The Future of EU Crowdfunding: Regulation, Growth, and Opportunities

No time to read? Let AI give you a quick summary of this article.

The EU’s crowdfunding landscape is evolving. With ECSPR enabling issuers to raise up to €5 million across member states, a review is now underway. Key updates may include higher funding caps, new asset classes like digital securities, and better alignment with institutional investors — crucial for scaling innovation and economic growth.

But before we dive into the details and look further into the future of European crowdfunding, let’s explore how it all started and the current crowdfunding performance in Europe.

What you will learn in this post:

European crowdfunding market overview

The EU’s crowdfunding landscape has witnessed significant growth in recent years. According to the European Securities and Markets Authority’s (ESMA) inaugural market report1, the EU’s crowdfunding sector facilitated over €1 billion in funding during 2023.

Loan-based crowdfunding was the most prevalent. It accounted for 65% of the total funds raised, while equity-based projects comprised 6%.

France and the Netherlands emerged as leading markets, each contributing approximately €292 million. Retail investors constituted 87% of the investor base, this detail highlights the democratization of the investment landscape.

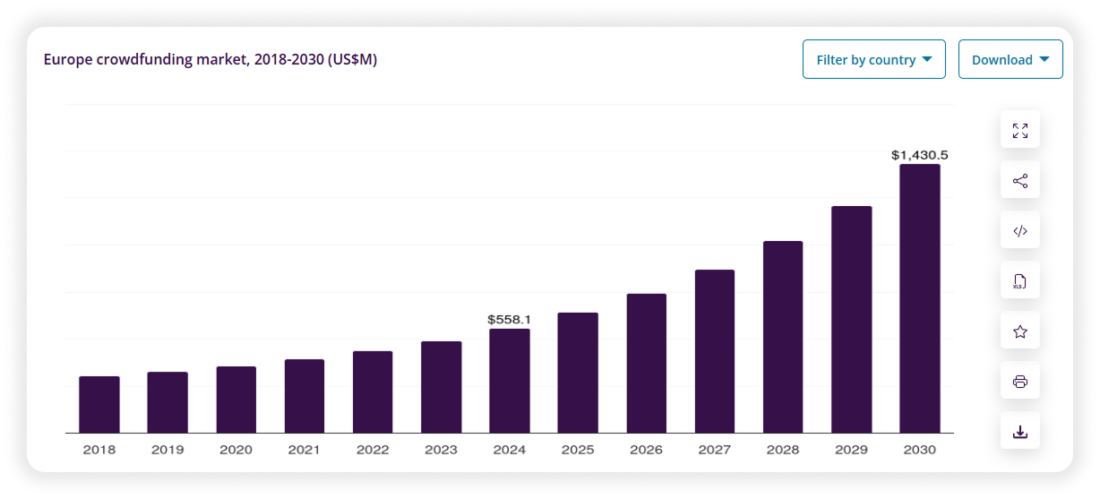

53 providers out of 98 offered loan-based crowdfunding services, while 30 focused on debt-based crowdfunding, 25 on equity-based crowdfunding, and 17 on other funding types. Loan-based projects accounted for approximately 65% of the total funds raised, followed by debt-based projects at 17% and equity-based projects at 6%.The European crowdfunding market continued the upward trajectory in 2024, too. During 2024, the market generated revenues of approximately USD 558.2 million2 and is projected to reach USD 1,430.6 million by 2030, reflecting a compound annual growth rate (CAGR) of 17.4% from 2025 to 2030.

Debt-based crowdfunding currently dominates the market; however, equity-based crowdfunding is emerging as the fastest-growing segment, indicating a shift in investor preferences.

This data demonstrates the diversity of crowdfunding applications across various industries, something that would be impossible without a clear regulatory framework.

Regulatory framework: the ECSPR

The ECSPR3 establishes uniform rules for both investment-based and lending-based crowdfunding services within the EU. It sets a funding threshold of €5 million per project over a 12-month period to balance investor protection with market accessibility.

Key provisions include standardized disclosure requirements, governance protocols for platforms, and supervision by national authorities. This regulatory coherence aims to reduce operational costs for platforms and enhance cross-border investment opportunities.

The regulation also introduces specific measures to protect investors, such as the requirement for crowdfunding service providers to conduct due diligence on project owners and to provide investors with clear information about the risks associated with their investments. The ECSPR also mandates that platforms implement procedures to handle complaints and conflicts of interest. This will further enhance investor confidence in the crowdfunding ecosystem.

Impact of regulation on market growth

The ECSPR’s harmonization of crowdfunding regulations across member states has made cross-border operations for platforms easier. This helped to expand the potential investor base of the platforms.

