIMB Islamic

Being one of the leaders in Islamic Finance, CIMB, provides access to the Sukuk investments. CIMB is a universal bank in in Malaysia and a corporate advisor that focuses on consumer, investment and commercial banking and provides asset management services.

Shariah-compliant crowdfunding platforms

Despite the fact that there are not so many sukuk investment platforms, there are more shariah-compliant crowdfunding platforms out there.

Qardus

Qardus is one of the first shariah-compliant financial marketplaces in the UK. The platform has a set of principles and practices that guarantee that the platform is Shaiah-certified, all companies have passed the Shariah compliance screening and even Qardus itself has a Shariah advisor that conducts a semi-annual audit.

Forus

Forus is a Saudi-based P2P lending platform which adheres to the Shariah principles and provides compliant investment opportunities for different types of investors.

At LenderKit, we provided the crowdfunding software and built a peer-to-peer lending platform for Forus which they’ve used to apply to the SAMA regulatory sandbox and further set up and run their business.

Ethis

Ethis is one of the leading investment platforms in sustainable finance in Indonesia, Malaysia, Dubai and across the globe. The platform also focuses on the Islamic Finance and has a Shariah-board.

Ethis adheres to the Shariah-compliance principles and allows investors to take part in the halal crowdfunding deals.

Software for launching a sukuk crowdfunding platform

Sukuk crowdfunding is likely to grow in the future as a new trend as platforms all over the world gain more knowledge in the Islamic Finance. At this moment, crowdfunding platforms already provide Shariah-compliant investment opportunities in both SME and real estate for accredited and non-accredited investors.

If you’d like to join the market and are looking for halal crowdfunding software to meet your Sharia-compliance requirements and introduce Islamic Finance for companies and investors, LenderKit can be a way to go.

At LenderKit, we provide white-label crowdfunding software and build custom crowdfunding platforms. We have a strong pioneering experience and expertise in Islamic Banking and will work with you side by side to build the required investment, crowdfunding or sukuk trading platform for your needs.

If you’d like to learn more about LenderKit software and book an online demo with our Fintech Strategist, reach out to us.