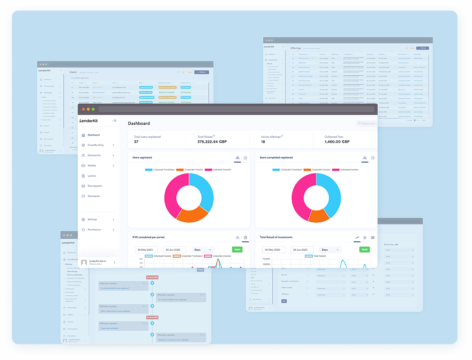

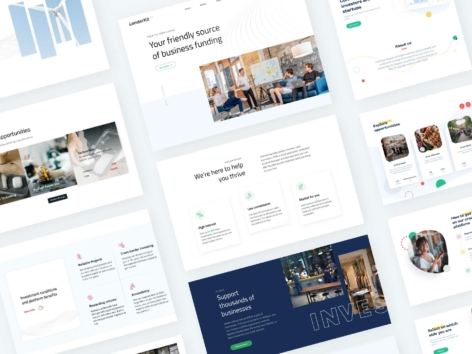

Build a shariah-compliant crowdfunding platform

Suitable for Islamic crowdfunding, LenderKit can become a halal crowdfunding software for your investment business. LenderKit is a crowdfunding software with successful projects in Saudi Arabia and UAE. Some of the clients such as NEOM, Forus and Matrix Capital are already using LenderKit.

- Launch halal platform

- Become shariah-compliant

- Apply to regulatory sandbox

- Grow your business

- Islamic crowdfunding platform

Types of halal crowdfunding platforms we create

P2P lending

Build a sukuk crowdfunding platform, become shariah-compliant and enter the debt crowdfunding market.

Equity crowdfunding

Create an Islamic equity crowdfunding platform for real estate or startup investing.

Real estate investing

Have LenderKit tailored for your debt or equity real estate crowdfunding business.

Building your halal-focused investment platform

LenderKit offers customisable white-label crowdfunding software for Islamic businesses:

- Real estate crowdfunding

- SME crowdfunding

- Halal-focused food & beverage crowdfunding, etc.

Combining technology, expertise, and services our team can help you build a shariah-compliant Islamic crowdfunding platform in Saudi Arabia, UAE, Bahrain or Oman.

Register a crowdfunding platform with SAMA, CMA or other authority

Registering your halal crowdfunding platform is a tedious process which requires “technical platform’s maturity”, business plan, and nerves of steel.

Our team has experience working with early-stage P2P lending and equity crowdfunding platforms that need to register with SAMA, CMA or a related regulatory body in your local market.

We will work with you side-by-side to ensure your platform’s readiness and will make adjustments in the progress until your platform is registered. Then, we’ll make a smooth transition from the MVP stage to a full-scale crowdfunding platform.

Apply for a Shariah compliance certificate for your crowdfunding platform

The way you structure your investment flows and online business should be carefully reflected on your crowdfunding platform. Whether you want to make a sukuk crowdfunding platform, P2P lending platform, or an equity crowdfunding one, we will make the required changes on the product side, so that LenderKit is fully consistent with your business strategy that will help you register a shariah-compliant crowdfunding platform.

Our team will work with you closely to ensure the best product-market fit and will guide you through the technical challenges to help you launch a halal crowdfunding business.