By providing a clear regulatory framework, the ECSPR has reduced uncertainties, encouraging more investors to participate in crowdfunding activities. This regulatory clarity has also attracted institutional investors, further contributing to market growth.

However, the impact of the regulation varies across different EU countries. For instance, while France and the Netherlands have seen substantial crowdfunding activities, other member states are still in the process of adapting to the new regulatory environment. The success of the ECSPR in fostering market growth largely depends on its consistent implementation and the ability of platforms and investors to navigate the new regulatory landscape.

Opportunities that arise from the ECSPR

The ECSPR opens several avenues for the growth and development of crowdfunding within the EU.

Enhanced cross-border operations

With a unified regulatory framework, platforms can more easily operate4 across multiple EU countries, accessing a broader pool of investors and projects.

Increased investor protection

Standardized disclosure requirements and governance protocols enhance transparency and help to build investor confidence. This will potentially attract more participants to the crowdfunding market.

Integration of innovative financial instruments

The regulation’s framework allows for the inclusion of diverse asset classes5, such as blockchain-based digital securities, aligning crowdfunding with emerging financial technologies.

Alignment with EU economic objectives

By facilitating access to finance for SMEs and fostering innovation, crowdfunding under the ECSPR supports the EU’s broader economic goals, including sustainability and the development of a more integrated capital market.

Challenges and considerations

While the ECSPR provides a robust framework for crowdfunding, certain challenges persist:

- Regulatory compliance: Platforms must navigate complex regulatory requirements, which may increase operational costs and necessitate significant adjustments to business models.

- Market fragmentation: Despite harmonization efforts, variations in national implementations of the ECSPR can lead to inconsistencies, potentially hindering truly seamless cross-border operations.

- Investor education: Ensuring that investors understand the risks associated with crowdfunding investments remains crucial for market stability and growth.

The future of crowdfunding in the Europe

The European crowdfunding sector is subject to significant transformation, driven by technological advancements and evolving investor preferences.

One visible trend is the integration of blockchain technology, leading to the emergence of asset tokenization. This innovation allows for the representation of assets, such as real estate or company shares, as digital tokens on a blockchain. Tokenization enhances liquidity and broadens access to investment opportunities, enabling investors to acquire fractional ownership in assets that were previously out of reach. For example, platforms like Urbanitae6 have capitalized on this trend, thereby addressing gaps left by traditional financing methods.

The diversification of crowdfunding models is also evident across Europe. In Estonia, for example, platforms like Hooandja7 have pioneered peer-to-peer lending and creative project funding, respectively, since the early 2010s8. The supportive regulatory environment has already contributed to a thriving crowdfunding ecosystem, with over 20 national platforms operating as of 20248.

As the sector matures, the role of organizations like the European Crowdfunding Network (ECN)9 becomes more important. Established to promote transparency, self-regulation, and governance within the industry, the ECN strives to introduce the best practices and engage in policy discussions to shape a sustainable future for crowdfunding in the EU. Their efforts aim to harmonize standards across member states and ensure that crowdfunding remains a viable and secure option for both fundraisers and investors.

Launch your platform in EU with LenderKit

If you are thinking of launching a crowdfunding platform in the EU, check out white-label crowdfunding software by LenderKit.

Starting with a ready-made solution offers you a faster entry to the market while meeting all the necessary tech and regulatory requirements. While you do need to consider local regulations and get licensed, LenderKit has got you covered on the tech side.

LenderKit offers a modular architecture that allows for extensive customization to align with specific business requirements and regulatory frameworks. Key features include user-friendly dashboards for investors and fundraisers, automated investment flows, and a robust back-office for platform administrators to manage operations efficiently.

LenderKit facilitates integration with external services like payment gateways, KYC/AML providers, and marketing automation tools through APIs, thus enhancing the platform’s functionality and user experience.

To get a better overview of how LenderKit can help you, don’t hesitate to reach out to us.

Article sources:

- PDF (https://www.esma.europa.eu/sites/default/files/2025-01/ESMA50-2085271018-4039...)

- Just a moment...

- Regulation - 2020/1503 - EN - EUR-Lex

- Crowdfunding - Finance - European Commission

- Tokenised crowdfunding – obstacles, opportunities and the outlook ahead in the EU - PwC Legal

- El ‘crowdfunding’ inmobiliario de Urbanitae se dispara un 60%, a los 213 millones, por la falta de financiación bancaria | Empresas | Cinco Días

- Hooandja

- Crowdfunding in Estonia - Wikipedia

- European Crowdfunding Network - Wikipedia